United States General Accounting Office

GAO

Report to the Chairman, Subcommittee

on Transportation, Committee on

Appropriations, U.S. Senate

June 1999

TRANSPORTATION

INFRASTRUCTURE

Advantages and

Disadvantages of

Wrap-Up Insurance for

Large Construction

Projects

GAO/RCED-99-155

GAO

United States

General Accounting Office

Washington, D.C. 20548

Resources, Community, and

Economic Development Division

B-281480

June 1, 1999

The Honorable Richard C. Shelby

Chairman, Subcommittee on Transportation,

Committee on Appropriations

United States Senate

Dear Mr. Chairman:

Traditionally, for large construction projects, project owners (such as

state departments of transportation and transit agencies), contractors, and

subcontractors have purchased insurance independently to protect

themselves from financial losses. In contrast, with wrap-up insurance, the

project owner can cover all the parties involved in the project—the owner,

the construction manager, the general contractor, and the subcontractors.

Over the past decade, wrap-up insurance has been used increasingly on

large construction projects because of the potential for cost savings. In

1998, wrap-up insurance covered about 300 construction projects

nationwide. However, wrap-up insurance has been used infrequently on

highway construction projects because they often are too small. As part of

your Committee’s continuing oversight of federally funded transportation

projects, you asked us to identify the advantages and the disadvantages of

wrap-up insurance over traditional insurance and the factors that can

affect the broader use of wrap-up insurance. As part of our methodology,

we reviewed the justification for, the costs of, and the potential benefits or

problems with wrap-up insurance on six federally funded highway and

mass transit projects. These projects varied in cost, geographic location,

and type of construction and included highway, bridge, tunnel, and rail

transit construction. We also interviewed officials in the insurance and

construction industry and reviewed reports and analyses of wrap-up

insurance in order to gain an understanding of the broad issues in using

wrap-up insurance.

Results in Brief

Owners of transportation projects, such as transit agencies and state

departments of transportation, experience a number of advantages and

disadvantages when they use wrap-up insurance. Major advantages

include savings from buying insurance “in bulk,” eliminating duplication

in coverage, handling claims more efficiently, reducing potential litigation,

and enhancing workplace safety. According to insurance industry officials,

wrap-up insurance can save project owners up to 50 percent on the cost of

traditional insurance, or from 1 to 3 percent of a project’s construction

GAO/RCED-99-155 Transportation InfrastructurePage 1

B-281480

cost, depending on its size. The potential disadvantages of wrap-up

insurance include requiring project owners to invest more time and

resources in administration. Project owners must hire additional

personnel or pay to contract out the management of the wrap-up

insurance. In addition, project owners could also have to pay large

premiums at the beginning of the project. However, transportation

officials said these costs were reasonable.

A number of factors can affect the broader use of wrap-up insurance.

Perhaps the most significant barriers are state systems for workers’

compensation that, in some states, effectively prevent wrap-up insurance

by greatly reducing its potential cost savings. Another limitation is that a

project must be sufficiently large, or contain at least a sufficient amount of

labor costs, to make wrap-up insurance financially viable. Finally, some

contractors dislike wrap-up insurance because it reduces a contractor’s

profits from insurance rebates.

Background

Contractors and project owners purchase insurance to protect their

business assets from potential claims and losses. Under both traditional

and wrap-up insurance, the project owner and construction contractors

must buy the same kinds of policies. The basic types of insurance for

construction projects include workers’ compensation, general liability,

architects’ and engineers’ professional liability, builders’ risk, excess

liability, and pollution liability.

1

For some projects, more specialized

insurance policies are needed. For example, construction projects on or

near water must have longshoremen’s and harborworkers’ insurance,

while projects on or near a railroad must have railroad protective liability

insurance. Wrap-up insurance can provide all of these types of coverage

but does not provide for automobile liability or insurance on the

contractors’ tools and equipment.

In general, a project owner may choose from two basic types of wrap-up

insurance. The simplest form of coverage is the payment of a flat premium,

also known as a guaranteed cost plan. With this plan, the premiums stay

the same during the term of the policy, even if a high amount of claims is

paid out. The guaranteed cost plan is the more common form of coverage

for small to medium-sized businesses. With the second type of plan,

known as a loss-sensitive plan, the premiums depend on the policyholder’s

claims that are actually paid, called “losses.” A loss-sensitive plan

generally returns a refund for low losses and charges additional premiums

1

See app. I for a description of these types of policies.

GAO/RCED-99-155 Transportation InfrastructurePage 2

B-281480

for high losses, giving the owner an incentive to run a safe operation. In

either a guaranteed cost or loss-sensitive plan, a policyholder can assume

a deductible limit (as with automobile insurance) before the insurance

carrier contributes to the claim settlement. Deductible limits make owners

assume some of the insurance risk, which helps to lower insurance costs.

Five of the six agencies we contacted chose loss-sensitive insurance plans;

one used a guaranteed cost plan. All six agencies used deductible limits to

lower their insurance costs.

Advantages and

Disadvantages of

Wrap-Up Insurance

Owners of construction projects have cited a number of advantages from

using wrap-up insurance, including potential cost savings and enhanced

workplace safety. The six projects we reviewed all claimed cost savings as

a result of using wrap-up insurance. According to project owners, the

fewer injuries resulting from centralized safety programs contributed to

these savings. Two potential disadvantages include greater administrative

costs to manage the wrap-up insurance and the potential for higher

up-front insurance premiums. However, the project owners believe that

these additional costs were reasonable.

Potential Cost Savings Are

Available From Wrap-Up

Insurance

According to insurance industry officials, wrap-up insurance can save

project owners up to 50 percent on the cost of traditional insurance, or

from 1 to 3 percent of a project’s construction cost. Officials from the six

transportation projects we reviewed estimated insurance savings of from

$2.9 million to $265 million by using wrap-up insurance. Wrap-up

insurance generates these savings by using bulk buying power, avoiding

duplicate insurance coverage, using more efficient ways to process claims,

and reducing litigation.

Purchasing Insurance in Bulk Insurance industry officials we interviewed said that the initial savings

from wrap-up insurance are due to an owner’s bulk buying power and

economies of scale. A project’s owner can purchase coverage at a lower

premium than the contractors would pay if they purchased insurance

individually. The owner can obtain coverage designed for the specific

needs of the project and provide primary coverage, such as that for

general liability and workers’ compensation, for all the contractors and

subcontractors involved in the project. However, the size of the

construction project will affect how much buying power the owner will

have; insurance companies can provide a better rate for larger projects.

Large labor-intensive projects with construction costs between $50 million

GAO/RCED-99-155 Transportation InfrastructurePage 3

B-281480

and $100 million would be in a better position to obtain wrap-up

insurance.

