ACC 0772 04/07/24

Page 1 of 16

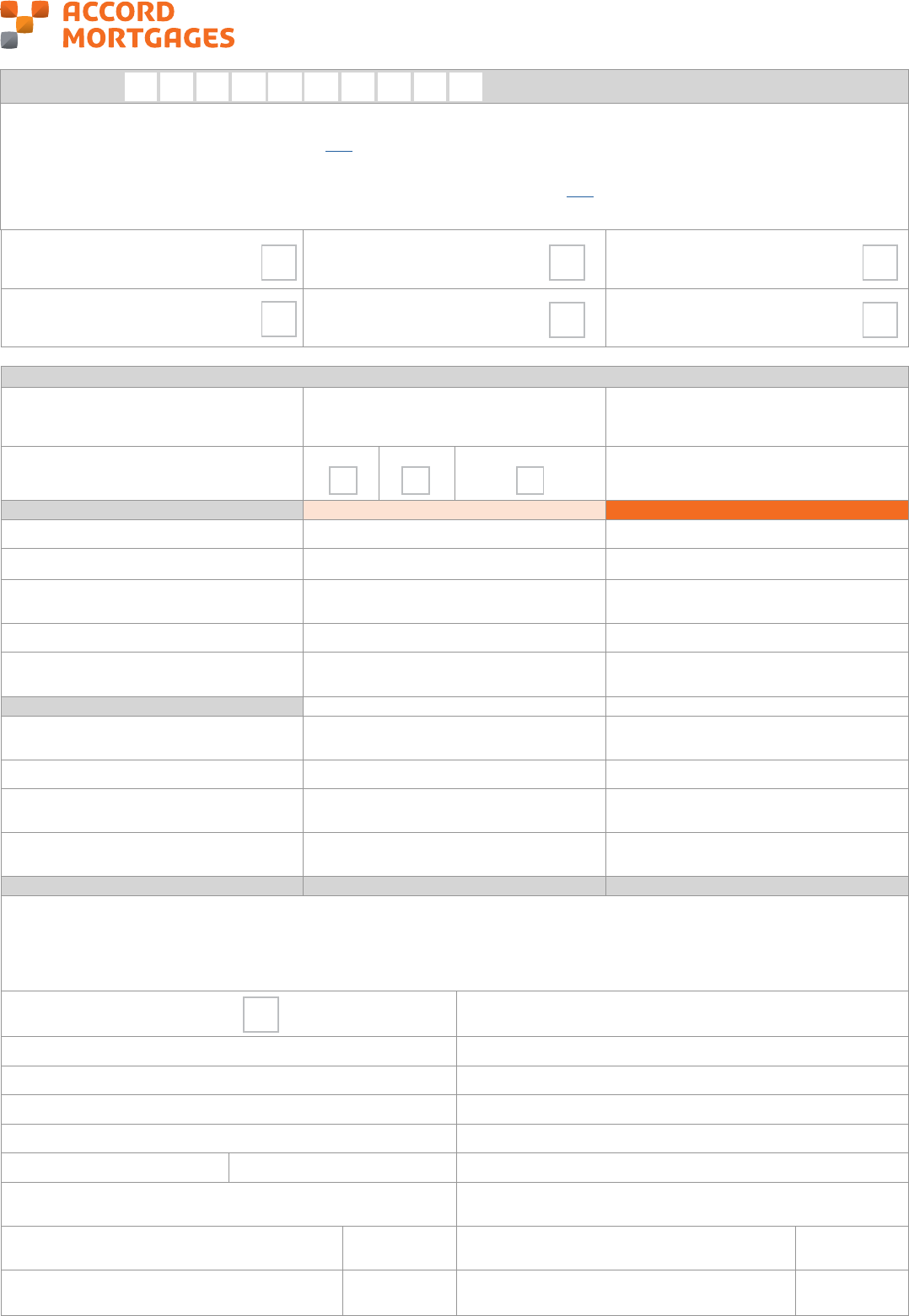

If you have already submitted an ONLINE application, DO NOT USE THIS application form.

Accord Mortgages

Portability Application Form

For more details of our requirements please refer to our website www.accordmortgages.com.

Contact us to make your valuation

fee payment by card over the phone

Evidence of post retirement

income (if within 15 years of

retirement)

75% LTV and below - Latest payslip/

pension payslip & latest bank statement

(Employed / Retired applicants)

Above 75% LTV - Latest 3 payslips/

pension payslips & latest bank statement

(Employed / Retired applicants)

Latest personal bank statement &

latest business bank statement

(Self-employed applicants)

Evidence of repayment strategies for

any new Interest Only borrowing

(e.g. latest investment statements)

INSURANCE ARRANGEMENTS, VERIFICATION OF CUSTOMER IDENTITY & INTERMEDIARY DECLARATION

I am arranging the following buildings

insurance/contents cover

Company name Sum insured (if known) £

Premium £

I am arranging the following mortgage

payment insurance cover

Accident Sickness Unemployment

Through (name of company)

Name verication 1st Applicant 2nd Applicant

Document type (e.g. Driving licence, passport)

Issuer (e.g. DVLC, passport oce)

Document reference number

(e.g. Passport number)

Document expiry date

Document’s country of origin

(if foreign passport or national ID card used)

Residency verication

Document type (e.g. Utility bill, bank

statement)

Issuer

Document reference number (e.g. customer

number)

Document issue date (must be within 3

months)

DECLARATION

I conrm that I have veried the customer(s) identity and will retain suitable records of the evidence seen to satisfy identity verication requirements

under the Money Laundering Regulations 2007 and the Financial Services and Markets Act 2000. I will make these records available, on request, to

Accord Mortgages Ltd or the Financial Conduct Authority (FCA). I have advised the customer on the types of valuations and surveys available; the

other costs included; and credit scoring (if you need any further information about these please refer to our website www.accordmortgages.com I

also conrm that the registration number for the FCA completed below is correct, and that I have complied with the FCA rules in giving advice to the

customer(s). I conrm that I am not submitting this application on behalf of an unauthorised person or rm.

Please tick to provide consent Date

Name Position

Firm name Email

Address Telephone

Fax

Postcode FSR Number

Please indicate the mortgage club/network to be used

(We are unable to pay you a procuration fee without this information)

What is your fee charged to your client for arranging

this mortgage?

£

What is the amount of your fee that is refundable if

the mortgage application does not proceed?

£

What is your fee charged to your client for arranging

insurance?

£

Is the level of service oered to your client advised?

Account number

Please use this application form to port your clients existing Accord mortgage. Where your applicant is within 90 days of their product expiring you

can apply for a new business product via this application form.

Step 1. Obtain an Illustration for you and your client here

Step 2. Complete the below editable PDF application form

Step 3. Ensure you have received confirmation from all applicants to submit the application and their personal data for processing

Step 4. Save the completed application form as a PDF, check out our guide on how to do this here

Step 5. Attach the completed application form along with supporting documentation in an email to [email protected]. Please

note we cannot accept a scanned c

opy of the application form

Please select

Please select

Please Select

Please Select

Please Select...

