WORLD

ENERGY

TRANSITIONS

OUTLOOK

1. 5° C PATHWAY

2

WORLD ENERGY

TRANSITIONS OUTLOOK

2

WORLD ENERGY

TRANSITIONS OUTLOOK

ABOUT IRENA

The International Renewable Energy Agency (IRENA) serves as the principal platform

for international co-operation, a centre of excellence, a repository of policy, technology,

resource and financial knowledge, and a driver of action on the ground to advance the

transformation of the global energy system. A global intergovernmental organisation

established in 2011, IRENA promotes the widespread adoption and sustainable use of all

forms of renewable energy, including bioenergy, geothermal, hydropower, ocean, solar and

wind energy, in the pursuit of sustainable development, energy access, energy security, and

low-carbon economic growth and prosperity. www.irena.org

© IRENA 2021

Unless otherwise stated, material in this publication may be freely used, shared, copied,

reproduced, printed and/or stored, provided that appropriate acknowledgement is given of IRENA

as the source and copyright holder. Material in this publication that is attributed to third parties

may be subject to separate terms of use and restrictions, and appropriate permissions from these

third parties may need to be secured before any use of such material.

ISBN: 978-92-9260-334-2

CITATION

IRENA (2021), World Energy Transitions Outlook: 1.5°C Pathway, International Renewable Energy

Agency, Abu Dhabi.

Available for download: www.irena.org/publications

For further information or to provide feedback: info@irena.org

DISCLAIMER

This publication and the material herein are provided “as is”. All reasonable precautions have been

taken by IRENA to verify the reliability of the material in this publication. However, neither IRENA

nor any of its officials, agents, data or other third-party content providers provides a warranty

of any kind, either expressed or implied, and they accept no responsibility or liability for any

consequence of use of the publication or material herein.

The information contained herein does not necessarily represent the views of all Members of

IRENA. The mention of specific companies or certain projects or products does not imply that they

are endorsed or recommended by IRENA in preference to others of a similar nature that are not

mentioned. The designations employed, and the presentation of material herein, do not imply the

expression of any opinion on the part of IRENA concerning the legal status of any region, country,

territory, city or area or of its authorities, or concerning the delimitation of frontiers or boundaries.

WORLD

ENERGY

TRANSITIONS

OUTLOOK

3

ACKNOWLEDGEMENTS

This publication was prepared by IRENA’s Renewable Energy Roadmap (REmap), Policy, Finance

and Socio-economics teams. The 1.5°C Scenario including a technology pathway and investment

needs, was developed by Dolf Gielen, Ricardo Gorini, Rodrigo Leme and Gayathri Prakash, with

significant support and contributions from Nicholas Wagner, Luis Janeiro, Maisarah Abdul Kadir,

Sean Collins and Elisa Asmelash. The finance, policy and socio-economic analyses were developed

by Rabia Ferroukhi, Diala Hawila, Divyam Nagpal, Costanza Strinati, Ulrike Lehr, and Xavier Garcia

Casals. This publication benefited from insights and contributions by Elizabeth Press who also

developed the Executive Summary.

Valuable input, support and comments were provided by IRENA experts: Paul Durrant, Seungwoo

Kang, Karan Kochhar, Martina Lyons, Trish Mkutchwa, Carlos Ruiz (end-use and bioenergy),

Emanuele Taibi, Herib Blanco , Raul Miranda, Carlos Fernandez (power system transformation and

hydrogen), Francisco Boshell, Arina Anise, Elena Ocenic (innovation and technology standards),

Roland Roesch, Gabriel Castellanos, Gayathri Nair, Barbara Jinks (grid integration, greening the gas

and shipping), Asami Miketa, Pablo Carvajal (power sector investment planning), Michael Taylor

(renewable energy cost status and outlook), Simon Benmarraze, Paula Nardone, Josefine Axelsson

(Renewable Energy Markets and Technology), Sandra Lozo and Kingsmill Bond (renewable

energy finance), Emanuele Bianco (hydrogen policy), Sara Pizzinato (power sector restructuring),

Jinlei Feng (end-use policy), Stephanie Weckend and Kelly Tai (community energy and circular

economy), Sufyan Diab (targets and NDCs), Michael Renner, Celia García-Baños and Bishal Parajuli

(labour markets and socio-economics), Samah Elsayed (education and skills), Anastasia Kefalidou,

Kathleen Daniel, Claire Kiss and Waiman Tsang (planning and programme).

Modelling of the funding structure of the energy transition was developed with the support of the

Boston Consulting Group (BCG). Macro-econometric modelling (E3ME) results benefited from the

support of Cambridge Econometrics (CE).

IRENA appreciates the insights and comments provided by Michael Hackethal, Ann-Katrin Siekemeier

and Linus Herzig from the German Federal Ministry of Economics and Technology (BMWi), Ruud

Kempener, European Commission Directorate General for Energy (ENER) and Deger Saygin (consultant).

Valuable support and inputs were also provided by Laura Secada Daly. The publication,

communications and editorial support were provided by Stephanie Clarke, Daria Gazzola, Nicole

Bockstaller, Manuela Stefanides and Abdullah Abou Ali. The report was copy-edited by Steven B.

Kennedy. The graphic design was done by weeks.de Werbeagentur GmbH.

IRENA is grateful for the generous support of the Federal Ministry for Economic Affairs and

Energy of Germany, which made the publication of this document a reality.

4

WORLD ENERGY

TRANSITIONS OUTLOOK

We have no time. The window is closing and the pathway to a net zero future is narrowing. This was

the message I delivered plainly and unambiguously when we released the World Energy Transitions

Outlook preview at the Berlin Energy Transitions Dialogue earlier this year. Science is clear: 45% of

global greenhouse gas emissions from 2010 levels must be reduced by 2030. Unfortunately, the

recent trends show that the gap between where we are and where we should be is widening. We are

on the wrong path, and we need to change the course now.

The choices we make in the coming years will have a far-reaching impact. They could bring us on a path

toward the goals we set out in 2015 when we adopted the highly consequential international agreements

on sustainable development and climate change. Or they could take us in the opposite direction to

further warming, with profound and irreversible economic and humanitarian consequences.

It is unwise to make predictions or pre-empt outcomes at uncertain times. But several trends are

shaping an unfolding energy transition and giving an indication of its direction. First, the costs of

renewable technologies have plummeted to the point that new fossil-based electricity is no longer

an attractive option. Second, the progress in the power sector is spilling over to end uses, allowing

a re-imagining of possibilities with the abundance of renewable options at hand. Third, a consensus

has formed that an energy transition grounded in renewable sources of energy and efficient

technologies is the only way to give us a fighting chance of limiting global warming by 2050 to 1.5°C.

Only a few years ago, the renewables-centred approach espoused by IRENA was considered too

progressive, idealistic or even unrealistic. Today, our vision has become mainstream, and accepted

as the only realistic option for a climate-safe world. And this is reflected in the growing number of

commitments to net zero strategies by countries in all corners of the world, creating unprecedented

political momentum for a transformative change.

IRENA’s World Energy Transitions Outlook outlines the avenues to take us out of the climate crisis

toward a resilient and more equitable world. It clearly shows the options we have today and what

gaps need to be filled. The analysis and options presented prioritise existing emission-reduction

solutions and those with the highest chance to become viable in the coming years. It does not bet on

unproven technologies or pending inventions but encourages much-needed innovation to perfect

and advance the fastest path to emission reduction.

The Outlook offers a compelling path for decarbonising all energy uses, with electrification and

energy efficiency as primary drivers, enabled by renewables, green hydrogen and sustainable

modern bioenergy. But a scenario and its assumptions, however rigorous and comprehensive,

are only an instrument to inform policy making. To translate this vision of the energy future into

reality, we need to transcend the limits of the existing infrastructure created for the fuels of the

past. And these decisions are not made in a vacuum. Economic and human development goals,

environmental concerns, and financial avenues must all be reconciled.

FOREWORD

5

It is in this context that IRENA brings its unique value.

The Outlook shows that, when we look beyond the narrow confines of energy supply, a renewables-

based transition unlocks a range of valuable benefits. The Outlook thus presents the policy

frameworks necessary to advance a transition that is just and inclusive. It provides an improved

understanding of structural changes and offers a quantitative framework for impacts such as gross

domestic product (GDP), employment and welfare. The report also examines funding structures to

show the necessary shift in capital markets.

And this knowledge provides the basis for IRENA to support countries in realising their priorities and

turning their strategies into action. With our 164 Members, we see how collective action can drive

progress worldwide and where overarching needs and gaps may exist.

This global reach is what gives the Agency the credibility - and privilege - to support international

co-operation across the gamut of energy transition issues to help countries learn from each other

and tap into the vast expertise of the Agency. And we are actively working with partners, including

the private sector, to provide a dynamic platform that drives action, foresighted planning, holistic

policy making and investment at scale.

The demands of our time are great and full of uncertainty. We are entering a new era of change,

one in which energy transformation will drive economic transformation. This change is bringing

unprecedented new possibilities to revitalise economies and lift people out of poverty. But the task

ahead is daunting. I hope that this Outlook provides a fresh view on how to turn today’s energy

problems into tomorrow’s solutions.

Our shared future will only be bright if we move together, taking everyone along towards a more

resilient, equal, and just world.

Francesco La Camera

Director-General, IRENA

6

WORLD ENERGY

TRANSITIONS OUTLOOK

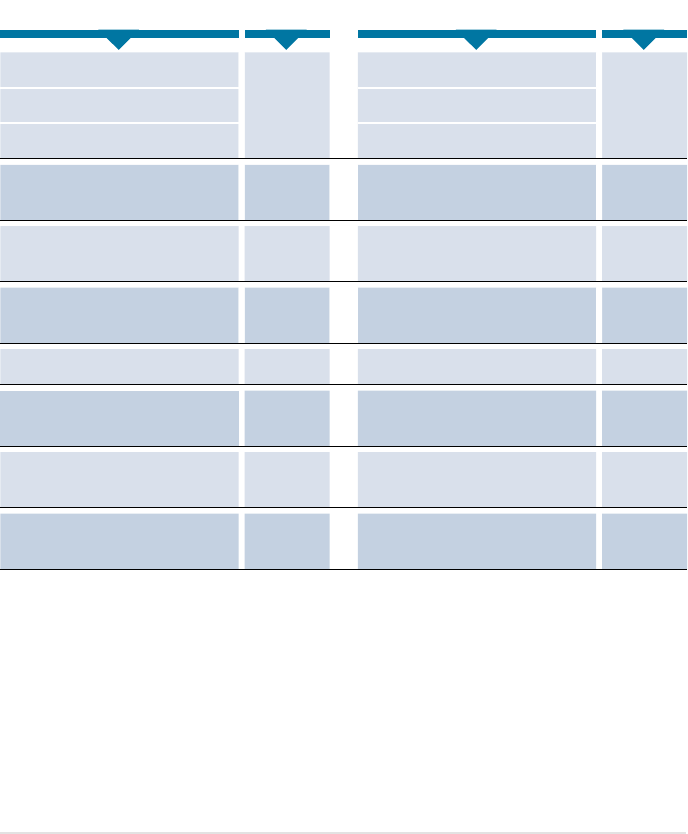

TABLE OF CONTENTS

Acknowledgements .........03

Foreword .................04

Executive Summary ..........16

A Way Forward ............250

References ................ 252

ANNEX A

Sector-specific transition

strategies .................260

References Annex A ........ 295

ANNEX B

Socio-economic footprint

of the transition ...........297

LEVERAGING THE COMPETITIVENESS

OF RENEWABLES TO HASTEN THE

ENERGY TRANSITION AND MINIMISE

CLIMATE CHANGE ...............38

1.1

Energy transition trends .......40

1.2

The evolving policy landscape ..47

1.3

Renewable energy investments ..48

1.4

Jobs ........................54

1.5

Outlook for achieving

the 1.5°C goal ................57

1.6

Conclusion .................. 61

TECHNOLOGICAL AVENUES

TO CLIMATE TARGETS

............64

2.1

Contextualising the

1.5°C climate pathway .........66

2.2

Achieving climate targets

under the 1.5°C Scenario ......72

2.3

Comparison of energy

scenarios .................... 91

2.4

Conclusion ..................94

01

02

7

INVESTMENT NEEDS AND FINANCING

FOR THE ENERGY TRANSITION ....96

3.1

New investment priorities in

the 1.5°C Scenario ............99

3.2

Funding structures for a

climate safe 1.5°C future ......106

3.3

The impact of the energy

transition on financing risks

and capital pools ............ 122

3.4

Conclusion ................. 127

COMPREHENSIVE POLICY

FRAMEWORK FOR THE ENERGY

TRANSITION

................... 128

4.1

Cross-cutting policies enabling

the energy transition ........ 133

4.2

Policies to support the

technological avenues of the

energy transition ............149

4.3

Policies for structural change

and a just transition .........180

4.4

Holistic global policy

framework ..................194

4.5

Conclusion ................. 197

SOCIO-ECONOMIC IMPACTS OF THE

ENERGY TRANSITION

............ 198

5.1

The climate policy basket .....201

5.2

Socio-economic footprint

results .....................207

5.3

Conclusion .................248

0503

04

8

WORLD ENERGY

TRANSITIONS OUTLOOK

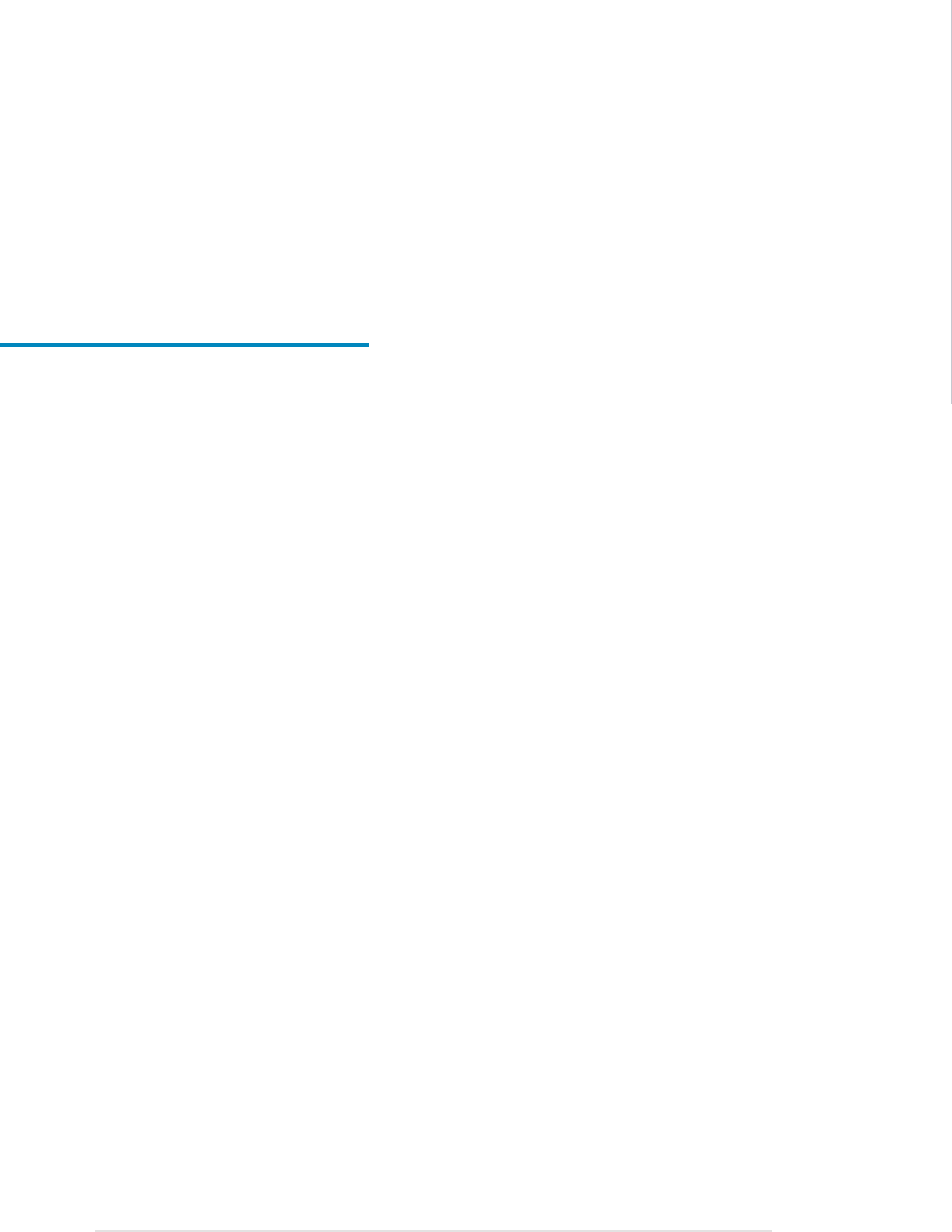

LIST OF FIGURES

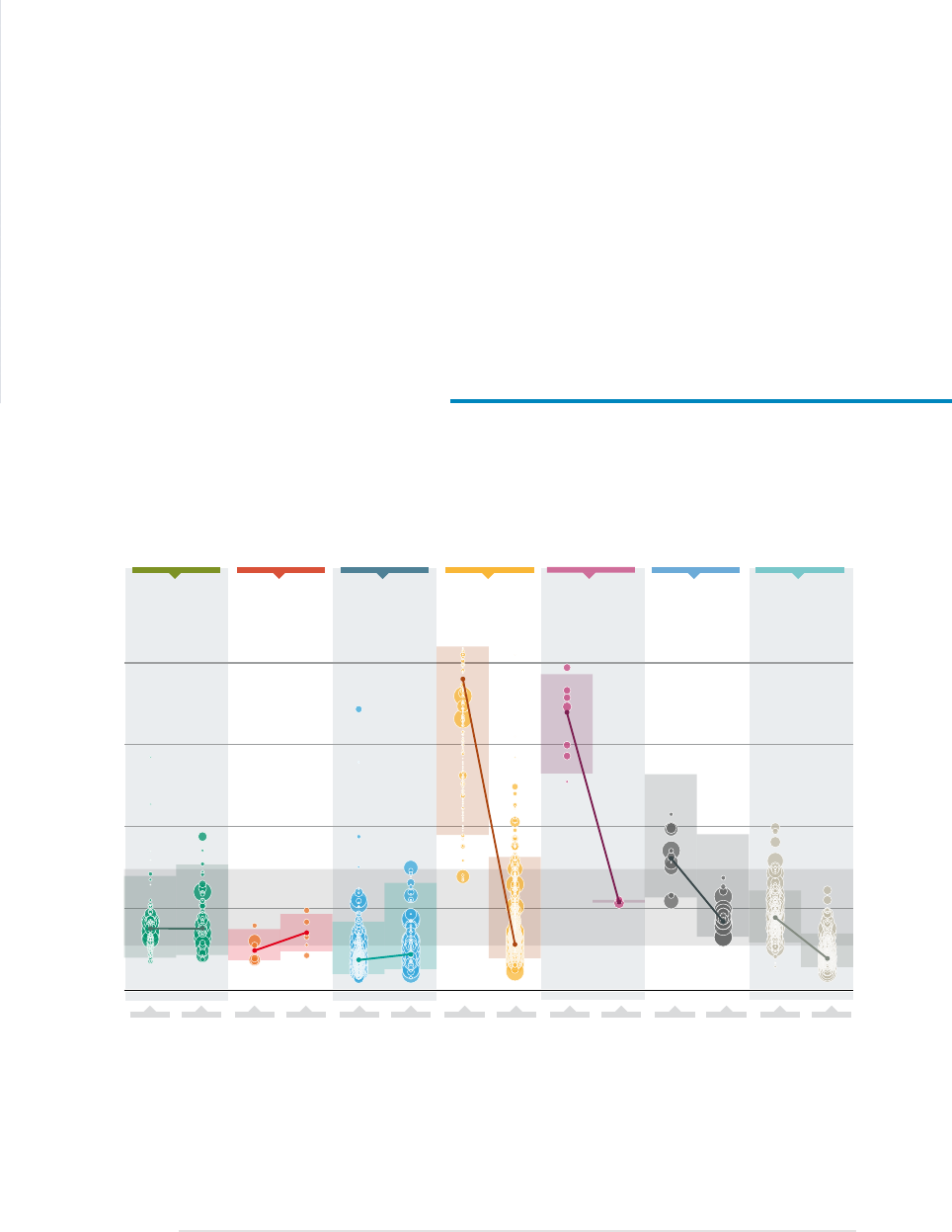

FIGURE S.1 Share of new electricity capacity, 2001-2020 ................................. 18

FIGURE S.2

Global renewable energy employment, by technology, 2012-2019 ............... 19

FIGURE S.3

The WETO theory of change ...............................................22

FIGURE S.4

Carbon emissions abatements under the 1.5°C Scenario (%) ....................23

FIGURE S.5

Evolution of emissions with phaseouts of coal and oil, 2021-2050 ...............25

FIGURE S.6

Total average yearly investment by source and type of financing as of 2019,

PES and 1.5°C Scenario (2021-2030 and 2031-2050) ...........................29

FIGURE S.7

Cumulative dierence between costs and savings of 1.5°C Scenario compared

to the PES, 2021-2050 .....................................................30

FIGURE S.8

Energy sector jobs by technology under the PES and 1.5°C Scenario (million),

global results ................................................................32

FIGURE S.9

Energy sector jobs, by segment of value chain, in the 1.5°C Scenario and PES

(excluding vehicles) .......................................................32

FIGURE S.10

Jobs in renewable energy, by technology, in the 1.5°C Scenario and PES (million) ...33

FIGURE S.11

Structure of jobs in the 1.5°C Scenario by 2050 for a subset of renewable technologies

by technology, segment of value chain and occupational requirements ............33

FIGURE S.12

Structure of IRENA's Energy Transition Welfare Index ..........................34

FIGURE S.13

Enabling policy framework for a just and inclusive energy transition .............37

FIGURE 1.1

Global LCOE of newly commissioned utility-scale renewable power generation

technologies, 2010 and 2020 ...............................................41

FIGURE 1.2

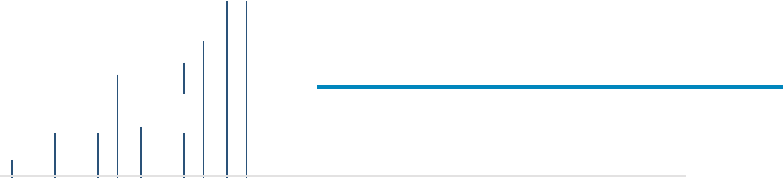

Share of new electricity capacity, 2001-2020 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 42

FIGURE 1.3

New energy vs. old energy: S&P Global Clean Energy and Energy Indices,

24 May 2016 to 24 May 2021 ................................................44

FIGURE 1.4

Global investment in energy transition technologies, 2005-2020 ................46

FIGURE 1.5

Global annual renewable energy investments by technology, 2005-2019 .........49

FIGURE 1.6

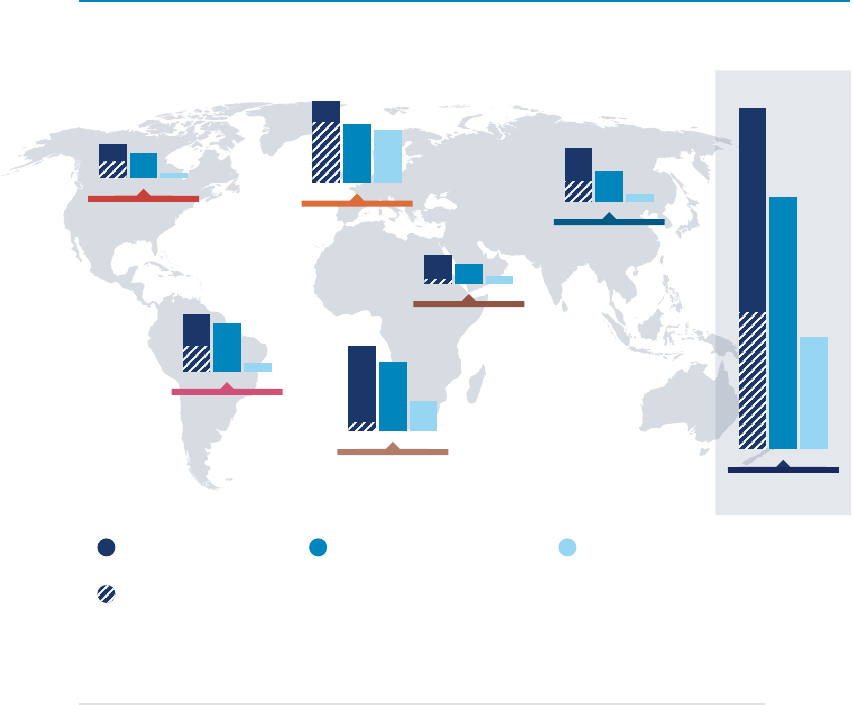

Global annual renewable energy investments by location, 2005-2019 ............50

FIGURE 1.7

Annual commitments to o-grid renewable energy by region, 2008-2019 ........ 51

FIGURE 1.8

Public annual renewable energy investments in emerging and developing

countries by technology, 2005-2019 .........................................53

FIGURE 1.9

Global renewable energy employment by technology, 2012-2019 ................55

FIGURE 1.10

Projected trends in global CO

2

emissions under three scenarios, 2020-2050 ......58

FIGURE 1.11

Primary supply of fossil fuels (exajoules), 2018 to 2050, under the 1.5°C Scenario ....60

9

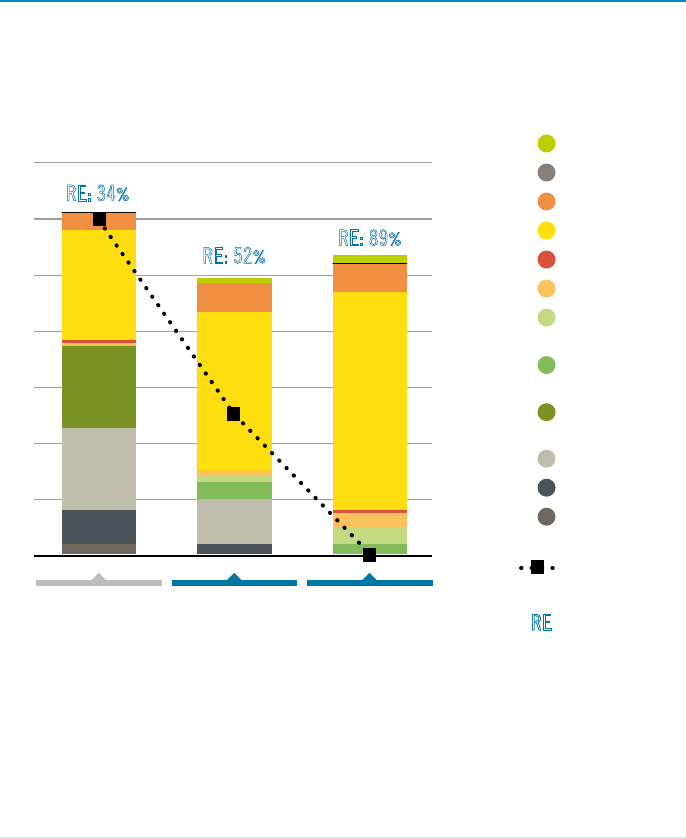

FIGURE 2.1 Carbon emissions abatements under the 1.5°C Scenario (%) ....................66

FIGURE 2.2

Renewable and non-renewable share of total primary energy supply in

2018 and 2050, PES and the 1.5°C Scenario (EJ/year) ..........................67

FIGURE 2.3

Energy intensity improvement rate and contributions, by category,

historical and under the 1.5°C Scenario, 2018–2050 ...........................70

FIGURE 2.4

Breakdown of total final energy consumption (TFEC) by energy carrier

in 2018 and 2050 (EJ) in the 1.5°C Scenario .................................. 71

FIGURE 2.5

Electricity generation and capacity by source, 2018 and 2050

(TWh/yr and GW) in the 1.5°C Scenario ......................................73

FIGURE 2.6

Emerging innovations that support the integration of VRE .....................75

FIGURE 2.7

TFEC split by direct electricity and the use of green hydrogen and its

derivative fuels, 2018 and 2050, in PES and the 1.5°C Scenario (EJ/yr) ...........79

FIGURE 2.8

Electricity consumption by sector, 2018, 2030 and 2050 (TWh/yr) in the

1.5°C Scenario ............................................................80

FIGURE 2.9

Hydrogen production costs resulting from low and high electricity

cost assumptions .......................................................... 81

FIGURE 2.10

CO

2

emissions abatement options in the 1.5°C Scenario compared to

PES in the industry, transport and building sectors .............................84

FIGURE 2.11

Primary bioenergy demand in 2018 and 1.5°C Scenario 2050 (EJ/yr) ............86

FIGURE 2.12

Amount of CO

2

(GtCO

2

) yet to be removed in the 1.5°C Scenario ................89

FIGURE 2.13

Shares of renewables in total primary energy in 2018 and 2050 in various

energy scenarios ..........................................................92

FIGURE 2.14

CO

2

emissions versus electrification rates in various energy scenarios ............93

FIGURE 3.1

Total investment by technology: PES and 1.5°C Scenario (2021-2050). . . . . . . . . . . 100

FIGURE 3.2

Annual average investments in power and end uses, historical (2017-2019)

and needed to meet 1.5°C Scenario (USD billion/year) ........................102

FIGURE 3.3

Energy transition technologies and their development stage ...................111

FIGURE 3.4

Total average yearly investment by source and type of financing as of 2019,

PES and 1.5°C Scenario (2021-2030 and 2031-2050) ...........................113

FIGURE 3.5

Number of renewable energy project transactions involving institutional

investors by technology, 2009 - Q2 2019 .....................................114

FIGURE 3.6

Annual global green bond issuance by region, 2014-2019 ......................121

10

WORLD ENERGY

TRANSITIONS OUTLOOK

FIGURE 4.1 Enabling policy framework for a just and inclusive energy transition ............130

FIGURE 4.2

Renewable energy components of NDCs, as of the first quarter of 2021 .........136

FIGURE 4.3

Global installed capacity of renewable power: historical trends and future

projections based on targets .............................................. 137

FIGURE 4.4

Solutions and enabling infrastructure for the energy transition in heating

and cooling ............................................................. 138

FIGURE 4.5

Phase-out of coal in Germany by 2038. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .141

FIGURE 4.6

Share of households unable to keep home adequately warm,

by income level, in selected countries, 2019 (%) .............................. 145

FIGURE 4.7

Roles of municipal governments in the energy transition ......................153

FIGURE 4.8

Auction design for objectives beyond price discovery ........................156

FIGURE 4.9

Unequal advance in dierent transition layers, with organisational

structures lagging behind .................................................160

FIGURE 4.10

Misalignments in marginal pricing allocation mechanisms:

Missing money and cannibalisation eects ..................................163

FIGURE 4.11

Global energy use for space cooling covered by MEPS in selected

jurisdictions, 2018 ........................................................ 167

FIGURE 4.12

Cities with bus rapid transit systems, per year and cumulative, 1968-2020 .......169

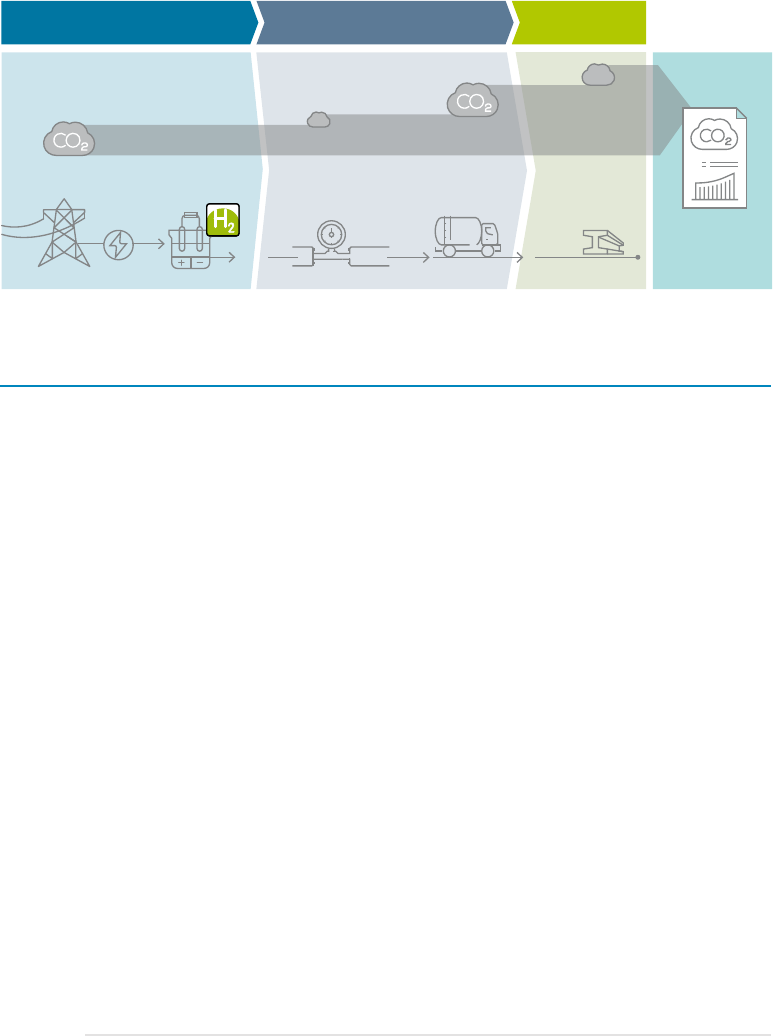

FIGURE 4.13

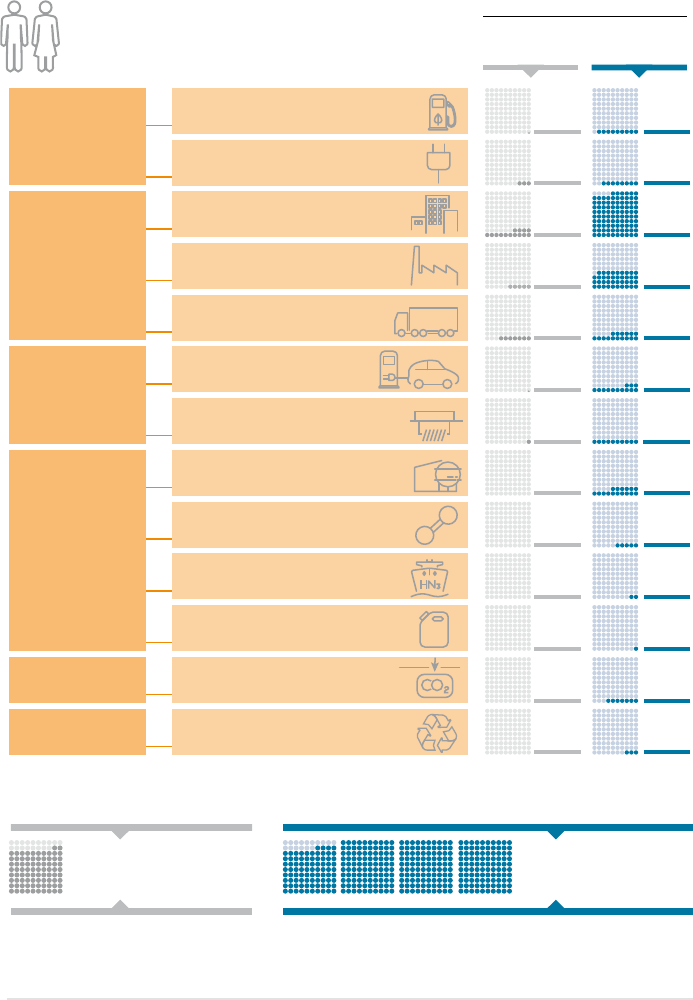

Green hydrogen value chain ............................................... 173

FIGURE 4.14

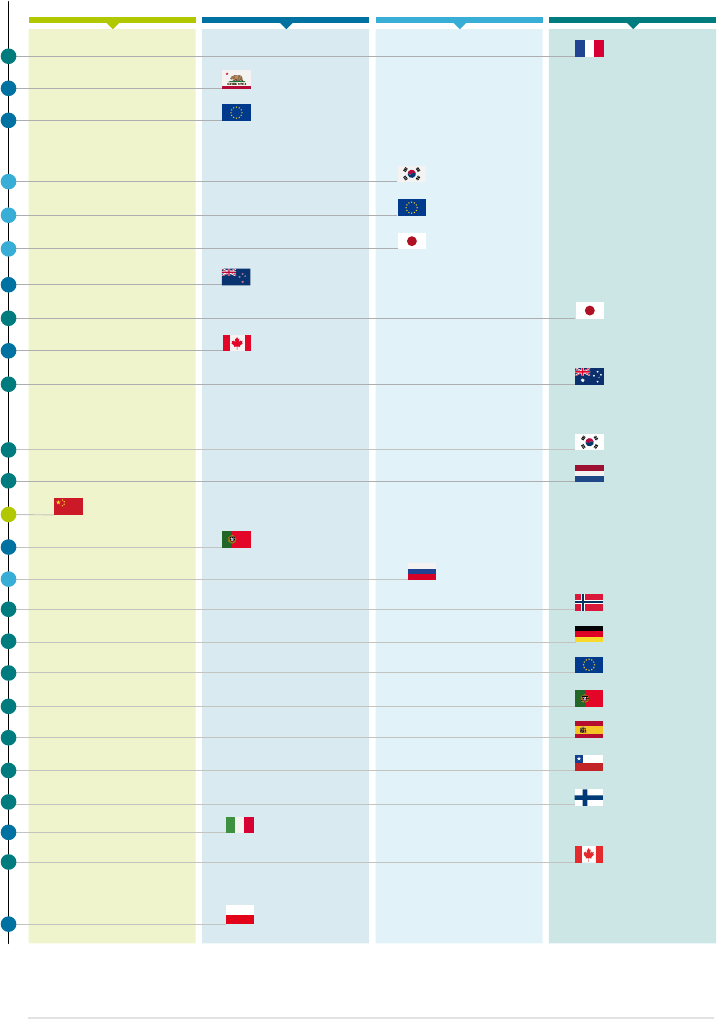

Government hydrogen-related initiatives announced between

June 2018 and February 2021 .............................................. 175

FIGURE 4.15

Guarantees of origin and life-cycle emissions ................................ 177

FIGURE 4.16

Distribution of material and human resource requirements for the

development of a 50 MW wind farm. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 185

FIGURE 4.17

Human resource requirements in the solar PV and wind industries .............188

FIGURE 4.18

Human resource requirements for the manufacturing and installation of

solar water heaters ....................................................... 189

FIGURE 4.19

Overview of EU PV recycling operations, by year and by country, 2019 .......... 192

11

FIGURE 5.1 Cumulative dierence between costs and savings of 1.5°C Scenario compared

to the PES, 2021-2050 ....................................................209

FIGURE 5.2

GDP dierence between the 1.5°C Scenario and PES, with GDP drivers .......... 212

FIGURE 5.3

Dierences in economic output between 1.5°C Scenario and PES, by sector ..... 215

FIGURE 5.4

Eects of climate damages on global GDP under the 1.5°C Scenario and PES,

for each scenario (left) and for the dierence between both scenarios (right) ... 217

FIGURE 5.5

Employment dierence between the 1.5°C Scenario and PES, by driver .........220

FIGURE 5.6

Employment dierence by sector between the baseline and 1.5°C Scenario

(thousands of jobs) ...................................................... 221

FIGURE 5.7

Energy sector jobs by technology (left) and segment of value chain (right) under

the PES and 1.5°C Scenario, global results (millions of jobs) ...................223

FIGURE 5.8

Evolution of energy sector jobs by technology under the PES and 1.5°C Scenario,

including vehicles and associated recharging infrastructure ...................225

FIGURE 5.9

Jobs in renewable energy, by technology, in the 1.5°C Scenario

and PES (million) .........................................................228

FIGURE 5.10

Renewable energy jobs, by segment of value chain, in the 1.5°C Scenario

and PES .................................................................229

FIGURE 5.11

Evolution of the distribution of jobs in the energy sector,

by education level, in the PES and 1.5°C Scenario ............................ 231

FIGURE 5.12

Structure of jobs in the 1.5°C Scenario by 2050 for a subset of renewable technologies,

by technology, segment of value chain and occupational requirements ...........233

FIGURE 5.13

Structure of IRENA’s Energy Transition Welfare Index .........................234

FIGURE 5.14

Overall welfare (centre) and dimensional (blades) indices for the PES and

1.5°C Scenario by 2050, global results, multi-dimensional representation ........235

FIGURE 5.15

Overall Energy Transition Welfare Index and dimensional

contributions of the PES and 1.5°C Scenario by 2050, global results,

unidimensional representation .............................................236

FIGURE 5.16

Relative improvement of the Energy Transition Welfare Index and

its dimensional contributions by 2050, global results .........................237

FIGURE 5.17

Economic index under the 1.5°C Scenario and PES by 2050,

by indicator, global results ................................................238

FIGURE 5.18

Social index under the 1.5°C Scenario and PES by 2050,

by indicator, global results. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .240

FIGURE 5.19

Environmental index under the 1.5°C Scenario and PES by 2050,

by indicator, global results ................................................ 241

FIGURE 5.20

Distributional index under the 1.5°C Scenario and PES Average

2021-2050, by indicator, global results ......................................242

FIGURE 5.21

Contributions to two access index indicators under the 1.5°C Scenario

and PES by 2050, global results ...........................................246

FIGURE 5.22

Ecosystem needs for supporting livelihoods with distributed

renewable energy solutions ...............................................247

12

WORLD ENERGY

TRANSITIONS OUTLOOK

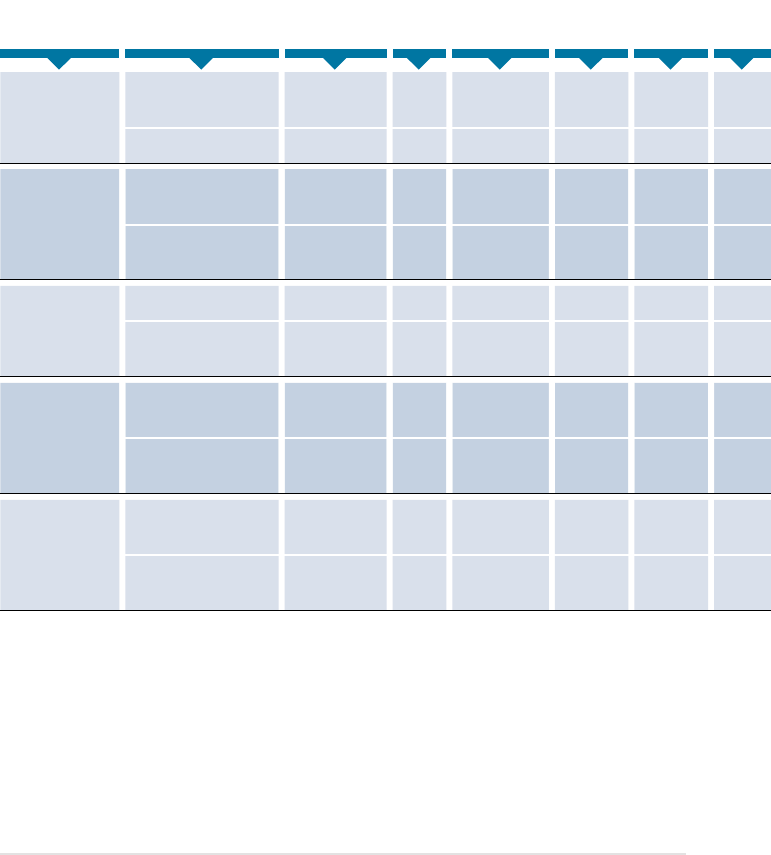

TABLE S.1 Overview of cross-cutting policies to enable the energy transition ..............27

TABLE S.2

Overview of policies to support energy transition solutions .....................36

TABLE 3.1

Key investment risks and financial risk-mitigation tools to address them ........109

TABLE 3.2

TCFD recommendations regarding ‘decision-useful’ climate-related disclosure ....119

TABLE 4.1

Overview of cross-cutting policies to enable the energy transition .............134

TABLE 4.2

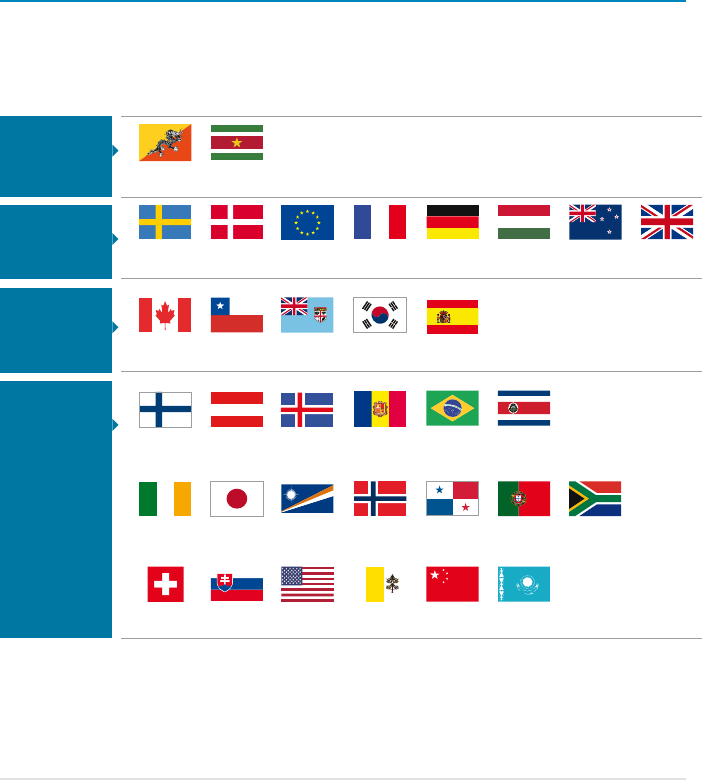

Jurisdictions with net zero targets as of the first quarter of 2021 ............... 135

TABLE 4.3

Results of auctions for coal plant phase-out in Germany ......................142

TABLE 4.4

Overview of policies to support energy transition solutions ....................150

TABLE 4.5

A dual approach to the procurement of electricity ........................... 165

TABLE 4.6

Overview of structural change and just transition policies ......................181

TABLE 5.1

Elements included in the modelling of government fiscal balances

(% of global cumulative fiscal balances 2021-2050) ..........................203

TABLE 5.2

Key economic and demographic trends of the PES (

compound annual growth rates) ............................................. 210

TABLE 5.3

Global improvement in jobs in the 1.5°C Scenario over the PES,

in relative and absolute terms ............................................. 219

TABLE 5.4

Global renewable energy jobs in the 1.5°C Scenario and

dierences with the PES ..................................................227

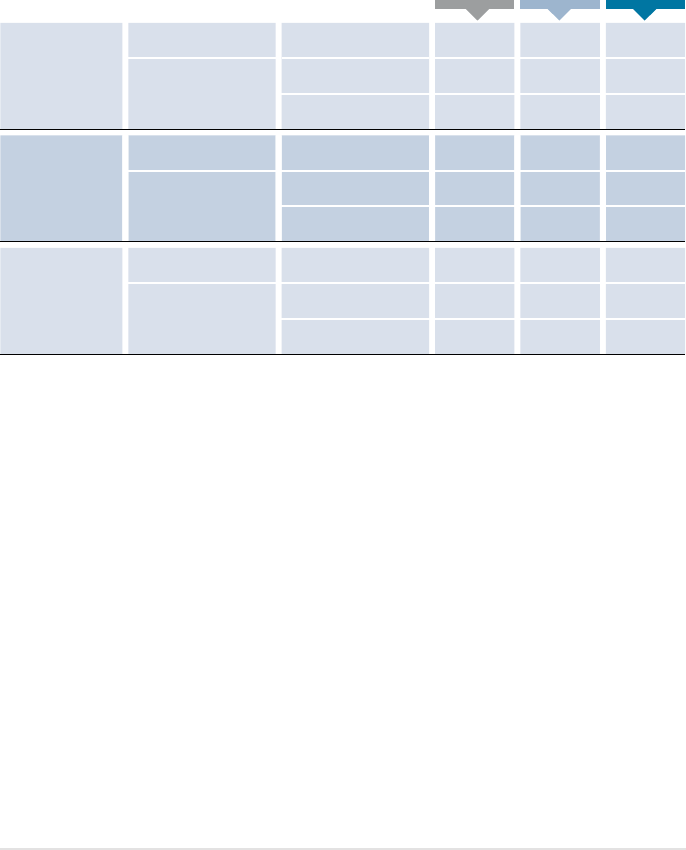

LIST OF TABLES

13

BOX 2.1 Scenario comparison ......................................................92

BOX 3.1

De-risking investments in the energy transition ..............................108

BOX 3.2

Funding sources at each stage of a technology revolution ......................110

BOX 3.3

Institutional investors and the energy transition ...............................114

BOX 3.4

Green taxonomy and climate-related risk disclosure ...........................118

BOX 3.5

Green bonds ............................................................120

BOX 4.1

Integrating innovation in buildings with district energy networks in

the European Union ......................................................139

BOX 4.2

Germany’s tender for coal being phased out by 2038 as part of its green

recovery plan .............................................................141

BOX 4.3

Addressing energy poverty ................................................144

BOX 4.4

The role of cities in the energy transition in end uses ......................... 153

BOX 4.5

Auction design to support policy objectives beyond price ..................... 156

BOX 4.6

Policies for o-grid renewable energy solutions .............................. 157

BOX 4.7

Definitions of power system organisational structure and misalignments .........161

BOX 4.8

Policies supporting the supply of green hydrogen ............................ 178

BOX 4.9

Policies and measures for the sustainable use of bioenergy. . . . . . . . . . . . . . . . . . . . 179

BOX 4.10

Fostering women’s employment at the Ethiopian Electric Utility ...............190

BOX 4.11

Energy access skills .......................................................191

BOX 4.12

European Waste Electrical and Electronic Equipment Directive (WEEE) for

end-of-life management of PV .............................................192

BOX 5.1

Socio-economic footprint of the 1.5°C Scenario, 2030 and 2050: A snapshot ....200

BOX 5.2

Carbon pricing in IRENA’s modelling exercise ................................204

BOX 5.3

Transition cost-benefit analyses ............................................208

BOX 5.4

The energy transition’s implications for jobs in road transport .................224

BOX 5.5

The hydrogen supply chain ................................................226

BOX 5.6

Evolution of education levels necessary to support the energy transition ........230

BOX 5.7

Linking energy supply with livelihood services ...............................247

LIST OF BOXES

14

WORLD ENERGY

TRANSITIONS OUTLOOK

TABLE OF CONTENTS

|

ANNEX

ANNEX A Sector-specific transition strategies ........................................260

REFERENCES Annex A ................................................................295

ANNEX B Socio-economic footprint of the transition ..................................297

FIGURE A.1 Total energy consumption and CO

2

emissions in transport .....................267

FIGURE A.2

Emission reductions in transport in 2050 ....................................273

FIGURE A.3

Total energy consumption and CO

2

emissions in industry .......................276

FIGURE A.4

Emission reductions in industry in 2050. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .284

FIGURE A.5

Total final energy consumption and CO

2

emissions in buildings ................286

FIGURE A.6

Emission reductions in buildings in 2050 ....................................294

FIGURE B.1

Potential transition implications of sub-optimal carbon pricing ................297

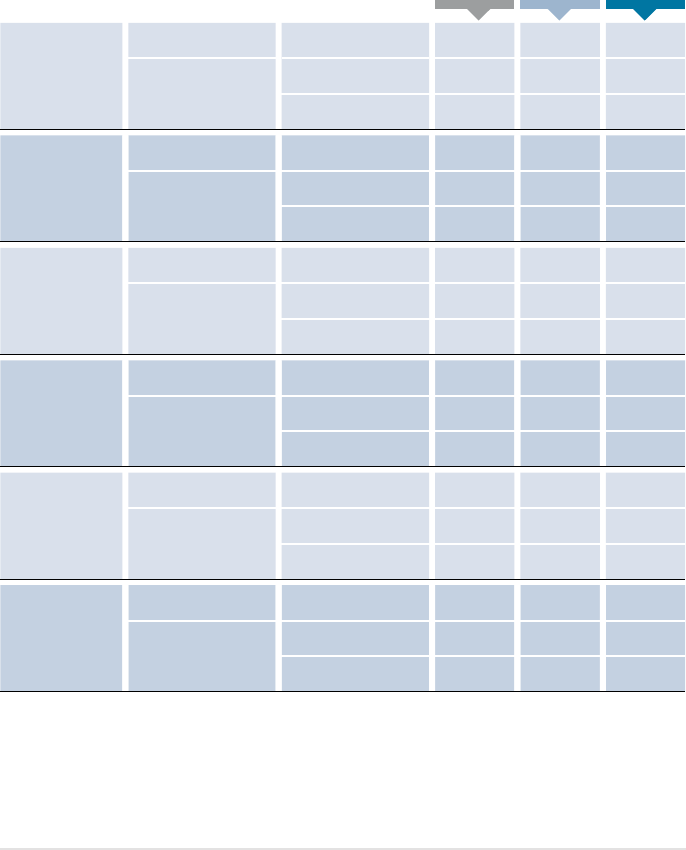

TABLE A.1 Energy Sector: Indicators of progress – status in 2018 and targets for

2030 and 2050 ..........................................................262

TABLE A.2a

Transport: Indicators of progress – status in 2018 and targets for

2030 and 2050 ..........................................................268

TABLE A.2b

Transport: Energy transition investments ....................................269

TABLE A.3a

Industry: Indicators of progress – status in 2018 and targets for

2030 and 2050 ..........................................................278

TABLE A.3b

Industry: Energy transition investments .....................................280

TABLE A.4a

Buildings: Indicators of progress – status in 2018 and targets for

2030 and 2050 ..........................................................288

TABLE A.4b

Buildings: Energy transition investments ....................................290

TABLE B.1

Goalposts for the indicators in IRENA’s Energy Transition Welfare Index. . . . . . . . .302

15

TABLE OF CONTENTS

|

ANNEX

DATA TABLES | EMPLOYMENT

TABLE B.2 Energy sector jobs for the 1.5°C Scenario and dierences with PES over time,

global results ............................................................304

TABLE B.3 Renewable energy jobs by technology in the 1.5°C Scenario and dierences

with the PES, global results ..............................................305

TABLE B.4 Renewable energy jobs by segment of value chain in the 1.5°C Scenario

and dierences with the PES, global results .................................306

TABLE B.5 Energy sector jobs by educational requirement in the 1.5°C Scenario

and dierences with the PES, global results .................................306

DATA TABLES | WELFARE

TABLE B.6 Welfare and dimensional indexes for 1.5-S and PES, as well as the relative

dierence between both, for 2030 and 2050, global results ..................307

TABLE B.7 Economic index and its indicator’s indexes for 1.5°C Scenario and PES,

for 2030 and 2050, global results .........................................308

TABLE B.8 Social index and its indicators’ indexes for 1.5°C Scenario and PES,

for 2030 and 2050, global results .........................................309

TABLE B.9 Environmental index and its indicators’ indexes for 1.5°C Scenario and PES,

for 2030 and 2050, global results ..........................................310

TABLE B.10 Distributional index and its indicators’ indexes for 1.5°C Scenario and PES,

average 2021-2050, global results ...........................................311

TABLE B.11 Access index indicator’s contributions for 1.5S and PES by 2050, global results ....311

BOX A.1 Status of battery technology ..............................................272

EXECUTIVE SUMMARY

17

Where are we in the energy transition?

The energy sector, known for its slow pace of change, is undergoing a dynamic transition. The

imperatives of climate change, energy poverty and energy security to underpin development and

industrial strategy have made the widespread adoption of renewables and related technologies an

essential solution. Policy drivers, technology developments and international co-operation have

moved these technologies from niche to mainstream, especially in the past decade. Even in the

face of the turmoil caused by the COVID-19 pandemic, renewables-based systems demonstrated

remarkable resilience, showing technical reliability of renewables-based electricity system with

high share of solar and wind.

A consensus has formed that an energy transition grounded in renewable sources and

technologies that increases efficiency and conservation is the only way to give us a fighting

chance of limiting global warming to 1.5°C by 2050. Only a few years ago, the renewables-

centred approach espoused by IRENA was considered idealistic. Today, even some of the most

conservative energy players have realised it as the only realistic option for a climate-safe world.

Such a profound and pervasive shift of views is rooted in undeniable evidence, not only of the

world’s grave problems, but also of trends in technology, policy and markets that have been

reshaping the energy sector for over a decade.

For the past seven years, more renewable power was added to the grid annually than fossil

fuels and nuclear combined. Renewable power technologies now dominate the global market

for new electricity generation capacity, as they have become the cheapest sources of electricity

in many markets. A record level of 260 gigawatts (GW) of renewables-based generation

capacity was added globally in 2020, more than four times the capacity added from other sources

(IRENA, 2021a). This a promising trajectory for rapid decarbonisation of the power sector.