Avoiding Duplication and Gaps

in Coverage

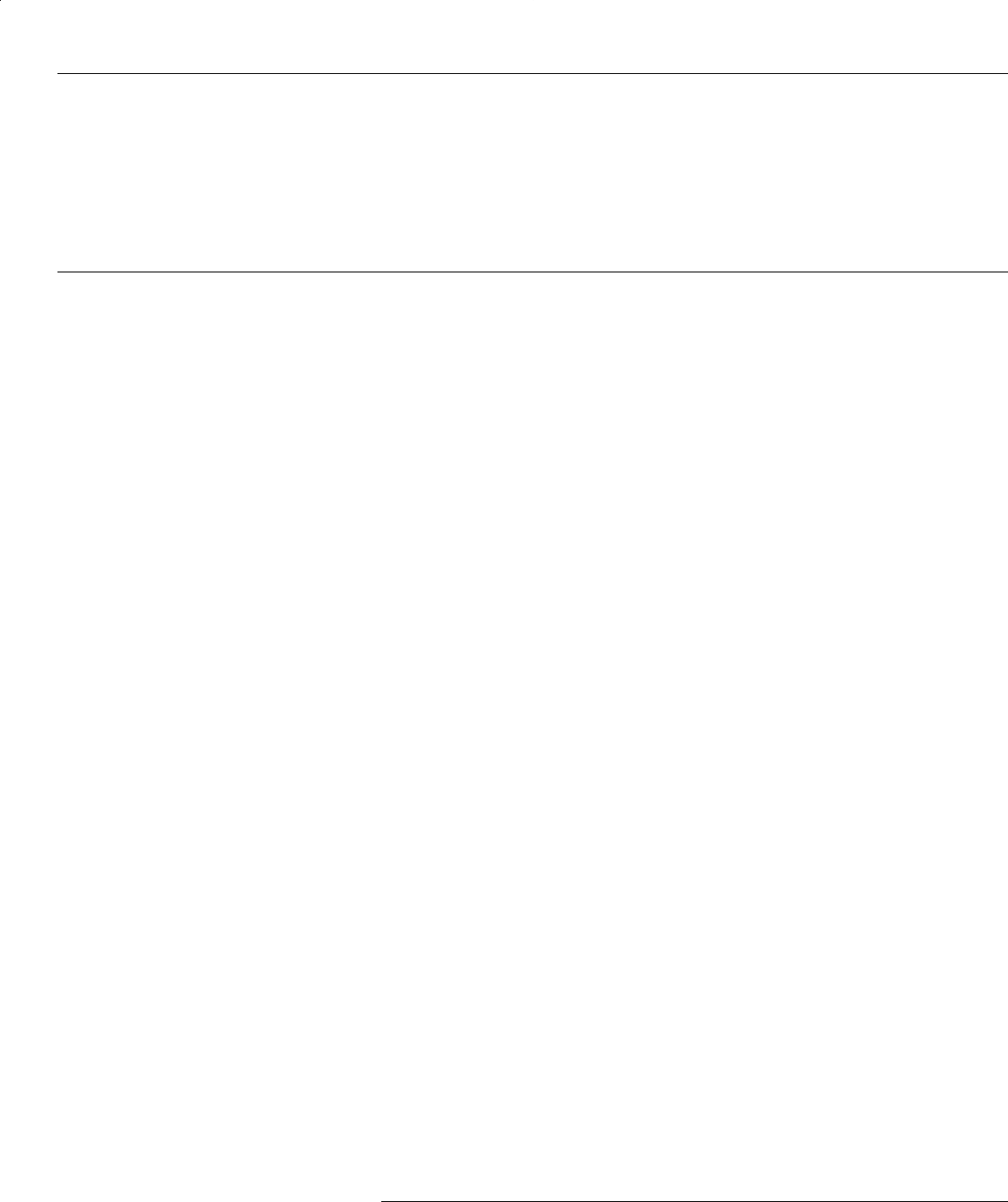

As table 1 shows, under traditional insurance, every contractor and

subcontractor buys separate insurance policies. The result can be

duplication and overlap of coverage because the contractors and the

subcontractors are insuring themselves against the same accidents, even

though they all may not be liable for the resulting claims. This kind of

duplication can also result in litigation between insurance companies over

claims. Under wrap-up insurance, the project’s owner can ensure that

there are no gaps or duplication in coverage because only one insurance

company is used. This is an important factor for the owner because

contractors using different insurance companies could have variations in

their policies or lower coverage than required, thereby exposing the owner

to uninsured claims. By purchasing insurance directly, the owner can

ensure sufficient coverage for the general liability and workers’

compensation aspects of the policy as well as sufficient coverage for the

general contractor and the subcontractors.

2

Table 1: Traditional Insurance

Coverage Compared to Wrap-Up

Insurance

Traditional insurance Wrap-up insurance

The project owner purchases policies to

cover the following: workers’ compensation,

general liability, automotive liability, excess

liability, and builders’ risk insurance.

The project owner purchases insurance

policies that cover the owner, the general

contractor, and the subcontractors for the

following: workers’ compensation, general

liability, excess liability, and builders’ risk

insurance.

The general contractor purchases policies

to cover the following: workers’

compensation, general liability, automotive

liability, excess liability, and builders’ risk

insurance.

The subcontractors purchase policies from

multiple

insurance companies to cover the

following: workers’ compensation, general

liability, automotive liability, excess liability,

and builders’ risk insurance.

More Efficient Claims

Processing and Less Litigation

According to insurance brokers and project management officials,

wrap-up insurance facilitates more efficient and simplified claims

processing. A single insurer is the control point for reporting claims,

conducting the investigations, and making payments. In addition, a single

2

General liability insurance protects owners and contractors from the financial consequences of

various risks such as accidents, hazardous operations, or accidents after work is completed. The

policy pays for a variety of benefits including legal expenses, injuries to people, and damage to

property.

GAO/RCED-99-155 Transportation InfrastructurePage 4

B-281480

insurer can prepare the loss data for the owner to identify current claims

and costs. With one insurer, claim settlement procedures are more

consistent.

Wrap-up insurance reduces potential litigation and disputes between

insurance companies. For instance, the more insurers that are involved in

a construction project, the greater the chance of lawsuits to settle accident

and injury claims. This is especially true with traditional insurance

because each contractor purchases policies through separate insurance

companies. The subsequent disputes and litigation can be costly, as the

various insurance companies seek to determine responsibility and reduce

their liability. The liability and the litigation costs can be passed on to each

policyholder in the form of higher premiums. Wrap-up insurance, on the

other hand, can reduce the incidence of insurance companies’ disputes

and litigation and the associated costs because the policies are with a

single carrier that is responsible for claims.