Please select

Page 2 of 16

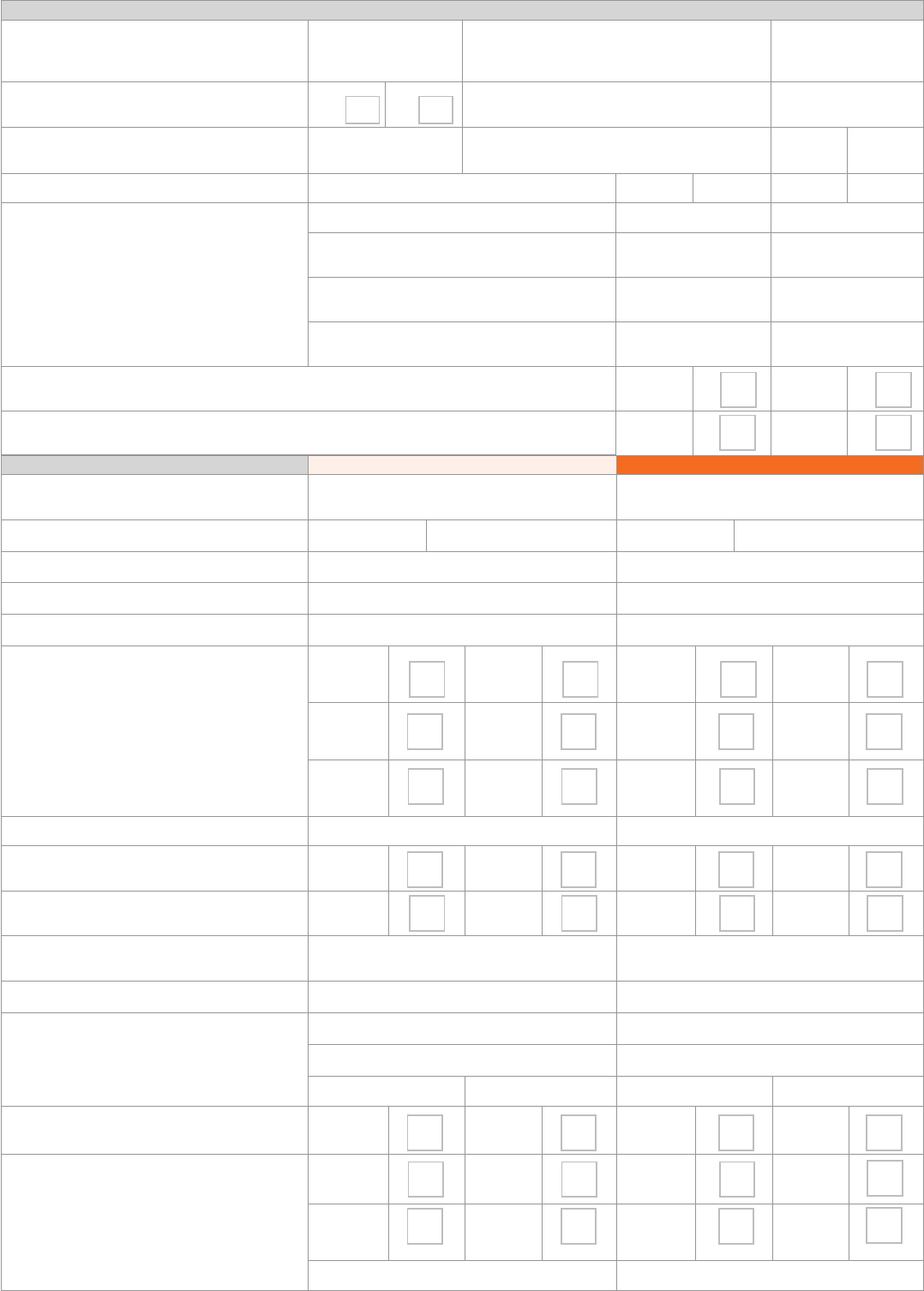

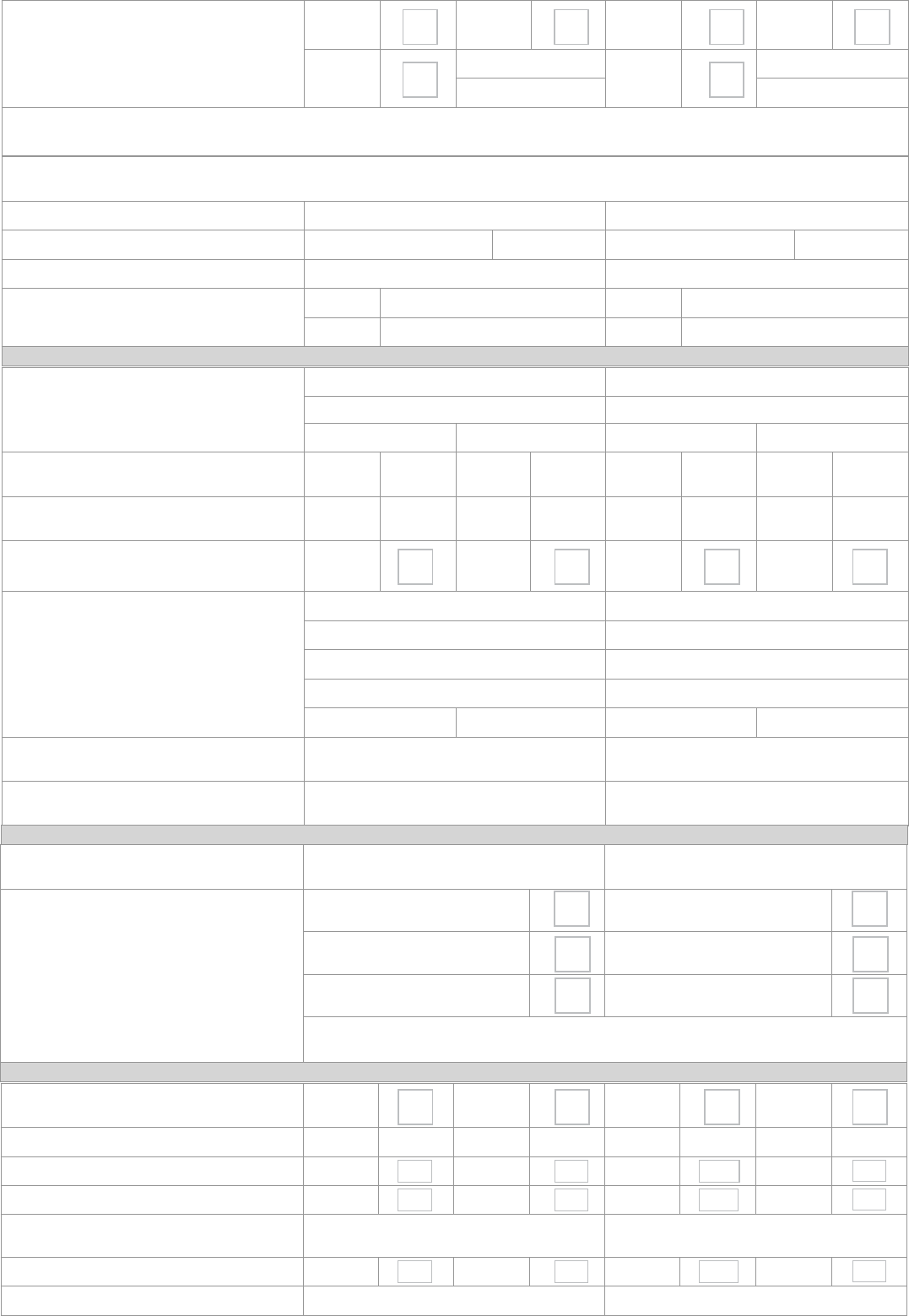

PERSONAL DETAILS 1st Applicant 2nd Applicant

1. Existing account numbers with Accord

Mortgages (if applicable)

2. Title (Mr, Mrs, etc) and surname

Title Surname Title Surname

3. Forename(s)

4. Date of birth

5. Nationality

6. Marital status (delete as appropriate) Married

civil

Partner

Single Married

civil

Partner

Single

Dissolved

civil

Partner

Separated

Dissolved

civil

Partner

Separated

Widowed Surviving

civil

Partner

Widowed Surviving

civil

Partner

7. Maiden/previous surname

8. Are you a UK citizen or do you hold a

European Community passport?

Yes No Yes No

If No, do you have indenite leave to

remain in the UK?

Yes No Yes No

9. Number of dependants (e.g. children who

are nancially dependant on you)

10. At what age do you expect to retire?

11. Present address (including postcode)

Postcode Postcode

12. How long have you lived at your present

address?

Years Months Years Months

13. Are you currently (tick as appropriate) Owner

occupier

Tenant Owner

occupier

Tenant

Living

with

relatives

Living

with

friends

Living

with

relatives

Living

with

friends

Other (please specify) Other (please specify)

LOAN DETAILS

1. Purchase price (house purchase only)

or approximate value of property

(if remortgaging)

£

What is the current valuation amount of the

property? (Scotland only)

£

2. Is this a Help to Buy Equity Loan

application?

Yes No

If yes, please conrm which Help to Buy

scheme (i.e. England)

3. If Help to Buy scheme, what is the equity

loan amount?

£ Equity loan term (whole years only)

Years

4. Total loan required and over what term? £ Years Months

5. If remortgaging, how much is the loan for? Repayment of existing mortgage £

Capital raising (please note this may not be

used for business purposes)

£

Home improvements (please specify)

(e.g. Central heating/bathroom/kitchen)

£ For

Other (please specify) (e.g. Purchase of land/

transfer of property subject to mortgage)

£ For

6. Is the loan for the benet of all applicants (remortgage only)? Yes No

7. Are you purchasing, or was the property purchased, under the ‘Right to Buy’ scheme or as a

concessionary purchase?