EXECUTIVE SUMMARY

18

WORLD ENERGY

TRANSITIONS OUTLOOK

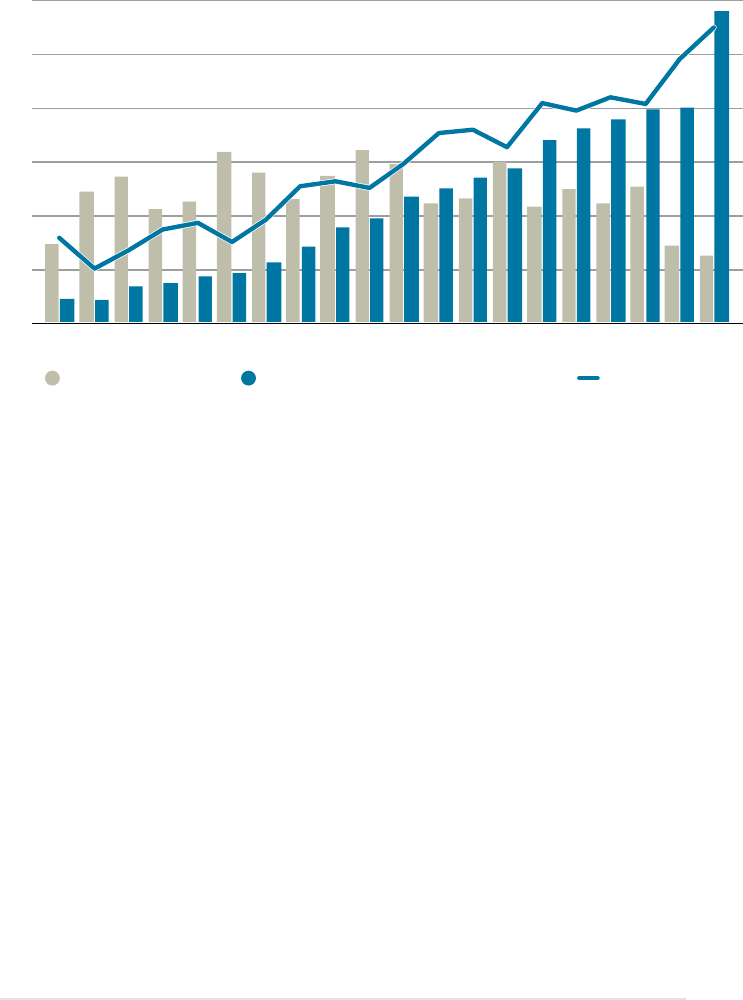

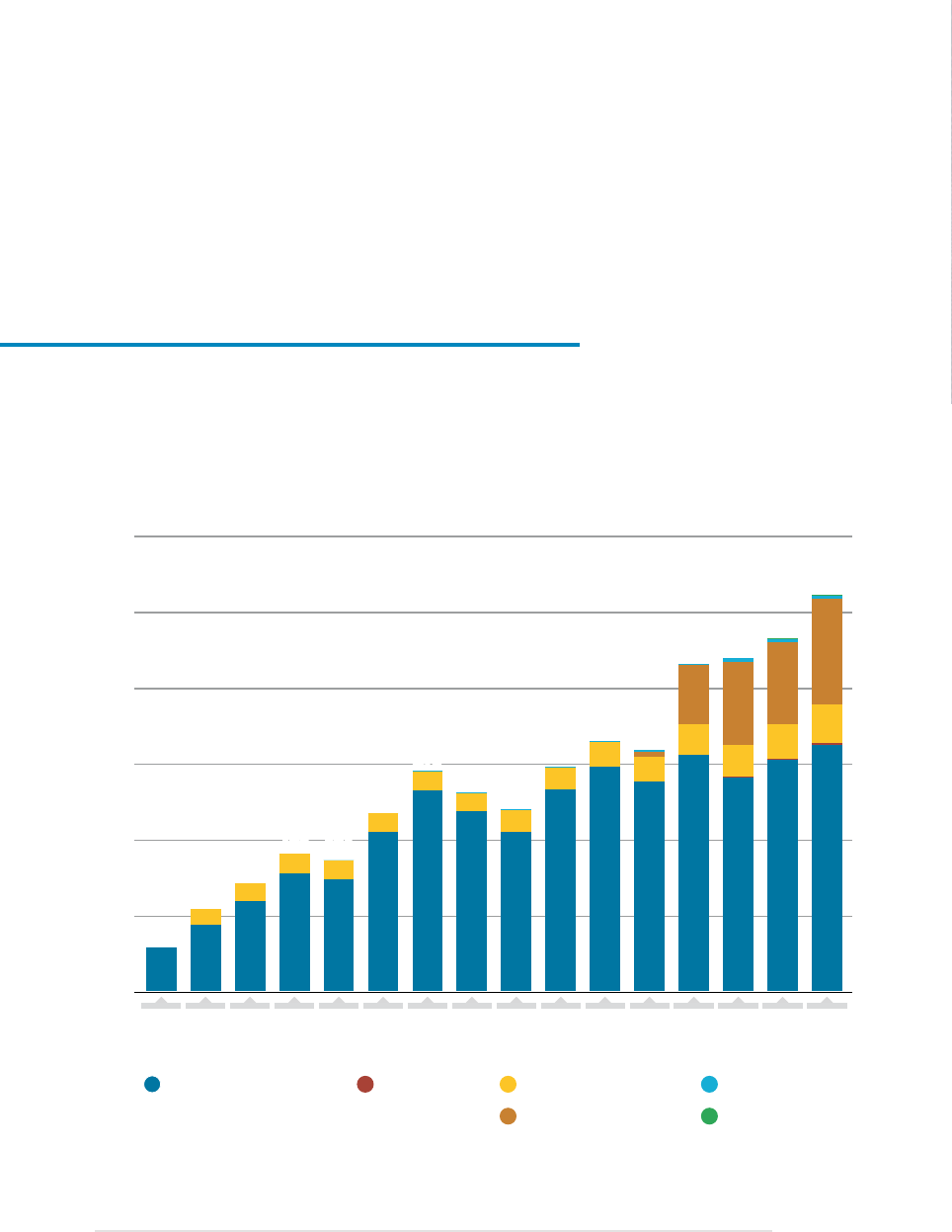

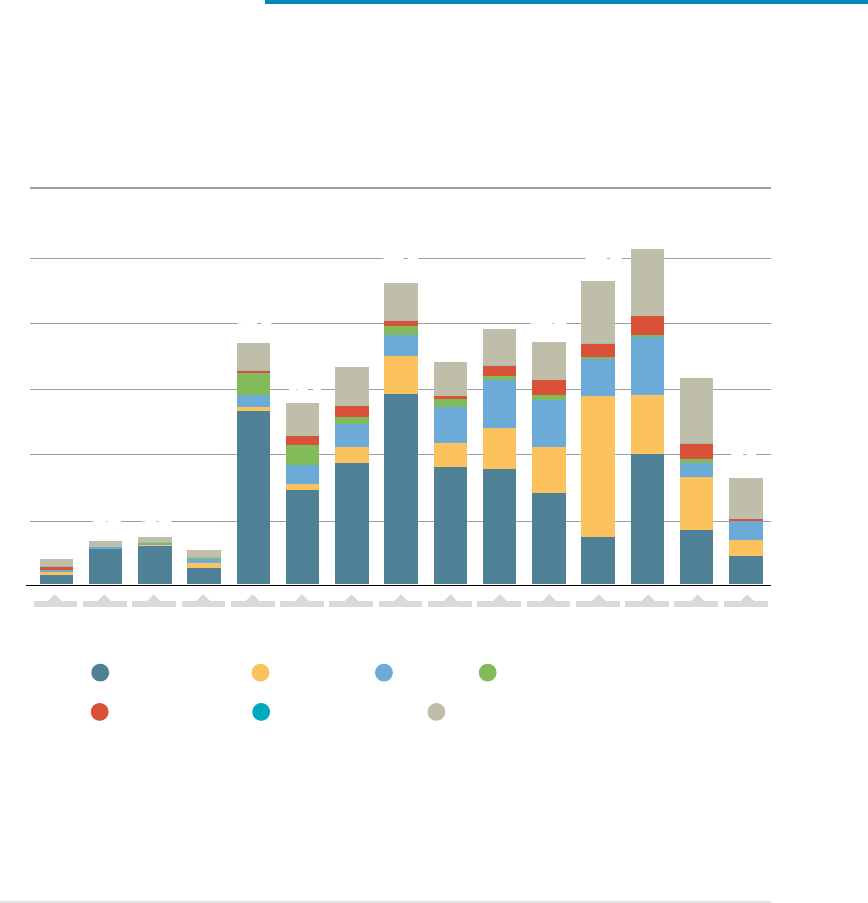

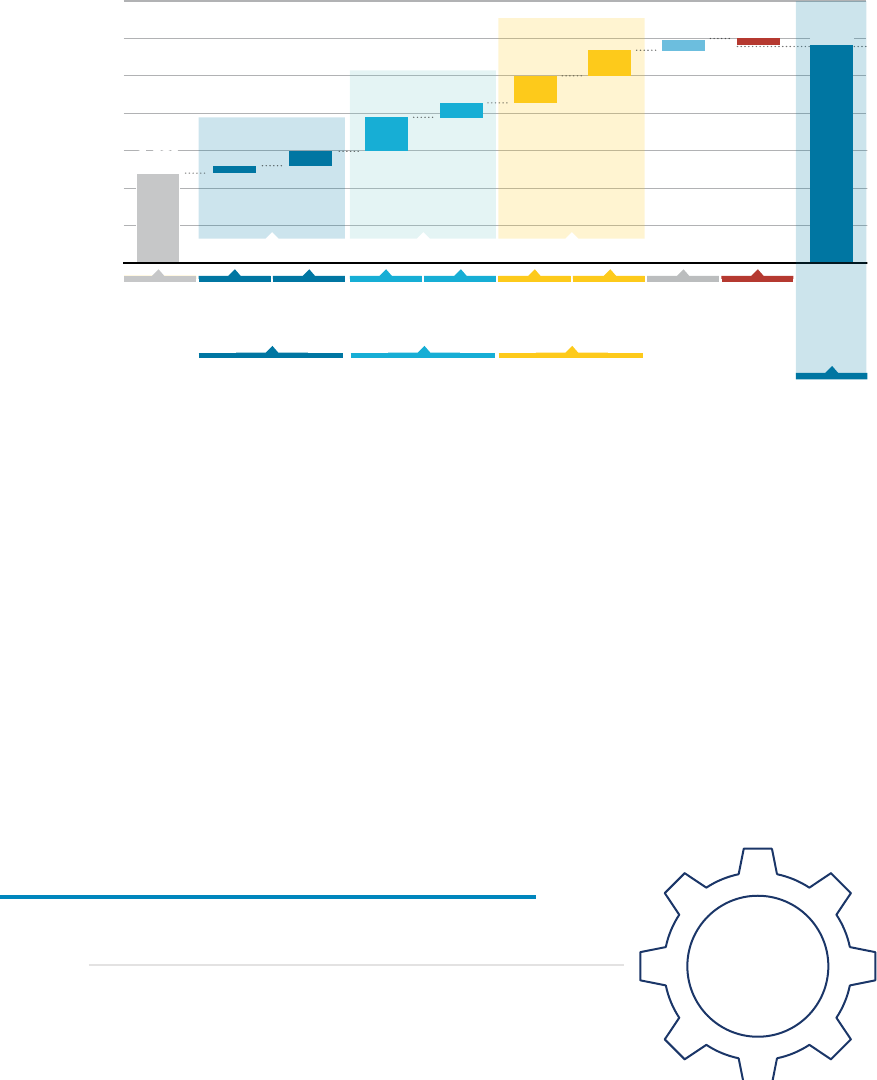

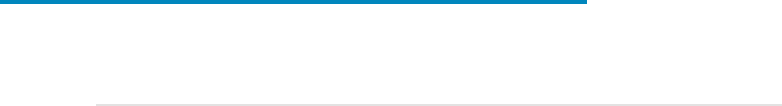

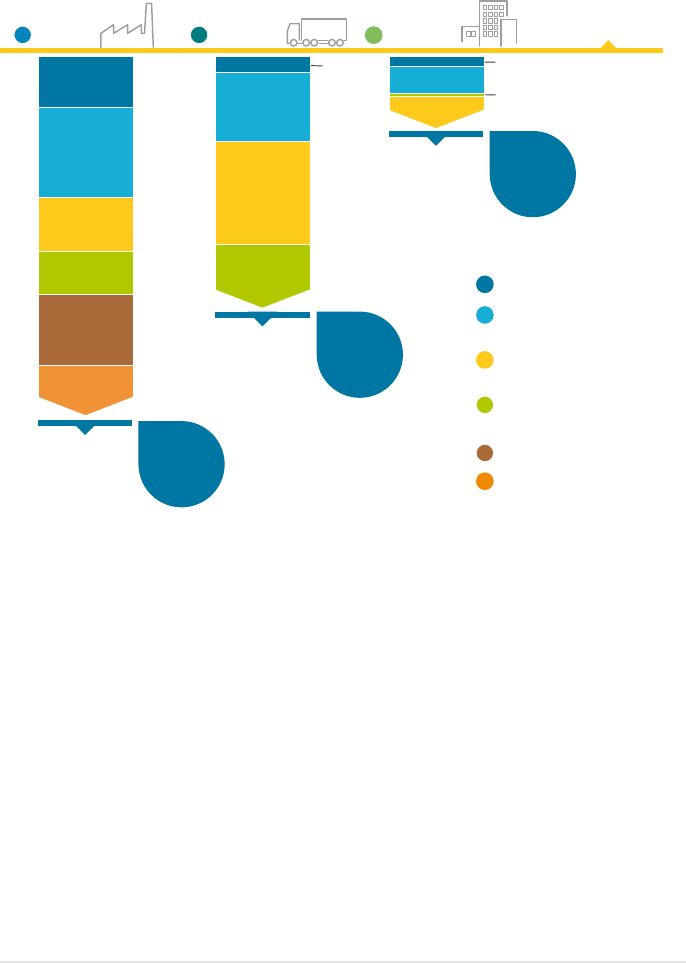

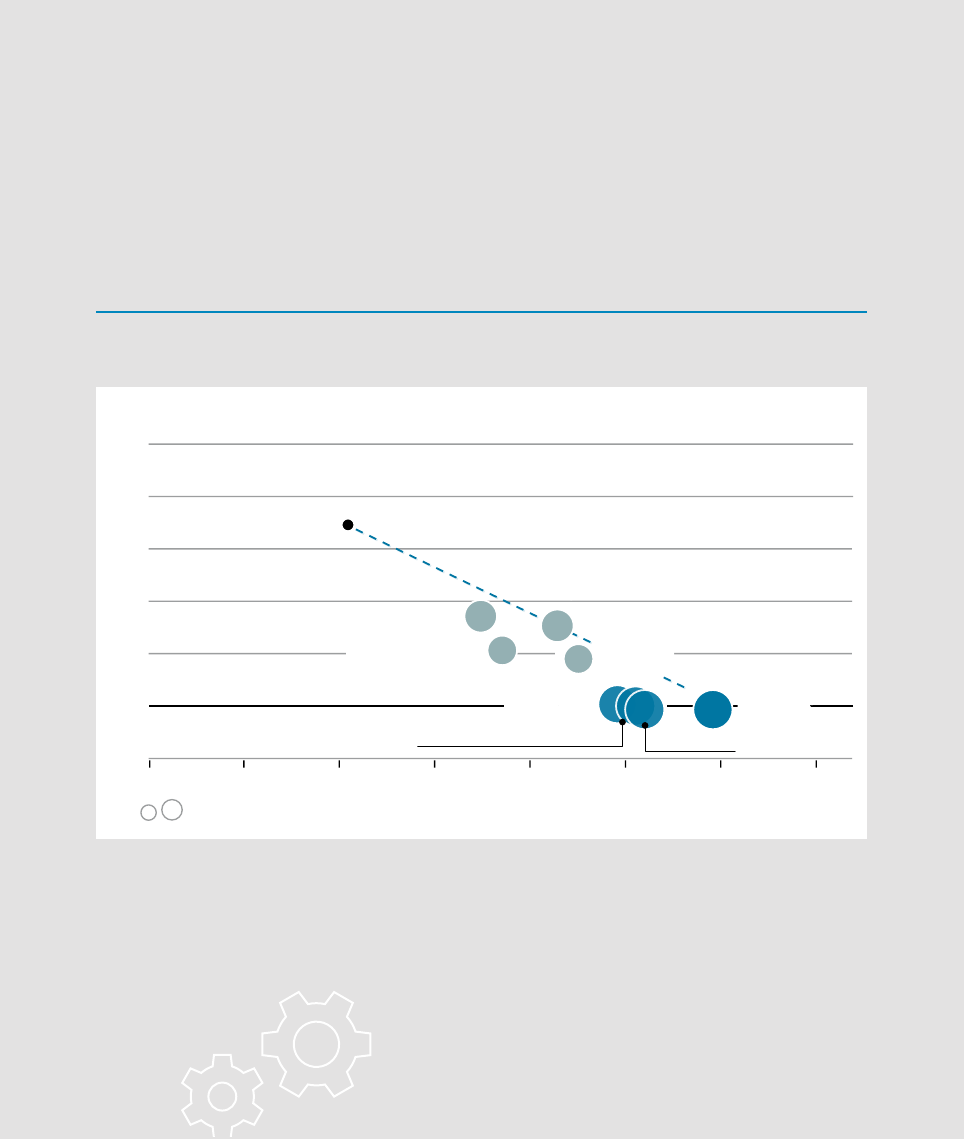

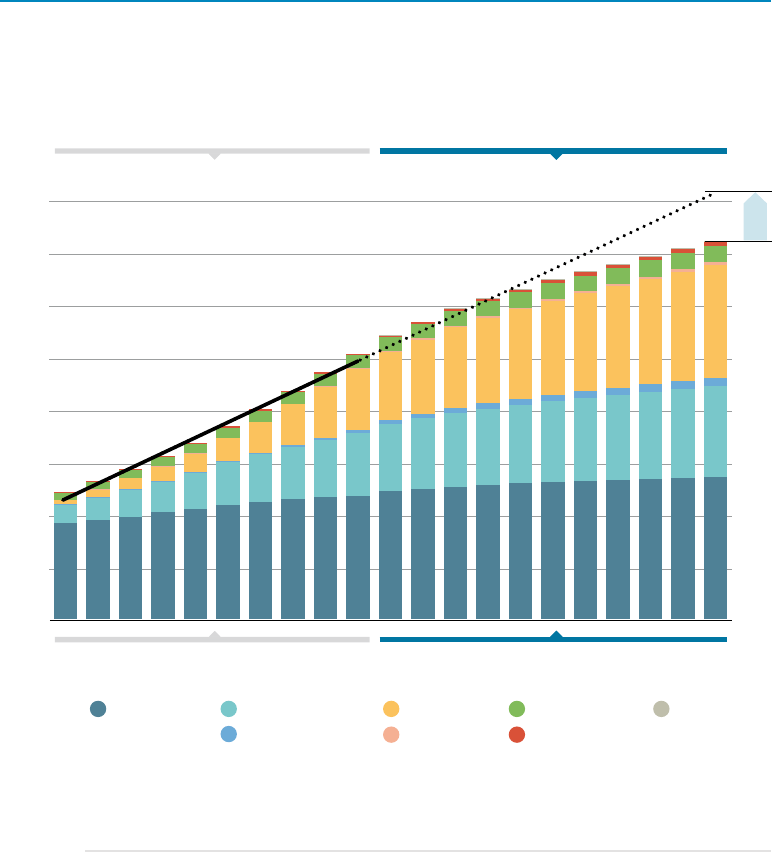

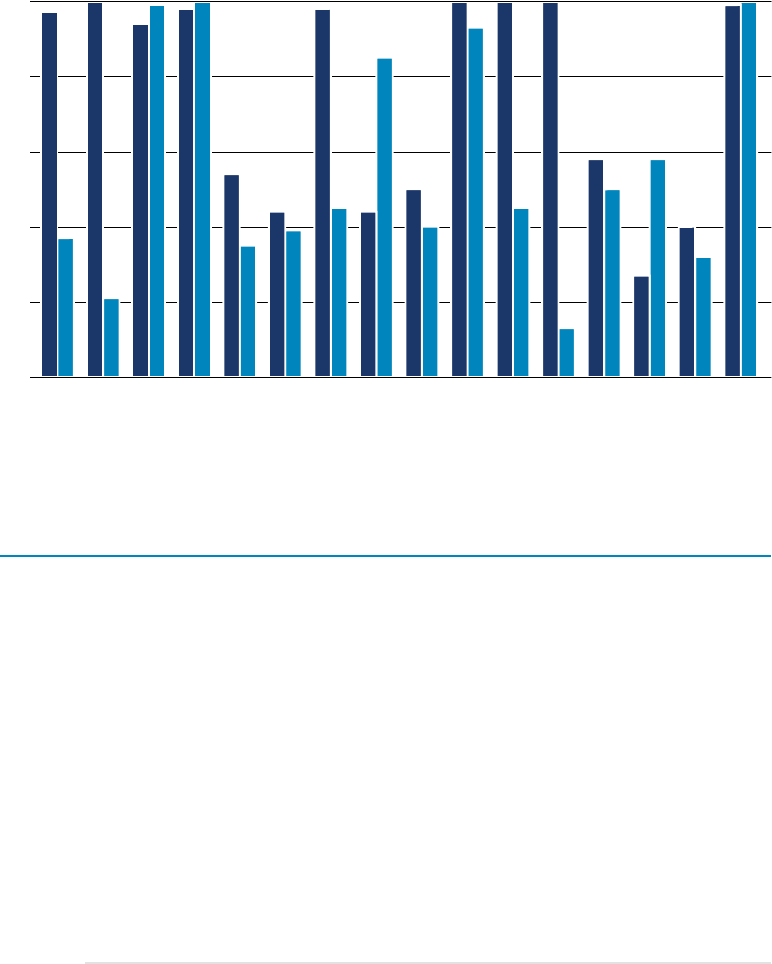

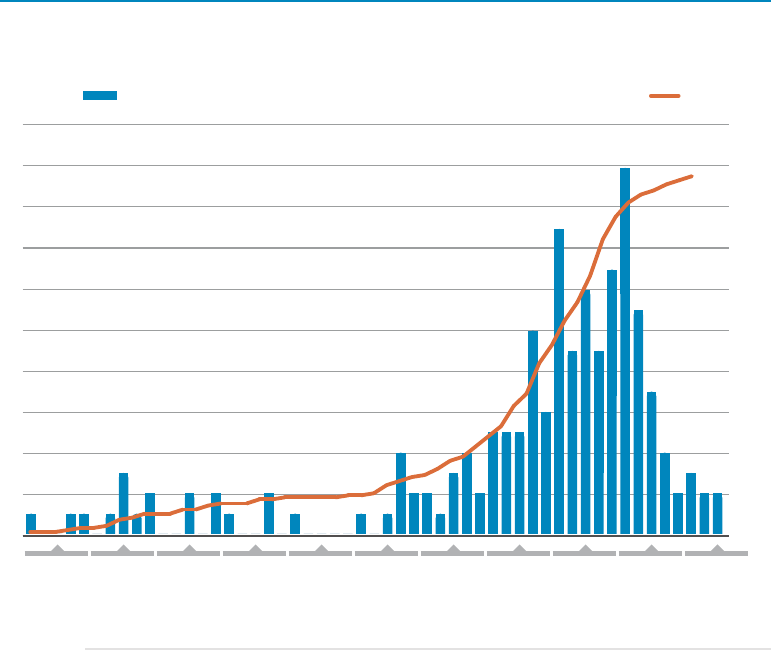

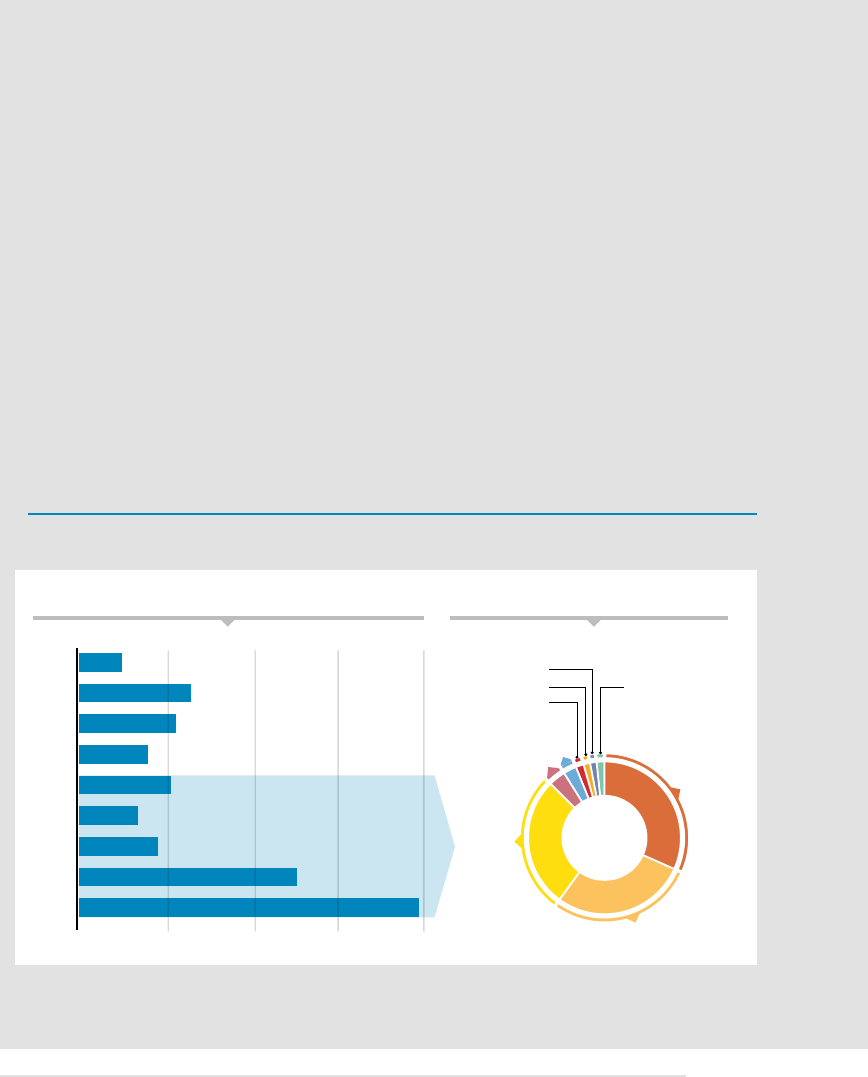

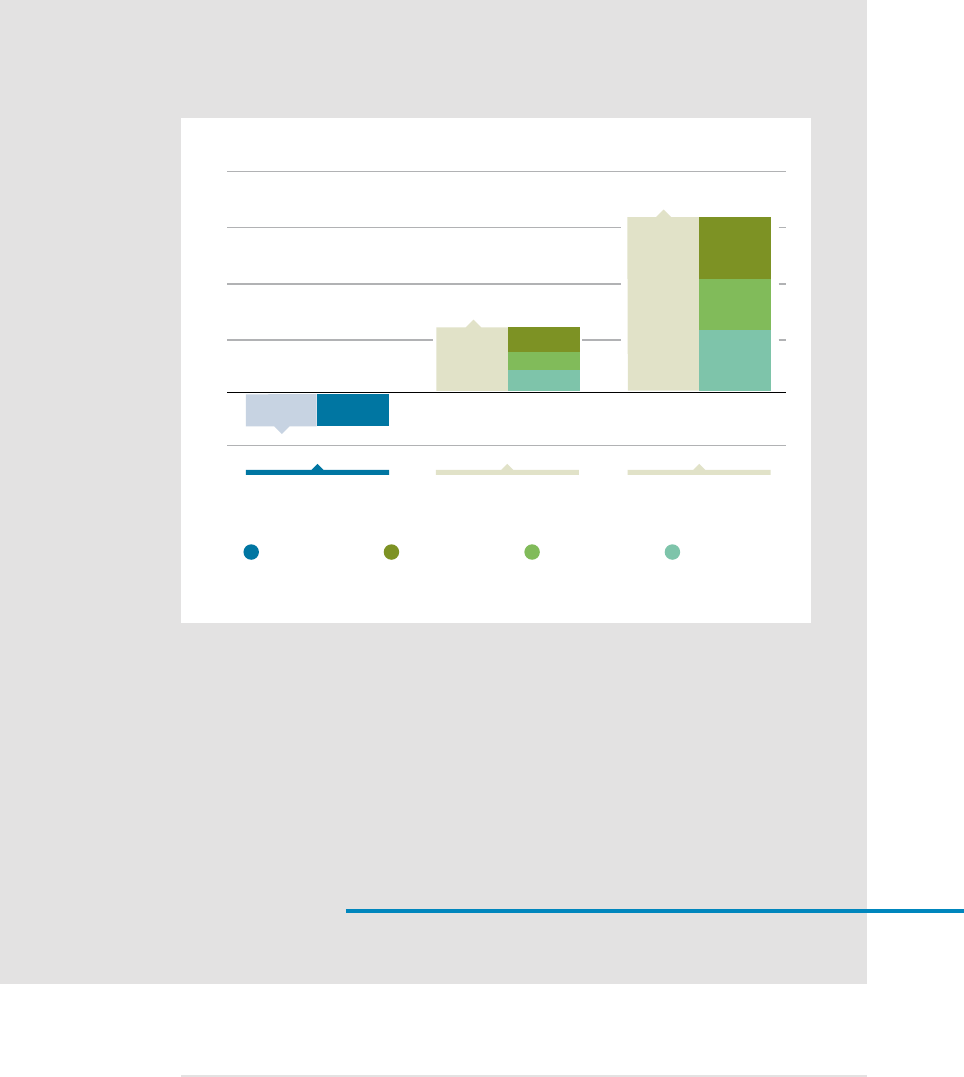

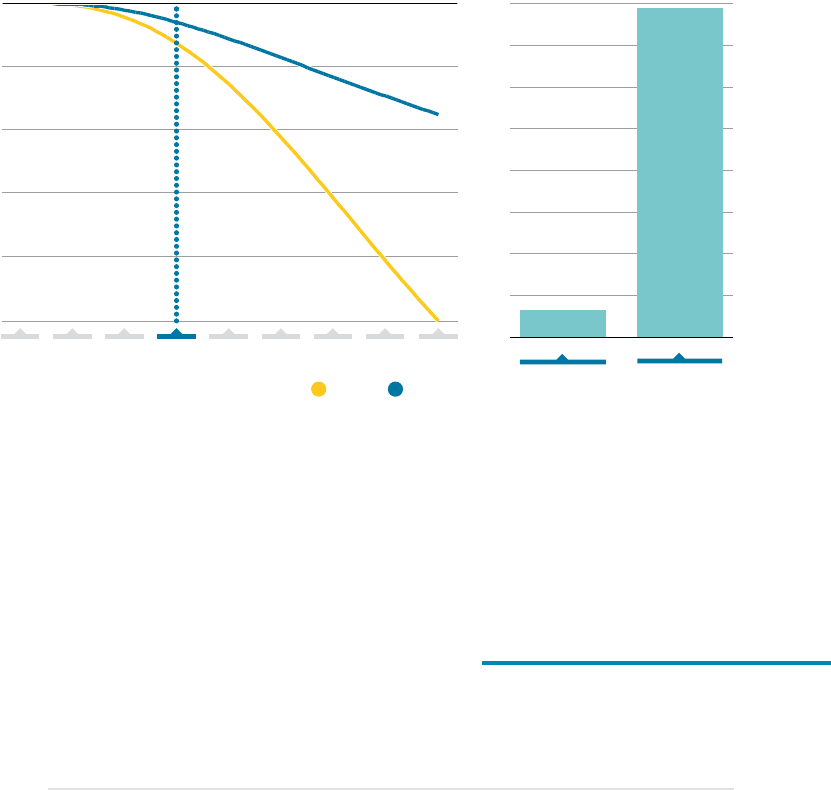

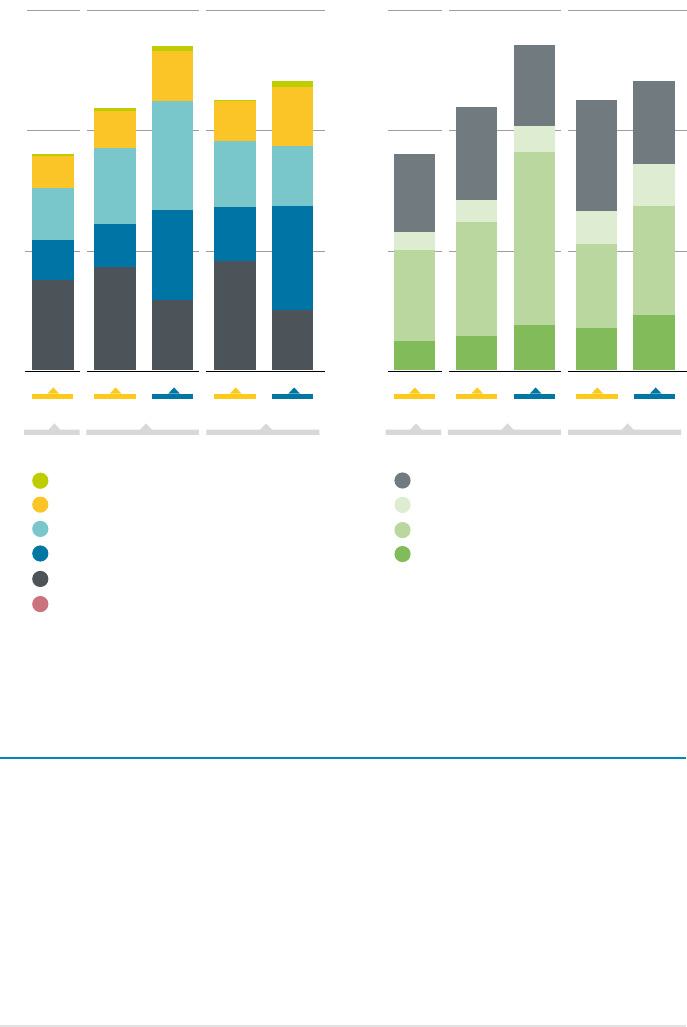

FIGURE S.1 Share of capacity, 2001-2020

15

30

45

60

75

45

90

135

180

225

New capacity

non-renewables (GW)

New capacity

renewables (GW)

0

Annual capacity installations (GW/yr)

20132001 20152009 201720052003 20112007 2020

90

0

270

Share of new electricity generating capacity (%)

Renewable share (%)

Based on IRENA’s renewable energy statistics.

Innovative solutions are reshaping the energy system and opening new possibilities for a

decarbonised future much faster than expected. Innovations in technology, policy and markets are

being implemented worldwide (IRENA, 2019a). Significant progress has been made in electric mobility,

battery storage, digital technologies and artificial intelligence, among others. These shifts are also

drawing greater attention to the need for sustainable exploitation and management of rare earths

and other minerals, and investment in the circular economy. New and smart grids, ranging from mini-

to super grids, bolstered by facilitative policies and markets, are enhancing the power sector’s ability

to cope with the variability of renewables. Direct uses of renewables – including bioenergy – and

green hydrogen are bringing much-needed solutions in transport, buildings and industry.