Projects’ Estimated Cost

Savings

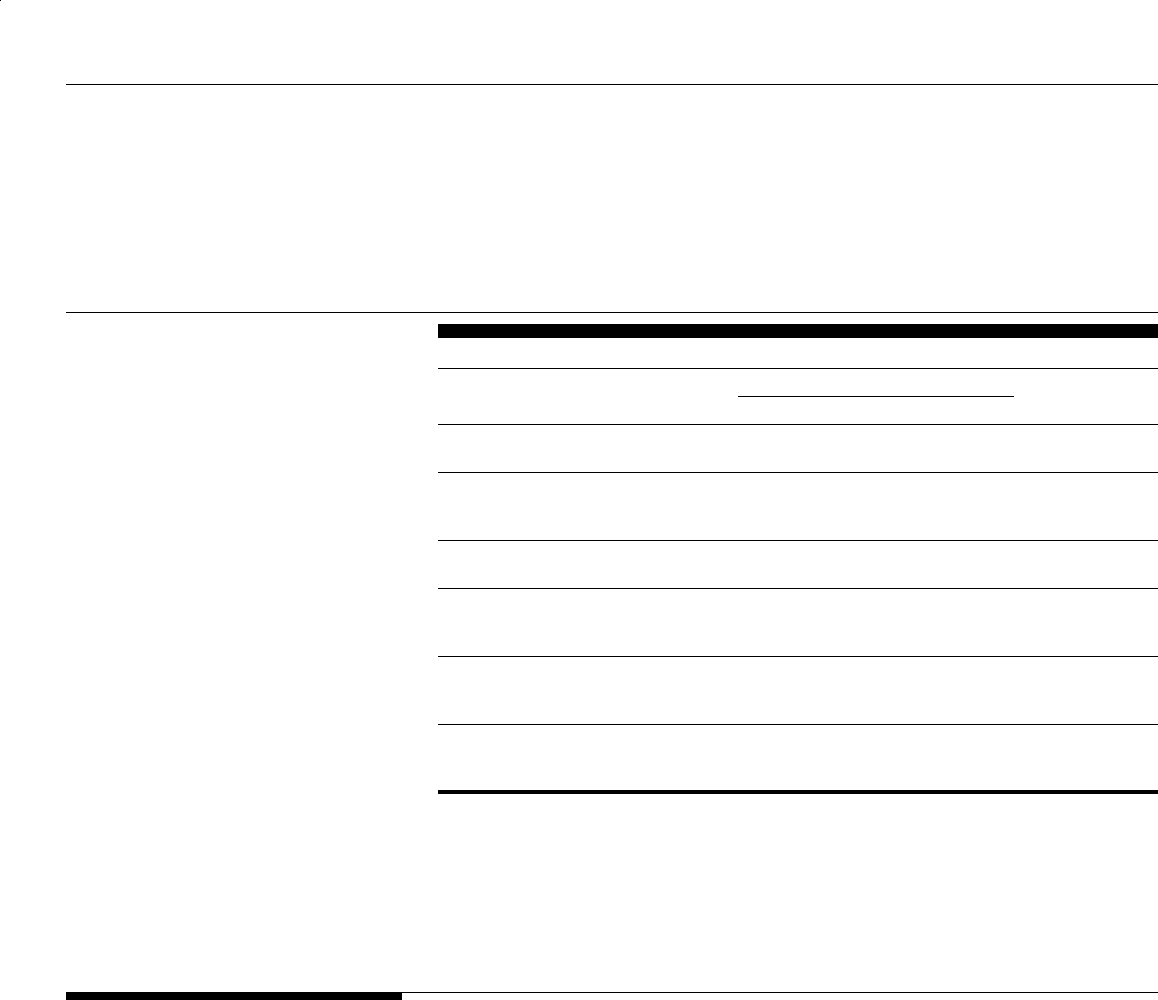

To test the cost savings associated with wrap-up insurance, we reviewed

six large transportation infrastructure projects that used this insurance.

Table 2 shows the projects we reviewed, the projects’ total costs, and the

owners’ estimated insurance costs for wrap-up insurance and traditional

insurance. All the project owners provided estimates of their costs to use

wrap-up or traditional insurance and their estimated savings. Estimated

savings for these projects ranged from about $3 million to $265 million. On

the basis of the owners’ estimates, using wrap-up insurance could save

between 1 and 3 percent of each project’s total costs.

The estimated savings for these transportation projects are consistent with

study results and industry estimates. In 1998, the Transit Construction

Roundtable conducted a survey of its members and had similar findings.

3

Of the 18 members who responded to the survey, 14 had experience with

wrap-up insurance, and all of them responded that wrap-up insurance

costs less than traditional contractor-provided insurance. Thirteen of these

project owners estimated that, on average, wrap-up insurance costs

28 percent less than traditional insurance. The six projects we reviewed

provided similar findings. Data from these six show that, on average, their

wrap-up insurance costs about 38 percent less than traditional insurance

would have cost.

3

The Transit Construction Roundtable is a partnership between the Federal Transit Administration and

local public transportation agencies that was formed to share information and discuss issues related to

the construction of mass transit systems.

GAO/RCED-99-155 Transportation InfrastructurePage 5

B-281480

Table 2: Transportation Projects Using

Wrap-Up Insurance and Owners’

Estimated Costs and Savings

Insurance costs

Dollars in millions

Project name

and location

Total project

cost Traditional Wrap-up

Insurance

savings

Blue Water

Bridge, Michigan

$97.2 $10 $7.1 $2.9

Boston Central

Artery Tunnel,

Massachusetts

$10,800 $1,030 $765 $265

I-15, Salt Lake

City, Utah

$1,600 $52.2 $22.3 $29.9

CTA Green Line

Rehabilitation,

Chicago, Illinois

$408.7 $32.5 $21.0 $11.5

Hudson-Bergen

Light Rail (initial

segment)

$992 $20 $11 $9

Tri-Met, Westside

Light Rail,

Portland, Oregon

$952 $27.1 $17.2 $9.9

Note: We did not independently audit the accuracy of the project owners’ cost estimates. In the

process of choosing to use wrap-up insurance, each owner developed cost information by one of

three methods: (1) obtaining two bids—one with insurance included and one with insurance

excluded, (2) removing insurance costs from existing contracts, or (3) relying on brokers’

estimates of traditional insurance.

Source: Various state highway and mass transit authorities.

Centralized Safety

Programs Are

Important to

Achieving Savings

Much of the potential savings from wrap-up insurance derives from a

well-managed centralized safety program that results in fewer injuries.

Under traditional insurance, each contractor, along with its insurance

broker and insurance company, may be involved in safety, but typically

there is no single coordinated safety program. While some contractors

budget for safety and make every effort to run a safe operation under

traditional insurance, coordination can be difficult because there are many

insurance companies and contractors, each with its own safety program.

In contrast, wrap-up insurance can provide a greater emphasis on and

level of control over safety because the project owner controls the safety

program and can ensure that there is an effective, comprehensive safety

program in place. Each of the six projects we reviewed had centralized

safety programs and safety records that were better than the national

average. Officials from each project stated that the project’s safety

program contributed to its actual or projected insurance savings.

GAO/RCED-99-155 Transportation InfrastructurePage 6

B-281480

Wrap-Up Insurance

Facilitates Comprehensive

Safety Programs

According to insurance industry officials, wrap-up insurance can improve

safety because one safety team can oversee all aspects of safety at a job

site. Project owners said that using wrap-up insuranceallowed for the

development of a centralized safety program covering all the operations of

the contractor and the subcontractors. Owners, insurance brokers, and

insurance companies have a compelling financial interest to keep claims

to a minimum. Owners can save by having to pay less in deductibles, while

insurance brokers and companies pay out less when there are fewer

claims. Therefore, the safety representatives of the project owner, the

insurance broker, the insurance companies, and the contractors oversee

the procedures outlined in the comprehensive safety plan. A project’s

safety team provides an ongoing on-site presence to improve safety and

can provide innovative safety improvements. For example, in constructing

the Blue Water Bridge in Michigan, the project’s management team faced

the problem of providing safety netting for its bridge workers to protect

them from a fatal fall. Traditionally, safety netting is strung to an existing

structure, and the workers that string the safety netting have to work

without the protection that they are installing. Because of this emphasis on

safety, the general contractor developed the idea of attaching the nets to

the bridge before the sections were put in place, thus eliminating the need

for the dangerous work involved in stringing the nets and reducing the risk

of a fall.

In contrast, under traditional insurance, a coordinated approach to project

safety is difficult because the contractors and the subcontractors oversee

safety for only their segment of the work. In addition, there is some

variability in how much emphasis individual contractors place on safety;

while some contractors make every effort to achieve safety, others may

not. Also, with traditional insurance, insurance brokers and companies

with minimal involvement in a project cannot justify a continuous safety

presence at the construction site. As a result, some contractors and

subcontractors may not be closely monitored. Finally, lower insurance

rates are a safety incentive for general contractors and subcontractors

under traditional insurance. However, as one insurance industry official

noted, other incentives, such as bonuses for early completion, can make

completing a project within a certain time frame an overriding objective

for them.

Project Owners Believe a

Centralized Safety

Program Saved Costs

Each of the six project owners we contacted emphasized the importance

of a centralized safety program as the basis for the success of their

wrap-up insurance. According to officials from the six transportation

GAO/RCED-99-155 Transportation InfrastructurePage 7

B-281480

projects, improved safety at a construction site has the positive effect of

reducing general liability and workers’ compensation claims, thus

producing cost savings for the owner. All six project owners cited injury

losses lower than the national average and lower than had been initially

anticipated. For example, officials from the Boston Central Artery project

identified reduced injuries as the main basis for cost savings on their

project and cited a loss ratio of 23 percent compared to a historic national

average of about 65 percent for that type of construction project.