Yes No

Please Select

Please Select

Please select

Please select

Page 3 of 16

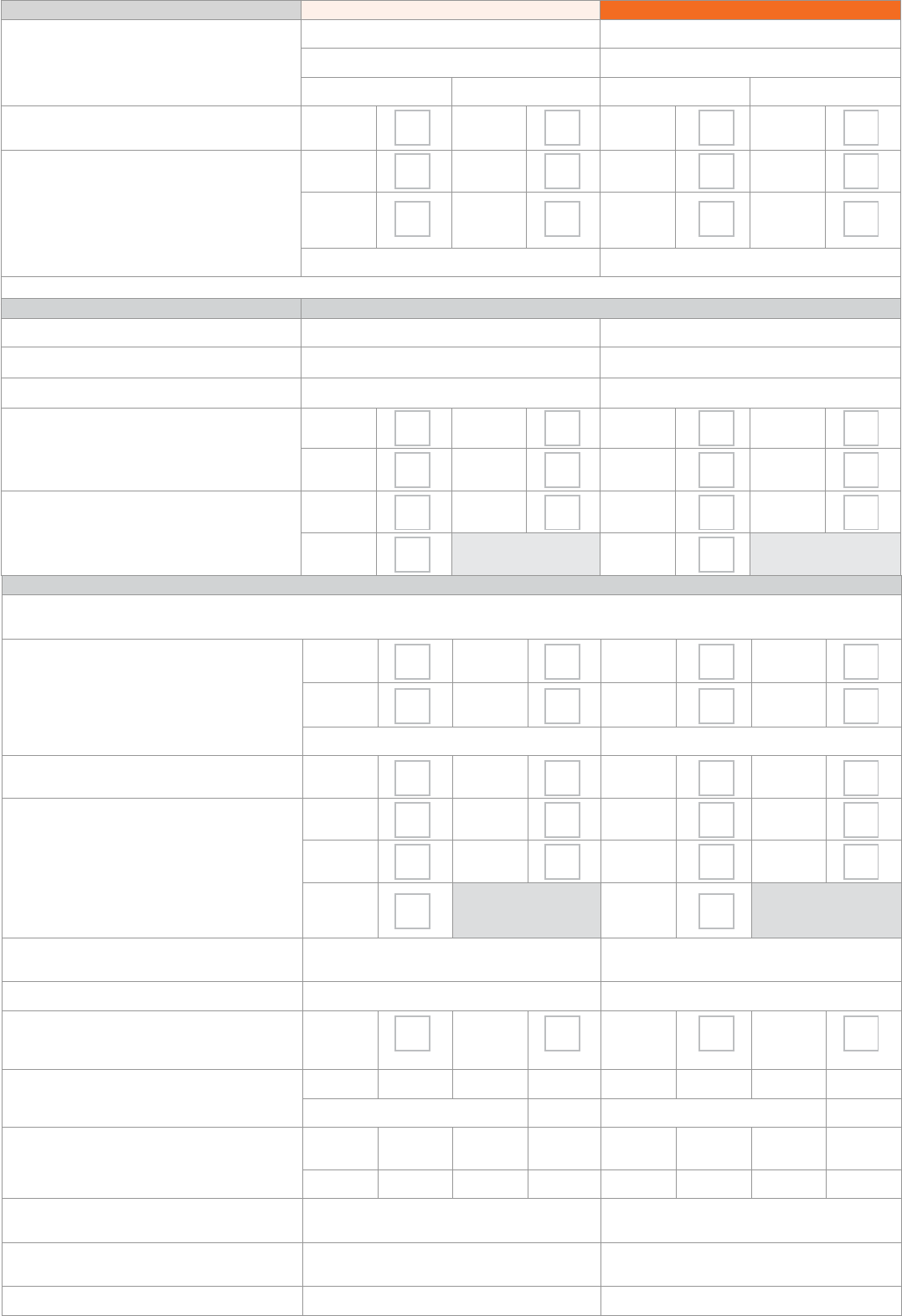

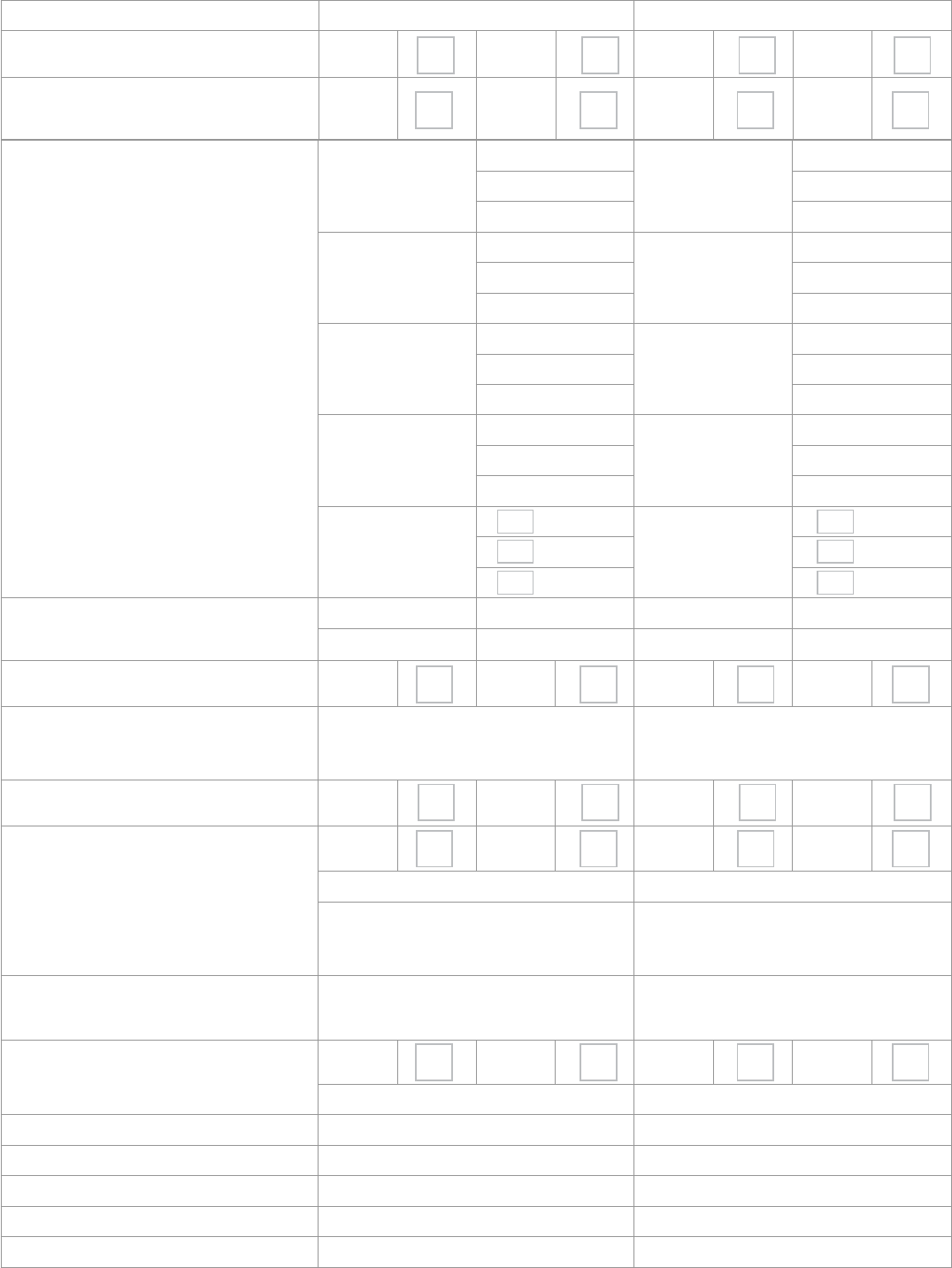

PERSONAL DETAILS 1st Applicant 2nd Applicant

14. If you have lived at your present address

for less than 3 years, please tell us your

previous address

Postcode Postcode

15. How long were you at your previous

address?

Years Months Years Months

16. Were you previously Owner

occupier

Tenant Owner

occupier

Tenant

Living

with

relatives

Living

with

friends

Living

with

relatives

Living

with

friends

Other (please specify) Other (please specify)

If you have more than one previous address during the last 3 years please provide details for each address in the extra space on page 10

CONTACT DETAILS

1. Email address

2. Home telephone number

3. Work telephone number (include ext)

4. Preferred contact Email Post Email Post

Mobile Home/

work

Mobile Home/

work

5. Preferred time Morning Afternoon Morning Afternoon

Evening Evening

INCOME DETAILS

I understand that it is a criminal oence if either I or someone acting on my behalf provides incorrect information in order to obtain a mortgage, and

the provision of any inaccurate information can lead to prosecution for fraud.

1. Are you currently (tick as appropriate) Employed Self

employed

Employed Self

employed

Retired Un-

employed

Retired Un-

employed

Other (please specify) Other (please specify)

2 Are you? Full time Part time Full time Part time

Are you? Permanent Fixed term Permanent Fixed term

Zero hours

contract

Salaried

director

Zero hours

contract

Salaried

director

Non-

salaried

director

Non-

salaried

director

What is your company’s/employer’s trade

profession?

What is your job title?

3 Are you a member of a company pension/

annuity scheme or superannuation

scheme?

Yes No Yes No

4. Basic annual salary and/or pension/

annuity?

Salary £ Pension £ Salary £ Pension £

Zero hour salary (if applicable) £ Zero hour salary (if applicable) £

Share of net prots for the last 2 years plus

a projection and go to question 7

Year

ending

Year

ending

Amount £ £ £ Amount £ £ £

Sustainable annual overtime

(i.e. the amount

you reasonably expect to continue earning)

£ £

Sustainable annual bonus (

i.e. the amount

you reasonably expect to continue earning)

£ £

Annual commission £ £

Do you receive childcare vouchers? Yes No Yes No

Please tell us the annual amount £ £

Other (e.g. annual band enhancement/

annual dividends)

£ £

Total income £ £

5. Are you due a pay rise in the next 3

months?

Yes No Yes No

If YES, new annual basic salary £ £

Are you due an increment in the next 12

months?

Yes No Yes No

If YES, new annual basic salary £ £

6. Is your income likely to reduce in the

future?

Yes No Yes No

If YES, please provide details

7. What date did you start your current

employment?

If you are a xed term contract, please

state the start and end dates of contract?

