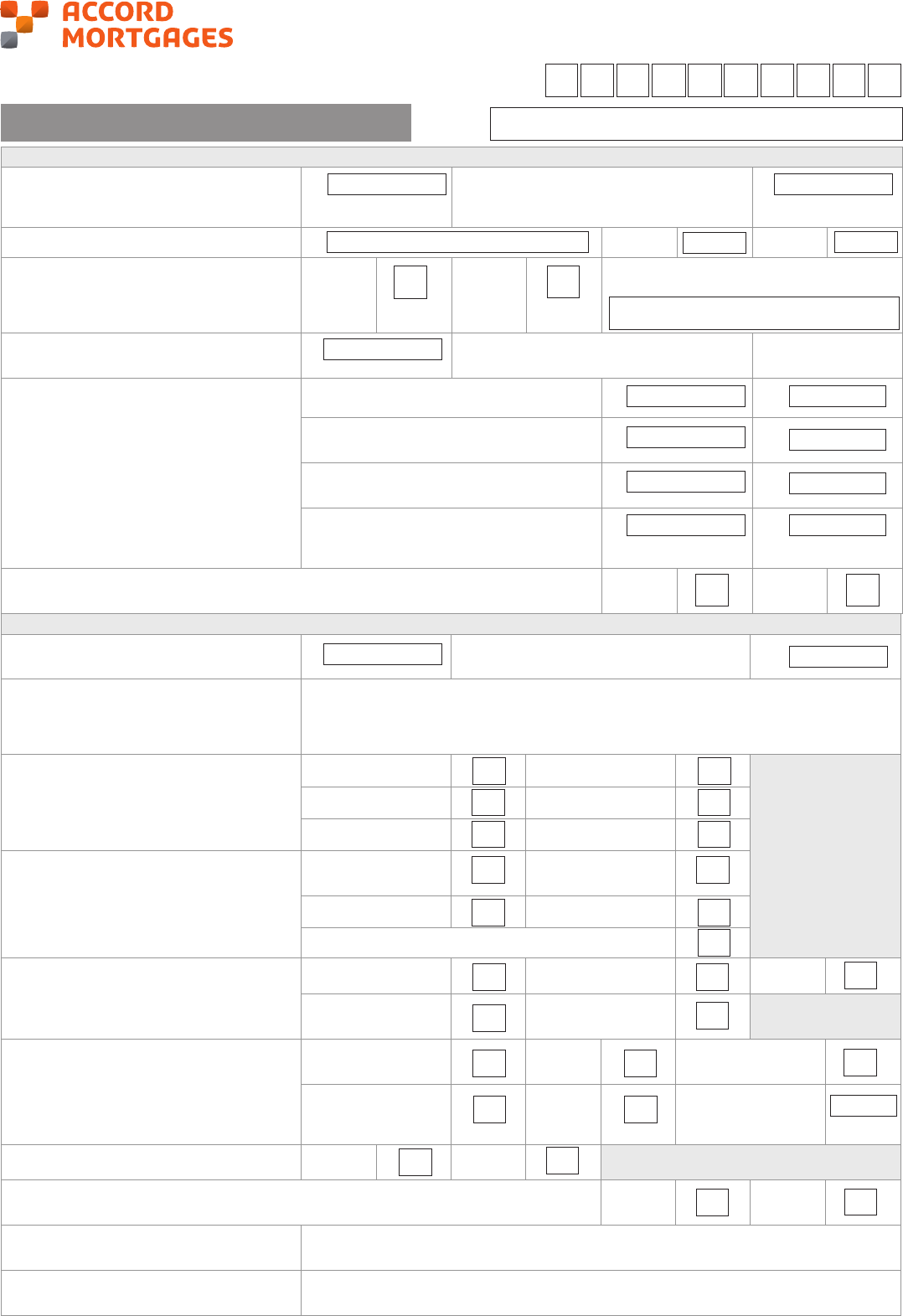

Following my/our recent mortgage application,

please amend the details as follows:

replacement property

application form

LOAN DETAILS

1. Purchase price (house purchase only)

or approximate value of property (if

remortgaging)

£ What is the current valuation amount of

the property? (Scotland only)

£

2. Total loan required and over what term £ Years Months

3. Is this a ‘Help to Buy’ Equity loan

application

Yes No If YES please conrm which Help to Buy

Scheme (i.e. England)

4. If ‘Help to Buy’ Equity loan scheme,

what is the Equity loan amount?