4

Officials

from the Michigan Blue Water Bridge project cited a loss ratio of

10 percent compared to a national average of 50 percent for that type of

project. Moreover, project owners said that even without the cost

reductions resulting from the lower claims, improving safety on large

construction projects is a worthy goal in itself. In the case of the Portland

Tri-Met project, the primary reason for using wrap-up insurance was not

cost savings but improved safety, according to agency officials. They said

that using wrap-up insurance allowed them to establish the type of

well-controlled safety program they believed was essential to the project.

Project Owners Face

Increased Administrative

Costs With Wrap-Up

Insurance

One of the disadvantages to using wrap-up insurance is the additional

administrative and up-front insurance costs that the project owners can

incur. Project owners are responsible for administering the wrap-up

insurance and must either out source this function or assign additional

administrative staff to plan and implement it. Depending on how it is

structured, wrap-up insurance can also have large premium costs at the

start of a construction project. In addition, wrap-up insurance presents

project owners with greater risks than with traditional insurance.

However, these increased risks can be mitigated somewhat by the type of

insurance policies that owners purchase and by an effective safety

program.

Wrap-up insurance can impose additional administrative burdens on

project owners. They become responsible for supplying the resources to

help design and implement its administration. Wrap-up insurance

emphasizes job site safety, controlling losses, and effective claims

management—activities that require additional resources for internal

audits and risk management. For the projects we reviewed, some owners

chose to out source some of these administrative functions to insurance

brokers or agents, while others performed some or all of these functions

with their staff. For example, the Chicago Transit Authority relied on its

broker to administer the wrap-up insurance for the Green Line

4

A loss ratio is the dollar amount paid out for claims as a percentage of premiums paid.

GAO/RCED-99-155 Transportation InfrastructurePage 8

B-281480

Reconstruction project. The Michigan Department of Transportation

(

MDOT) and the New Jersey Transit Corporation also delegated

administrative responsibilities to their insurance agents and brokers. On

the other hand, the Tri-County Metropolitan Transportation District of

Oregon used its staff to administer the wrap-up insurance program for its

Westside Light Rail project. Most owners hired safety engineers for their

projects to supplement their insurance brokers’ and general contractors’

safety teams. However, all of the agencies we contacted relied on their

insurance companies to investigate and settle claims.

Recognizing the increased interest in using wrap-up insurance for public

construction projects, the Transit Construction Roundtable in 1998

surveyed transit agencies on their use of wrap-up insurance. The survey

asked them whether a wrap-up insurance program added an additional

administrative burden. All the respondents affirmed that wrap-up

insurance added to their administrative workload but that the burden was

reasonable.

In addition, some insurance companies may require owners to make large

premium payments at the start of a construction project. The policies may

require that owners establish a special reserve to ensure that funds are

available to pay deductible requirements on claims. For example, the

Chicago Transit Authority had to pay $21 million in premium costs at the

beginning of the Green Line project. This was an additional burden to the

owner because, under a traditional insurance arrangement, the owner

would not have to make a lump sum payment. The owner would make

payments to contractors, who would have to make premium payments and

establish their own reserves for deductibles.

Factors Preventing

the Broad Application

of Wrap-Up Insurance

State insurance laws, minimum project size, and contractors’ concerns

may limit the broader use of wrap-up insurance. Some states specify that

contractors must use the state fund for workers’ compensation as the

primary insurance vehicle for construction projects.

5

Because

three-fourths of the total insurance cost on a construction project can be

for workers’ compensation, removing it from the project owner’s control

effectively eliminates most of the cost savings derived from wrap-up

insurance. Projects must also have sufficiently high labor costs to produce

the level of premium payments that insurance companies need to

underwrite a wrap-up. This normally limits wrap-up programs to larger

5

Workers’ compensation insurance pays claimants in case of injury, disability, or death of employees

resulting from work on the job.

GAO/RCED-99-155 Transportation InfrastructurePage 9

B-281480

construction projects or projects with high labor costs. Finally, some

construction contractors dislike wrap-up insurance. Contractors view

insurance rebates as a potential source of profits that they do not obtain

with wrap-up insurance because with wrap-up insurance such rebates go

to the project owner.

State Insurance Regulation

Wrap-up insurance may not be viable in at least five states because of the

way the states structure their workers’ compensation system. According to

a 1997 General Services Administration study of wrap-up insurance,

6

five

states—North Dakota, Ohio, Washington, West Virginia, and

Wyoming—have a state workers’ compensation fund into which all

contractors pay. In these states, a project owner cannot obtain separate

workers’ compensation insurance coverage, so most of the insurance

premiums for a project would be excluded from the owner’s wrap-up

insurance. This effectively eliminates the owner’s financial benefit from

wrap-up insurance because the bulk of insurance for a construction

project—as much as 75 percent of the cost—is related to workers’

compensation. Thus, wrap-up insurance without workers’ compensation

eliminates most of the owner’s potential cost savings. Insurance regulation

is generally a state function, and states have placed requirements on

wrap-up insurance that may limit but do not necessarily prevent its use.

For example, some states, such as Michigan and Oregon, have specific

laws that limit wrap-up insurance. Both states require that an owner

obtain prior approval for wrap-up insurance from the state insurance

regulator. Michigan law also establishes a minimum project cost of

$65 million to be eligible for wrap-up insurance. Oregon law sets a

$100 million minimum project cost to be eligible for wrap-up insurance

and prohibits rolling wrap-up insurance, that is, combining several

different projects under one insurance program.

Project Size and Labor

Costs

For an insurance company to issue policies for wrap-up insurance, a

project must be large enough to generate enough premiums to make it

worthwhile for the company. For this reason, wrap-up insurance generally

has not been used on small projects. Most of the insurance premiums an

owner pays under wrap-up insurance are to cover potential workers’

compensation claims. The insurance premiums for workers’ compensation

are based on the project’s estimated payroll costs multiplied by the

workers’ compensation rate set by the state. As the payroll costs for a

project increase, the amount of workers’ compensation premiums also

6

Wrap-Up Insurance Study, General Services Administration, Dec., 1997.

GAO/RCED-99-155 Transportation InfrastructurePage 10

B-281480

increases. Likewise, if the state’s workers’ compensation rate increases,

the amount of workers’ compensation premiums increases. The General

Services Administration’s study of the use of wrap-up insurance for federal

buildings concluded that insurers usually require at least $1.25 million in

annual premiums before they will assume the risk associated with a

wrap-up policy. However, because workers’ compensation rates vary from

state to state, the amount of payroll required to generate the required

premiums also varies. For example, Indiana, which has a low workers’

compensation rate, might require a project with $16.9 million in labor

costs to reach the $1.25 million annual premium level. In contrast, a

project in Minnesota, which has a high workers’ compensation rate, would

need only $3.2 million in labor costs to produce the same amount of

premiums. Because of these variations among the states, an owner’s

decision to use wrap-up insurance should be made on a project-by-project

basis, according to insurance industry officials.

For small construction projects that cannot achieve the $1.25 million

premium threshold, some owners have used rolling wrap-up insurance

that combines several projects under one insurance program. For

example, on the basis of its positive experience with wrap-up insurance on

the I-15 highway project, Utah established rolling wrap-up insurance for its

entire state highway program. Utah officials stated that it was too early to

assess performance of this insurance. However, one insurance industry

official cautioned that combining multiple small projects that are spread

over separate locations could greatly diminish the safety enhancements

and the resulting cost savings that can come from wrap-up insurance. The

official said it would be difficult to provide oversight and implement a

comprehensive safety program for many small projects spread over

separate locations. Therefore, one question to be answered is whether

Utah can achieve the same safety program and results on a statewide basis

as it did with the I-15 highway project.