Current

Start

Current

Start

End End

Previous

Start

Previous

Start

End End

8. Please give details of any other income

you receive (e.g. pay from 2nd job, share

dividends, maintenance payments, rental)

£ £

Source Source

If you receive any of the following

benets, please provide details: DLA,

PIP, Employment and Support Allowance,

Carer’s allowance, Industrial Injuries

Disablement Benet

£ £

Source Source

If dividend income, please provide last 2

years plus projection

Last year Last year

Year 2 Year 2

Projection Projection

If you are a company director, please

provide your share of net prots minus

corporation tax for the last 2 years, plus a

projection’

Last year Last year

Year 2 Year 2

Projection Projection

EMPLOYED AND / OR RETIRED APPLICANTS

1. National Insurance number

2. Name of your Tax Oce

3. Tax Reference (not your tax code)

4. Employee number and/or pension/annuity

reference

5. Employer and/or pension/annuity

company name

6. Employer and/or pension/annuity

company address

Postcode Postcode

7. Name and telephone number (inc

ext) of the individual who can provide

conrmation of your income

Name Name

Telephone Telephone

8. How are you paid? Cash Cheque Cash Cheque

Direct to

bank

Other

(please specify) Direct to

bank

Other (please specify)

Page 4 of 16

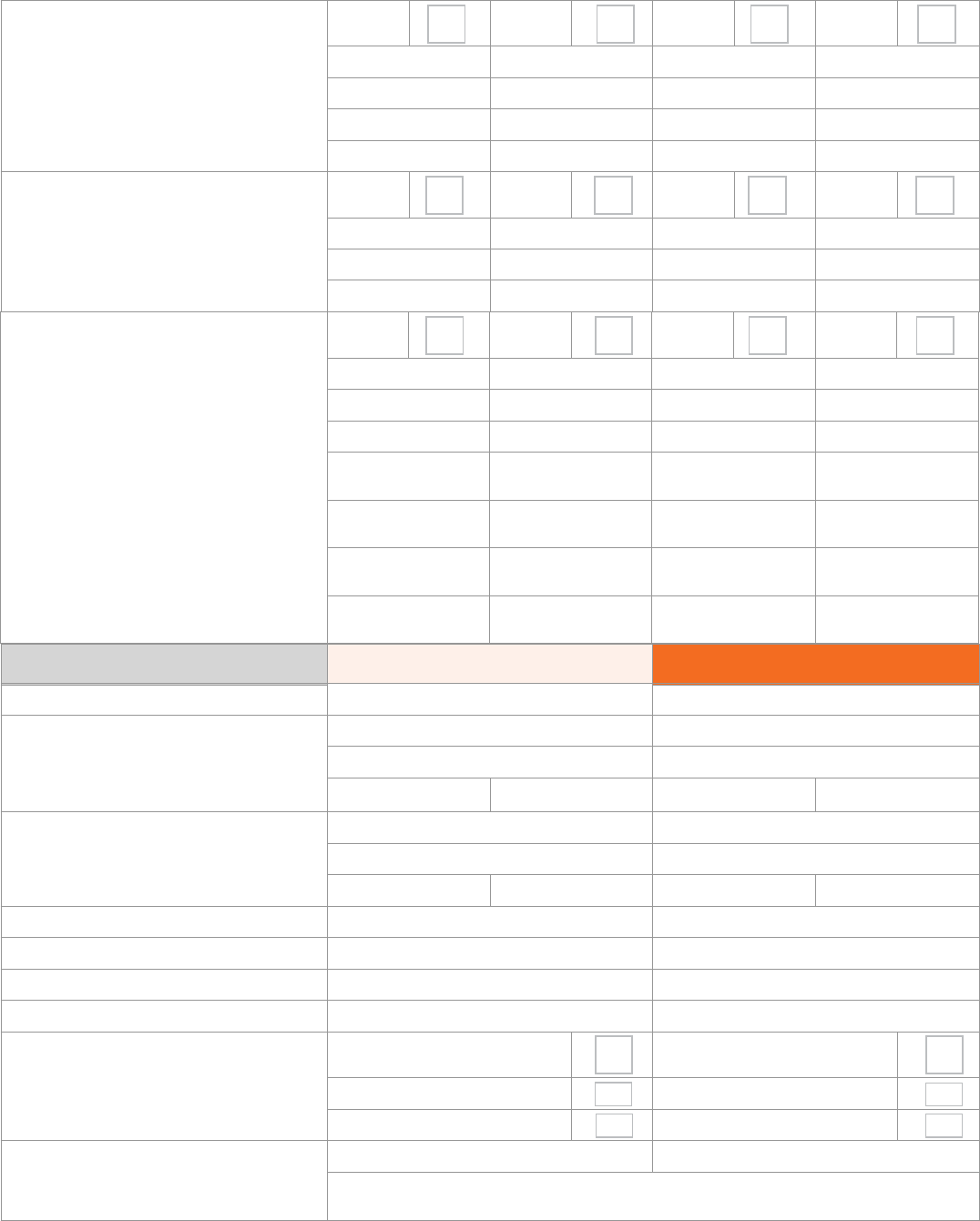

Page 5 of 16

9. How often are you paid? Weekly

Monthly

Weekly

Monthly

4 weekly Other (please specify) 4 weekly Other (please specify)

If you are about to leave your current employment, please give details of any future employment in the extra space on page 10

If you receive income from more than one pension or have more than one employer, please give us details in the extra space on page 10

10. If you have been with your current employer for less than 3 months, please tell us where you previously worked during the last year and when

your employment stated and nished?

Previous employer’s name

Previous employer’s address

Postcode Postcode

Previous employer’s telephone number

Dates of employment Start Start

End End

1. Name and address of your business

Name of business Name of business

Address Address

Postcode Postcode

How long has the business been

established?

Years Months Years Months

How long have you been connected with

the business?

Years Months Years Months

2. Do you produce accounts? Yes No Yes No

3. Name, address and telephone number of

your accountant (incl name of person)

Name Name

Telephone Telephone

Address Address

Postcode Postcode

4. What qualications does your accountant

hold? (e.g. FCA, ACA)

5. If you are a company director, what is your

% shareholding?

% %

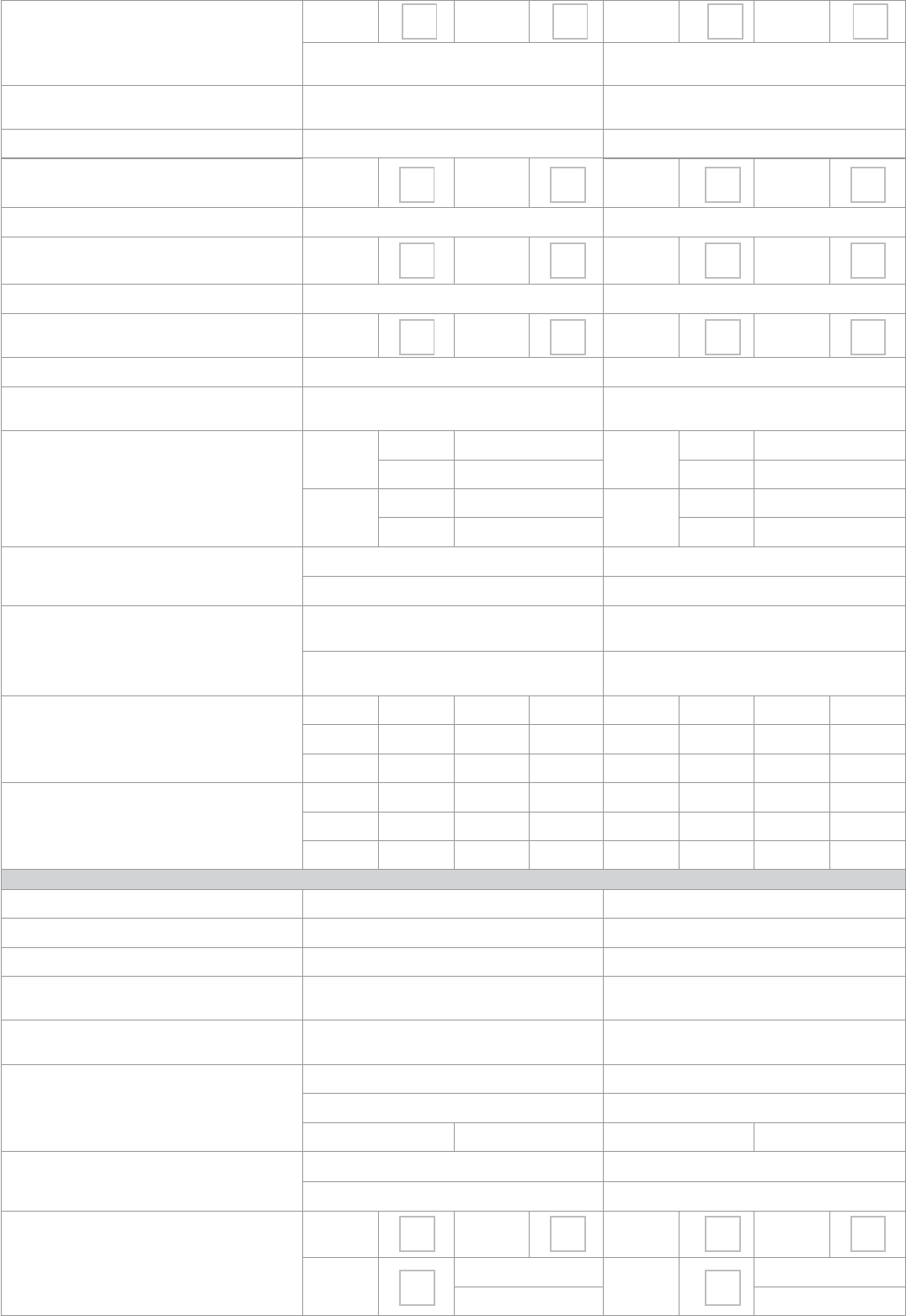

SELF-EMPLOYED APPLICANTS AND SHAREHOLDING DIRECTORS

RETIREMENT INCOME

1. Please tell us your anticipated retirement

income

2. Please tell us what you will do should your

retirement income be insucient to cover

the mortgage payments.