19

EXECUTIVE SUMMARY

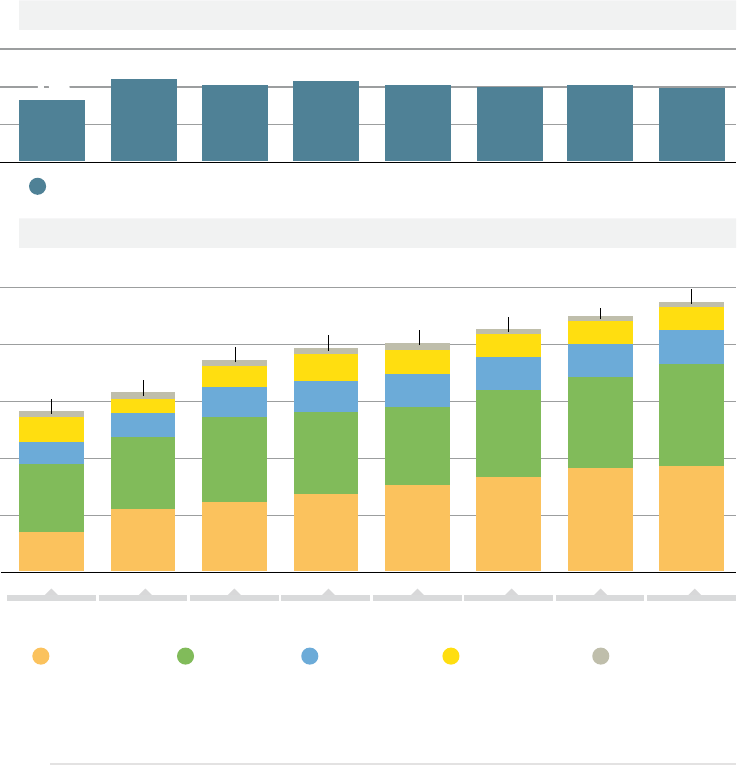

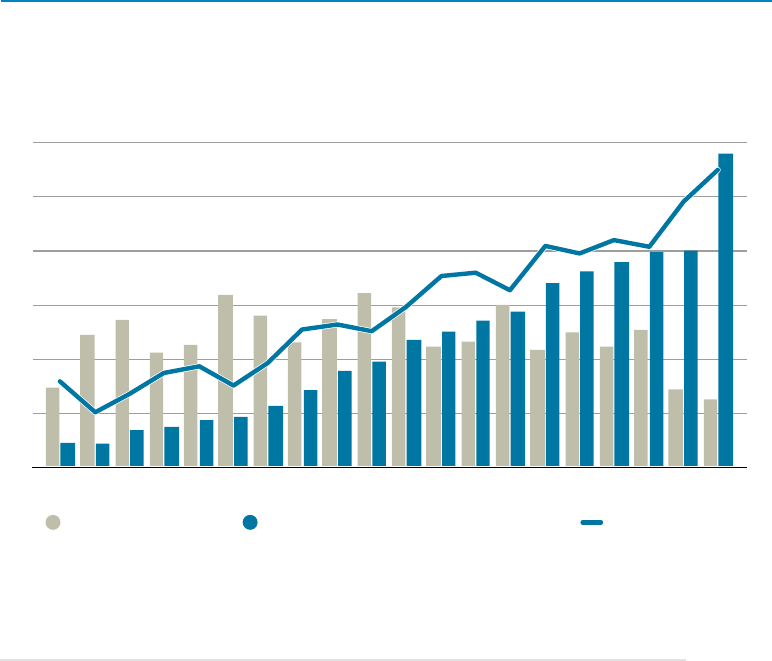

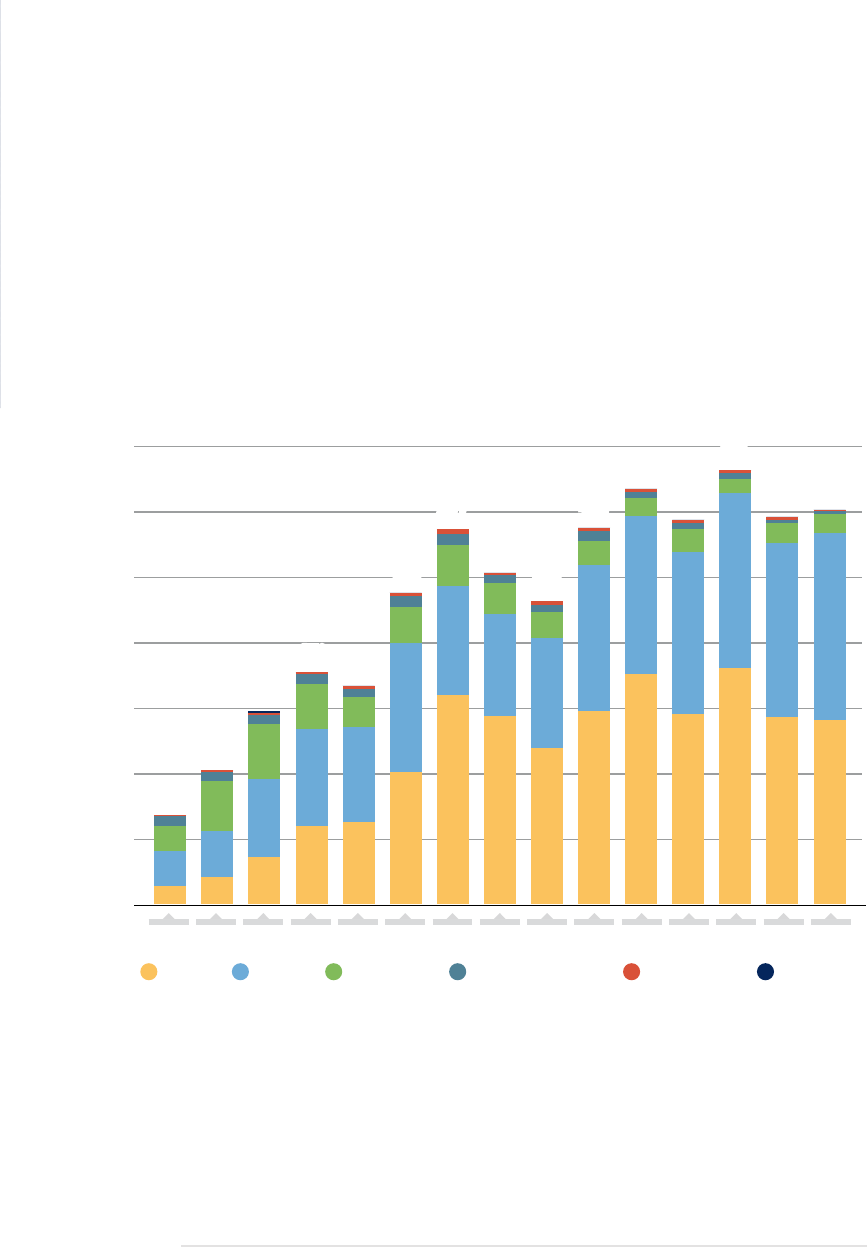

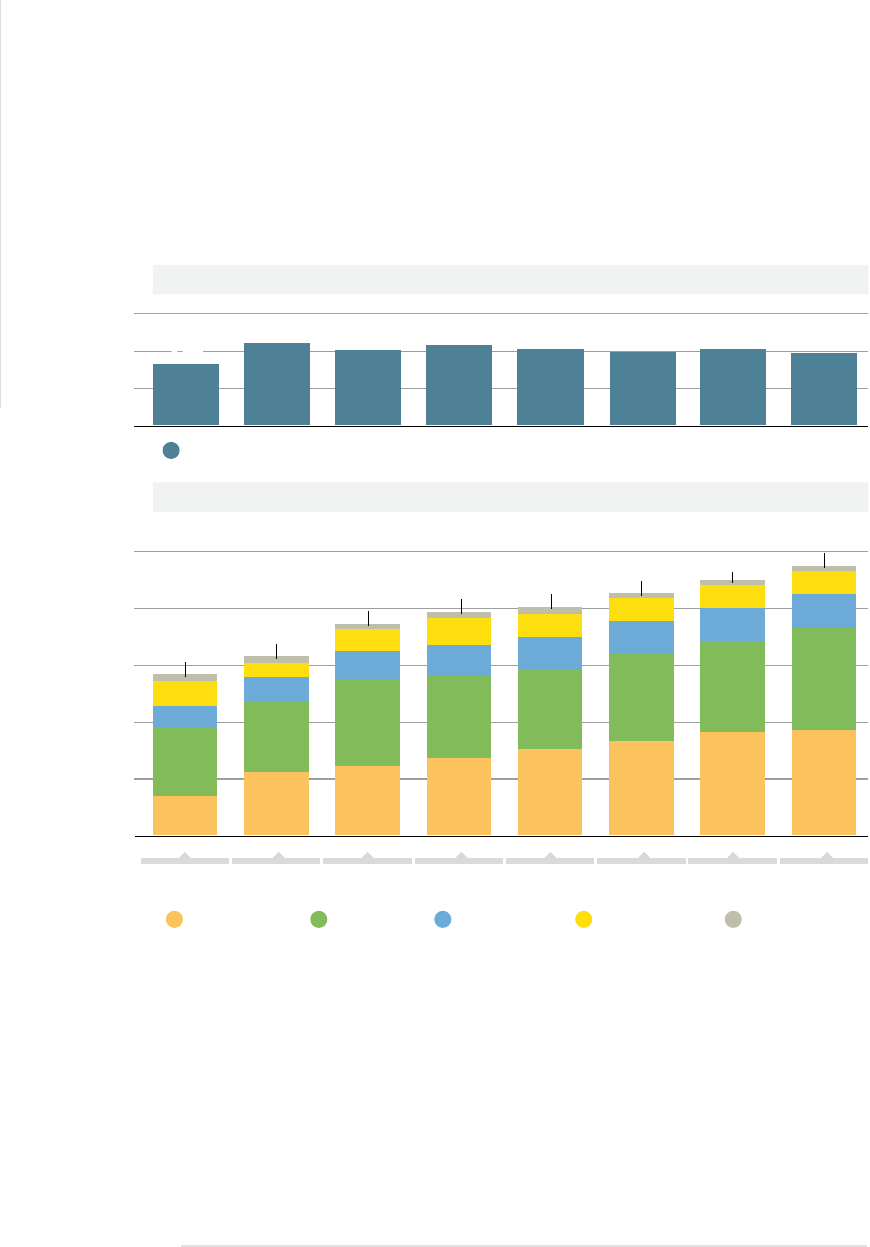

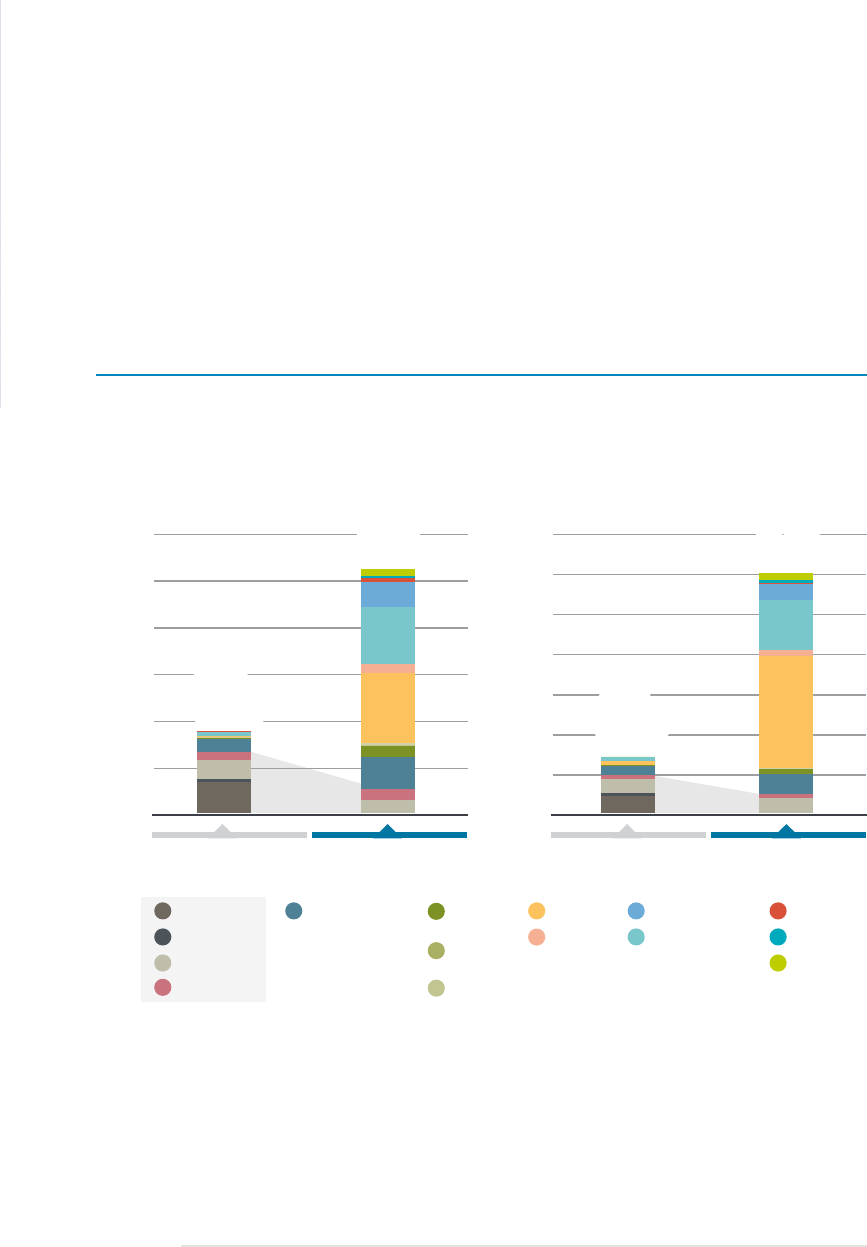

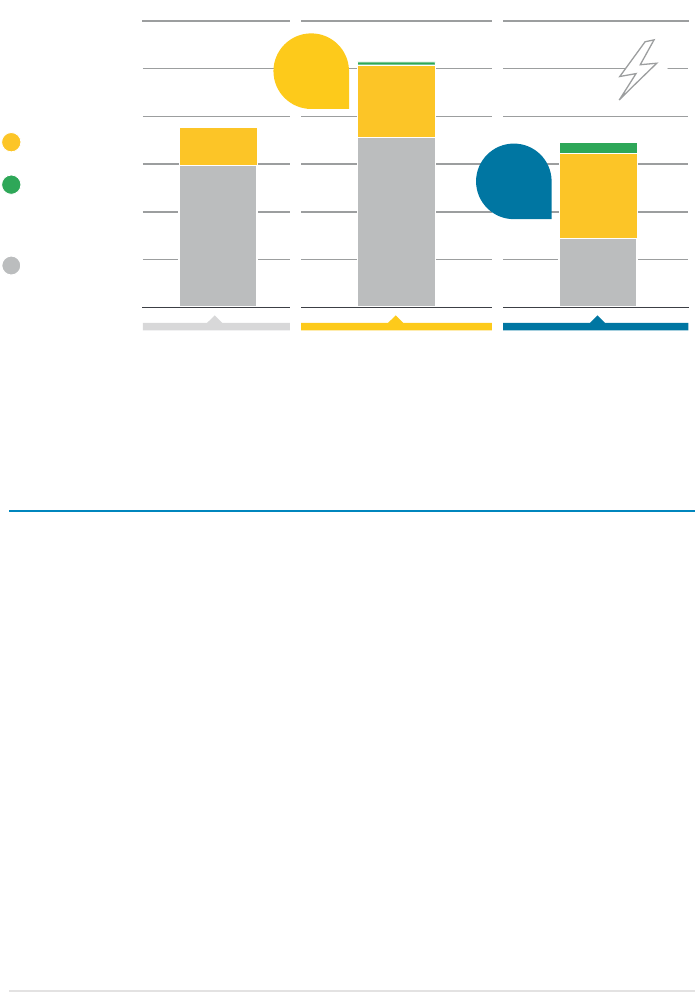

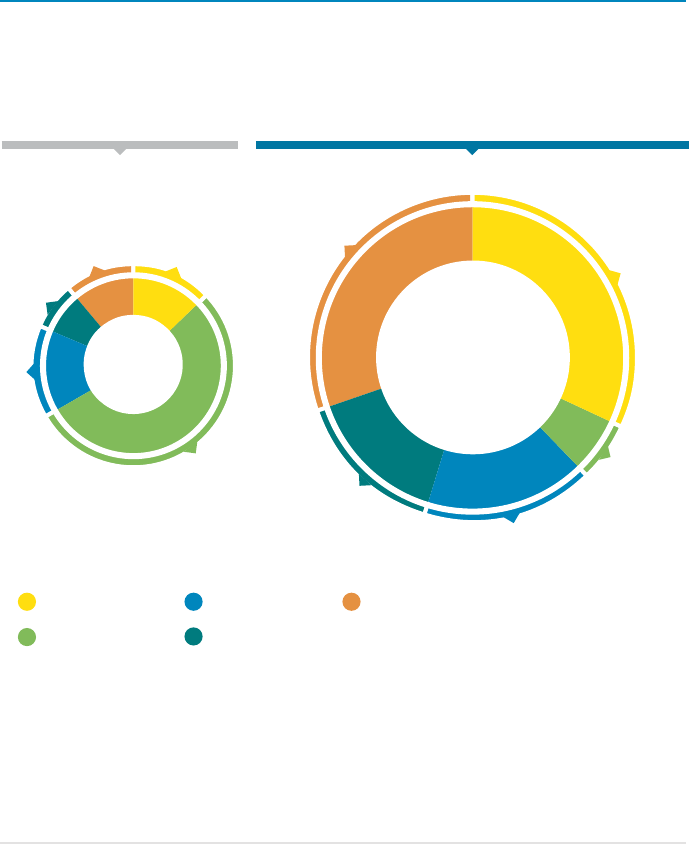

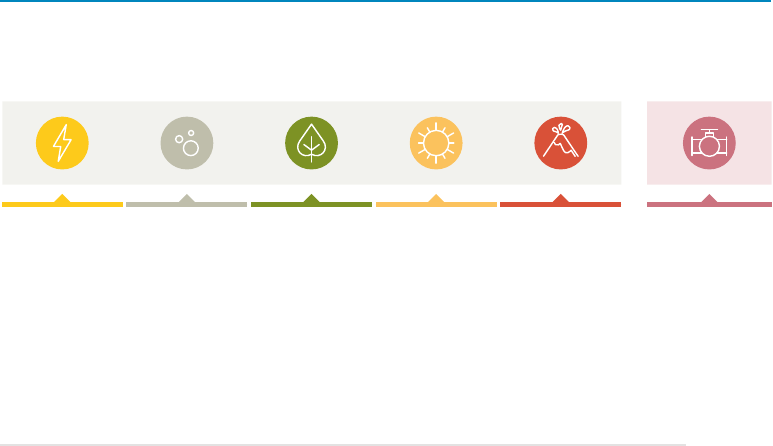

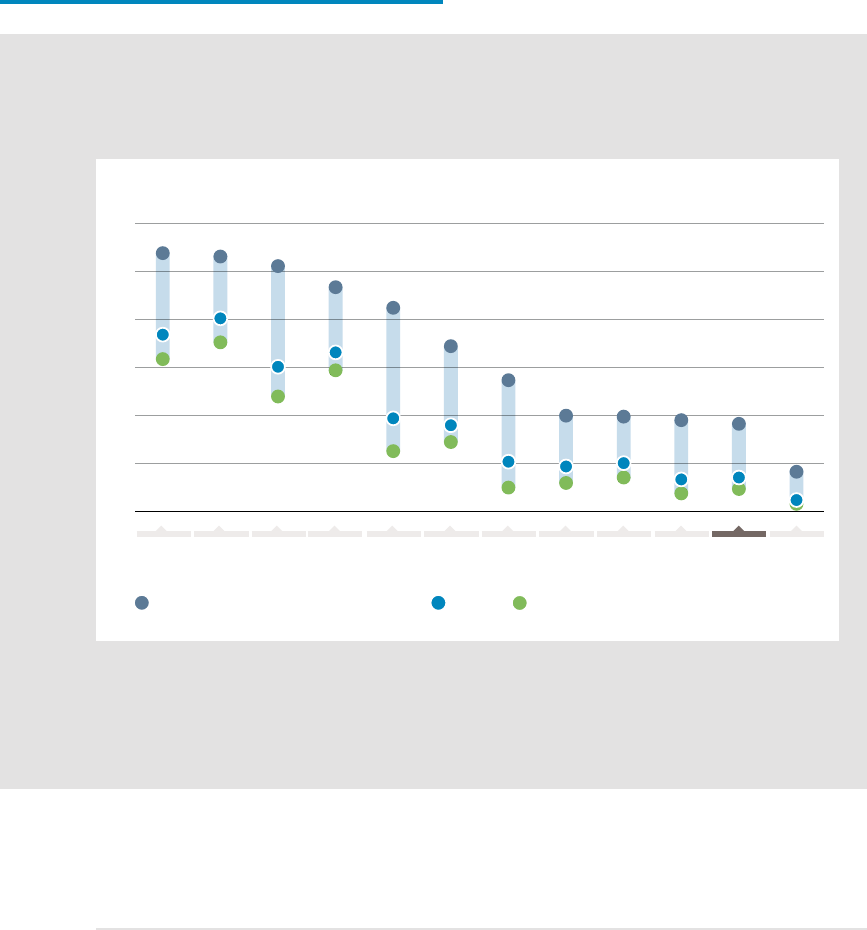

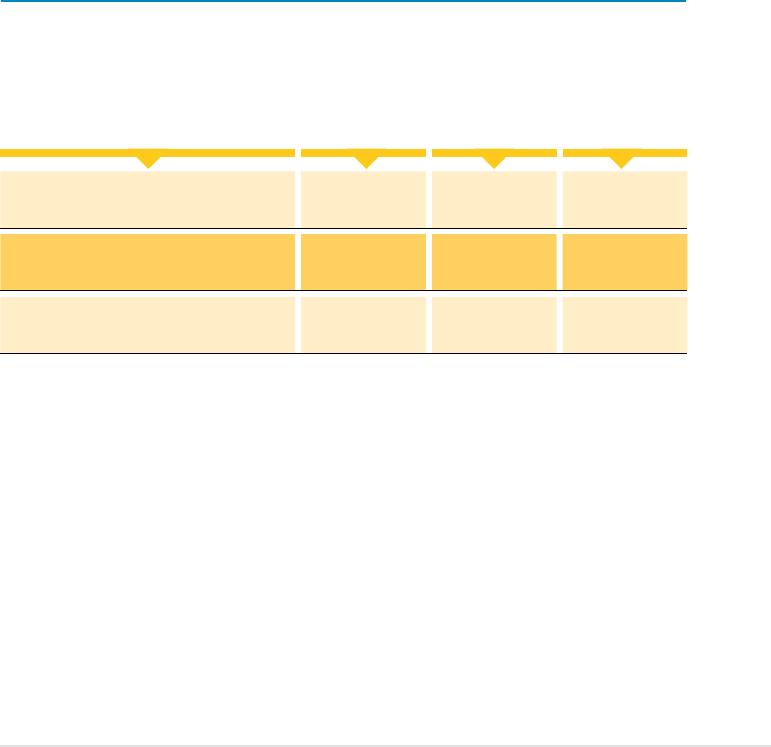

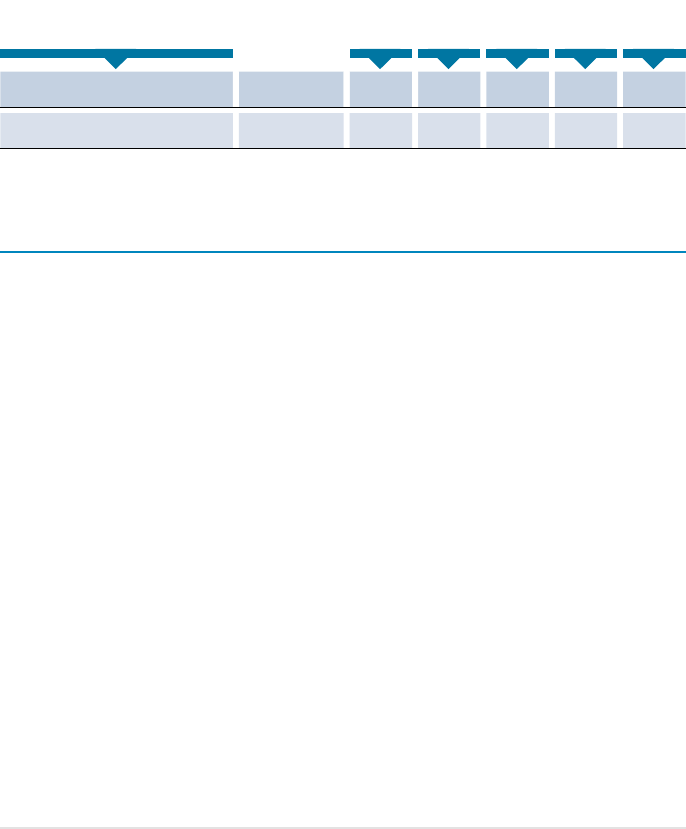

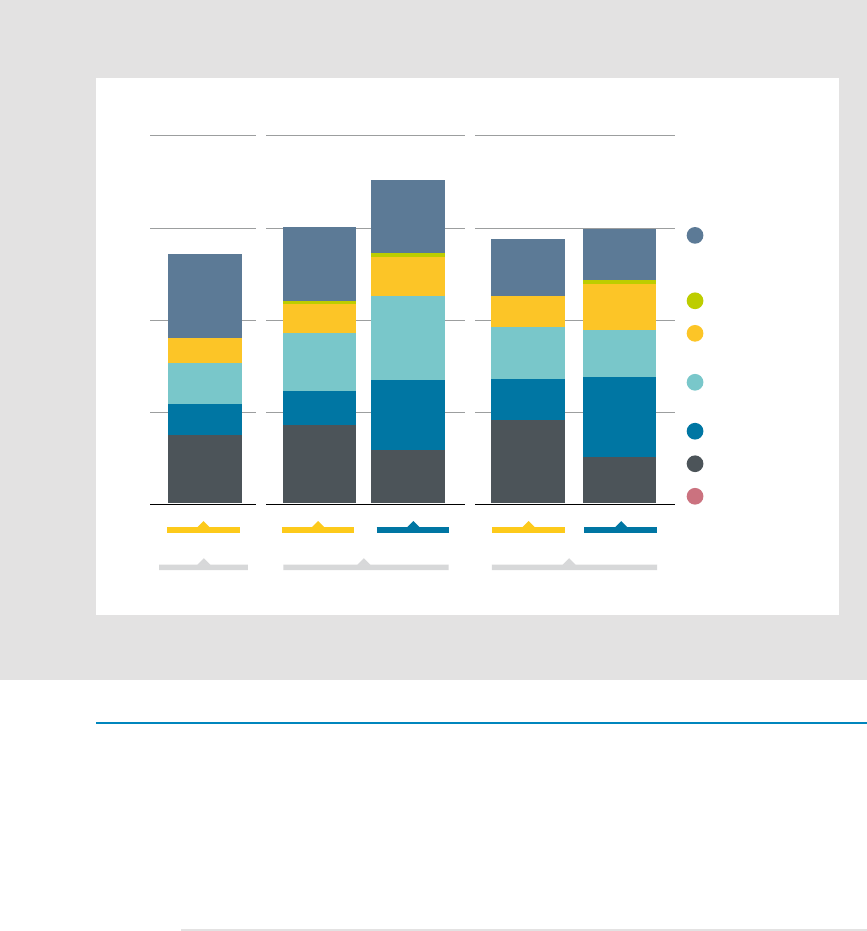

FIGURE S.2 Global renewable energy employment by technology, 2012-2019

TotalTotalTotal

SubtotalSubtotalSubtotal

Hydropower (direct jobs only)

Solar

photovoltaics

Bioenergy Wind energy Solar heating

and cooling

Others

0

2

4

6

8

10

2012 2013 2014 2015 2016 2017 2018 2019

Million

jobs

3

2

1

0

1.961.96

11.4611.4611.46

2.052.05

10.9810.9810.98

1.991.99

10.5310.5310.53

2.062.06

10.1310.1310.13

2.162.16

10.0410.0410.04

2.042.04

9.509.509.50

2.212.21

8.558.558.557.287.287.28

9.59.59.59.09.09.08.58.58.58.18.18.17.97.97.97.57.57.56.36.36.35.65.65.6

1.661.66

1.361.361.36

2.272.272.27

2.492.492.49

2.992.992.99

1.031.031.03

0.760.760.76

0.940.940.94

0.200.200.20

1.081.081.08

2.882.882.88

2.772.772.77

3.093.093.09 3.373.373.37

3.683.683.68 3.753.753.75

3.583.583.58

3.183.183.18

3.053.053.05

2.742.742.74

1.161.161.16

1.151.151.15

1.161.161.16

0.800.800.80

0.180.180.18

0.810.810.81

0.160.160.16

0.830.830.83

0.240.240.24

1.171.171.17

0.820.820.82

0.180.180.18

0.190.190.19

2.502.502.50

0.830.830.83

0.500.500.50

0.230.230.23

2.402.402.40

0.750.750.75

0.890.890.89

0.220.220.22

Of the 58 million energy jobs worldwide in 2019, some 20% were in the renewable sector. The

change in global employment patterns reflects new trends in energy deployment. Employment

grew from 7.3million in 2012, when IRENA began monitoring jobs in renewables, to 11.5million in

2019. During the same period, energy jobs were decreasing owing to growing automation, lack of

competitiveness of some fuels and changing market dynamics. There is also growing evidence of

the wider impacts of the shift toward renewables. Notably, the rise of renewables has improved

the gender balance in the energy sector, with women accounting for 32% of jobs in renewables,

compared with 22% in the oil and gas.

Source: IRENA, 2020a.

20

WORLD ENERGY

TRANSITIONS OUTLOOK

The growing number of countries committing to net zero carbon strategies indicates a major

shift in the global climate discourse. Similar trends are observed at all levels of government

and in the private sector, including in hard to abate and oil and gas sectors. As much of the world

grapples with the economic downturn, investment in the energy transition can help align short-

term priorities with medium- and long-term development and climate objectives. This is a unique

opportunity to instigate a lasting shift with foresighted and targeted investment in energy, most

immediately in infrastructure, efficiency and renewables (IRENA, 2020b). Indeed, several countries

have made significant commitments to appropriate public funds for these purposes and to support

solutions such as electric mobility and clean hydrogen.