Contractors’ Views and

Concerns About Wrap-Up

Insurance

For several reasons, some construction contractors view the use of

wrap-up insurance unfavorably. Under traditional insurance, contractors

can derive profits from their insurance programs. The contractors’ costs of

insurance are included in the bids and thus are paid by the project owner.

Contractors with good safety records can receive rebates on their

premiums from their insurance carriers, thereby generating profits. In

contrast, under wrap-up insurance the owner pays the premiums and

receives the rebates on the basis of a project’s good safety record.

However, some project owners provide contractors with good safety

GAO/RCED-99-155 Transportation InfrastructurePage 11

B-281480

records with additional payments. For example, contractors for Portland’s

Tri-Met Westside Project received almost $1.3 million in safety incentives.

Under a traditional insurance approach, a contractor with a better safety

record has a competitive advantage over a contractor with a safety record

that is not as good. The safer contractor has lower insurance premiums, so

this lower cost can be reflected in a lower bid. Under wrap-up insurance,

this competitive advantage is lost because insurance is not part of a

contractor’s bid. On the other hand, as a risk management consultant we

interviewed pointed out, many factors go into the bidding calculations of a

construction contractor, and insurance premiums can be less important

than other factors, such as labor productivity. In addition, officials from

Portland Tri-Met and the Chicago Transit Authority stated that by

eliminating insurance from bids, more disadvantaged businesses,

minorities, and women contractors are able to bid on construction

contracts. According to Chicago Transit Authority officials, using wrap-up

insurance on the Green Line project enabled the agency to achieve its goal

of having disadvantaged, minority, and women contractors represent

30 percent of the project’s costs. Some disadvantaged businesses,

minorities, and women contractors have difficulty obtaining sufficient

insurance to bid on large infrastructure projects.

In addition, with wrap-up insurance, a contractor may bear additional

record-keeping costs. For example, in reporting for workers’

compensation purposes, a contractor must carefully segregate the payroll

for a project using wrap-up insurance from the payrolls for other projects.

When a project requires changes to the original specifications, the

contractor has to remove insurance costs from the change order costs and

again segregate the labor costs. Thus, the contractor incurs costs in a

wrap-up insurance project that, under traditional insurance, would not be

necessary.

MDOT officials noted that to be fair to contractors, project

owners need to make contractors aware of these added costs before

contractors bid on a project.

Scope and

Methodology

To obtain information on the advantages and the disadvantages and the

factors affecting the broader use of wrap-up insurance, we reviewed

related publications and contacted trade associations, insurance brokers,

representatives of insurance companies, contractors’ representatives, and

a risk-management consultant. In addition, we interviewed officials from

the Department of Transportation’s Federal Highway Administration and

Federal Transit Administration about the extent to which wrap-up

GAO/RCED-99-155 Transportation InfrastructurePage 12

B-281480

insurance has been used on federally funded highway and transit

construction projects. For further review, we selected six transportation

projects that had recent or ongoing experience with wrap-up insurance.

We contacted managers and reviewed project documents for three

highway projects: the Michigan Department of Transportation’s Blue

Water Bridge Reconstruction, the Utah Department of Transportation’s

I-15 Reconstruction, and the Massachusetts Turnpike Authority’s Boston

Central Artery/Tunnel. We also reviewed three transit projects: the

Chicago Transit Authority’s Green Line Reconstruction, the New Jersey

Transit Corporation’s Hudson-Bergen Line, and the Oregon Tri-County

Metropolitan Transportation District’s Westside Line. The projects we

selected provided variations in project cost, type of construction (tunnel,

bridge, highway, light rail, and heavy rail), and state insurance regulatory

environment and included design-build and traditional construction

approaches.

We performed our review from September 1998 through April 1999 in

accordance with generally accepted government auditing standards.

Agency Comments

We provided a draft of this report to the Department of Transportation for

review and comment. We discussed the Department’s comments with

officials from the Office of the Secretary and the Federal Highway

Administration. The Department agreed with the information presented,

and the Federal Highway Administration provided several technical

comments that we incorporated into the report, as appropriate.

We will send copies of this report to cognizant congressional committees;

Rodney E. Slater, Secretary of Transportation; Kenneth R. Wykle,

Administrator, Federal Highway Administration; Gordon J. Linton,

Administrator, Federal Transit Administration; and other interested

parties. We will make copies available to others upon request. Please call

GAO/RCED-99-155 Transportation InfrastructurePage 13

B-281480

me at (202) 512-2834 if you or your staff have any questions. Major

contributors to this report were Joseph Christoff, Robert Ciszewski,

Alexander Lawrence, and Frank Taliaferro.

Sincerely yours,

Phyllis F. Scheinberg

Associate Director,

Transportation Issues

GAO/RCED-99-155 Transportation InfrastructurePage 14

GAO/RCED-99-155 Transportation InfrastructurePage 15

Contents

Letter

1

Appendix I

Types of Construction

Insurance

18

Appendix II

Transit and Highway

Construction Projects

Using Wrap-Up

Insurance

20

Tri-Met Westside Light Rail Line 20

New Jersey Transit Corporation Hudson-Bergen Rail Line 22

Chicago Transit Authority Green Line Rehabilitation Project 24

Utah Department of Transportation Interstate 15

(I-15) Reconstruction Project

26

Boston Central Artery/Tunnel Project 28

Michigan Department of Transportation Blue Water Bridge

Project

30

Tables

Table 1: Traditional Insurance Coverage Compared to Wrap-Up

Insurance

4

Table 2: Transportation Projects Using Wrap-Up Insurance and

Owners’ Estimated Costs and Savings

6

Abbreviations

CA/T Central Artery/Tunnel

CTA Chicago Transit Authority

FHWA Federal Highway Administration

GAO General Accounting Office

MDOT Michigan Department of Transportation

UDOT Utah Department of Transportation

GAO/RCED-99-155 Transportation InfrastructurePage 16

GAO/RCED-99-155 Transportation InfrastructurePage 17

Appendix I

Types of Construction Insurance

The following is a brief description of the various types of insurance

coverage used for construction projects.

Workers’ Compensation Pays claimant in case of injury, disability, or death of employees resulting

from work on the job.

General Liability Protects the owners and the contractors from the financial consequences

of various risks, such as accidents, hazardous operations, or accidents,

after work is completed. The policy pays for a variety of benefits,

including legal defense expenses, injuries to people, and damage to

property.

Builders’ Risk Pays for damages and losses to a project that occur while it is being built.

Excess Liability An umbrella policy that pays for losses that exceed primary policies, such

as general liability.

Pollution Liability Pays for environmental losses associated with accidental chemical spills

and the leakage or disbursement of dangerous vapors.

Professional Liability Pays for architects’ and engineers’ professional liability for errors and

omissions. This coverage is usually purchased by the architectural and

engineering firms but could be included under wrap-up insurance for a

design-build project.

Railroad Protective Liability insurance coverage for railroads, purchased by those who

conduct operations (construction) on or adjacent to railroad property.

Longshoremen/Maritime Liability insurance similar to workers’ compensation that provides

coverage for workers, including construction workers, on the water

(working on barges) or those working over water.

Automobile Liability Pays for damage to one or more vehicles that occurs while they are used in

the course of business. Also pays medical costs of persons injured in or by

an automobile. This insurance is typically not included in wrap-up

insurance because vehicles are operated outside the confines of the

project.