£ Equity loan term (whole years only) Years

5. If remortgaging, how much is the loan

for

Repayment of existing mortgage £

Capital raising (please note this may not

be used for business purposes)

£

Home Improvements (please specify)

(e.g. Central heating/bathroom/kitchen)

£ For

Other (please specify) (e.g. purchase

of land/transfer of property subject to

mortgage)

£ For

6. Are you purchasing under the ‘Right to Buy’ scheme or as a concessionary

purchase?

Yes No

Account number

Name(s)

PROPERTY INFORMATION

1. Approximate year that the property

was built

Date of Entry (Scotland Only)

2. Full address (if it is a new property,

and yet to be numbered, please tell us

the plot number)

3. Type of property (more than one

answer may apply)

House Bungalow

Flat/Maisonette Detached

Semi-detached Terrace

4. If you have ticked FLAT or

MAISONETTE, please tell us

Which oor in

block

No of oors in

block

Purpose built Converted house

Above/below premises

Page 1 of 3

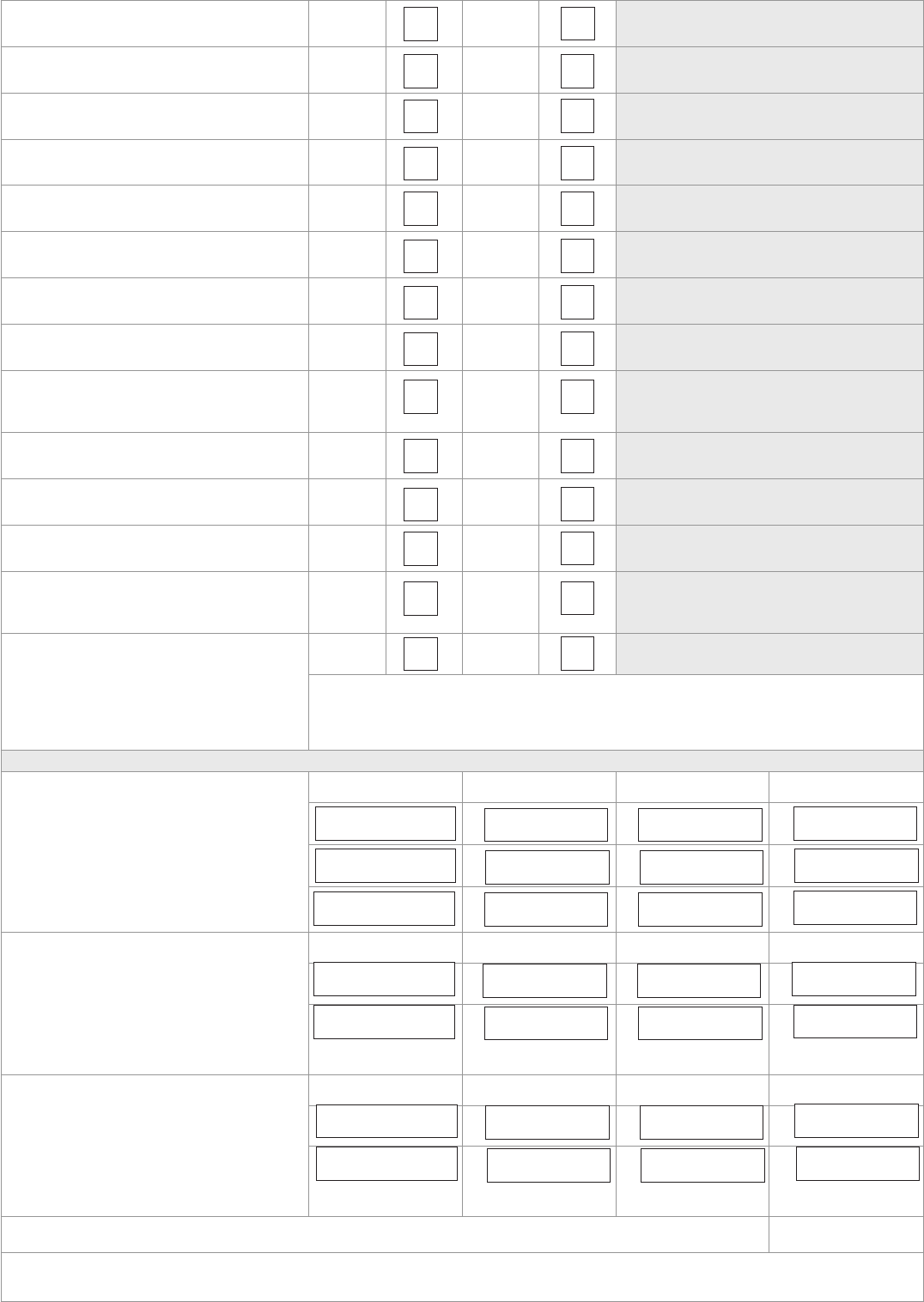

5. Accommodation - please indicate the

number of:

Reception rooms Kitchens Bedroom

Bathrooms Inside WCs

(if separate)

6. Is the property (more than one answer

may apply, please complete as

appropriate)

Heritable (Scotland

only)

Freehold

Commonhold

Leasehold -

unexpired term of

lease

Years Ground rent and

service charge

7. Has the property ever been occupied? Yes No

8. Is the property a new build? (will you be the rst owner/occupier since the

property was built/converted to its current state)?

Yes No

9. If a new Build, please provide the

Builders name:

10. If a new Build, please provide the

Development name:

ACC0778 02/12/22

11. Is the property in need of

refurbishment?

Yes No

12. Is the property a listed building? Yes No

13. Is the property habitable? Yes No

14. Is the property ex local authority? Yes No

15. Is the property at risk of coastal or

river erosion?

Yes No

16. Does the property have a garage or

parking space?

Yes No

17. Does the property have a basement or

a cellar?

Yes No

18. Does the property have a plot size

greater than one acre?

Yes No

19.Does the property have walls

constructed of one of the following:

brick, block or stone?

Yes No

20. Does the property have a roof

constructed of either tile or slate?

Yes No

21. Has the property been ooded in the

last ve years?

Yes No

22. Has the property suered from

subsidence, heave or landslip?

Yes No

23. Has the property had signicant

structural alterations made that are

not visible from the road?

Yes No

24. Do you intend to run a business from

or let any part of the property?

If YES please provide details

Yes No

MORTGAGE REQUIREMENTS

1. Which Accord Mortgages’ product are

you applying for?

Please note: If you would like to have

more than one product, or you are

an existing borrower wishing to use

portability, please conrm the amount

required on each product

Product Repayment Interest-only Total

£ £ £

£ £ £

£ £ £

2. For any existing Interest-only parts,

please state the proposed repayment

strategy that will be used to repay the

amount borrowed at term end. Please

refer to the Accord website for details

of acceptable repayment strategies

for any existing Interest Only parts.

Repayment strategy

Amount

Repayment strategy

Amount

£ £

£ £

3. For any new Interest-only borrowing,

please state the proposed repayment

strategy that will be used to repay

the amount borrowed at term end

e.g. Existing endowment, general

investment, sale of mortgaged

property etc.

Repayment strategy

Amount

Repayment strategy

Amount

£ £

£ £

If you are applying for an oset mortgage product, please complete the supplementary form

Please note, we may carry out a new credit check (soft footprint), in addition aordability may need to be reassessed and up to

date income verication documents required.