No less than 80% of the world’s people live in countries that are net importers of fossil fuels.

By contrast, every nation possesses some renewable potential that can be harnessed for greater

energy security and independence, increasingly at least cost (IRENA, 2019b). A transformation

of the global energy system aligned with the 1.5°C climate goal can become a great equaliser in a

world that must become more resilient, just and inclusive. Such an energy system requires the rapid

development and deployment of resilient technologies and investments in people and institutions.

Progress has been significant but uneven across geographies and communities. The longest

strides have been made in a handful of countries and regions. In other areas, widespread energy

poverty continues to hold back economic progress and social wellbeing. In 2020, Europe, U.S.

and China accounted for the largest share of new renewable capacity, while Africa accounted for

only 1% of the global total of new renewable capacity. This is even though the continent has the

largest needs for expanded access to modern forms of energy and a renewable potential that far

exceeds projected needs. Only USD1billion was invested in off-grid renewables between 2008

and 2019, despite being a major avenue for expanding access. Uneven deployment patterns are

also mirrored in the concentration of jobs and industries, leaving behind large parts of the world.

Current plans fall woefully short of a 1.5°C goal. Based on existing government energy plans and

targets, including the first round of Nationally Determined Contributions (NDCs) under the Paris

Agreement, the policies in place will do no more than stabilise global emissions, with a slight drop

as 2050 approaches. Despite clear evidence of human-caused climate change, widespread support

for the Paris Agreement, and the prevalence of clean, economical, and sustainable energy options,

energy-related CO

2

emissions increased by 1.3% annually, on average, between 2014 and 2019.

1.5-SPES

21

EXECUTIVE SUMMARY

The 1.5°C Scenario (1.5-S) describes an

energy transition pathway aligned with

the 1.5°C climate ambition – that is, to

limit global average temperature increase

by the end of the present century to

1.5°C, relative to pre-industrial levels. It

prioritises readily available technology

solutions, which can be scaled up at the

necessary pace for the 1.5°C goal.

Time is of the essence, and a rapid decline in emissions must begin now to preserve a fighting

chance to hold the line at 1.5°C. In alignment with the Intergovernmental Panel on Climate

Change’s (IPCC) report on limiting global warming to 1.5°C by 2050, coal and oil should already have

peaked, with natural gas peaking in 2025. The resources and technologies needed to accelerate

the energy transition are available now. IRENA plots the way to a steep and continuous downward

trajectory towards a 45% decline in carbon dioxide (CO

2

) emissions from 2010 levels by 2030, and

net zero by 2050, in line with IPCC’s schedule.

IRENA’s World Energy Transitions Outlook is a unique 1.5°C-compatible pathway that also

examines full socio-economic and policy implications, and provides insights on the structural

changes and finance. Technologies for rapid decarbonisation are increasingly available, but

thinking related to the energy transition should not be confined within the energy silo. Realising

the transition’s far-reaching potential requires systemic innovation that considers technologies

and enabling frameworks in tandem. Renewables-based energy systems will instigate profound

changes that will reverberate across economies and societies. Only by understanding these deep

currents can we achieve optimal results from the transition process. This inaugural edition of the

World Energy Transitions Outlook marshals IRENA’s extensive knowledge to make this possible –

by providing policy makers with insights, tools and advice to chart the path ahead.

IRENA’s 1.5°C Scenario

The Planned Energy Scenario (PES)

is the primary reference case for this

study, providing a perspective on

energy system developments based

on governments’ current energy plans

and other planned targets and policies,

including Nationally Determined

Contributions (NDCs) under the Paris

Agreement.

22

WORLD ENERGY

TRANSITIONS OUTLOOK

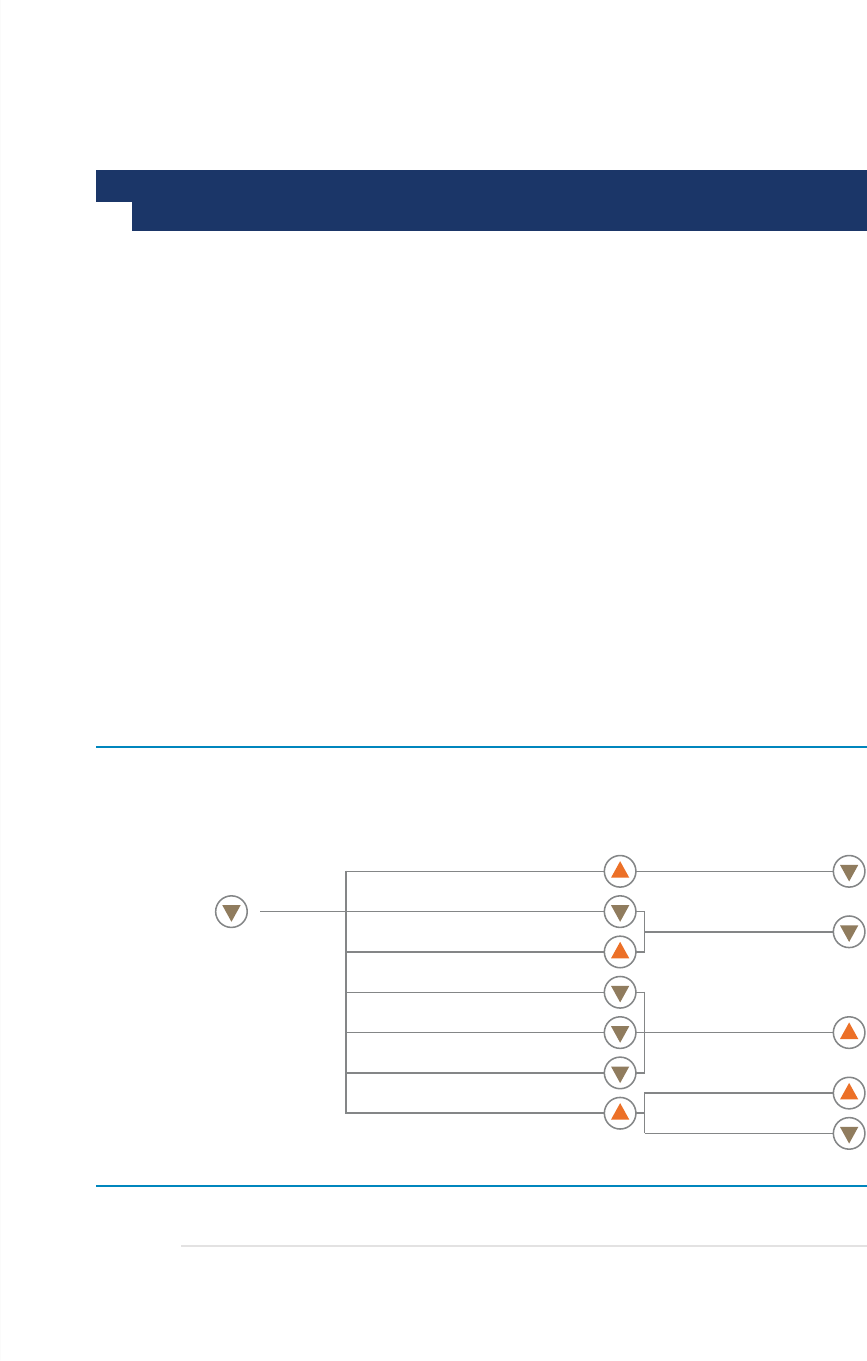

The time imperative requires careful investment and policy choices in the coming decade. The

window of opportunity to achieve the 2030 emission milestone set out by the IPCC is small, and the

choices made in the coming years will determine whether a 1.5°C future remains within reach. This

Outlook is guided by the UN’s Agenda for Sustainable Development and the Paris Agreement on

Climate Change. Several prerequisites underpin the theory of change behind IRENA’s 1.5°C Pathway:

• Pursuing the path that is most likely to drive down energy emissions in the coming decade and

put the world on a 1.5°C trajectory.

• Supporting emerging technologies most likely to become competitive in the short-term and

most effective in achieving emissions reductions in the long-term.

• Limiting investments in oil and gas to facilitating a swift decline and a managed transition.

• Reserving carbon capture and storage technologies for economies heavily dependent on oil

and gas and as a transitional solution where no other options exist

• Phasing out coal and fossil fuel subsidies.

• Adapting market structures for the new energy era.

• Investing in a set of policies to promote resilience, inclusion, and equity and protect workers

and communities affected by the energy transition.

• Ensuring all countries and regions have an opportunity to participate in and realise the benefits

of the global energy transition.

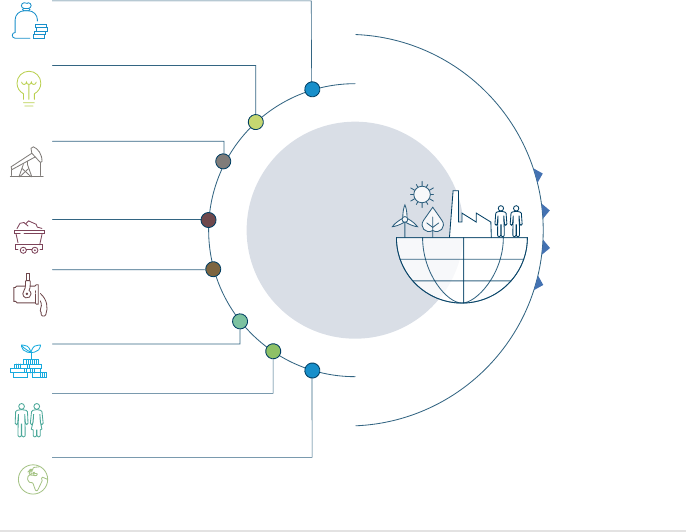

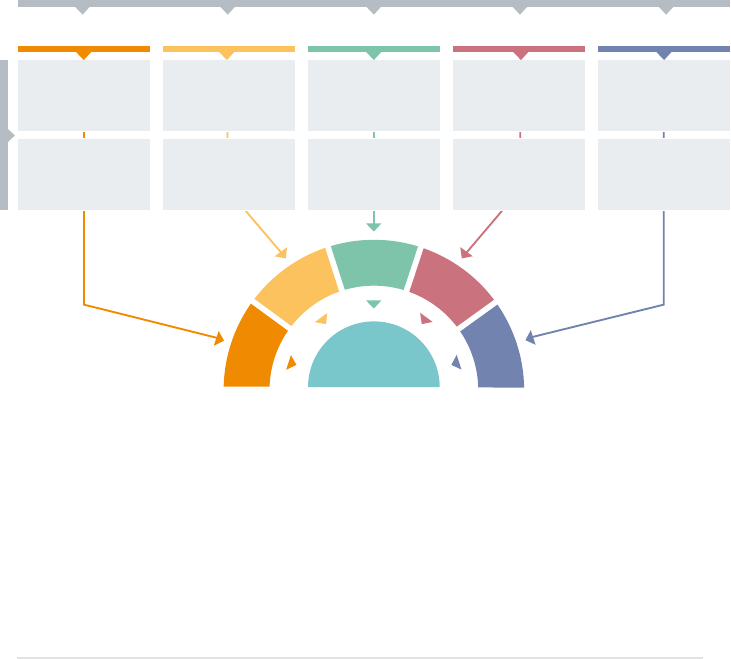

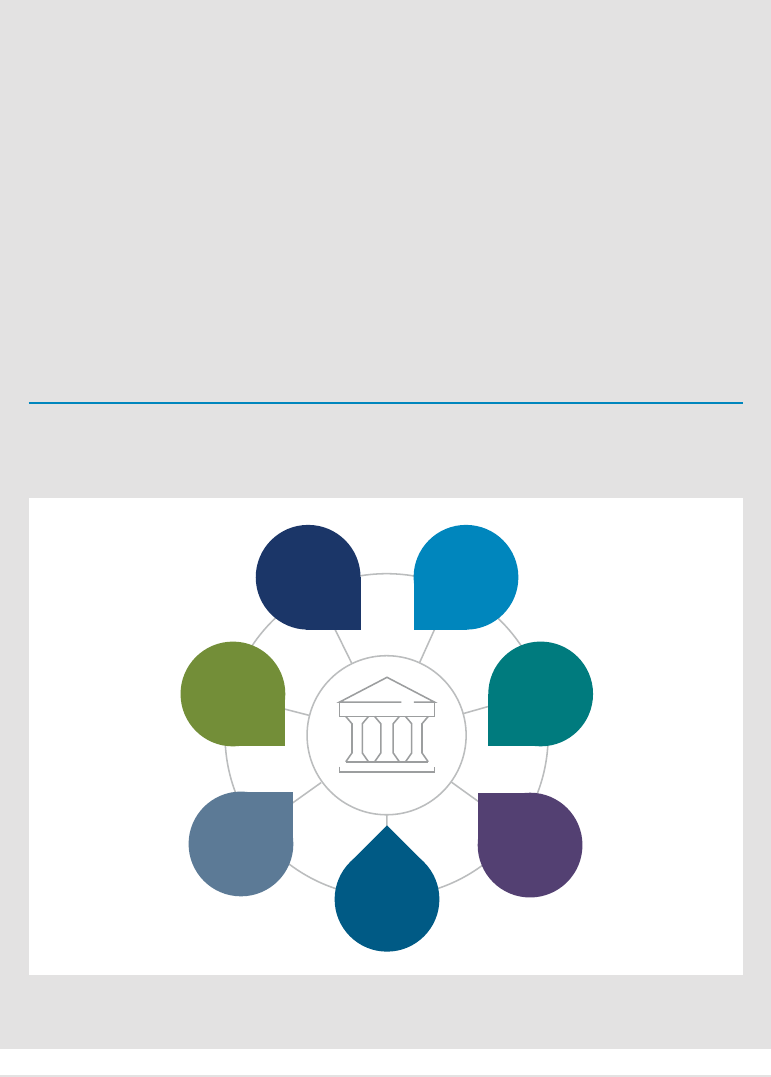

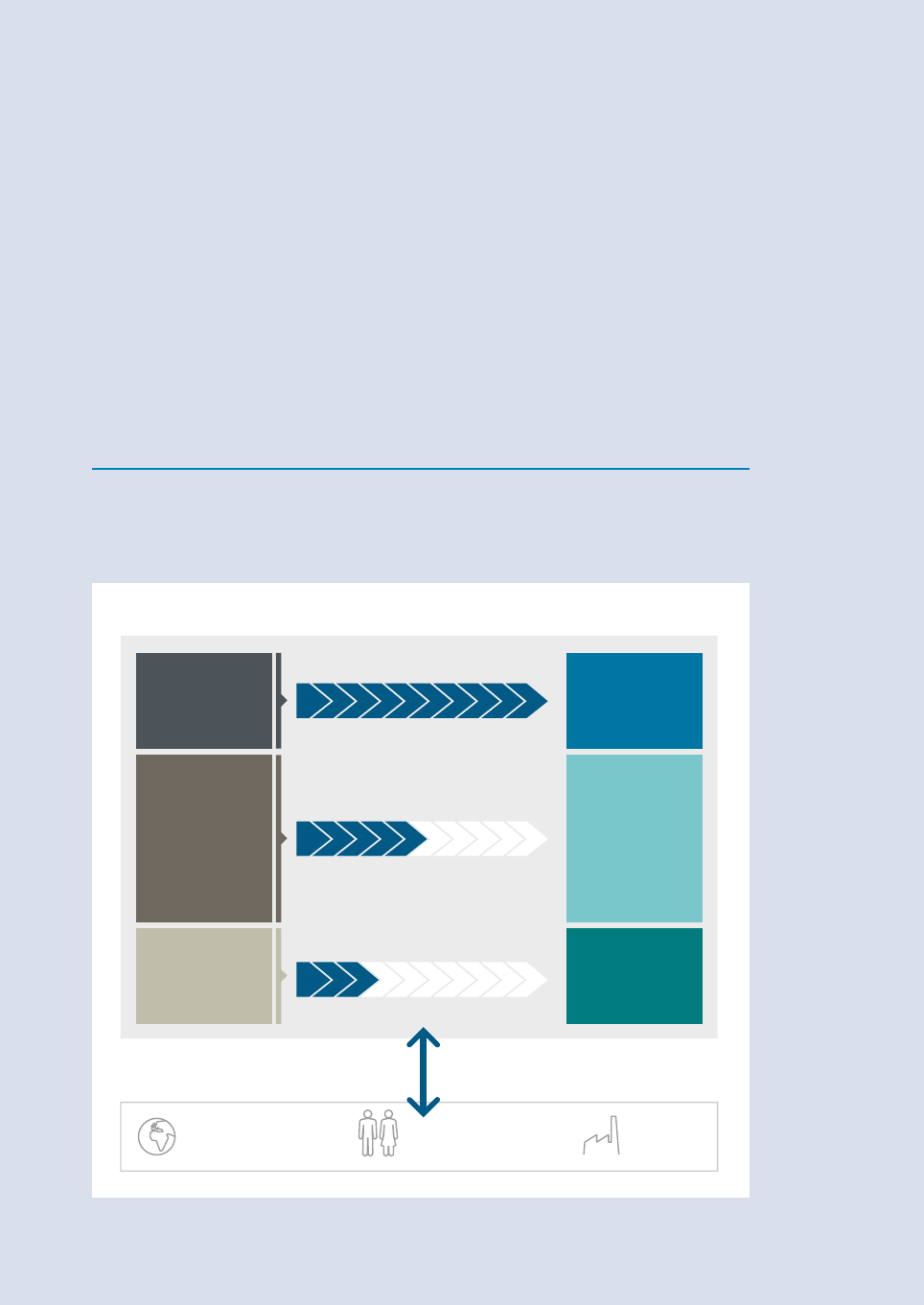

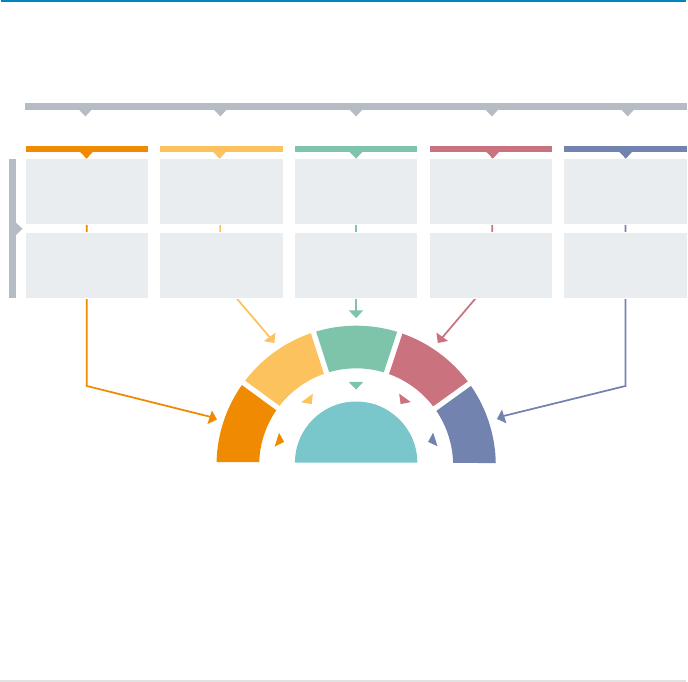

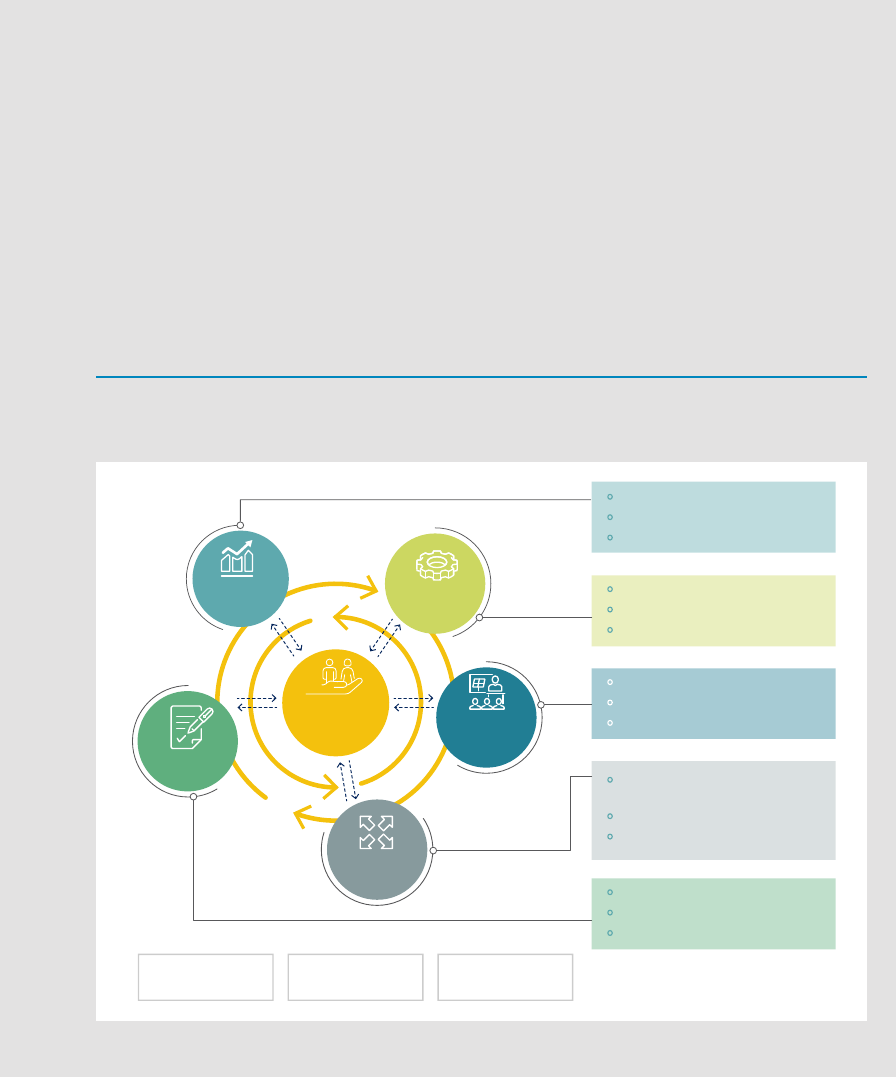

FIGURE S.3 Guiding framework of WETO theory of change

Pursue the path that is most likely

to drive down energy emissions

in the coming decade.

Invest in a set of policies for

resilience, inclusion, and equity

and protect workers and communities.

Support emerging technologies

most likely to become competi-

tive in the short-term and most

eective in the long-term.

Reserve CCS for econo-

mies heavily dependent

on oil and gas and as a

transitional solution.

Adapt market structures

for the new energy era.

Phase out coal and

fossil fuel subsidies.

Limit investments in oil

and gas to facilitating

a swift decline and a

managed transition.

Ensure all countries and regions

have an opportunity to realise the

benefits of the transition.

1.5°C

PEOPLE

PLANET

PROSPERITY

WORLD

ENERGY

TRANSITIONS

OUTLOOK

23

EXECUTIVE SUMMARY

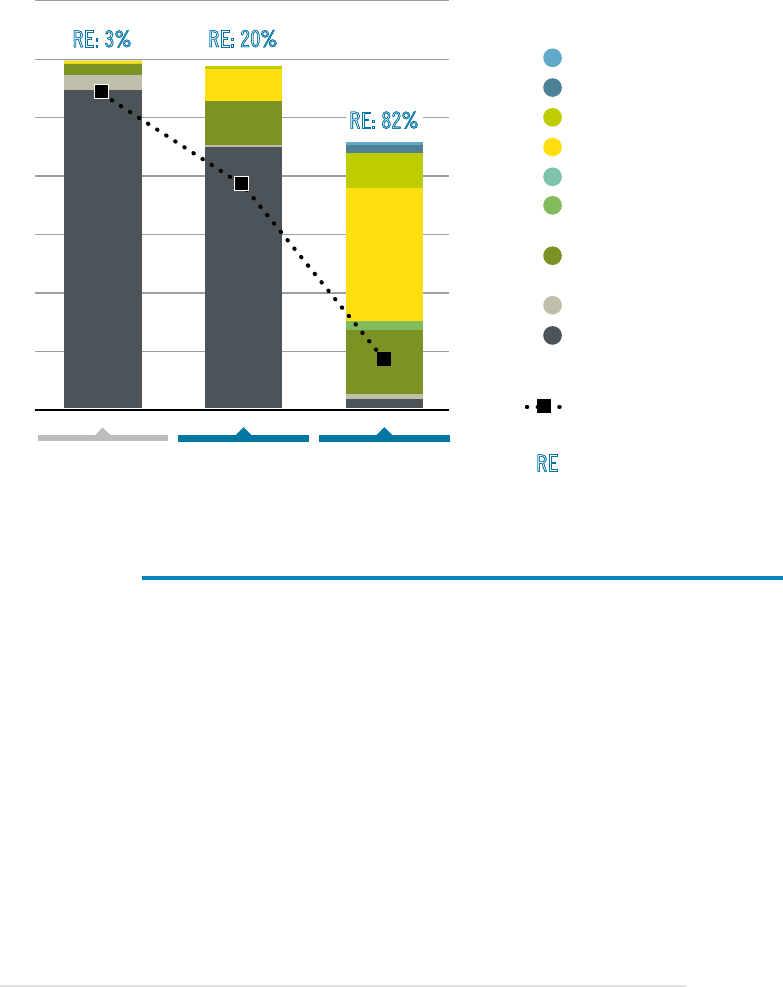

FIGURE S.4 Carbon emissions abatements under the 1.5°C Scenario (%)

Abatements 2050

6 %

Renewables

(power and direct uses)

Energy conservation

and eciency*

Electrification in end use sectors

(direct)

BECCS and other carbon

removal measures

Hydrogen and its derivatives*

CCS and CCU industry

20 %

10 %

25 %

25 %

14 %

-36.9

GtCO

2

/yr

-36.9

GtCO

2

/yr

Technological avenues to climate targets

IRENA’s analysis shows that over 90% of the solutions shaping a successful outcome in 2050

involve renewable energy through direct supply, electrification, energy efficiency, green

hydrogen and bioenergy combined with carbon capture and storage (BECCS). The technological

avenues leading to a decarbonised energy system have crystalised, dominated by solutions that

can be deployed rapidly and at scale. Technologies, markets, and business models are continuously

evolving, but there is no need to wait for new solutions. Considerable advancement can be achieved

with existing options. But taking the energy transition technologies to the necessary levels, and

at a speed compatible with a 1.5°C goal, requires targeted policies and measures.

24

WORLD ENERGY

TRANSITIONS OUTLOOK

By 2050, electricity will be the main energy carrier, increasing from a 21% share of total final

energy consumption in 2018 to over 50% in 2050. Sectoral boundaries are shifting, with the

electrification of end-use applications in transport and heating. This increase is mostly driven by

the use of renewable electricity in place of fossil fuels in end-use applications. As this shift occurs,

the annual growth rate of renewable technologies will see an eightfold increase. Electrification of

end-uses will also reshape several sectors, most notably transport, with electric vehicles coming to

account for 80% of all road activity in 2050.

The annual energy intensity improvement rate needs to rise to 2.9%, nearly two and a half

times the historical trend. With this rise, the energy intensity of the global economy will fall more

than 60% by 2050. Energy efficiency technologies and measures are “ready-to-go" solutions,

available for significant scale-up now. Policies and measures to increase energy conservation and

efficiency will be crucial to reduce total final energy consumption from 378 exajoule (EJ) in 2018

to 348 EJ in 2050. An important contribution will also come from structural and behavioural

changes, which will account for about a tenth of the improvement in efficiency.

Hydrogen and derivatives will account for 12% of final energy use by 2050. They will play an

important role in hard-to-decarbonise, energy-intensive sectors like steel, chemicals, long-haul

transport, shipping and aviation. Hydrogen will also help balance renewable electricity supply and

demand and serve as long-term seasonal storage. Some 5 000GW of electrolyser capacity will be

needed by 2050, up from 0.3GW today. This scale of growth accentuates the importance of low-

carbon hydrogen from the outset. In 2050, two-thirds of the total hydrogen will be green – produced

with renewable electricity – and one-third blue, produced by natural gas coupled with carbon

capture and storage (CCS).

Bioenergy will represent 18% of total final energy consumption in 2050. Increasing sustainable

production and use of biomass is needed across the energy system. In some sectors, it plays

a significant role – particularly as feedstock and fuel in the chemicals sectors and as fuel in the

aviation sector. In others, it helps to address gaps that other options cannot fully resolve, such

as replacing natural gas with biomethane in buildings that cannot be renovated. Additionally,

biomass coupled with CCS (BECCS) in the power sector and some industrial sectors will deliver the

negative emissions needed to achieve the net zero goal.

In residual use of fossil fuels and some industrial processes, decarbonisation efforts may

require CCS and CO

2

removal technologies and measures. In the 1.5°C Scenario, some emissions

persist in 2050 from residual uses of fossil fuels and some industrial processes. Therefore, the

remaining CO

2

will have to be captured and sequestered. CCS is limited mainly to process-related

CO

2

emissions in cement, iron and steel, and blue hydrogen production. CO

2

removal includes

nature-based measures such as reforestation and BECCS, direct carbon capture and storage,

and other approaches that are still experimental.