Tools and Equipment Pays when a contractor’s tools, equipment, field offices, or other property

are destroyed, damaged, or stolen. This insurance is not included in

wrap-up insurance because these items are considered mobile and

GAO/RCED-99-155 Transportation InfrastructurePage 18

Appendix I

Types of Construction Insurance

therefore difficult to manage. In addition, the premium costs for these

policies are not significant and would be difficult to isolate from bids.

GAO/RCED-99-155 Transportation InfrastructurePage 19

Appendix II

Transit and Highway Construction Projects

Using Wrap-Up Insurance

Tri-Met Westside Light

Rail Line

Project Description

The Westside Light Rail line is an 18-mile extension of the existing light

rail line and runs west from downtown Portland to Hillsboro, Oregon. The

project included a 3-mile double tunnel, a station 260 feet below the

surface, and 19 other stations. In addition to the tunnel, project engineers

encountered other difficulties in building the line, including obtaining

rights-of-way through some heavily populated areas of central Portland.

Construction started in July 1993 and was completed in September 1998.

The project’s total estimated cost was about $952 million, as of

February 1999. The project’s construction costs included purchasing 36

low-floor, light rail cars and building a 74,000-square-foot maintenance

facility.

Wrap-Up Insurance

Coverage

Johnson and Higgins, Marsh and McLennan was the insurance broker for

this project. Marsh and McLennan hired the brokerage firm of DH Lloyd to

provide administrative support for the workers’ compensation portion of

the wrap-up insurance. However, according to Tri-Met officials, Oregon

law prohibits the use of deductibles for workers’ compensation insurance.

The officials said they could have saved more money if they had been able

to purchase a workers’ compensation policy that had deductibles.

Rationale for Using

Wrap-Up Insurance

Tri-Met officials stated that they used wrap-up insurance to increase their

control over the project, enhance safety, and improve efficiency with

which claims are settled. Officials noted that wrap-up insurance is

particularly suitable for large, complex projects like the Westside Light

Rail line and that they would use it again on another large project.

Oregon passed specific legislation to allow wrap-up insurance. Prior

approval by the state director of insurance is required, but wrap-up

insurance can be used only for a construction project costing over

$100 million and scheduled to be completed in 5 years. Project owners

also have to demonstrate that wrap-up insurance would substantially

improve safety and claims handling. The state prohibits wrap-up insurance

to be used for unrelated projects that are combined only to meet the

$100 million requirement. In addition, the broker handling the wrap-up

insurance is required to protect small insurance agents who could suffer

GAO/RCED-99-155 Transportation InfrastructurePage 20

Appendix II

Transit and Highway Construction Projects

Using Wrap-Up Insurance

from the loss of income that threatens to put them out of business. This

protection took the form of a special fund of $25,000 for every $100 million

in project costs to be deposited with the state of Oregon.

Savings Experience

Tri-Met officials estimated savings of about $10 million from using wrap-up

insurance. Tri-Met officials estimated that traditional insurance would cost

about $27.1 million, whereas their final wrap-up insurance costs, including

reserves, were about $17.2 million. Tri-Met officials required bidders to

remove insurance from their bids, but directed them to include an estimate

for traditional insurance should the agency decide not to use wrap-up

insurance. Bidders were also directed to include an estimate of

subcontractors’ insurance. Tri-Met provided contractors with safety

incentives totaling about $1.3 million.

Safety Program

Overall, Tri-Met officials were pleased with the results of the project’s

safety program. However, they had to adjust the program midway through

the project. To improve safety, Tri-Met officials began monthly safety

meetings, added more safety engineers, and authorized safety engineers to

halt construction when they observed unsafe conditions. The safety

program was difficult to administer, in part, because it was spread over a

wide area. Agency officials said that compared to the federal average for

all construction, the project had a good safety record because it included a

twin-tunnel, which involved greater risk than other types of construction.

Tri-Met officials had a target loss ratio of 40 percent and finished the

project with a loss ratio of 36.7 percent. Three fatalities on the project

contributed to the loss ratio.

GAO/RCED-99-155 Transportation InfrastructurePage 21

Appendix II

Transit and Highway Construction Projects

Using Wrap-Up Insurance

New Jersey Transit

Corporation

Hudson-Bergen Rail

Line

Project Description

According to the New Jersey Transit Corporation, the Hudson-Bergen

Light Rail Transit System will alleviate traffic congestion and pollution and

allow people to move more efficiently between densely populated areas of

northern New Jersey. The initial 9.6-mile segment will have 16 stations and

will run along the Hudson River from Hoboken to Bayonne. When

completed, the entire 20-mile project will connect to ferries and other rail

lines to take passengers to New York City. Construction began in

December 1996, and the initial 9.6-mile segment is scheduled to open for

service in March 2000. New Jersey Transit estimates the segment will cost

$992 million, including the low-floor, light-rail cars and a new maintenance

facility.

Wrap-Up Insurance

Coverage

Johnson and Higgins, Marsh and McLennan were the insurance brokers for

this project. The Hudson-Bergen line’s construction is being done under a

design, build, operate, and maintain contract. Because one construction

firm is responsible for all of these functions, additional insurance was

needed to cover the design, operations, and maintenance activities that

would not normally be included under wrap-up insurance. As a result, in

addition to the workers’ compensation, general and excess liability

policies, the wrap-up insurance includes a professional liability policy to

cover engineering errors and omissions, an environmental liability policy,

and builders’ risk coverage.

Rationale for Using

Wrap-Up Insurance

New Jersey Transit officials decided to use wrap-up insurance for several

reasons, including cost savings and improved safety. Wrap-up insurance

also ensured that all contractors and subcontractors had the same type

and limits of coverage. Furthermore, New Jersey Transit officials said that

covering every contractor with one insurance carrier eliminated lawsuits

among insurance carriers. New Jersey Transit staff and the insurance

broker were also able to reduce the administrative costs associated with

receiving, documenting, and verifying separate insurance certificates for

each contractor and subcontractor. New Jersey Transit officials also said

GAO/RCED-99-155 Transportation InfrastructurePage 22

Appendix II

Transit and Highway Construction Projects

Using Wrap-Up Insurance

that using wrap-up insurance helped disadvantaged and minority business

enterprises because under traditional insurance, high insurance costs or

requirements might preclude their participation.

New Jersey Transit officials stated that, because of their positive

experience with wrap-up insurance, they may use it for other planned

construction projects. They noted that no state laws limit the use of

wrap-up insurance and they are currently using it on another transit

project. New Jersey Transit officials said that $20 million is the lowest

amount in labor costs that a project needs for wrap-up insurance to be

cost-effective.

Savings Experience

New Jersey Transit officials estimated that they saved $9 million using

wrap-up insurance on the Hudson-Bergen project. They budgeted

$11 million for wrap-up insurance for the project but estimated that

traditional insurance would have cost $20 million. Prior to implementing

wrap-up insurance, they solicited proposals from various insurance

companies to estimate the costs of traditional insurance.

Safety Program

According to New Jersey Transit officials, by using wrap-up insurance,

they planned, organized, and implemented a common set of safety

procedures under a centralized safety program. Officials said that the

insurance broker, New Jersey Transit, and the contractors all have

representatives in the field to help ensure that safety is maintained. In

addition, the insurance broker processes and monitors claims and

identifies lapses in safety. As a result of their safety program, the officials

noted that the project received safety awards from one of the insurance

carriers.

GAO/RCED-99-155 Transportation InfrastructurePage 23

Appendix II

Transit and Highway Construction Projects

Using Wrap-Up Insurance

Chicago Transit

Authority Green Line

Rehabilitation Project

Project Description

In February 1994, the Chicago Transit Authority (CTA) began rehabilitating

its 100-year-old Green Line system at a cost of about $409 million. Over the

prior 20 years, the line’s physical condition had deteriorated, causing

CTA

to increase the amount of time and resources to maintain it. The

deterioration resulted in longer travel times because of the number of

“slow zones” established for repairs and safe usage. The travel time from

one end of the line to the other was 73 minutes, compared to the original

design time of 45 minutes. Renovation included making stations accessible

to the disabled, shoring up steel structures, and replacing all bridge ties

and track. Construction began in February 1994 and was substantially

completed as of April 1999.