Sell 2nd property Sell 2nd property

Sell this property and downsize Sell this property and downsize

Make regular overpayments Make regular overpayments

Please note that the term of the mortgage cannot extend beyond your expected retirement date

for any interest only parts of your mortgage

FINANCIAL DETAILS

1. Do you have a current account with a bank

or building society?

Yes No Yes No

If YES, how long you have had it? Years Months Years Months

Do you have a debit card? Yes No Yes No

Do you regularly use an overdraft facility? Yes No Yes No

Maximum amount overdrawn in last 3

months

£ £

2. Do you have a savings account? Yes No Yes No

3. Please tell us how much you have in savings £ £

Please select

Please select

Page 6 of 16

4. How many credit cards do you have?

5. Are you planning on taking any further

debts and/or credit cards?

Yes No Yes No

6. Do you have any debts outstanding under

hire purchase arrangements, bank loans,

credit cards, secured loans, student loans?

Yes No Yes No

If YES, please give details, including

outstanding debts, monthly repayments,

the dates when the debts are due to be

fully repaid, and if they will be paid o on

completion

Type Type

Outstanding debt Outstanding debt

Monthly repayment Monthly repayment

Final repayment Final repayment

Repaid on

completion

Repaid on

completion

7. Do you have childminding, nursery or

school fees or signicant outgoings e.g.

hobbies/gym/golf membership?

Type of outgoing Monthly amount Type of outgoing Monthly amount

£ £

8. Are you making maintenance payments to a

third party?

Yes No Yes No

If YES, please provide full details

9. Have you had a mortgage or been party to

one?

Yes No Yes No

10.Following completion of this mortgage,

will you be party to any other mortgage(s)?

If you are in the process of applying for

a mortgage (including buy to let and

investment mortgages) with another lender,

you should tell us about this too

Yes No Yes No

If YES, please provide full details If YES, please provide full details

11.When you take out this mortgage what will

the outstanding balance be on any other

mortgage?

£ £

12.Have you ever been behind with any

nancial commitment?

Yes No Yes No

Maximum months arrears

Last date 3 months in arrears

Missed payments in last 12 months

Missed payments in previous 12 months

Payments made in last 3 months

Please select

Please select

Please select

Please select

Please select

Please select

Please Select

Please Select

Please Select

Please Select

Page 7 of 16

13. Have you ever had a county court judgment

(CCJ) or a high court judgment registered

against you?

If YES, please provide full details

Yes No Yes No

Date registered Date registered

Amount Amount

Is it satised? Is it satised?

Date satised Date satised

14. Have you ever been subject to a

Bankruptcy order or Trust Deed

(Scotland only)?

If YES, please provide full details

Yes No Yes No

Date registered Date registered

Is it discharged? Is it discharged?

Date discharged Date discharged

14.1 Have you ever been subject to an

Individual Voluntary Arrangement (IVA)?

If YES, please provide full details

Yes No Yes No

Date registered Date registered

Is it satised? Is it satised?

Date satised Date satised

Maintained

satisfactorily

Maintained

satisfactorily

Monthly payment

date

Monthly payment

date

Final IVA payment

date

Final IVA payment

date

Repaid on

completion

Repaid on completion

APPLICANTS WHO HAVE A MORTGAGE NOW

OR HAVE HAD A MORTGAGE IN THE PAST

1st Applicant 2nd Applicant

1. What is the mortgage account number?

2. Name and address of the lender

Name Name

Address Address

Postcode Postcode

3. What is the address of the property?

Postcode Postcode

Date mortgage opened

Date repaid

(if applicable)

Balance outstanding (if applicable) £ £

Monthly mortgage payment

(if applicable) £ £

4. If this mortgage will still be outstanding

when your new mortgage completes, will

you:

Repay the mortgage at the time of

completion

Repay the mortgage at the time of

completion

Be released from the mortgage Be released from the mortgage

Retain the mortgage Retain the mortgage

5. If applicable, what is the selling price/

value of your property?

£ £

If you have had more than one mortgage in the last 12 months, please answer questions 1-5

above for each mortgage held in the extra space on page 10

Please Select

Please Select

Please Select

Please Select

Please Select

Please Select

Please Select

Please Select

Please Select

Please Select

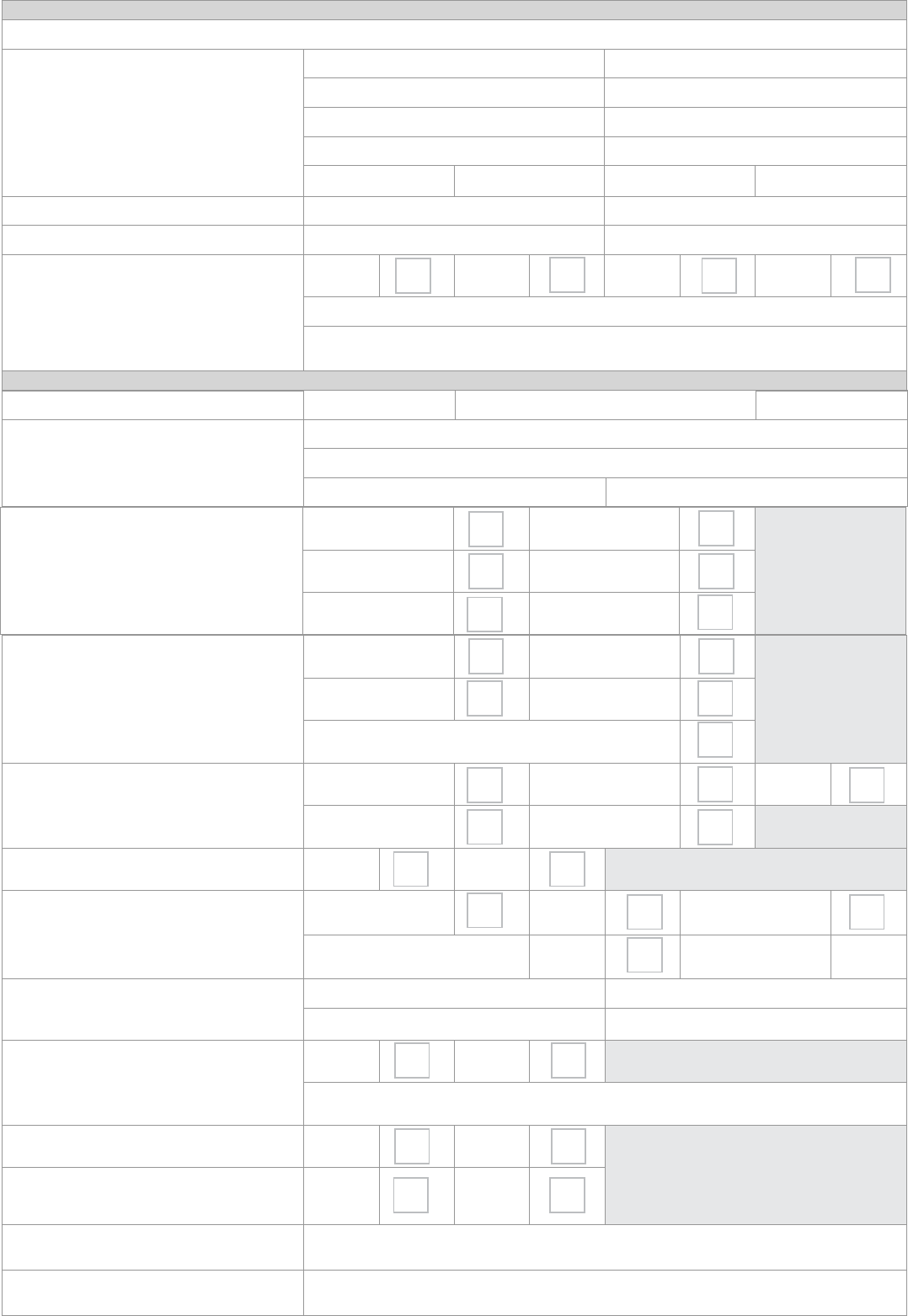

The date your tenancy began

Your monthly rental payment £ £

2. Have all your rent payments been paid on

time?

Yes No Yes No

If No, please provide details in the extra space on page 10

If you have rented more than one property in the last 12 months, please provide full details

for each tenancy in the extra space on page 10

PROPERTY INFORMATION

1. Approximate year the property was built Date of entry (Scotland Only)

2. Full address (if it is a new property, and

yet to be numbered, please tell us the plot

number)

Postcode

Page 8 of 16

5. Accommodation - please indicate the

number of:

Reception rooms Kitchens

Bedrooms

Bathrooms Inside WCs (if separate)

6. Are there solar panels on the property? Yes No

7. Which of these applies to the property?

(more than one answer may apply)

Heritable (

formerly

Feudal) (Scotland ONLY)

Freehold Commonhold

Leasehold unexpired term of

lease

Years Ground rent /service

charge

£

8. Please give the full names of anyone over

the age of 17 who will be living with you in

the mortgaged property

9. Do you intend to run a business from or let

any part of the property?

Yes No

If YES, please provide details

10. Will the property be your main residence? Yes No

11. Is the property a new build?

(will you be the

rst owner/occupier since the property was built/

converted to its current state)?