25

EXECUTIVE SUMMARY

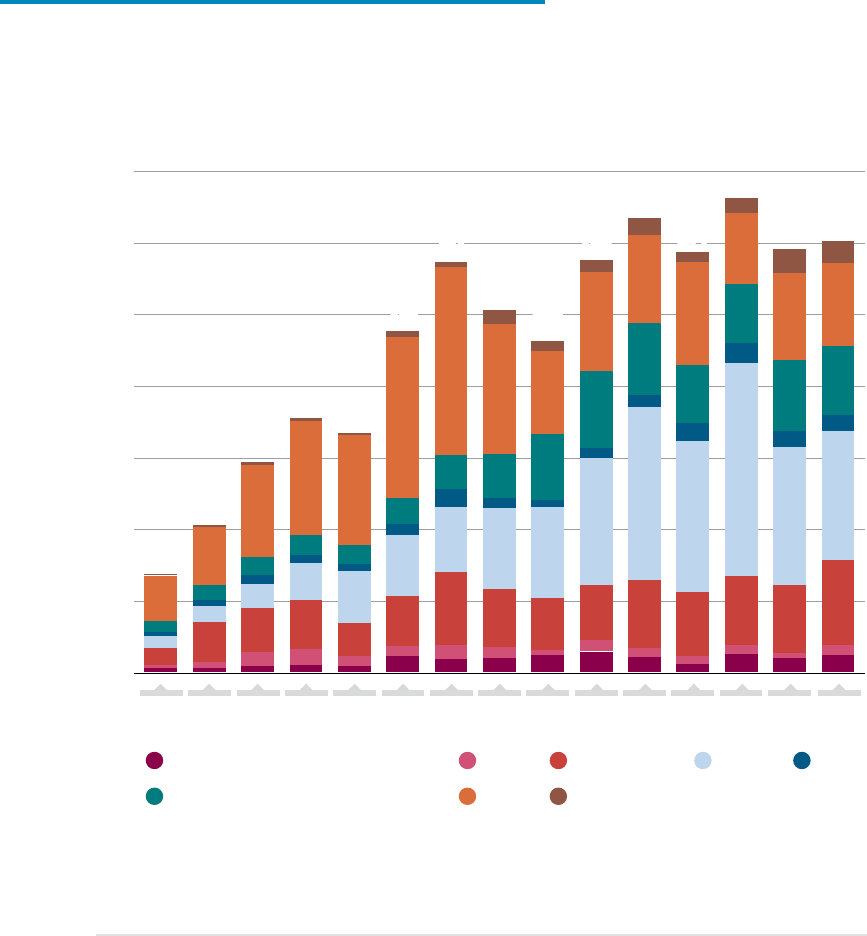

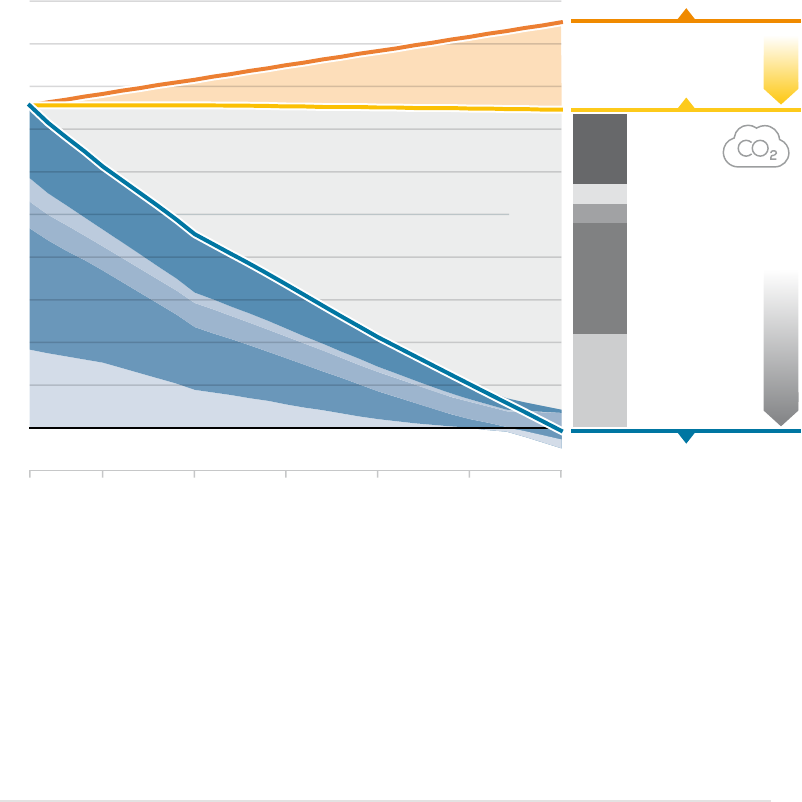

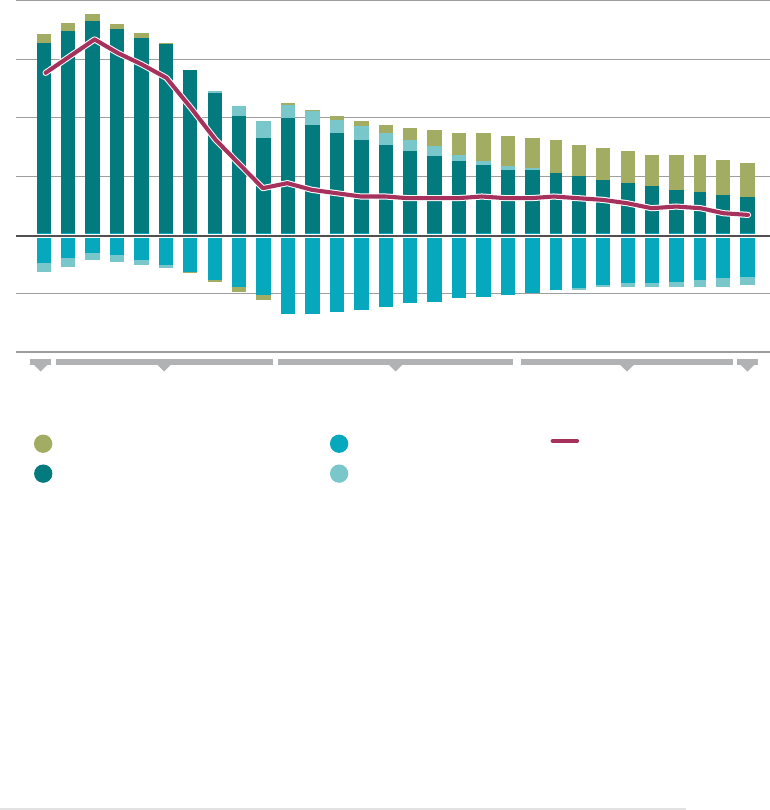

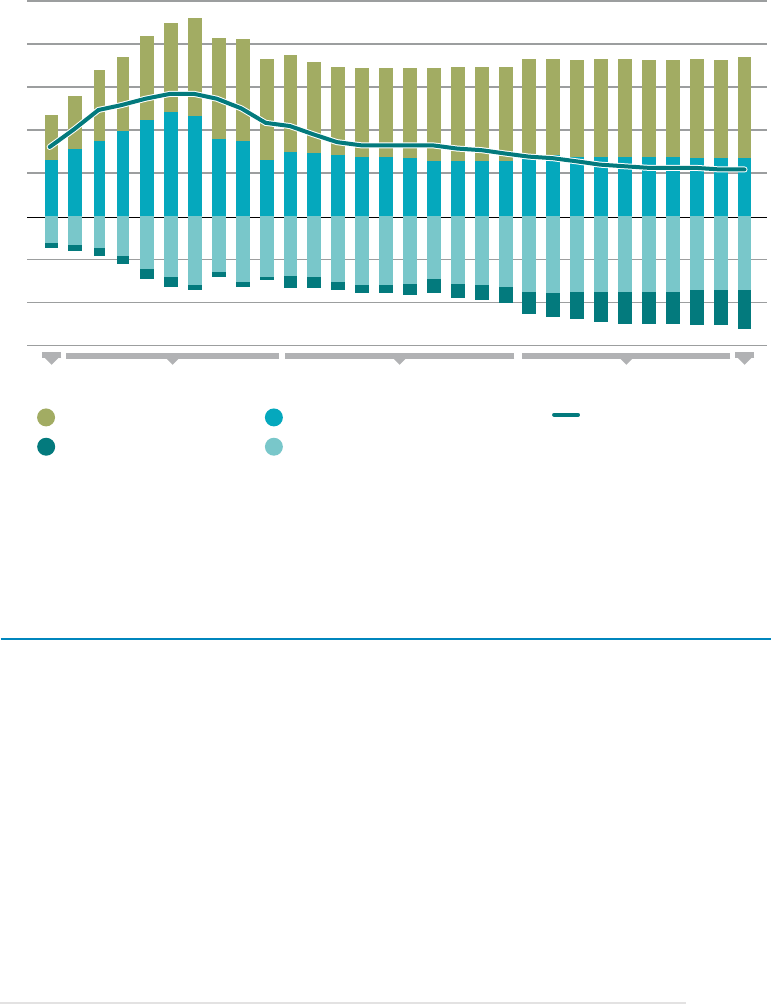

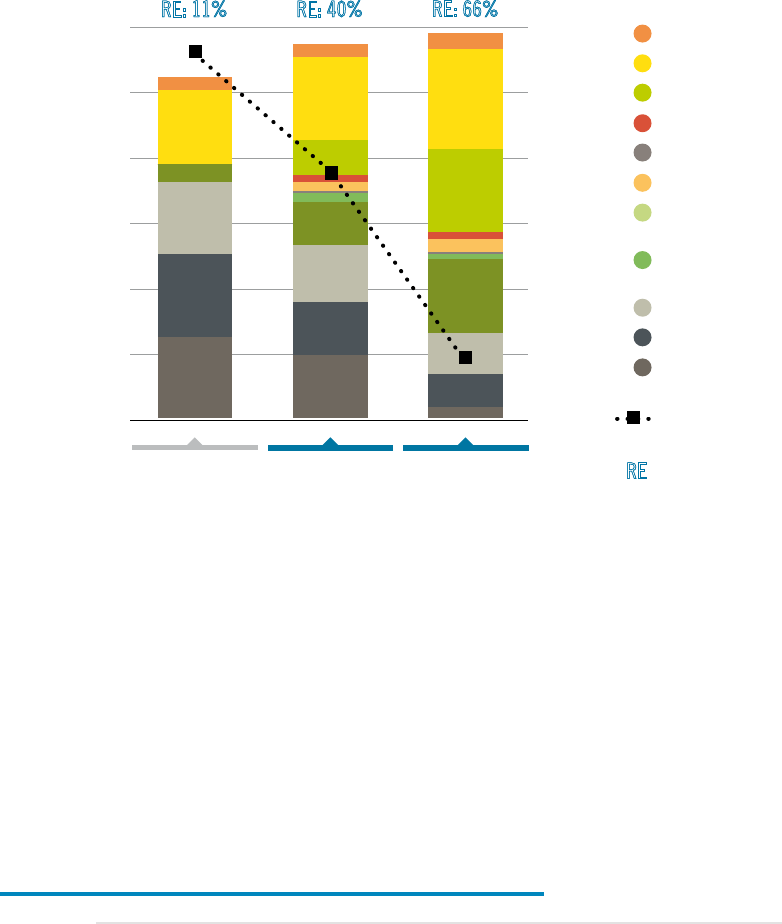

FIGURE S.5 Evolution of emissions with phaseouts of coal and oil, 2021-2050

Note: RE = renewable energy; VRE = variable renewable energy; CBAM = carbon border adjustment mechanism;

ICE = internal combustion engine; GW = gigawatt; Gt = gigatonne; CCS = carbon capture and storage; BECCS =

bioenergy combined with carbon capture and storage; CCU = carbon capture and utilisation.

Emissions (GtCO

2

)Emission reductions (GtCO

2

)

Coal

Oil

Natural gas

Electrification of end

uses (direct)

Hydrogen and its

derivatives

CCS and CCU

in industry

BECCS and other carbon

removal measures

Renewables

(power and direct uses)

Energy conservation

and eciency

Process and

non-energy

40

30

20

10

0

-10

-20

-30

-40

2018 20502030

2018 20502030

Rapid phaseout

of coal power and

expansion of

renewable power

Rapid phaseout of

oil for transport

and feedstock

2021-2030 2031-2050

•

RE power addition rate

triples

•

Systemic flexibility

policies worldwide

enable VRE integration

•

Carbon pricing (with CBAM)

is suciently high worldwide

(> USD 75/tonne)

•

Rapid decline in ICE car

sales worldwide

•

Ramp up clean hydrogen

production

•

CCS in industry >1 Gt

•

Building eciency renovation

rate triples in North

•

Governments accelerate grid

and hydrogen infrastructure

investments

•

Supply of sustainable

minerals and metals

ramps up

•

28 000 GW RE power

installed (x10),

90% RE power

•

5 000 GW electrolysers

installed

•

Biomass reaches 18%

of final consumption

•

Cars and trucks are

mostly electrified

•

Heat pumps play a

crucial role in space

heating

•

BECCS is deployed in

power and industry to

compensate remaining

fossil fuel emissions

•

Electrification and

renewables drive

eciency gains

•

Clean energy financing rises

to USD 4.4 trillion/year

26

WORLD ENERGY

TRANSITIONS OUTLOOK

By 2030, renewable power should reach 10 700 GW globally, almost quadrupling the current

capacity. Rapid scale-up deployment in the coming decade is necessary to set the stage for

decarbonisation of the power system and electrification of end-use by 2050. This level of deployment

is also a key recommendation of the Energy Transitions Theme Report, developed by IRENA, UNEP,

and UN ESCAP for the United Nations High-Level Energy Dialogue. The abundance of cost-effective

renewable potentials worldwide makes them a scalable option. For many countries, this translates

a technical and economic challenge into a set of investment, regulatory and societal opportunities.

Infrastructure upgrade, modernisation and expansion is a high priority in the coming decade.

Updating ailing infrastructure or investing in expansion is an integral part of the energy transition

and an enabler of modern technologies. This will be particularly important in the coming decade

as the share of renewables grows, requiring system flexibility and modern grids. Infrastructure

developments must be aligned with long-term plans and reflective of broader strategies, including

regional market integration.

The necessary deployment levels will be reached by 2030 only with policies to support these

technological avenues. Deployment policies support market creation, thus facilitating scale-up,

reducing technology costs and increasing investment levels aligned with energy transition needs.

Given the large amounts of public finance being injected into economies as part of the recovery

measures, such policies will shape the direction of the energy transition and set the stage for the

significant increase in the private sector investment required until 2050.

27

EXECUTIVE SUMMARY

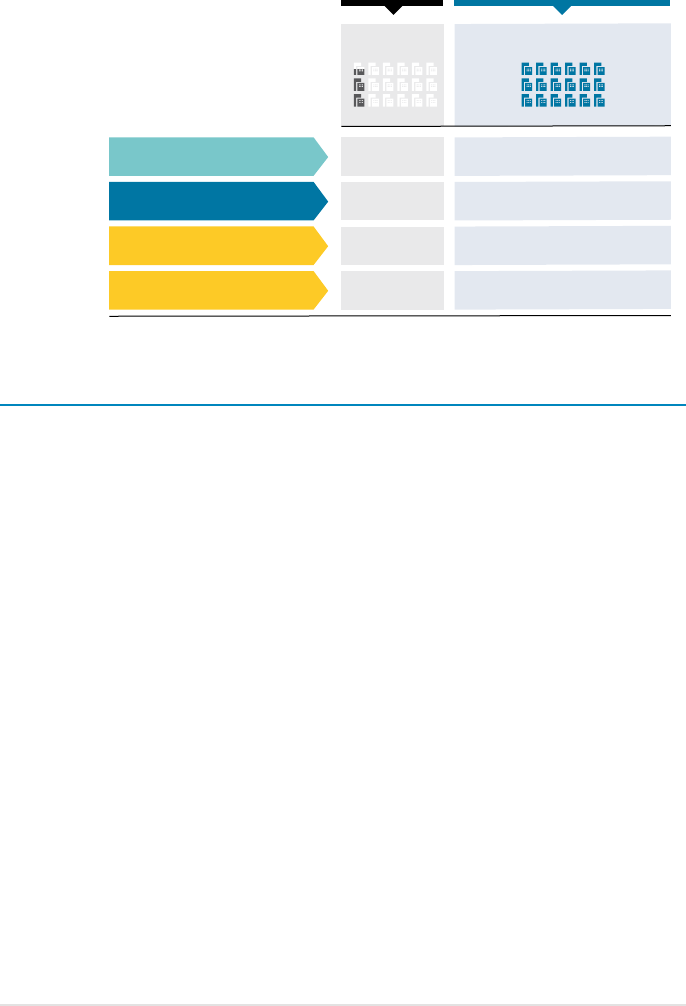

TABLE S.1 Overview of policies to support energy transition solutions

TECHNO-

LOGICAL

AVENUE

OBJECTIVE RECOMMENDATIONS

Renewables

(power and

direct uses)

Deploy renewable energy

in end uses

These policies include regulatory measures that

create a market, as well as fiscal and financial

incentives to make them more affordable and

increase their cost competitiveness compared to

fossil-fuel-based solutions.

Deploy renewable energy

in the power sector

The choice of instrument and its design should

consider the nature of the solution (e.g., utility

scale, distributed, off-grid), the sector’s level of

development, the power system’s organisational

structure and broader policy objectives.

Energy

conservation

and efficiency

Increase energy

conservation and efficiency

in heating and cooling

Energy efficiency policies such as strict building

codes, support for building retrofits and

appliance standards are critical for the energy

transition in buildings and industrial processes.

Increase energy

conservation in transport

Decarbonising the transport sector, among other

measures, requires a shift from energy-intensive

modes to low-carbon modes.

Electrification

of end uses

Electrify heating and

cooling

Targets for renewable power should consider

the rising demand from the electrification of

end uses, in line with long-term decarbonisation

objectives. Moreover, policies and power system

design are needed to support electrification

in achieving its potential for providing system

flexibility.

Electrify transport

Green

hydrogen

Support the development

of green hydrogen

An enabling policy framework should consider

four key pillars: a national green hydrogen

strategy, priority setting, guarantees of origin

and enabling policies.

Sustainable

bioenergy

Ensure the sustainable use

of bioenergy

Renewable energy is not exempt from

sustainability concerns. Some of these concerns

include greenhouse gas emissions related to

land-use change, and impacts on air and water

quality and biodiversity.

28

WORLD ENERGY

TRANSITIONS OUTLOOK

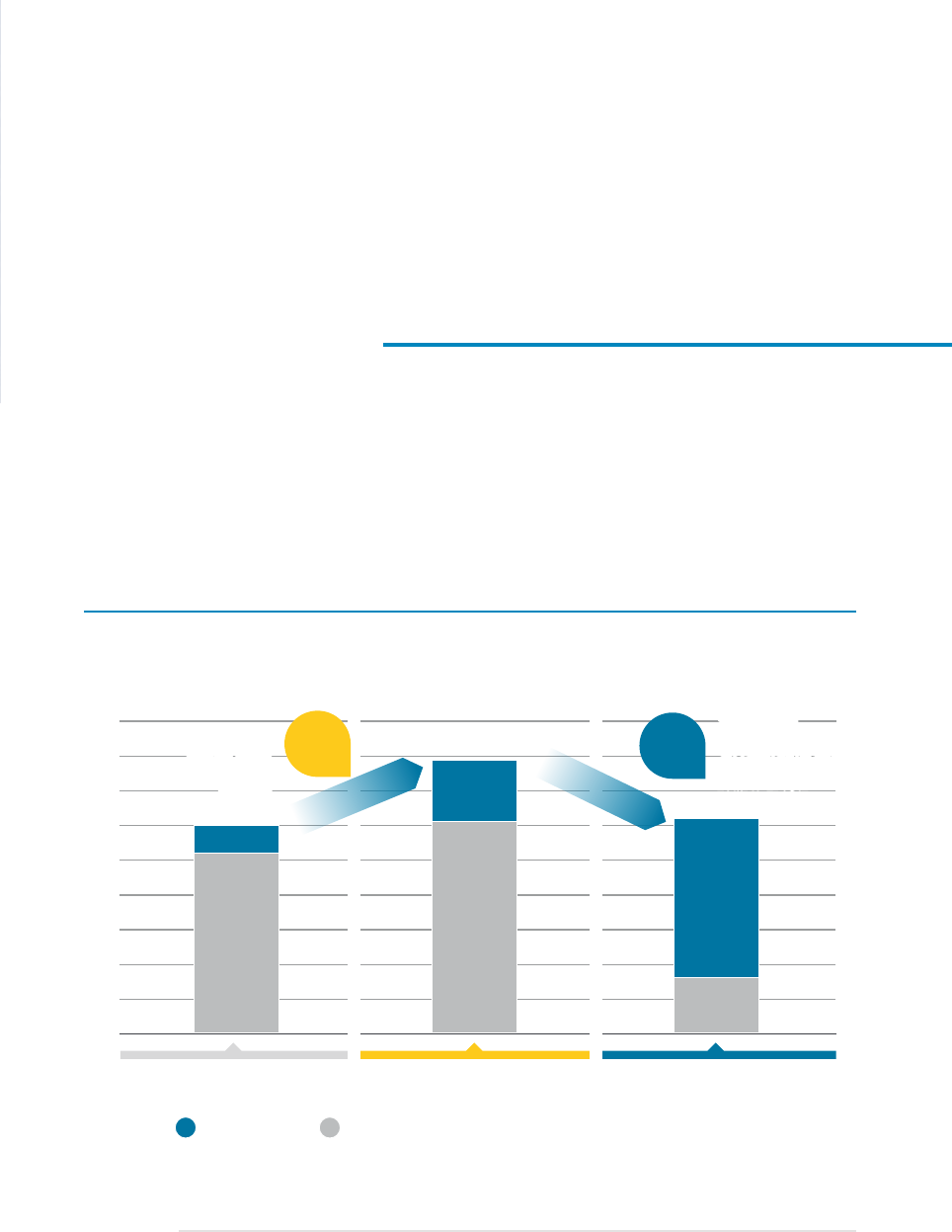

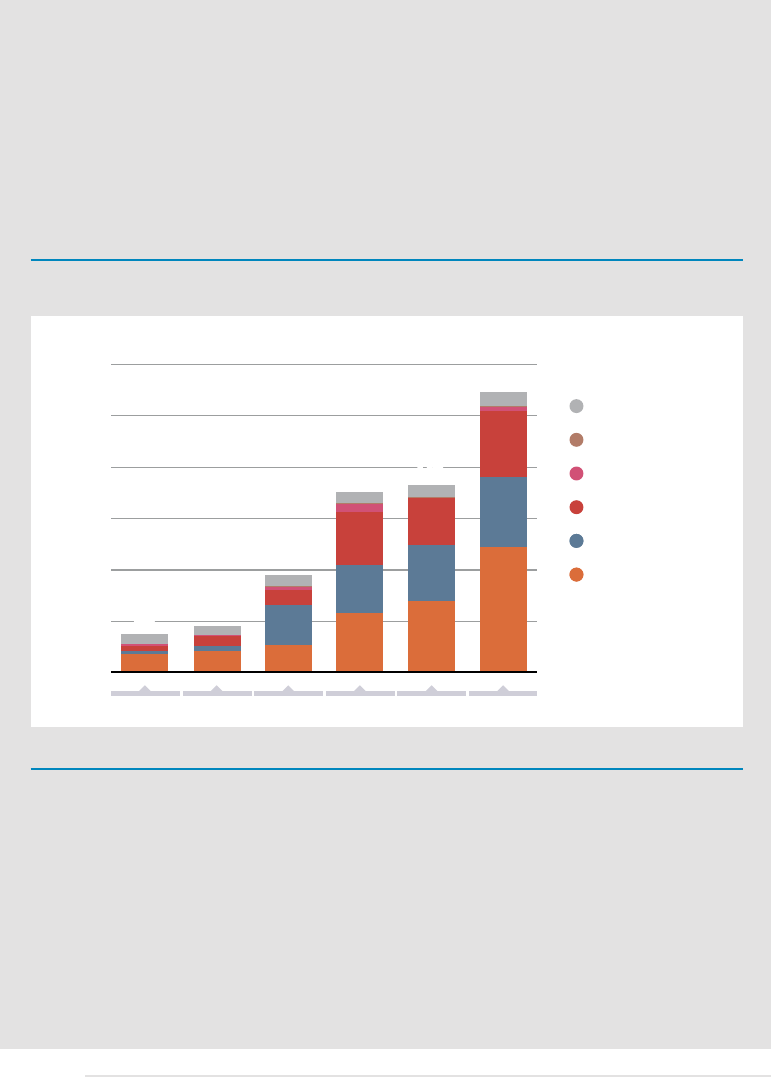

Financing the energy transition

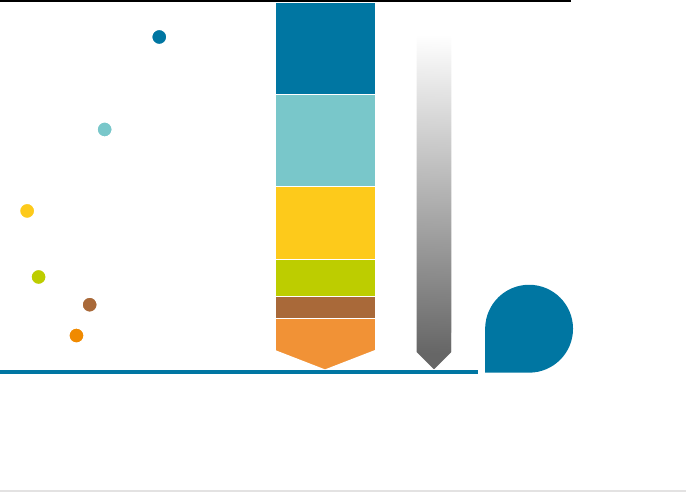

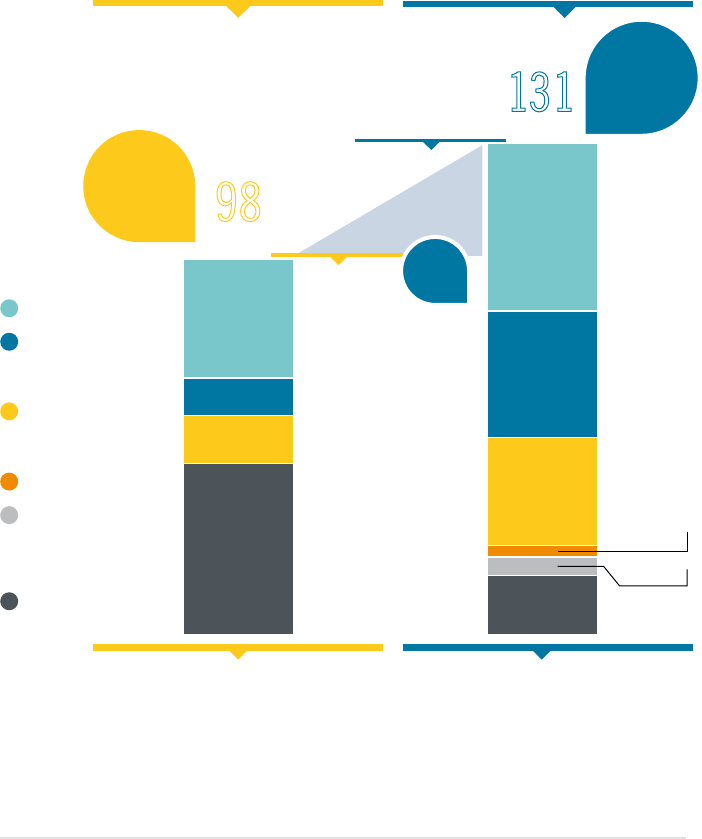

USD 131 trillion will need to flow into an energy system over the period to 2050 that prioritises

technology avenues compatible with a 1.5°C Pathway. While the annual funding requirement

averaging at USD4.4trillion is large, it represents 20% of the Gross Fixed Capital Formation in 2019,

equivalent to about 5% of global Gross Domestic Product (GDP). Between now and 2050, over 80%

of the USD 131 trillion total must be invested in energy-transition technologies, including efficiency,

renewables, end-use electrification, power grids, flexibility, hydrogen, and innovations designed to

help emerging and niche solutions become economically viable.

Current government strategies already envisage significant investment in energy amounting

to USD 98 trillion by 2050. Collectively referred to in this Outlook as the Planned Energy Scenario

(PES), they imply a near doubling of annual energy investment, which in 2019 amounted to

USD 2.1 trillion. Substantial funds will flow towards modernisation of ailing infrastructure and

meeting growing energy demand. But the breakdown of financing for technology under the 1.5°C

Scenario differs greatly from current plans: USD24trillion of planned investments will have to be

redirected from fossil fuels to energy transition technologies between now and 2050.

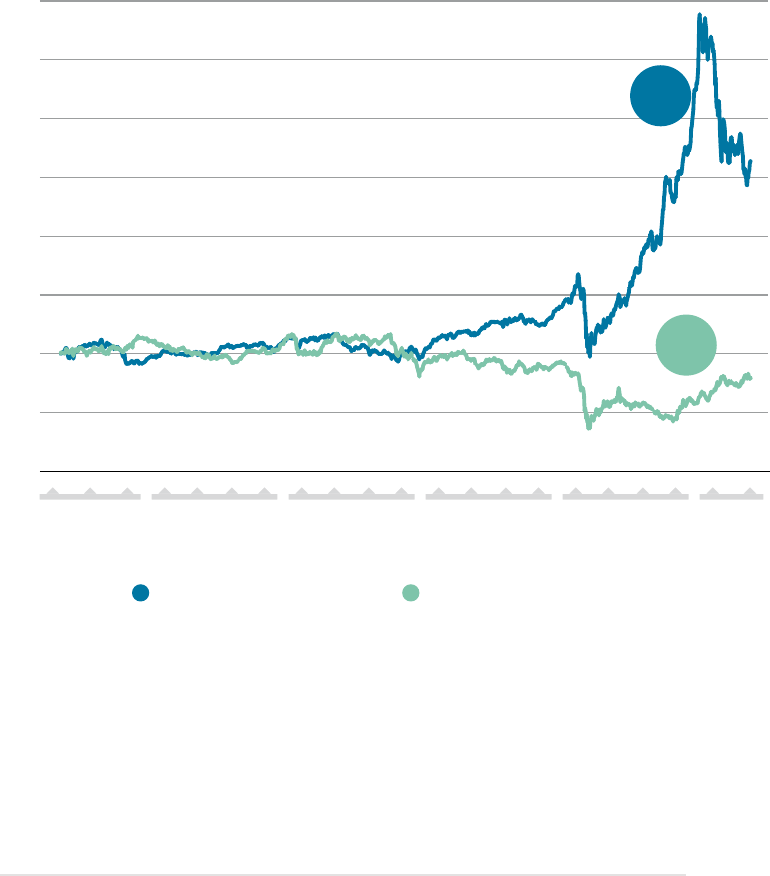

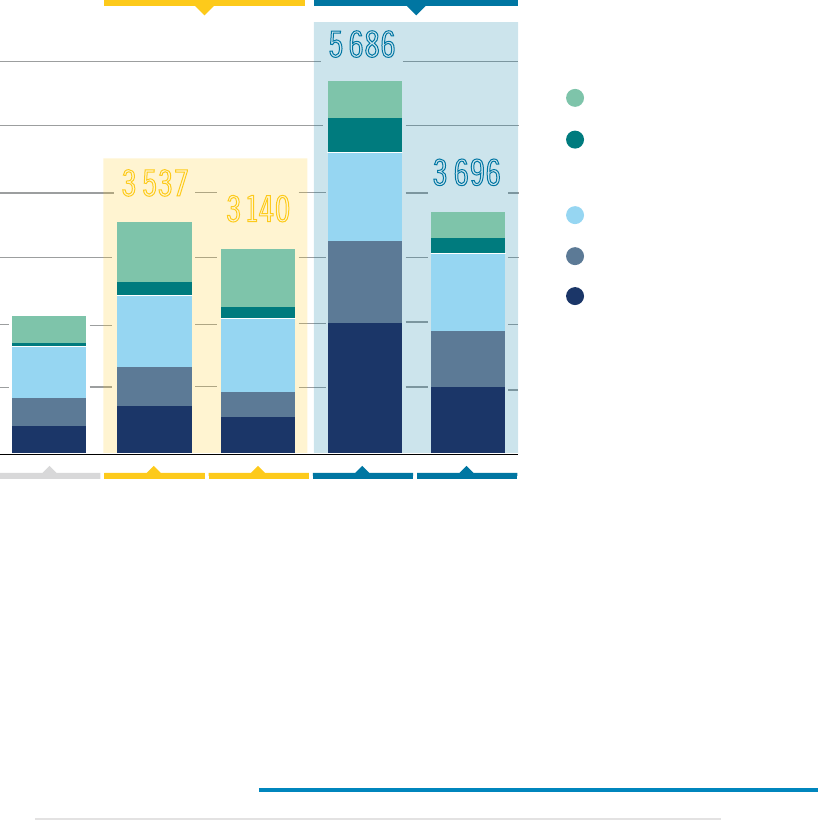

Funding structures in the 1.5°C Scenario are markedly different in terms of capital sources

(public and private) and types of capital (equity and debt). In 2019, USD1.6trillion in energy

assets were financed by private sources, accounting for 80% of total energy sector investment.