Wrap-Up Insurance

Coverage

Near North Insurance Brokerage, Inc., designed and administered the

wrap-up insurance. Several carriers provided insurance coverage for the

project.

CTA used a loss sensitive plan for its workers’ compensation and

general liability coverage, and included umbrella and excess liability,

builders’ risk and lead abatement liability insurance. Total wrap-up

insurance costs were about $23.6 million.

Rationale for Using

Wrap-Up Insurance

CTA officials said the agency had never used wrap-up insurance before but

used it on this project because of its size, the potential for large losses, a

desire to save money, and most importantly, to enhance safety through a

combined and coordinated safety program. Wrap-up insurance allowed the

agency to avoid gaps in and inadequate levels of coverage among the

contractors as well as expired coverage. Officials also stated this type of

insurance program would minimize disputes among insurance carriers and

guarantee effective claims management by using one primary insurance

carrier for claims reporting, investigation, and payment. In addition,

CTA

was able to help minority and disadvantaged business enterprises

participate in a construction project they normally would not be able to

afford. According to agency officials, minority and disadvantaged business

participation in this rehabilitation project was about 30 percent.

GAO/RCED-99-155 Transportation InfrastructurePage 24

Appendix II

Transit and Highway Construction Projects

Using Wrap-Up Insurance

Savings Experience

The insurance broker estimated that premium costs for workers’

compensation and general liability under a traditional insurance plan

would have cost

CTA about $32.5 million. Under wrap-up insurance, the

cost for these two lines of coverage is $21 million, an estimated savings of

about $11.5 million. However,

CTA did not obtain estimates of other types

of insurance, including builders’ risk, railroad protective liability, and lead

abatement. These items added about $2.6 million to the wrap-up

insurance, raising the total wrap-up insurance cost to about $23.6 million.

According to

CTA officials, because all claims have not been finalized, as of

March 1999, they do not know the full amount of savings.

Safety Program

CTA relied on its construction program manager and insurance company

staff to manage the operations of the project’s safety program. The project

had a safety incentive program that provided cash awards for the prime

contractor and the subcontractors. The actual cash award will be based on

the specific loss experience for each individual contractor and

subcontractor as well as the overall project loss. According to the agency’s

broker, as of February 1999, about $2.9 million remains in the loss fund

account. If no additional workers’ compensation or general liability claims

are made,

CTA will share this money with the contractors on a

70-percent/30-percent basis in the form of safety incentive awards.

GAO/RCED-99-155 Transportation InfrastructurePage 25

Appendix II

Transit and Highway Construction Projects

Using Wrap-Up Insurance

Utah Department of

Transportation

Interstate 15

(I-15) Reconstruction

Project

Project Description

The Interstate 15 (I-15) project in Salt Lake City, Utah, is the largest

“design-build” highway project ever undertaken in the United States.

7

The

Utah Department of Transportation (

UDOT) is reconstructing 17 miles of

interstate highway in and around Salt Lake City, Utah; replacing all

existing pavement; widening the road from 6 to 12 lanes; reconstructing

several major interstate highway junctions; and replacing about 140

bridges and other structures. The project is part of the state’s 10-year,

$2.6 billion plan for constructing and reconstructing highways throughout

Utah. According to state and Federal Highway Administration (

FHWA)

officials, the project is critical to both the transportation infrastructure of

the Salt Lake City area and the city’s and state’s ability to host the Winter

Olympic Games in 2002. Construction began in April 1997 and is scheduled

for completion in July 2001 at an estimated cost of $1.6 billion. As of

April 1999, the project was 60-percent complete.

Wrap-Up Insurance

Coverage

UDOT, with the assistance of Willis Corroon, insurance brokers for the

project, designed and implemented the wrap-up insurance. The project

uses a guaranteed plan with a $9.8 million

UDOT deductible. The total cost

of the wrap-up insurance is about $22.3 million and includes the following

coverage: workers’ compensation and general liability, umbrella liability,

professional liability, contractors’ pollution liability, railroad protective

liability, and builders’ risk.

Rationale for Using

Wrap-Up Insurance

According to a UDOT official, using wrap-up insurance will save the state

money. The state views these potential savings as significant, particularly

for the general liability and the workers’ compensation coverage.

UDOT

considers the administrative demands of implementing the safety program

to be manageable. Officials began using wrap-up insurance for Utah’s

highway construction projects on a statewide basis in 1999.

UDOT expects

7

A design-build contract combines, rather than separates, responsibility for the design and

construction phases of a project.

GAO/RCED-99-155 Transportation InfrastructurePage 26

Appendix II

Transit and Highway Construction Projects

Using Wrap-Up Insurance

to realize economies of scale by using rolling wrap-up insurance on all its

highway programs. Nevertheless, the state acknowledges that using rolling

wrap-up insurance will take more administrative effort because of the

larger number of contractors involved.

Savings Experience

UDOT officials estimated that the agency saved about $30 million over the

cost of using a traditional form of insurance coverage for I-15

reconstruction. Traditional coverage would have cost them as much as

$52.2 million compared to the maximum estimated wrap-up insurance cost

of $22.3 million. Because the project is 60-percent complete and

out-of-pocket claims paid to date are about $900,000, the state expects the

final claims to be no more than $4 million. This will allow the state to save

an additional $4 million in insurance costs.

Safety Program

Safety oversight is a shared responsibility between the state, the insurance

company, and the contractors.

UDOT provides two to three staff persons to

the project to review safety procedures and to ensure that contractors

perform weekly site safety inspections.

UDOT has developed a Safety

Incentive Program for the project that provides the contractor with

monetary incentives for the successful completion of the project’s safety

program. Furthermore, these incentives are specifically tied to loss-time

accident rates. According to

UDOT, the safety program has resulted in a

loss-time accident rate of 0.8 that is well below the national average of 5.0.

There has been one fatality on the project, according to a

UDOT official.

GAO/RCED-99-155 Transportation InfrastructurePage 27

Appendix II

Transit and Highway Construction Projects

Using Wrap-Up Insurance

Boston Central

Artery/Tunnel Project

Project Description

The Central Artery/Tunnel (CA/T) project comprises building or

reconstructing about 7.5 miles of urban highways—about half of them

underground. The project is designed to reduce traffic congestion in

downtown Boston through the construction of an 8- to 10-lane

underground Central Artery, a four-lane underwater tunnel that crosses

Boston Harbor, and a commercial traffic bypass road through South

Boston. The project entails numerous and complex construction

challenges in tunneling under densely populated downtown Boston and

close to buildings and subway tunnels. The current cost estimate for the

project is $10.8 billion.

8

Construction, which began in 1991, is about

50-percent complete and is scheduled for completion in 2004.

Wrap-Up Insurance

Coverage

According to project officials, the total wrap-up insurance cost is

$764.9 million. This covers general and excess liability and accidental

pollution ($234 million); workers’ compensation ($481.5 million);

architects’ and engineers’ professional liability ($11 million); builders’ risk

($22.1 million); railroad protective liability ($4.5 million); and airport

contractors’ liability for Logan Airport ($11.8 million). Coverage for

general liability, workers’ compensation and airport contractors’ liability is

under a loss-sensitive plan while coverage for professional liability,

builders’ risk, and railroad protective liability is under a fixed-price plan.