Yes No

12. If a new build, please provide the builders’

name

13. If a new build, please provide the

development name

4. If you have ticked FLAT or MAISONETTE,

please tell us

Which oor in block No of oors in block

Purpose built Converted house

Above/below shop premises

3. Type of property

(more than one answer may apply)

House Bungalow

Flat/maisonette Detached

Semi detached Terrace

APPLICANTS WHO ARE RENTING OR HAVE RENTED IN THE LAST 12 MONTHS

1. If you are currently renting the property that you are living in, please tell us:

The name, address and telephone number

of your current landlord

Name Name

Telephone Telephone

Address Address

Postcode Postcode

Page 9 of 16

MORTGAGE REQUIREMENTS

1. If you wish to pay on a date other than the

1st, please enter a date in the box

(2ND - 28TH)

2. Which of Accord Mortgages’ products are

you applying for?

Product code Capital & Interest

repayment

Interest only Total

£ £ £

£ £ £

£ £ £

Note: If you would like to have more than one product, or if you are an existing borrower wishing to use portability, please conrm the amount

required on each product

3. For any new Interest Only borrowing,

please state the proposed repayment

strategy that will be used to repay the

amount borrowed at term end e.g. Existing

endowment, general investments, sale of

mortgaged property

Repayment strategy Amount Repayment strategy Amount

£ £

£ £

You must make sure you have made the necessary arrangements to repay your mortgage at the

end of the repayment term.

4. For any existing Interest Only parts, please

state the proposed repayment strategy

that will be used to repay the amount

borrowed at term end. Please refer to the

Accord website for details of acceptable

repayment strategies for any existing

Interest Only parts.

Repayment strategy Amount Repayment strategy Amount

£ £

£ £

5. Do you want to add the Higher Lending

Charge to your loan amount?

Yes No N/A

VALUATION AND SOLICITOR DETAILS

A mortgage valuation is solely for our purposes and benet so that we can be satised that the property provides sucient security for us to lend.

You may not receive a copy of any valuation report prepared in connection with this application.

1. What type of valuation have you had/do

you require?

Mortgage valuation Home buyer survey &

valuation

Building

survey

If the valuation has already been carried

out please conrm contact name, address

and telephone number of the valuer

Name

Telephone number

Address

Postcode

2. Who can the valuer obtain keys from?

(Please conrm contact name, address and

daytime telephone number)

Name

Telephone number

Address

Postcode

3. Name and address of solicitor/licensed

conveyancer

(Please conrm contact name, address and

telephone number)

Name

Telephone number

Address

Postcode

Please Select

Please Select

Please Select

Please Select

Please Select

Please Select

Please Select

Please Select

Please Select

Please Select

Page 10 of 16

HOUSE PURCHASE ONLY

4. Name and address of person selling

(Please conrm contact name, address and

daytime telephone number)

Name

Telephone number

Address

Postcode

5. Apart from your Help to Buy Equity Loan (if applicable) if you are borrowing the dierence between the purchase price and the amount of loan

you are applying for, please tell us:

from where, and the date when you must

repay it

Date

how much you are borrowing and how

much you will be repaying each month

Amount borrowed £ Monthly repayment £

6. Are you receiving any cashbacks,

discounts, allowances or other incentives

in connection with this purchase

from any source?

Yes No

If YES, please provide full details opposite

7. If the property is under construction, do

you wish the mortgage to be released in

instalments?

Yes No

If YES, please provide a correspondence

address opposite

PRODUCT FEE - METHOD OF PAYMENT

If applicable, fee to be added to loan Yes No N/A

Please tell us how your client will pay any fees that are due

immediately:

Please make payment by card

Accord to contact customer by phone for card

payment

ADDTIONAL INFORMATION

OFFSET SAVING DETAILS (ALL APPLICANTS WHO ARE APPLYING FOR AN OFFSET MORTGAGE)

You are allowed to link up to a maximum of three accounts to your oset mortgage account. All names on the oset savings account must also be a

party to the mortgage application.

By signing the declaration on page 15 you are agreeing to us opening one oset savings account in the mortgage holder’s name(s) as indicated below.

If you would like additional oset savings accounts linked to your mortgage you must complete separate application forms (ACC0123OS) for each

additional account.

Applicant 1 Applicant 2 Joint

Your signature is required to enable you to maintain and transact on your account following completion of your mortgage. This also forms parts of the

Terms and Conditions of an oset mortgage.

Account holder Account number

Account holder Account number

Account holder Account number

EXISTING OFFSET SAVINGS DETAILS (PORTABILITY ONLY)

PLEASE USE CAPITAL LETTERS

Your payment date

A rst payment of initial interest will be payable immediately following completion. Your monthly payments will then be due on the rst day of the

month to which they relate, starting from the 1st of the month following release of funds. With Accord Mortgages’ agreement the date that your monthly

payments are due can be changed to any date between the 1st and 28th of the month, to help coincide with your salary payment.

1. If you prefer, you may specify a payment date between 1st and

28th of each month. Please enter the date opposite.

Your payment method

Accord Mortgages operates a Direct Debit scheme which provides a simple and convenient way to pay. On page 14 is a Direct Debit instruction form.

Please complete it, sign it and return it along with this application form, to ensure that there is no delay in commencing collection following completion

of your mortgage. No collections will be taken until after completion of your mortgage, and Accord Mortgages will give you ten working days’ notice

of any change in the amount or date of your direct debit collections.

If you have NOT completed the Direct Debit form, please indicate how

you intend to make payments

Standing order

Page 11 of 16

OFFSET PAYMENT DETAILS

With the oset mortgage account you have three options for your payment amount. You can change your oset option at any time during the life of

your mortgage by contacting us.

1. Net – Reduce current mortgage repayments Your monthly payment is calculated based on the dierence between your mortgage balance and

your oset savings balance; so the more savings you have, the lower your monthly mortgage payment will be. You must specify the total amount

of savings you will have linked to your mortgage within 30 days of completion to ensure we calculate your mortgage payments correctly. You

must make us aware if you reduce your oset savings balance at any time, as your mortgage payments will only automatically be recalculated at

our annual review and if savings are withdrawn, you could be underpaying.

2. Gross – Reduce future mortgage repayments You make your monthly mortgage payment as if there was no money in your oset savings account.

Your oset savings are used to reduce the interest charged on your mortgage and lower the monthly payment when it is recalculated at annual

review. The payment is recalculated, based on the mortgage balance and the remaining mortgage term.

3. Static – Pay your mortgage o sooner Similar to option 2, however a static/xed direct debit amount is set up and maintained throughout the

mortgage term which eectively pays the mortgage balance o quicker. The monthly direct debit payment will not reduce even though the

registered monthly mortgage payment will. The static payment can be amended at any time. You must specify the amount you want your xed

static payment to be which needs to be equal to or higher than the gross monthly payment to take eect.

Please indicate the payment option you require

Net payment - Enter estimated savings balance here £

Gross

Static payment - Enter static amount as discussed during your appointment here £

Please refer back to your adviser/broker if this was not discussed

ABOUT YOUR PERSONAL INFORMATION (ALL APPLICANTS) AND (IF APPLICABLE) YOUR OFFSET SAVING ACCOUNT

Accord Mortgages Limited decides what personal information we

need to collect about you, how we use it, who we share it with

and how long we keep it. This makes us the data controller of

your personal information for data protection purposes.

When we refer to ‘Society’, ‘YBS Group’ or ‘Yorkshire Group’

we mean Yorkshire Building Society Group (Accord’s parent

company) trading as:

- Yorkshire Building Society

(sometimes referred to as The Yorkshire, YBS)

- Chelsea Building Society

(sometimes referred to as The Chelsea, CBS)

- Norwich and Peterborough

(sometimes referred to as N&P)

We will use the personal information obtained from you and

additional information obtained in the course of opening and

managing your account. This includes, but is not limited to, name,

address, identication, account transactions and communications

and where relevant sensitive information, credit reference

data, nancial crime data, health details, nationality and legal

proceedings.

We will respect your rights to privacy and will only collect,

use, store and share your personal information where a lawful

purpose applies:

- It’s necessary for the performance of a contract you have or

have requested to enter into.

- If we have a legal obligation.

- If we have a legitimate business interest where it does not

have an unfair impact on you.

- If you have given your consent where the collection, use,

storage or sharing involves special category (sensitive)

personal information (e.g. health race and religion).

- Where we believe you or another person is at risk and we

need to protect your or their vital interests.

- Where it’s in the public interest or we have been given

ocial authority to do so.

For full details of the types of information used in each product,

and the other lawful purposes we may use it for, please see our

‘’How we use your personal information’’ booklet which can

found at www.accordmortgages.com or via your intermediary.

HOW WE USE YOUR PERSONAL INFORMATION

When you apply for a mortgage account we will use your personal

information together with other information available including

relevant sensitive information, (e.g. health, race and religion), for:

- Identity verication (including checking documents with

issuing authorities e.g. driving licence - DVLA)

- Processing any Decision in Principle

- Processing your application

- Making credit decisions about you

- Contacting you where necessary

- Fraud prevention and detection

- Arranging associated insurance (where you have requested us

to do so)

- Completing your mortgage

- Administering your account up to and including redemption

- Legal and regulatory compliance

- Marketing (where we have your consent) and market research

- General business purposes

If you are making an enquiry or application on behalf of another

person they must have authorised you to act on their behalf, to

give us their personal information, to authorise a credit search

and to consent to our use of their personal information. We may

also share information about you with a joint account holder if

they make an enquiry or further application without you being

present where they have conrmed you have authorised them to

act on your behalf.