Page 2 of 3

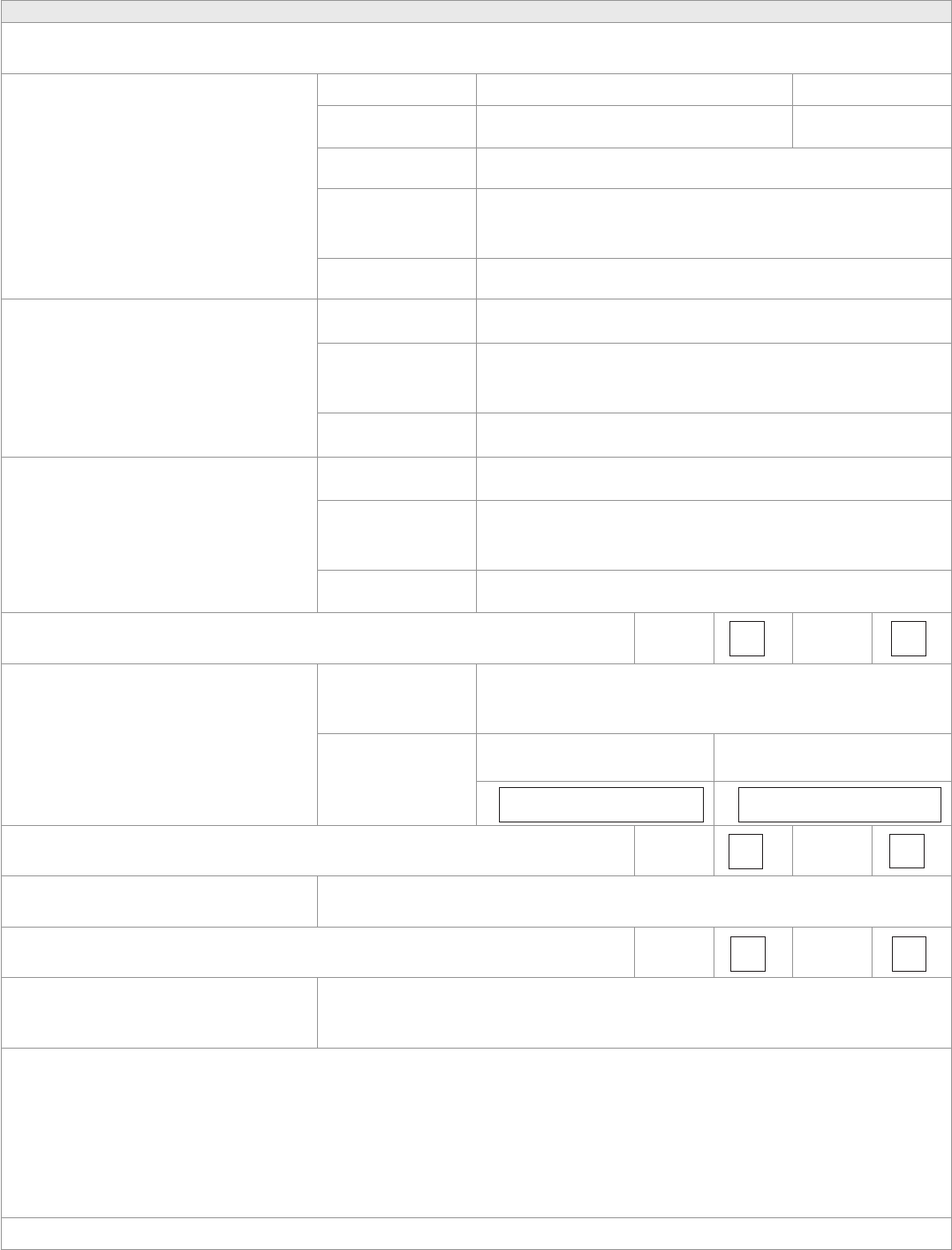

VALUATION DETAILS

A mortgage valuation is solely for our purposes and benet so that we can be satised that

the property provides sucient security for us to lend.

1. What type of valuation do you

require?

If the valuation has already been

carried ou,t please conrm contact

name, address and telephone number

of the valuer

Mortgage valuation Home buyer survey & valuation Building survey

Name

Address

Telephone no

2. Who can the valuer obtain keys from? Name

Address

Telephone no

3. Name and address of person selling? Name

Address

Telephone no

4. Apart from your ‘Help to Buy’ Equity Loan (if applicable) if you are borrowing the

dierence please tell us?

Yes No

5. If you are borrowing the dierence

between the purchase price and the

amount of loan you are applying for

please tell us:

(a) from where and

the date when you

must repay it

(b) how much you

are borrowing and

how much you are

repaying month

Amount borrowed Monthly repayment

£ £

6. Are you receiving any cashbacks, discounts, allowances or other incentives in

connection with this purchase from any source?

Yes No

If YES, please provide full details

7. Is there an increase in deposit? Yes No

If Yes, please provide a breakdown of the

source of funds.

Extra space - Please declare any additional information that has occurred since the signing of your last application which may have

aected your creditworthiness or any other relevant changes e.g. change of solicitor:

Date application completed

Accord Mortgages Limited is registered in England No. 2139881 Registered Oce:

Yorkshire House, Yorkshire Drive, Bradford, BD5 8LJ www.accordmortgages.com

Accord Mortgages Limited is authorised and regulated by the Financial Conduct

Authority. Accord Mortgages Limited is entered in the Financial Services Register

under registration number 305936. Accord Mortgages is a registered Trade Mark of

Accord Mortgages Limited. All communications with us may be monitored/recorded

to improve the quality of our service and for your protection and security.

Our printed material is available

in alternative formats e.g. large

print, Braille or audio. Please call

us on 0345 1200 872.

Page 3 of 3