Rationale for Using

Wrap-Up Insurance

Massachusetts had past experience with other wrap-up insurance when

the

CA/T project began. The state chose wrap-up insurance because it

would facilitate coordinated claims processing, improve overall program

administration, centralize data collection, and facilitate efficient financial

reporting and audits of the program and its participants. Wrap-up

insurance also ensures that coverage for all the contractors and the

subcontractors is in effect and has not lapsed or changed. The project

changed from traditional to wrap-up insurance after the bidding of some

initial contracts. The contractors had to go back and remove insurance

costs from their bids, which project officials found to be a difficult and

8

See Surface Infrastructure: Costs, Financing, and Schedules for Large-Dollar Transportation Projects

(GAO/RCED-98-64, Feb. 12, 1998).

GAO/RCED-99-155 Transportation InfrastructurePage 28

Appendix II

Transit and Highway Construction Projects

Using Wrap-Up Insurance

cumbersome process. Subsequent contracts have been let with

instructions indicating that the owner would provide insurance.

Savings Experience

Officials said that if the project had used traditional insurance, they

estimated insurance costs at about $1.03 billion. Wrap-up insurance has

reduced their costs to $765 million—a $265 million savings. Massachusetts

Turnpike Authority officials said they used wrap-up insurance because it

would save the agency $200 million alone in general liability and workers’

compensation coverage due to higher limits and broader coverage. Project

officials said wrap-up insurance has already achieved savings due to

coordinated loss control, consolidated claims handling, and an integrated

safety program, and they expect savings to increase as the project

continues.

Safety Program

The CA/T project has monetary incentives for improving safety. Since May

1998, over $2.7 million has been paid to the contractors. Twenty percent of

the savings generated from the wrap-up insurance will go to contractors in

the form of safety incentive awards. The project’s safety program and

safety incentives were meant to reduce loss ratios, produce zero accidents,

reward contractors with good records, lower the budgeted safety (loss

ratio) number, and help individual contractors. Officials said that because

of a better-than-expected safety record, strong claims handling, and good

claims investigations, their safety program has resulted in

lower-than-expected loss ratios—the dollar amount of losses paid out as a

percentage of paid-in premiums. In 1997, project officials estimated a 50

percent loss ratio for financial forecasting. As of February 1999, actual

losses for workers’ compensation and general liability were running at 23

percent and 15 percent, respectively. The largest claim against the

project’s general liability coverage was a $2 million claim resulting from a

heavy rain that caused flooding into an active subway line at the North

Station. Also, the project had a fatality last March 1998 that exposed it to

other potential liabilities.

GAO/RCED-99-155 Transportation InfrastructurePage 29

Appendix II

Transit and Highway Construction Projects

Using Wrap-Up Insurance

Michigan Department

of Transportation

Blue Water Bridge

Project

Project Description

The Blue Water Bridge construction project rehabilitated the original

bridge, built in 1938, and built a second bridge over the St. Clair River at

Port Huron, Michigan, and Point Edward, Ontario. Because ownership is

divided between Michigan and Ontario, the construction project is a joint

venture between the Ontario Blue Water Bridge Authority and the

Michigan Department of Transportation (

MDOT). Michigan’s total cost of

the project will be $97.2 million. The new bridge was finished in July 1997,

and the rehabilitation of the existing bridge will be completed in

August 1999.

Wrap-Up Insurance

Coverage

MDOT contracted with Johnson and Higgins, Marsh and McLennon, an

insurance agent, to administer the wrap-up insurance. The agent obtained

quotes and selected a combination of carriers on the basis of their

qualifications, services offered, and cost. While no work was actually done

on the water and no barges were used for construction, because the

project is a bridge,

MDOT officials decided to purchase insurance coverage

for longshoremen and harbor workers.

Rationale for Using

Wrap-Up Insurance

MDOT officials had no prior experience with wrap-up insurance, but used it

for the Blue Water Bridge project because the site was confined to one

area that managers could easily control. They also projected cost savings

and saw wrap-up insurance as an opportunity to obtain additional

coverage, such as excess liability insurance, and to process claims more

efficiently with only one insurance carrier. However,

MDOT officials said

that wrap-up insurance increased their administrative costs and that it

exposed the project to greater losses in the event of a catastrophic loss of

lives or serious injuries.

MDOT officials sought to lower that risk and

achieve additional cost savings by improving safety at the construction

site.

MDOT officials said they are using wrap-up insurance again but added

that it cannot be used on every construction project. Michigan has a

statutory minimum of $65 million on the size of projects using wrap-up

insurance. However,

MDOT officials do not see the legislative limit as an

GAO/RCED-99-155 Transportation InfrastructurePage 30

Appendix II

Transit and Highway Construction Projects

Using Wrap-Up Insurance

impediment because an analysis by the insurance industry indicated that

savings from wrap-up insurance might come when a project’s total costs

are at least $65 million to $70 million.

Savings Experience

Using wrap-up insurance, MDOT saved about $3 million over traditional

methods of insurance.

MDOT officials estimated that using small,

contractor-purchased policies would have cost about $10 million. Wrap-up

insurance for the Blue Water Bridge cost $7.1 million, including premiums,

deductibles, and the administrative costs charged by the insurance agent.

MDOT officials noted that the one drawback of wrap-up insurance was that

MDOT had to pay all of the premiums for liability insurance, and $828,000 in

premiums for workers’ compensation, at the start of the project.

MDOT

officials said they will save on deductibles if losses from claims are better

than expected and will get some of the premiums back from the agent.

Safety Program

MDOT officials found a greater emphasis on safety during the construction

of the Blue Water Bridge than other transportation projects. The safety

plan was site-specific to the bridge, with a full-time, on-site safety director

at Blue Water Bridge, and a comprehensive safety program that applied to

all contractors. The insurance agent’s risk management program tracked

all of the claims, grouped them by type of injury, and looked for trends. If

losses or claims were too high in an area, the agent examined the safety

program with the safety engineer to address the problem. According to

project officials, this has resulted in a better safety record than that for

most projects despite the inherent risks in bridge construction. Workers’

compensation is the largest component of insurance cost and the industry

average for premiums paid out in claims in Michigan is from 50 percent to

65 percent. The national average for projects under wrap-up insurance is

35 percent, but for Blue Water Bridge, less than 10 percent of workers’

compensation premiums had been paid out as of April 1999.

(348134) GAO/RCED-99-155 Transportation InfrastructurePage 31

Ordering Information

The first copy of each GAO report and testimony is free.

Additional copies are $2 each. Orders should be sent to the

following address, accompanied by a check or money order

made out to the Superintendent of Documents, when

necessary. VISA and MasterCard credit cards are accepted, also.

Orders for 100 or more copies to be mailed to a single address

are discounted 25 percent.

Orders by mail:

U.S. General Accounting Office

P.O. Box 37050

Washington, DC 20013

or visit:

Room 1100

700 4th St. NW (corner of 4th and G Sts. NW)

U.S. General Accounting Office

Washington, DC

Orders may also be placed by calling (202) 512-6000

or by using fax number (202) 512-6061, or TDD (202) 512-2537.

Each day, GAO issues a list of newly available reports and

testimony. To receive facsimile copies of the daily list or any

list from the past 30 days, please call (202) 512-6000 using a

touchtone phone. A recorded menu will provide information on

how to obtain these lists.

For information on how to access GAO reports on the INTERNET,

send an e-mail message with "info" in the body to:

or visit GAO’s World Wide Web Home Page at:

http://www.gao.gov

PRINTED ON RECYCLED PAPER

United States

General Accounting Office

Washington, D.C. 20548-0001

Official Business

Penalty for Private Use $300

Address Correction Requested

Bulk Rate

Postage & Fees Paid

GAO

Permit No. G100