We will share information with one or more Credit Reference

Agencies (CRAs), now and in the future, to:

- Check your identity

- Verify the accuracy of the information you have provided

- Assess your creditworthiness and aordability

- Manage your account(s)/relationship with us

- Process your application

- Ensure any oers we send are appropriate to you

- Trace and recover debts

- Prevent criminal activity, fraud and money laundering.

We will continue to exchange information about you with CRAs

while you have a relationship with us. We will also inform the

CRAs about your settled accounts. If you borrow and do not repay

in full and on time, CRAs will record the outstanding debt. This

information may be supplied to other organisations by CRAs.

When CRAs receive a search from us they will place a search

footprint on your credit le that may be seen by other lenders.

We routinely carry out an additional credit search for account

management purposes but this will not aect your future

creditworthiness as no hard foot print will be left.

If you are making a joint application, or tell us that you have a

spouse or nancial associate, we will link your records together,

so you should make sure you discuss this with them, and share

with them this information, before applying. CRAs will also link

your records together and these links will remain on your and

their les until such time as you or your partner successfully les

for a disassociation with the CRAs to break that link.

If we use an automated system to make a decision about you,

such as credit scoring, we will tell you if your application is

rejected and give you the opportunity to discuss the matter

with us. The decision can be reviewed to ensure an appropriate

decision has been made.

The personal information we have collected from you will be

shared with fraud prevention agencies who will use it to prevent

fraud and money-laundering and to verify your identity. If fraud

is detected, you could be refused certain services, nance or

employment in the future.

Further details of how your personal information will be used by

us, Credit Reference Agencies and Fraud Prevention Agencies can

be found in our booklet “How we use your personal information”

which can be found at www.accordmortgages.com or via your

intermediary.

If you take out Yorkshire Building Society home insurance or

other insurance we and/or your insurer may:

- Share information you have supplied and details of your policy

and claim with each other, a data administration company,

licensed credit reference agencies, relevant insurance

companies and fraud prevention bodies. This information will

be made available to other prospective lenders and insurers.

- Use your personal information together with other information

available (including relevant sensitive information (e.g. health,

race and religion) to carry out a risk assessment, process your

application, administer your policy and claims during the life

of the policy, for fraud prevention and detection, legal and

regulatory compliance, marketing and market research and

general business purposes.

- We may contact your medical professional representative with

your explicit consent to obtain information or conrm a pre-

existing medical condition you have informed us of, but we will

always explain why we need the information, how it will be

used and who it will be shared with.

Insurers pass information to the Claims and Underwriting Ex-

change register, run by Insurance Database Services Ltd. (IDS

Ltd.). The aim is to help us check information provided and also

to prevent fraudulent claims. When we deal with your request we

may search the register. When you tell us about an incident (such

as re, water damage or theft) which may or may not give rise

to a claim, we will pass information relating to it to the register.

IDS Limited may also pass on information received from other

insurers about other incidents involving anyone insured under

the policy.

We will only use, keep and share your personal information for

as long is required to meet our legal and regulatory obligations,

industry standards and business requirements, and to deal with

your enquiry, administer and manage your accounts, products

and relationship with us. After this time, we will delete your

personal information in line with the requirements of the

Financial Conduct Authority, Prudential Regulation Authority,

Money Laundering regulations, Financial Ombudsman Service

and HM Revenue & Customs.

Page 12 of 16

Page 13 of 16

DISCLOSING YOUR PERSONAL INFORMATION

We may disclose your personal information with other people or

organisations as follows:

• The progress of your application, including if it has been granted,

to your broker, Independent Financial Adviser, professional

adviser or other intermediary, if the request came from them.

• With HM Revenue & Customs, Department for Work & Pensions,

any lender, landlord, employer or professional adviser named

on this form to obtain information to conrm any income

received and payments made.

• To any government body providing you with nancial assistance

(for example, Homes England or Help to Buy (Wales) Limited)

any application or account information in which that body has a

legitimate interest such as an unauthorised letting or property

alteration or any identied false or inaccurate information.

• The information you have supplied, and details of how

you conduct your account including disputes, arrears and

repossession proceedings, to joint account holders, anyone

who guarantees the loan or their legal adviser.

• Your account, including current balance, current monthly

payment, projected balance and monthly payment to a

subsequent charge holder in connection with any application

for the postponement of that charge.

• Your account, including balance outstanding, interest rate(s)

applicable, early repayment charges and monthly payments

to potential borrowers if one of you in the future enquires

about adding or removing a party to the account (also known

as a “transfer of equity”). However, such a transaction will not

proceed without a completed application form signed by all

account holders.

• With Yorkshire Building Society and its subsidiary companies

for fraud prevention, lawful purposes, account administration

and for general business purposes (e.g. updating customer

records, handling customer queries and complaints).

• Personal information to (i) our external auditors and regulatory

bodies including the Financial Ombudsman Service, Prudential

Regulation Authority and the Financial Conduct Authority,

and (ii) associate companies, agents and service providers

including solicitors and valuers acting for the Society, eld

agents, debt recovery agents, tracing agents, letting agents,

brokers, printers, market research agencies and providers of

information technology services.

If we sell or transfer all or part of our business, we may share or

transfer our customer records as part of the proposed/actual sale

or transfer. However, we will only do so under a contract or where

we have a legal obligation to do so. The protection, security and

condentiality of your personal information are important to us

and we put in place appropriate safeguards to manage this.

Where we transfer personal information to countries outside

the European Economic Area (EEA) this is always done under a

contract which includes appropriate safeguards for the security

and condentiality of your personal information, with your

consent, or where permitted by Data Protection laws.

YOUR RIGHTS UNDER THE DATA PROTECTION LAWS

You have the right to:

- Be informed about processing of your personal information

- Have your personal information corrected if it is inaccurate or

incomplete

- Object or restrict to the processing of your personal information

- Have your personal information erased subject to conditions

(e.g. where the processing fails to satisfy legal requirements)

- Request access to your personal information and details about

how we process it

- Move, copy or transfer your personal information also known

as ‘data portability’

- Challenge automated decision making including proling, which

is the automated processing of your personal information to

evaluate certain things about you.

- Complain to the Information Commissioner’s Oce (https://ico.

org.uk/) which enforces data protection laws

TRANSFER OF MORTGAGE

Although you may not transfer your interest in the mortgage

without consent, there is no restriction in the mortgage against

a transfer of our interest. Accord Mortgages Limited may transfer

its interest in your mortgage to another party which may not

necessarily be a building society or an associated body of

building society. Accord Mortgages is part of the Yorkshire

Building Society group but is a separate legal entity from

Yorkshire Building Society. You will not be a member of, or have

any membership rights in Yorkshire Building Society.

For more information please see our ‘How we use your personal

information’ and ‘Your Rights and Data Protection’ booklets.

Our ‘How we use your personal information’ booklet explains

what personal information we need to collect, why we need it,

where we may obtain information from and how long we keep

it for.

Our ‘Your Rights and Data Protection’ booklet provides more

information on data protection laws, our legal obligation and

your individual rights in relation to the processing of your

personal information.

To obtain a copy of these booklets, or if you wish to invoke any of

the rights listed above, simply visit our website

www.accordmortgages.com or via your intermediary.

If you want to see what personal information we hold about you,

you can request a copy of this by completing a Subject Access

request form. This form can be found on our website

www.accordmortgages.com or by putting a request in writing to

our head oce address.

Our Data Protection Ocer (DPO) provides help and guidance

to make sure we apply the best standards to protecting your

personal information. You can contact the DPO by writing to:

Data Protection Ocer

Yorkshire House

Yorkshire Drive

Bradford

BD5 8LJ

Or by emailing [email protected]

Page 14 of 16

DECLARATION TO BE SIGNED BY ALL APPLICANTS

I apply for a loan on the property mentioned on page 7 & 8 (or any Replacement Property form attached to this form).

1. I agree:

• that this information will form the basis of the mortgage

contract between Accord Mortgages and me and that if I enter

into an associated insurance contract it will also be the basis

of a contract between the insurer and me

• I am aware that repayments for the capital and interest parts

of my loan may continue after I am retired. I conrm that I

have discussed this with my adviser and that I understand the

nancial implications.

• to pay Accord Mortgages’ conveyancing costs and valuation

fees even if the mortgage does not complete.

• to a 10-day notice period for Direct Debit changes

• to Accord Mortgages and its agents or other members of its

group disclosing the details of all oset savings accounts to

the other applicants and borrowers.

• to the processing of my personal information as explained

on page 11 of this form. My agreement here applies in any

circumstances during the mortgage where Accord Mortgages

needs to make a credit decision.

• to tell Accord Mortgages of any changes to the information in

this form which arise between now and completion of the loan.

• to the release to Accord Mortgages of my conveyancer’s le in

its entirety.

2. I conrm that:

• the information in this form is true and complete, including

any answers which have been completed by someone else.

• I am aware that repayments for the capital & interest parts of

my additional loan may continue after I am retired. I conrm

that I have discussed this with my adviser and that I understand

the nancial implications.

3. I have read the explanation on Transfers of Mortgage (above)

and had the opportunity to have anything I do not understand

explained to me. I acknowledge that you are entitled to transfer

Accord Mortgages’ interest in the mortgage which I am applying

for and any related security, assignment or other related deeds

or documents to another body. I consent to the transfer of Accord

Mortgages’ interest.

4. I understand that:

• Accord Mortgages does not have to make an oer of a loan or

refund any fees paid.

• If Accord Mortgages oers me a loan, this does not imply that

Accord Mortgages agrees that the price paid for the property

is reasonable.