That share would grow dramatically under the 1.5°C Scenario. The share of debt capital has to

increase from 44% in 2019 to 57% in 2050, almost 20% more than under the PES (see Figure

S.6). Energy transition technologies should find it increasingly easy to obtain affordable long-

term debt financing, while “brown” assets will progressively be avoided by private financiers and

therefore forced to rely on equity financing from retained earnings and new equity issues. Capital-

intensive, more decentralised projects will influence investors’ risk perception, which in turn may

need targeted policy and capital market interventions.

Public funding will need to grow almost two-fold to catalyse private finance and ensure just and

inclusive unfolding of the energy transition. Public financing plays a crucial role in facilitating the

energy transition, as markets alone are not likely to move rapidly enough. In 2019, the public sector

provided some USD450 billion in the form of public equity and lending by development finance

institutions. In the 1.5°C Scenario, these investments will grow to some USD780billion. Public debt

financing will be an important facilitator for other lenders, especially in developing markets with high

real or perceived risks. In some instances, this may include grants to reduce the cost of financing.

Public funds are also needed to create an enabling environment for the transition and ensure that it

occurs fast enough and with optimal socio-economic outcomes.

29

EXECUTIVE SUMMARY

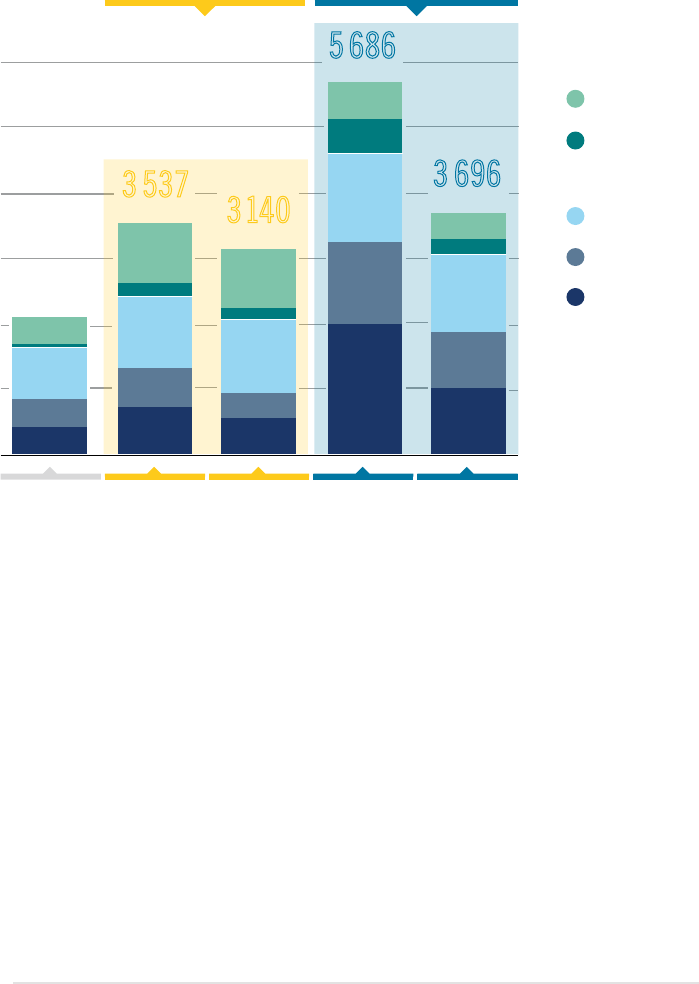

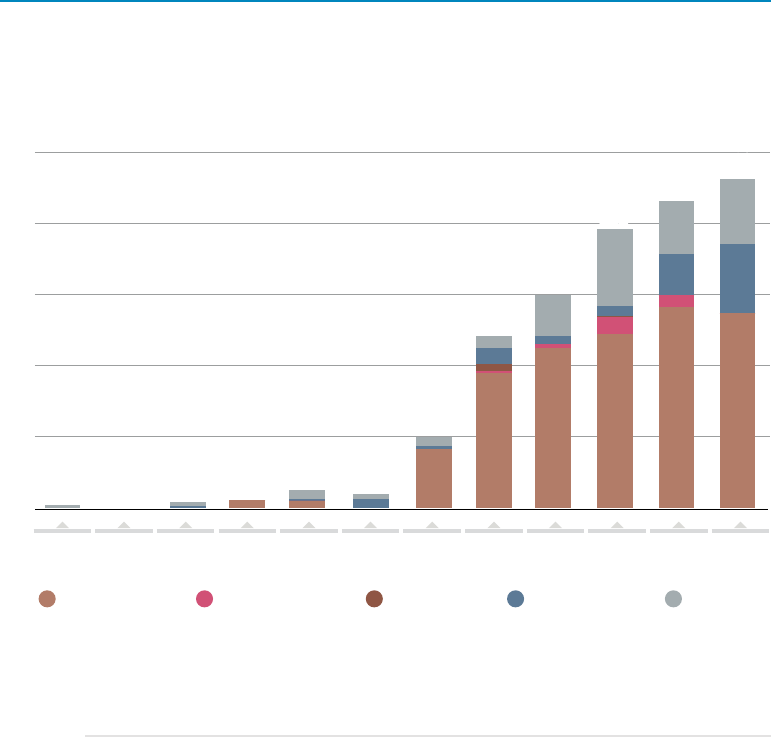

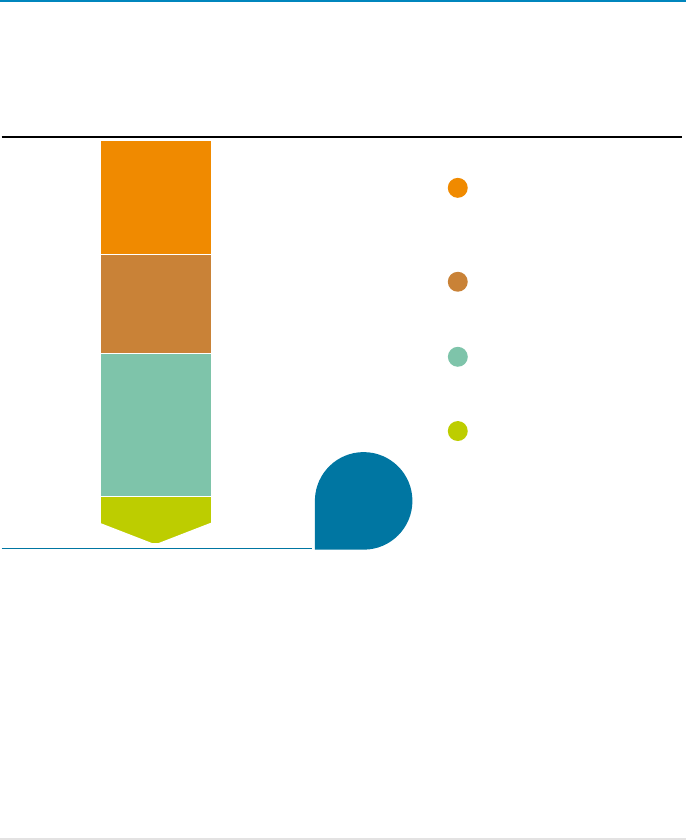

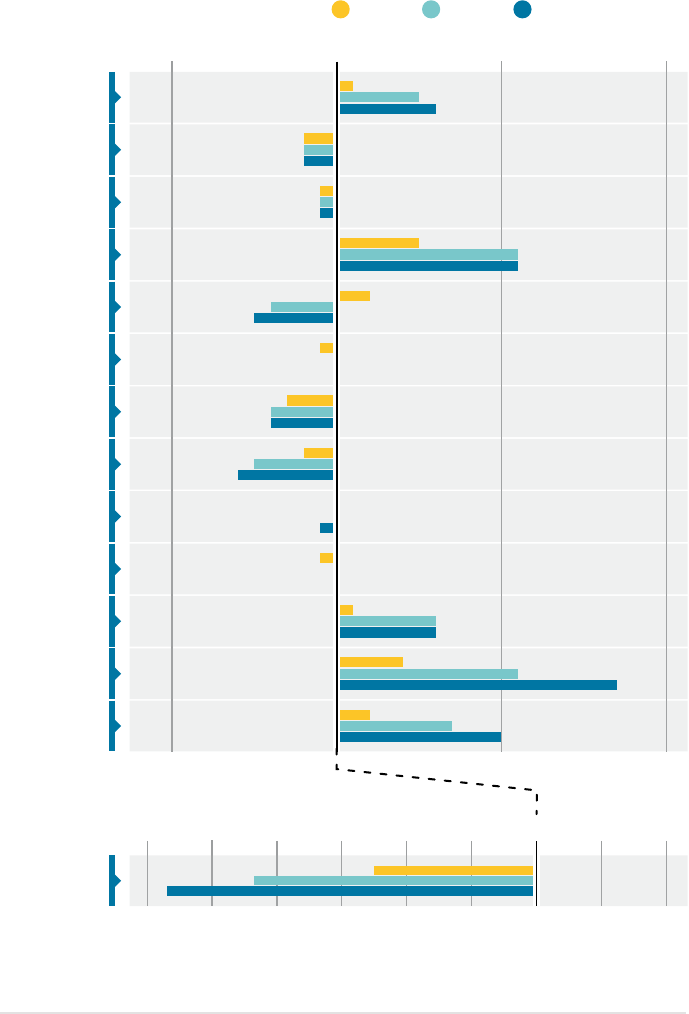

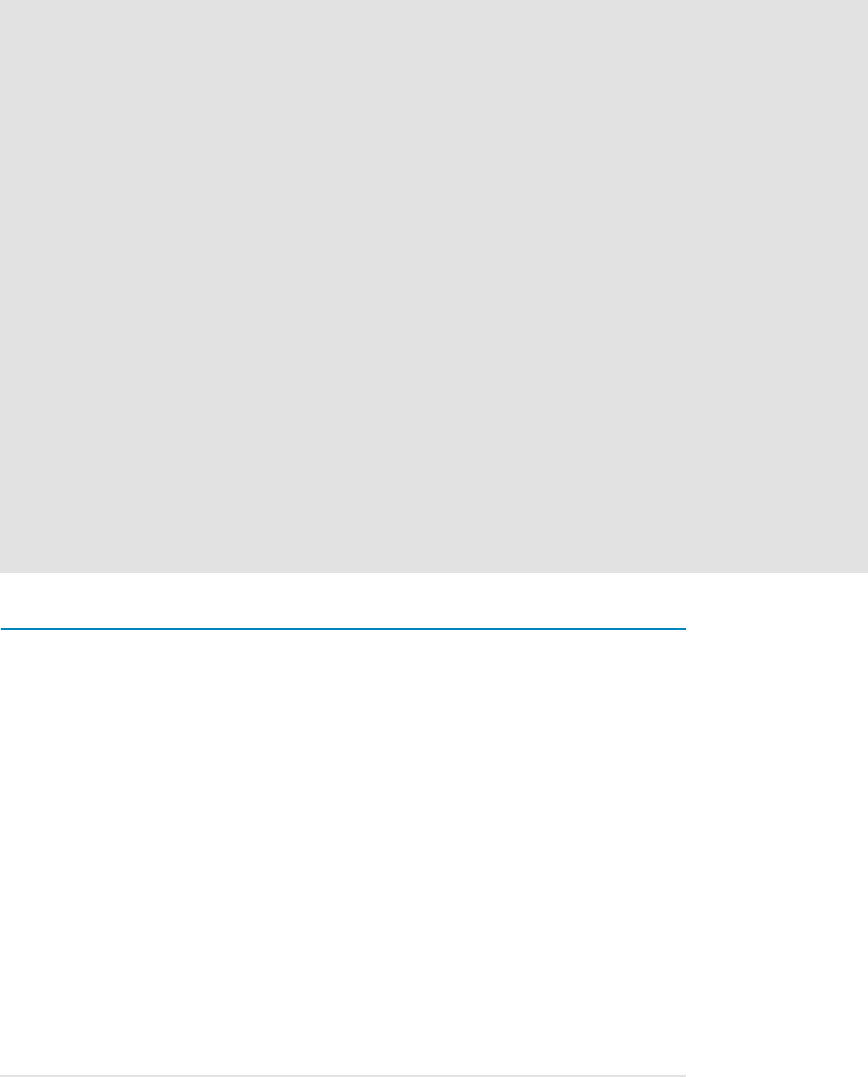

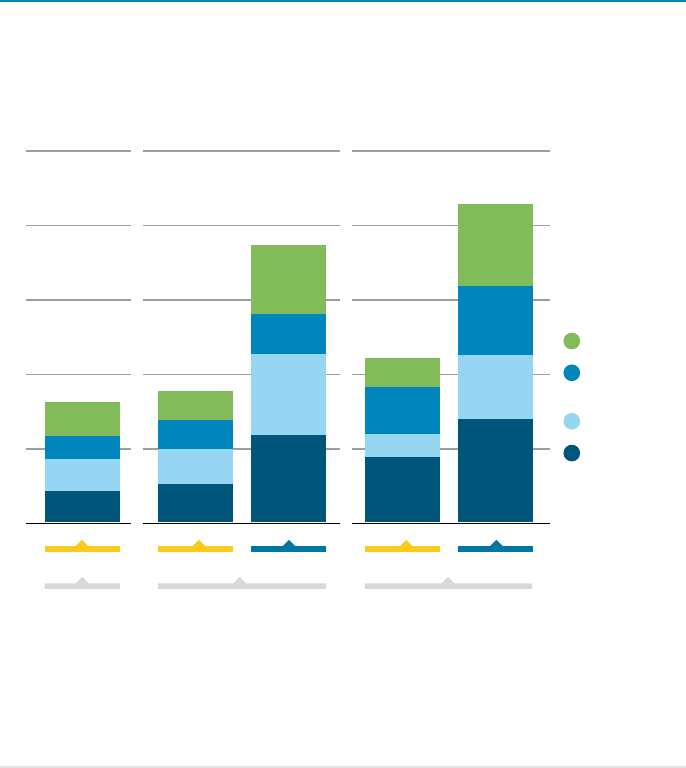

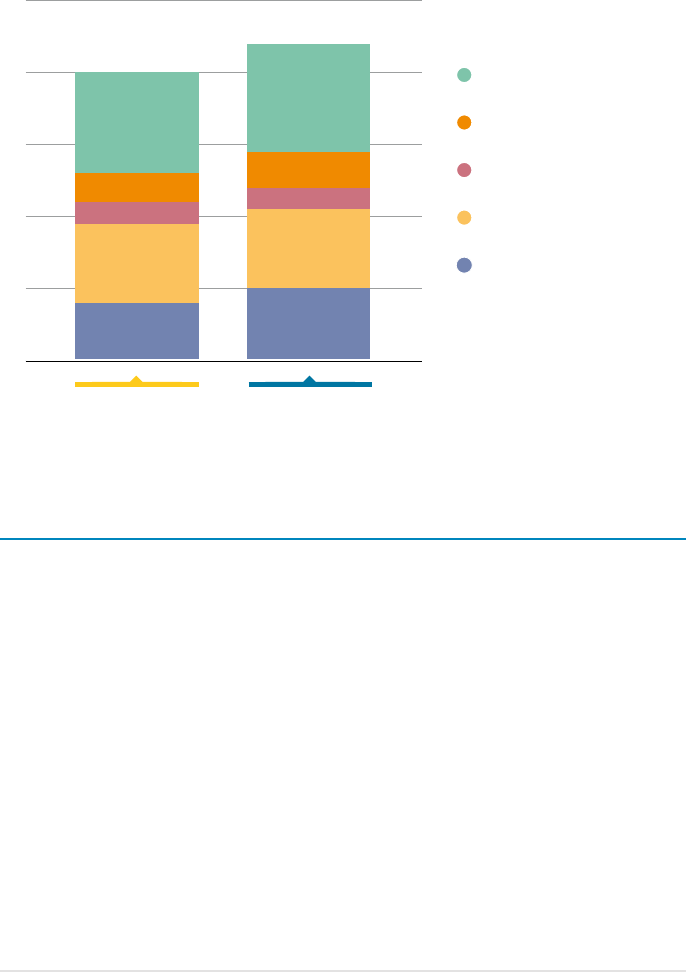

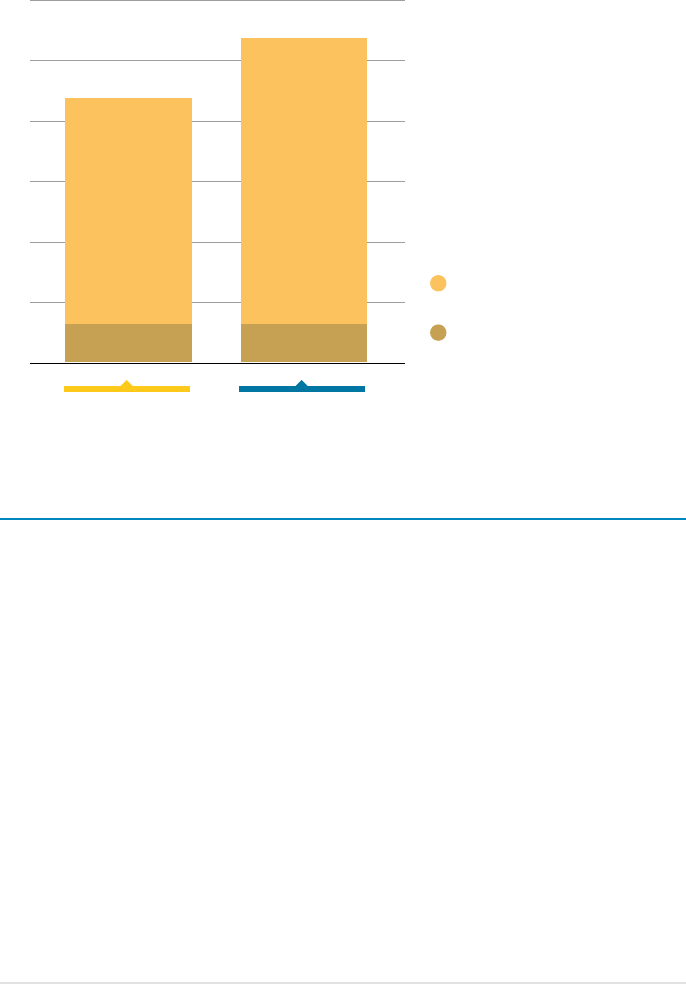

FIGURE S.6 Total average yearly investment by source and type of financing:

2019, PES and 1.5°C Scenario (2021-2030 and 2031-2050)

Sources: For 2019 investment: source and type of financing BNEF (2021a), IEA (2020a), IRENA and CPI (2020); for

PES and 1.5°C Scenario: IRENA and BCG analysis.

2 106

billion USD

2 106

billion USD

0

1 000

2 000

3 000

4 000

5 000

6 000

Lending (private)

Capital markets

Equity (public)

Equity (private)

Lending from

Development Finance

Institutions

2019 2021-2030 2031-2050 2031-20502021-2030

USD billion/year

19 %19 %19 %

26%26 %26%

29%29%29%

6 %6 %6 %

6 %6 %6 %

6%6%6%

32%32%

23%23%23%

28%28%28%

36%36%

12%12%12%

19%19%19%

35%35%35%

22%22%22%

24%24%

9%9%9%

10%10%10%

11%11%11%

31%31 %

16 %16 %16 %

21%21%21%

37 %37 %

20 %20 %20 %

21 %21 %21 %

Where we need to be (1.5-S)Where we are heading (PES)

3 537

billion USD

3140

billion USD

5 686

billion USD

3 696

billion USD

Measures to eliminate market distortions that favour fossil fuels, coupled with incentives for

energy transition solutions, will facilitate the necessary changes in funding structures. This

will involve phasing out fossil fuel subsidies and changing fiscal systems to reflect the negative

environmental, health and social costs of the fossil fuel-based energy system. Monetary and fiscal

policies, including carbon pricing policies, will enhance the competitiveness of transition-related

solutions. Such interventions should be accompanied by a careful assessment of the social and equity

dimensions to ensure that the situation of low-income populations is not worsened but improved.

30

WORLD ENERGY

TRANSITIONS OUTLOOK

Socio-economic footprint of the energy transition

Investment in the 1.5°C Scenario will yield a cumulative payback of at least USD 61 trillion

by 2050. The overall balance from the energy transition is positive, with benefits greatly

exceeding costs. The costs for reducing emissions vary by technology and sector, but the

incremental costs are significantly lower than the savings achieved by cutting external costs.

IRENA estimates that, under the 1.5°C Scenario, every USD 1 spent on the energy transition

should yield benefits from reduced externalities from human health and the environment

valued at between USD 2 and USD 5.5. In cumulative terms, the additional USD 30 trillion

cost implied by the 1.5°C Scenario over the period to 2050 will result in a payback of between

USD61 and USD164trillion.