PLEASE CONFIRM THAT THE FOLLOWING STATEMENTS APPLY TO THE APPLICATION:

• There are no more than 2 applicants

• The property to be mortgaged is not a studio at

• The applicant will not rely on non-sterling income or assets to repay the mortgage

• If there is an element of Interest Only and the repayment strategy is sale of mortgaged property, the customer has a minimum

equity of £250,000, or £300,000 if the property is located in London.

• The applicant(s) will not be using the property for business purposes or altering the outside appearance of the property for business

reasons

.

• The property to be mortgaged will be the applicants’ main residence.

I conrm that all the above statements apply

I conrm that all applicants have consented to my acting on their behalf

I conrm that I have read ‘How we use your personal information’ to the applicant(s) and they agree to their information

in the way specied

A Decision in Principle will conrm that we would be prepared to lend the applicant(s) the amount requested. It is not a guarantee

because it’s subject to proof of Income as well as any references we request and a valuation of the property.

CONSENT TO A CREDIT SCORE

Please be aware that a Decision in Principle is a full credit search and will leave a hard footprint against the credit record of the

applicant(s).

Please conrm you wish to continue

MANAGING OUR CONTACT WITH YOU:

From time to time we would like to tell you about products and services that may be of benet to you. These may be provided by us

or other carefully selected organisations. To do this, we would like to communicate with you by post, email, text message, telephone

or any other appropriate messaging service.

1st Applicant details 2nd Applicant details

Mail Phone Mail Phone

Email

(including

text & other

messaging

services)

No contact,

please.

Email

(including

text & other

messaging

services)

No contact,

please.

Please tick to conrm applicant one has been

made aware of the above and gives consent to proceed

Date

Please tick to conrm applicant two has been

made aware of the above and gives consent to proceed

Date

We will not sell your details to other companies but we may use marketing agents to act on our behalf.

Page 15 of 16

1. Name and full postal address of your bank or building society.

The Manager

...................................................................................................................................

...................................................................................................................................

...................................................................................................................................

...................................................... Postcode: ......................................................

Accord Mortgages Limited

Yorkshire House

Yorkshire Drive

Bradford

BD5 8LJ

INSTRUCTION TO YOUR BANK OR BUILDING SOCIETY TO PAY BY DIRECT DEBIT

6 7 6 5 3 2

2. Name(s) of Account Holder(s)

3. Branch Sort Code

4. Bank/Building Society

Account Number.

5. Instruction to your Bank or Building society

Please pay Accord Mortgages Limited Direct Debits from the account detailed in this Instruction subject to the safeguards assured by the

Direct Debit Guarantee. I understand that this instruction may remain with Accord Mortgages Limited and, if so, details will be passed

electronically to my bank or building society.

Signature(s)

Date

Banks and Building Societies may not accept Direct Debit Instructions for some types of account.

11/02/20

THIS GUARANTEE SHOULD BE DETACHED AND RETAINED BY THE PAYER

The Direct Debit Guarantee

• This Guarantee is oered by all banks and building societies that accept instructions to pay Direct Debits.

• If there are any changes to the amount, date or frequency of your Direct Debit Accord Mortgages Limited will notify you 10 working days in

advance of your account being debited or as otherwise agreed. If you request Accord Mortgages Limited to collect a payment, conrmation

of the amount and date will be given to you at the time of the request.

• If an error is made in the payment of your Direct Debit, by Accord Mortgages Limited or your bank or building society, you are entitled to a full

and immediate refund of the amount paid from your bank or building society.

- If you receive a refund you are not entitled to, you must pay it back when Accord Mortgages Limited asks you to.

• You can cancel a Direct Debit at any time by simply contacting your bank or building society. Written conrmation may be required. Please

also notify us.

ACC 0772 (1019) 11/02/20

Please complete the whole form using ballpoint pen and return the completed form to the address below.

All communications with us may be monitored/recorded to improve the quality of our service and for your protection and security.

Calls to 03 numbers are charged at the same standard network rate as 01 or 02 landline numbers, even when calling from a mobile.

This guarantee is provided by Accord Mortgages Limited

Accord Mortgages Limited is registered in England No. 2139881. Registered Oce: Yorkshire House, Yorkshire Drive, Bradford BD5 8LJ

Tel: 0345 1 200 872. Fax: 01274 734240. www.accordmortgages.com

For Accord Mortgages Limited ocial use only - this is not part of the instruction to your bank or building society

If you prefer, you may specify a payment date between 1st and 28th of each month. Please enter the date in the box.

Reference Number

Service User Number

Accord Mortgages Limited is authorised and regulated by the Financial Conduct Authority.

Accord Mortgages Limited is entered in the Financial Services Register under registration number 305936.

(i.e. Accord Mortgages Limited Mortgage Account Number.)

Page 16 of 16

Accord Mortgages Limited is authorised and regulated by the Financial Conduct Authority.

Accord Mortgages Limited is entered in the Financial Services Register under registration

number 305936. Accord Mortgages Limited is registered in England No. 2139881.

Registered Oce: Yorkshire House, Yorkshire Drive, Bradford, BD5 8LJ.

Tel 01274 801 000 - Fax 01274 801 070 - DX number 11756

Accord Mortgages is a registered Trade Mark of Accord Mortgages Limited.

All communications with us may be monitored/recorded to improve the quality of our

service and for your protection and security. Calls to 03 numbers are charged at the same

standard network rate as 01 or 02 landline numbers, even when calling from a mobile.

accordmortgages.com

OFFSET PAYMENT DETAILS

With the oset mortgage account you have three options for your payment amount. You can change your oset option at any time during the life of

your mortgage by contacting us.

1. Net – Reduce current mortgage repayments Your monthly payment is calculated based on the dierence between your mortgage balance and

your oset savings balance; so the more savings you have, the lower your monthly mortgage payment will be. You must specify the total amount

of savings you will have linked to your mortgage within 30 days of completion to ensure we calculate your mortgage payments correctly. You

must make us aware if you reduce your oset savings balance at any time, as your mortgage payments will only automatically be recalculated at

our annual review and if savings are withdrawn, you could be underpaying.

2. Gross – Reduce future mortgage repayments You make your monthly mortgage payment as if there was no money in your oset savings account.

Your oset savings are used to reduce the interest charged on your mortgage and lower the monthly payment when it is recalculated at annual

review. The payment is recalculated, based on the mortgage balance and the remaining mortgage term.

3. Static – Pay your mortgage o sooner Similar to option 2, however a static/xed direct debit amount is set up and maintained throughout the

mortgage term which eectively pays the mortgage balance o quicker. The monthly direct debit payment will not reduce even though the

registered monthly mortgage payment will. The static payment can be amended at any time. You must specify the amount you want your xed

static payment to be which needs to be equal to or higher than the gross monthly payment to take eect.

Please indicate the payment option you require

Net payment - Enter estimated savings balance here £

Gross

Static payment - Enter static amount as discussed during your appointment here £

Please refer back to your adviser/broker if this was not discussed

Please note: without adequate security, email is not a secure form of communication as it may be intercepted, lost or corrupted. If you send

attachments via email without adequate security this should be made clear to your client as Accord Mortgages cannot accept liability for any loss of

personal information provided via this medium.

NEW OFFSET SAVINGS DECLARATION (IF APPLICABLE)

DECLARATION:

I declare that the share account will not be held by me as trustee or nominee for a company or other corporate body or for persons who include

a company or other corporate body. I will be subject to the terms and conditions of the account which are set out as follows: (i) Oset Savings

account - Oset Terms, I have a copy of these. I will also be subject to the Rules of Yorkshire Building Society (a copy of which can be obtained on

request). Each person who signs makes this declaration.

I agree to the processing of my personal information as explained on page 11 of this mortgage application form.

I agree to Accord Mortgages disclosing details of this Oset Savings account to all borrowers and guarantors (if any) of an Oset Mortgage account

linked to this account.

For joint accounts: How many signatures are required to operate the account?

SIGNATURE(S) (ALL APPLICANTS MUST SIGN - APPLICATIONS WILL NOT BE ACCEPTED WITHOUT ALL SIGNATURE(S))

1st Applicant signature

Date

2nd Applicant signature

Date

IDENTIFICATION REQUIREMENTS

Under regulations for the prevention and detection of nancial crime, we have a responsibility to verify the identity of each applicant before

opening a new account, even existing customers. To do this we use an electronic verication system. However, in certain cases, for example, you are

not listed on the electoral roll or you have recently moved house, we may need further proof of your identity. For postal applications, this will mean

returning your application. Therefore, you may wish to provide additional proof of your identity with your application. To nd out which forms of

identication are acceptable, please call us on 0345 1200 872 or our website www.accordmortgages.com

FOR ACCORD MORTGAGES USE ONLY

New Oset savings account number

New Oset savings account holders

Commercial mortgages oered by YBS Commercial mortgages is not regulated by the Financial

Conduct Authority. YBS Commercial mortgages is a trading name of Yorkshire Building Society.

Yorkshire Building Society is a member of the Building Societies Association and is authorised

by the Prudential Regulation Authority and regulated by the Financial Conduct Authority.

Yorkshire Building Society is entered in the Financial Services Register under registration

number 106085. Registered Oce: Yorkshire House, Yorkshire Drive, Bradford, BD5 8LJ.

Our printed material is

available in alternative

formats e.g. large print,

Braille or audio.

Please call us on

0345 1200 891.