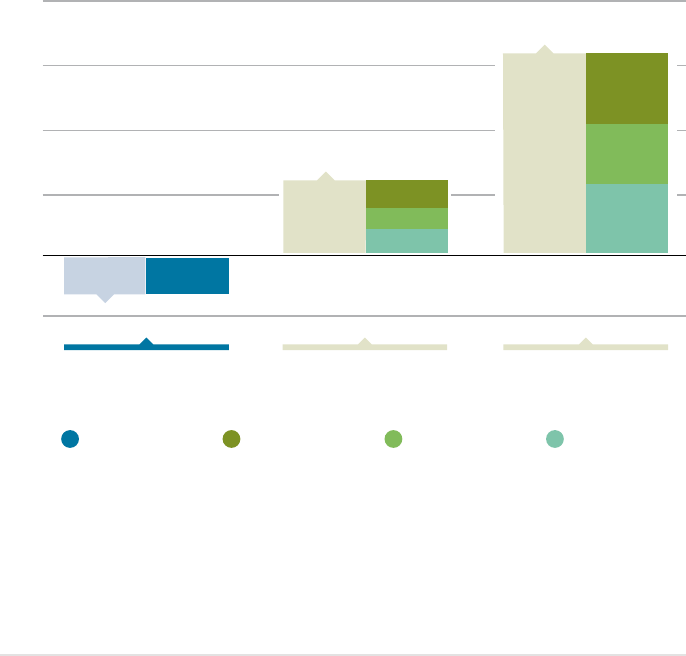

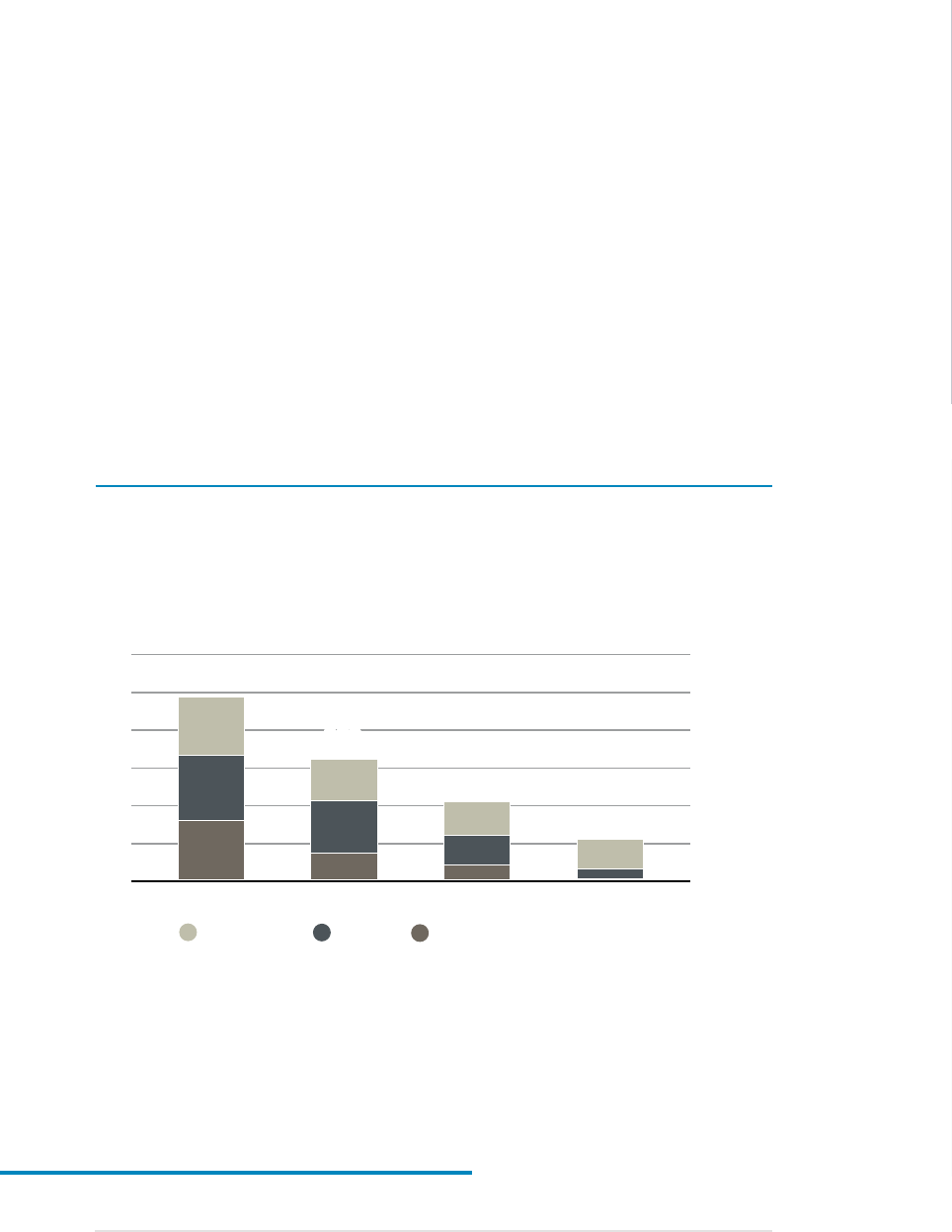

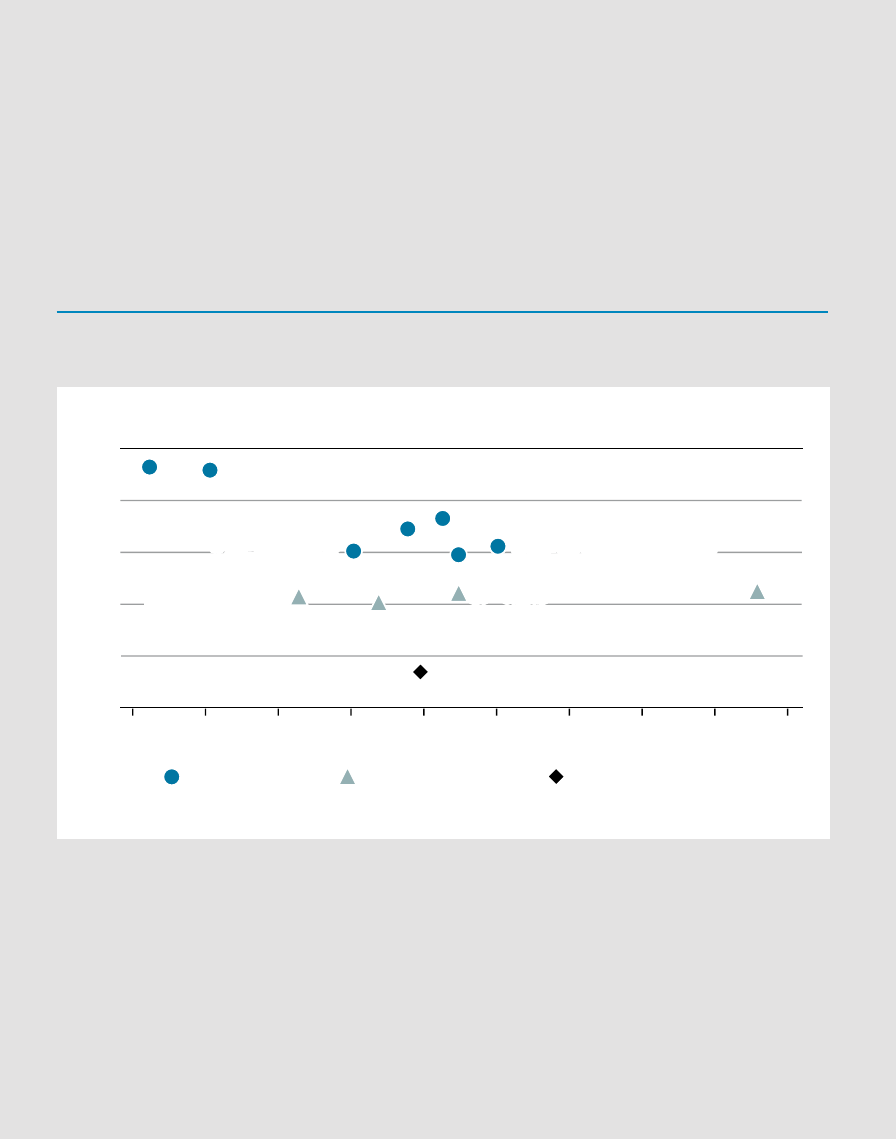

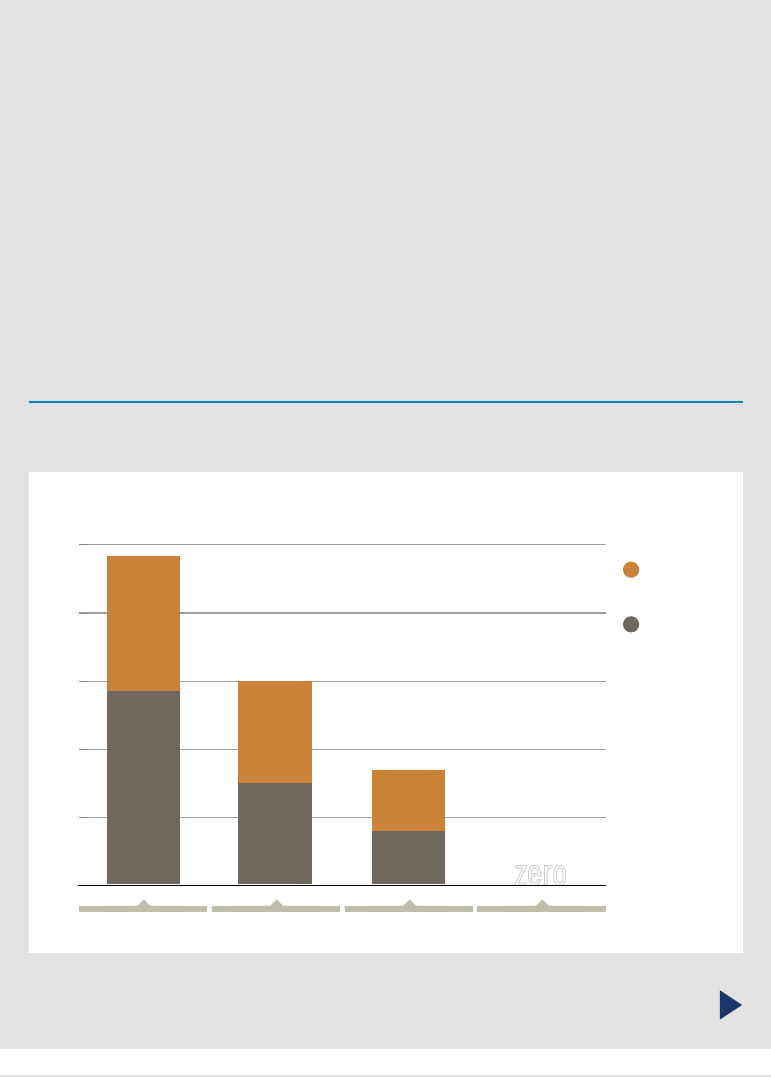

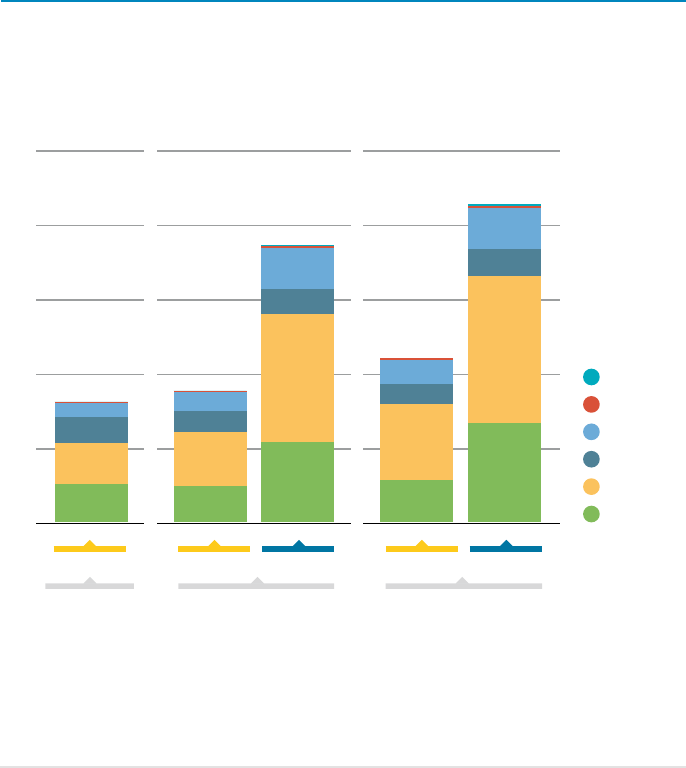

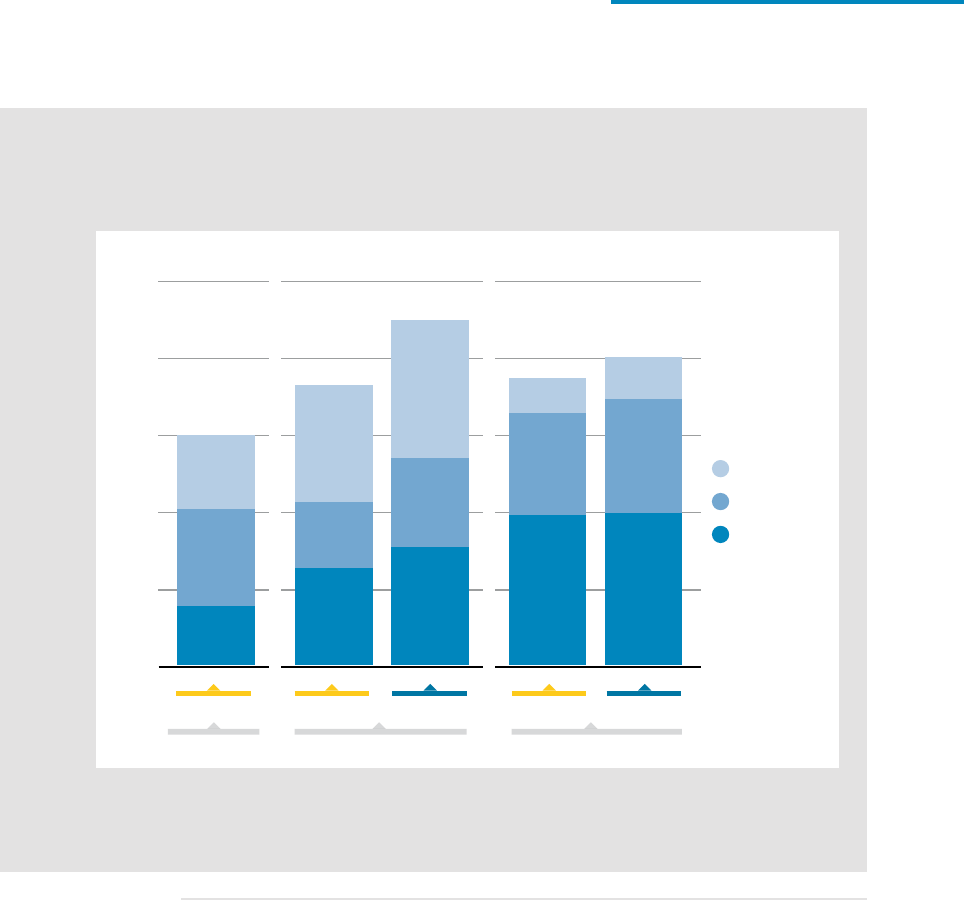

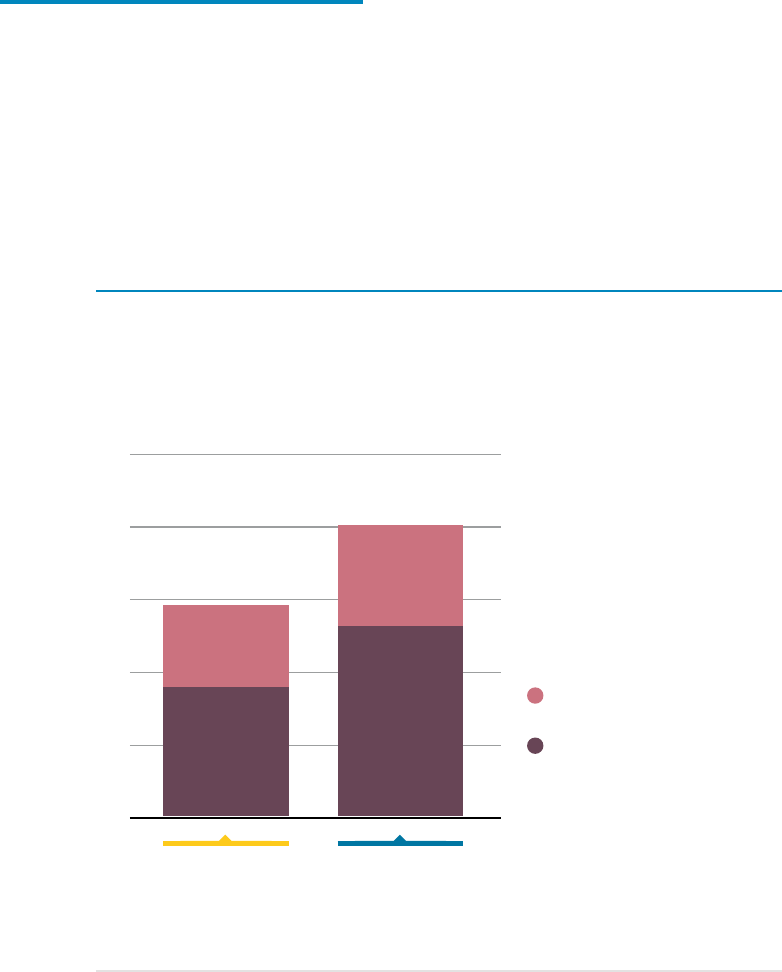

FIGURE S.7 Cumulative dierence between costs and savings of 1.5°C Scenario

compared to the PES, 2021-2050

58

58

49

49

57

57

Up to

5.5x

savings

Up to

5.5x

savings

2424

1717

2020

Up to

2x

savings

Up to

2x

savings

-30-30

CostsCosts

Savings from reduced

externalities (high)

Savings from reduced

externalities (low)

Costs – 1.5-S

0

50

100

150

200

Incremental

energy system

cost

Reduced

externalities -

climate change

Reduced

externalities -

outdoor air

pollution

Reduced

externalities -

indoor air

pollution

-50

USD trillion

2015

31

EXECUTIVE SUMMARY

The energy transition goes well beyond technology and brings deep structural changes

that will greatly affect economies and societies. IRENA continues to capture an increasingly

comprehensive picture of the socio-economic impacts of the energy transition. Results presented

in this Outlook demonstrate that steps towards a decarbonised energy future will positively affect

economic activity, jobs and welfare, provided a holistic policy framework is in place. Within the

analysis, countries’ existing policies are complemented with climate policies to reach energy

transition targets while addressing distributional challenges for just and inclusive outcomes.

The 1.5°C Pathway provides a boost in GDP that is 2.4% greater (on average) than that of the

PES over the next decade, aligned with the needs of a post-COVID recovery. Over the transition

period to 2050, the average improvement of GDP is estimated at 1.2% over the PES. Additional GDP

growth will be spurred by investment across the many dimensions of the energy transition, leading

to multiple adjustments between interdependent economic sectors. The reduced demand for fossil

fuels leads to lower revenues for mining and fuel refining industries, as well as for governments

(because of lower fossil fuel royalties), thus resulting in negative impacts on GDP in some countries.

This reality highlights the need for a holistic policy framework that addresses structural changes

caused by reduced fossil fuel dependency.

Throughout the transition period, economy-wide employment is 0.9% higher on average under

the 1.5°C Scenario than under the PES. One of the main positive impacts on employment comes

from investment in energy transition solutions, including renewables, grid enhancement and energy

efficiency. Shifting investment from fossil fuels (extraction and power generation) and other sectors

towards the energy transition decreases labour demand in fossil fuel and non-energy sectors and

along their value chains.

32

WORLD ENERGY

TRANSITIONS OUTLOOK

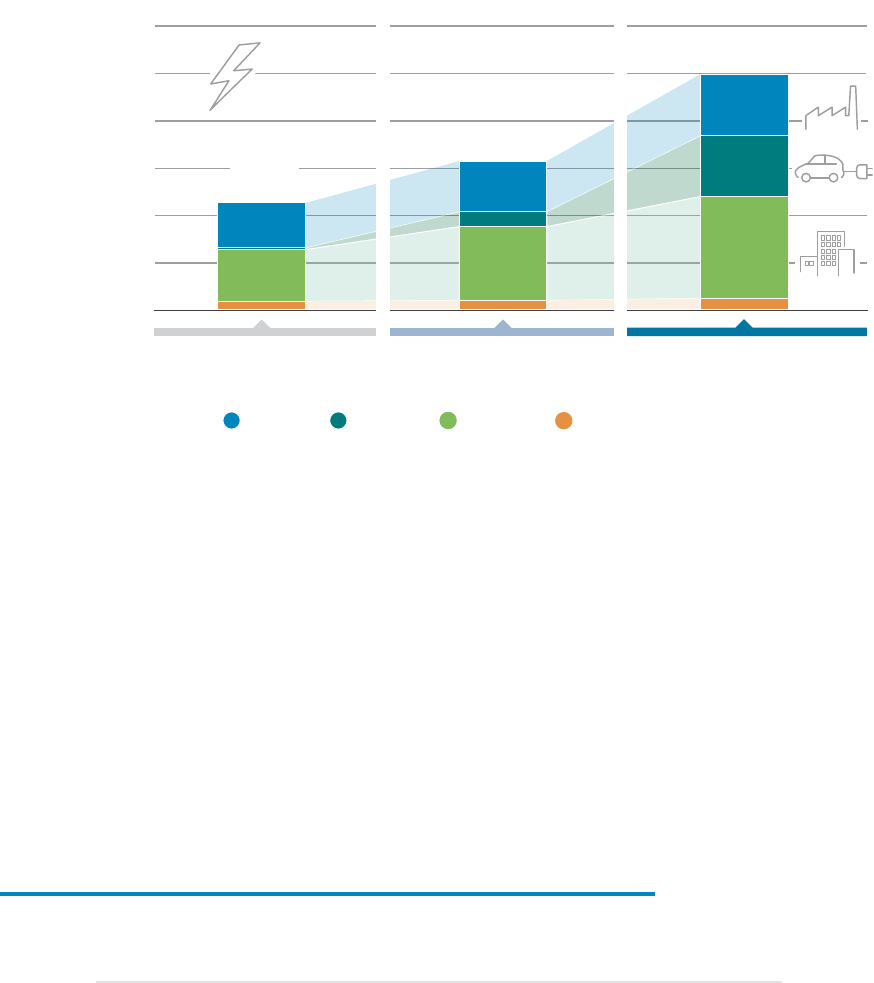

A transformed energy sector will have 122 million jobs in 2050. Qualifications, skills and

occupations under the ambitious 1.5°C Scenario are increasingly concentrated in manufacturing,

followed by fuel supply. Training for such occupations is relatively easy and offers opportunities

for workers from the fossil-fuel industry. The educational requirements for the labour force evolve

during the transition, with a continuous increase of the share and number of workers with primary

education and a peak of workers with tertiary education by 2030.

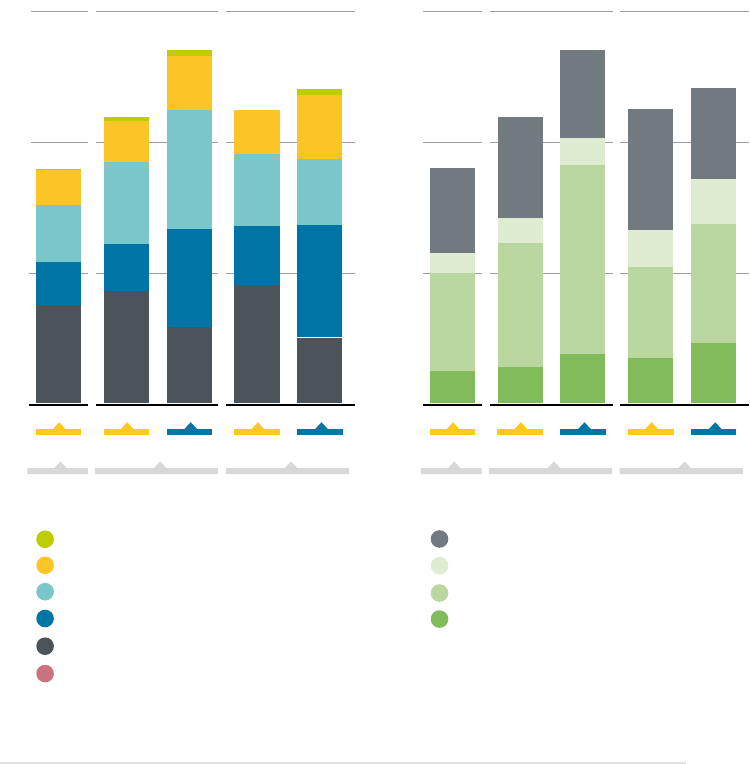

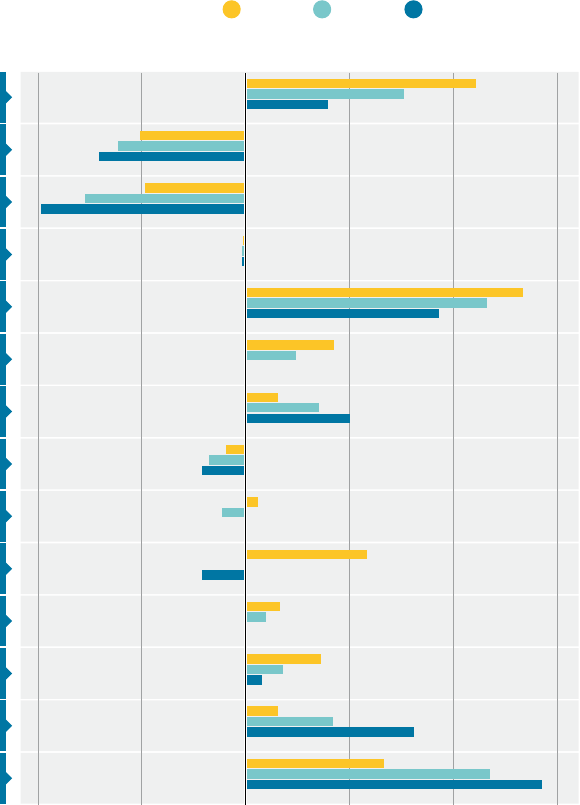

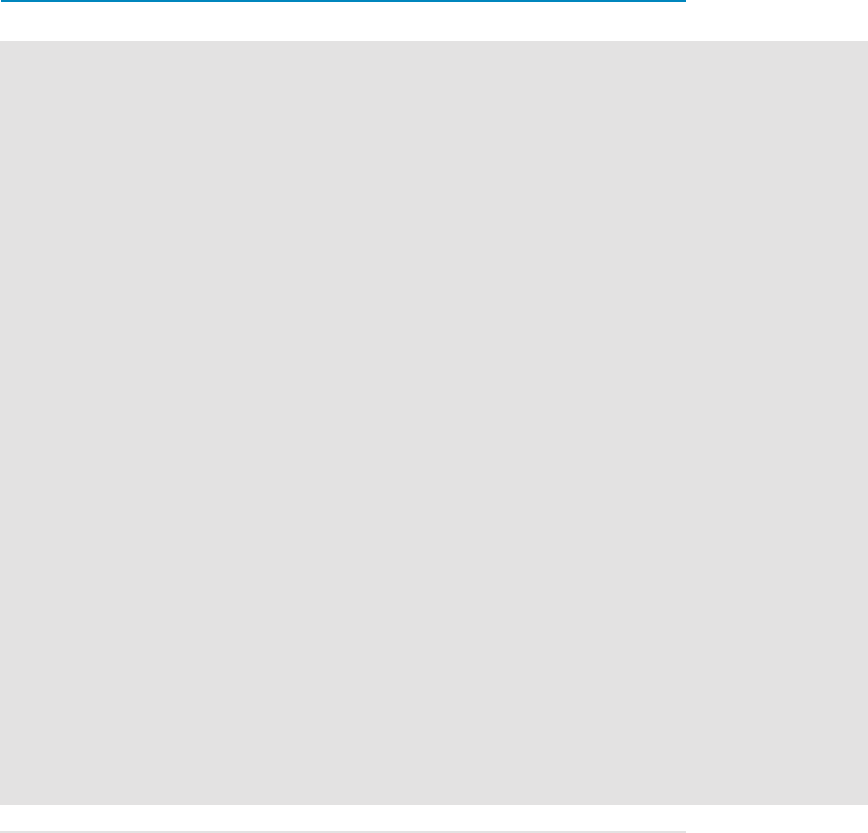

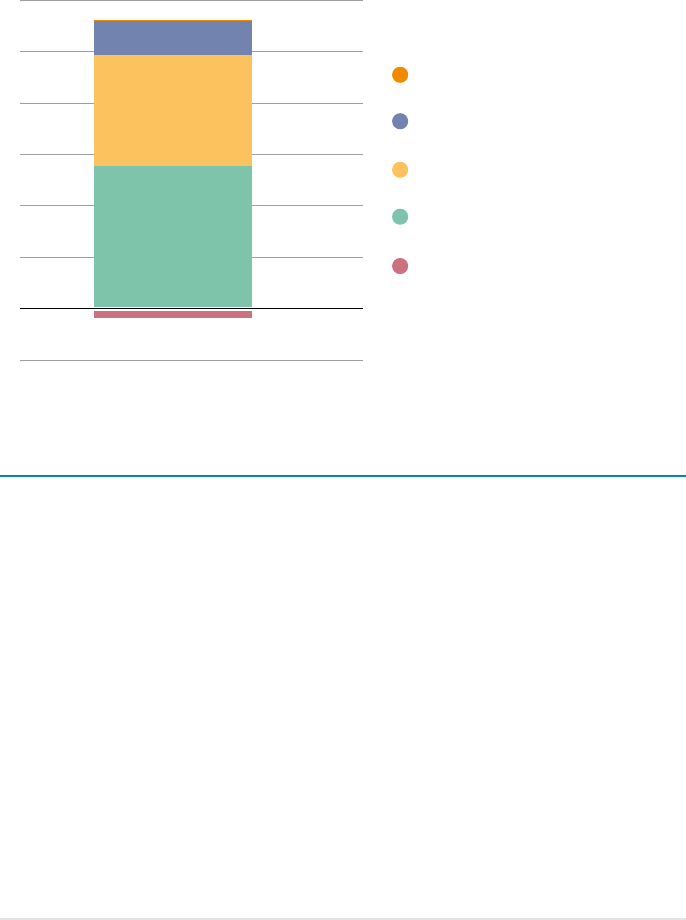

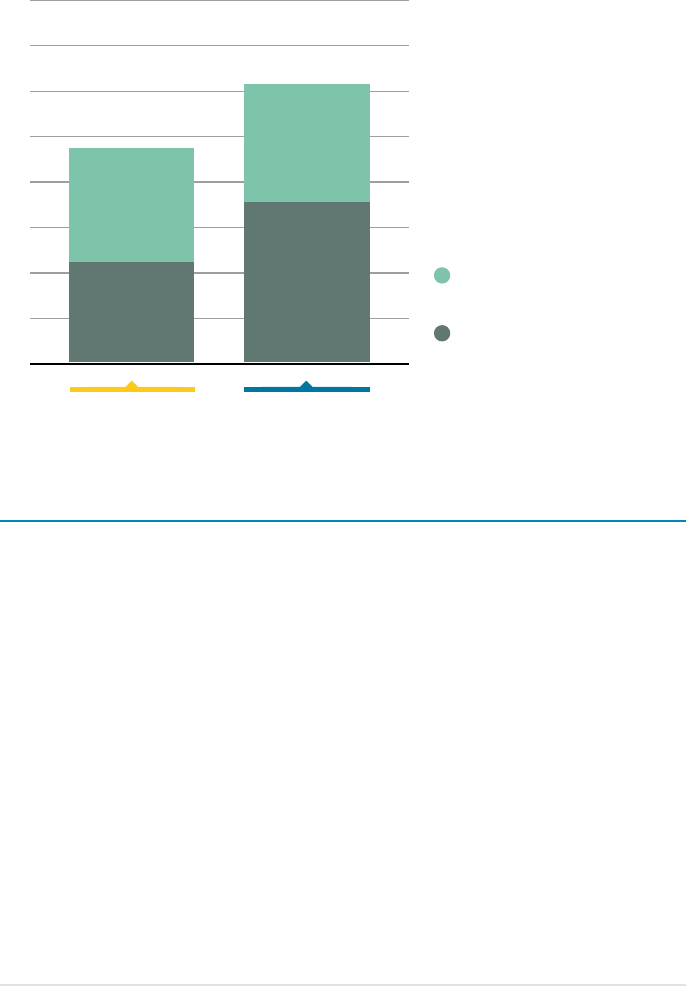

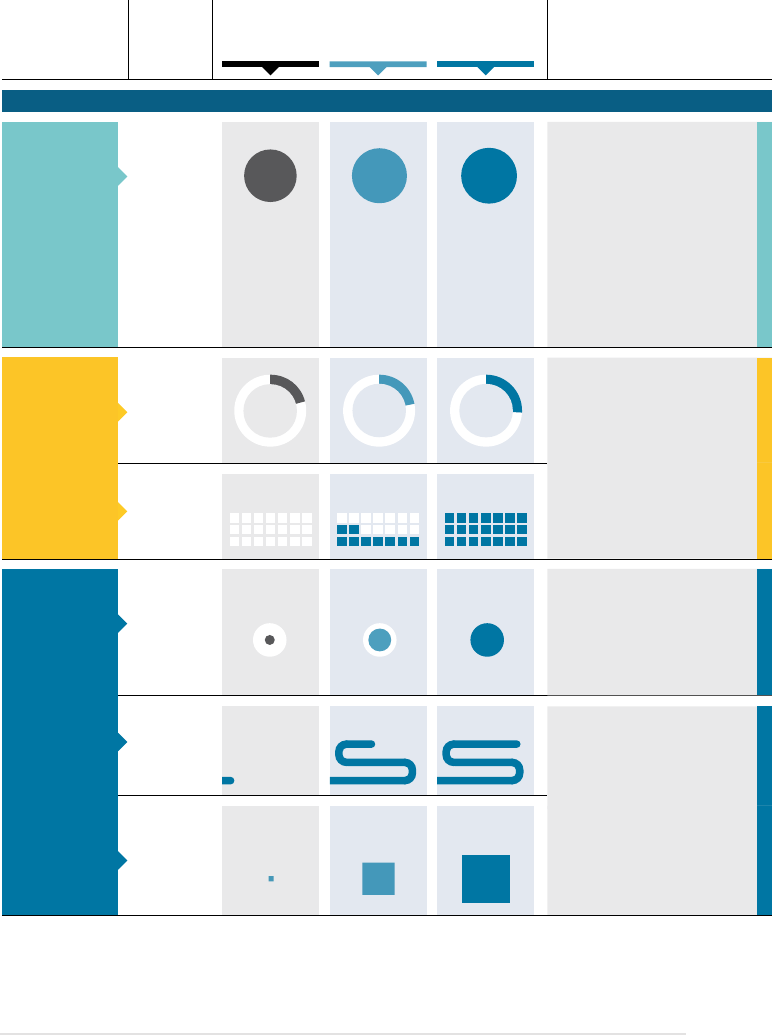

FIGURE S.9 Energy sector jobs, by segment of

value chain, in the 1.5°C Scenario

and PES (excluding vehicles)

Hydrogen

Power grids and energy flexibility

Energy eciency and heat pumps

Renewables

Fossil fuels

Nuclear

Fuel supply

Operation and maintenance

Manufacturing

Construction and installation

2021 2030

PESPES 1.5-S

2050

PES 1.5-S

0

50

100

150

Jobs (million)

2021 2030

PESPES 1.5-S

2050

PES 1.5-S

0

50

100

150

Jobs (million)

FIGURE S.8 Energy sector jobs by technology

under the PES and 1.5°C Scenario

(million), global results

Based on IRENA's analysis. Based on IRENA's analysis.

33

EXECUTIVE SUMMARY

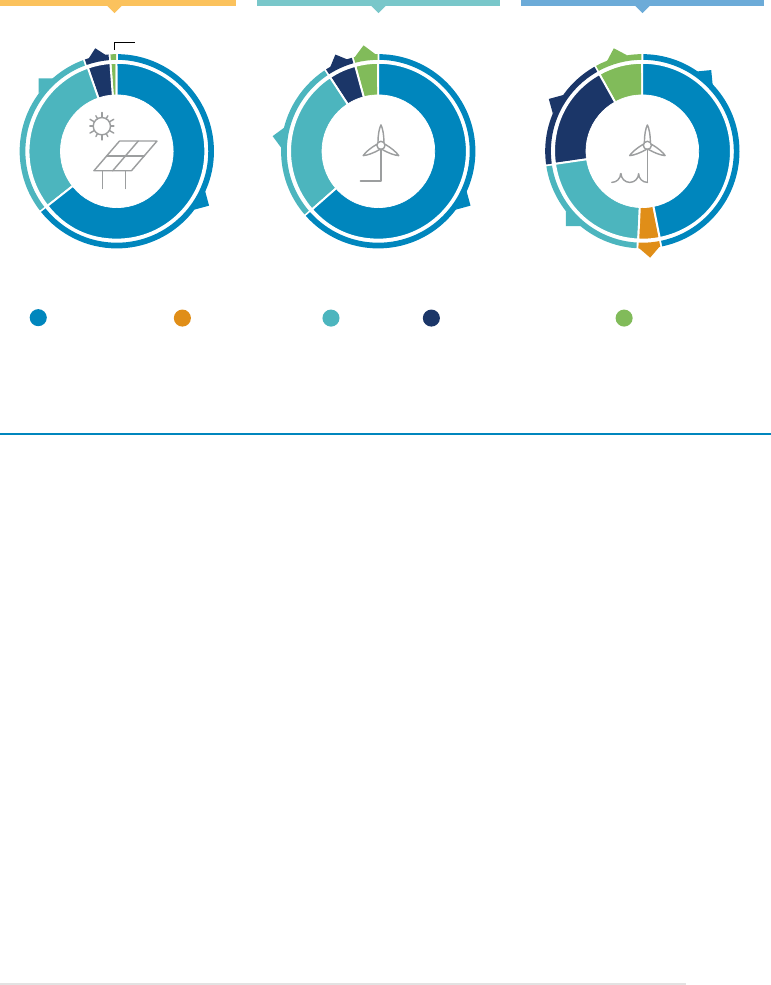

Renewable energy jobs will increase to 43 million in 2050. In the PES, renewable energy jobs

increase 9% from 2021 values to reach 18 million jobs by 2030 and 23 million by 2050. By contrast,

the 1.5°C Scenario leads to a much larger gain by 2030, with renewables jobs more than tripling

to 38 million over the coming decade. Solar photovoltaic (PV) accounts for the largest share,

followed by bioenergy, wind and hydropower. Construction, installation and manufacturing

boost renewable jobs during the following decade, with operation and maintenance gaining

relative weight as the transition advances under the 1.5°C Scenario.

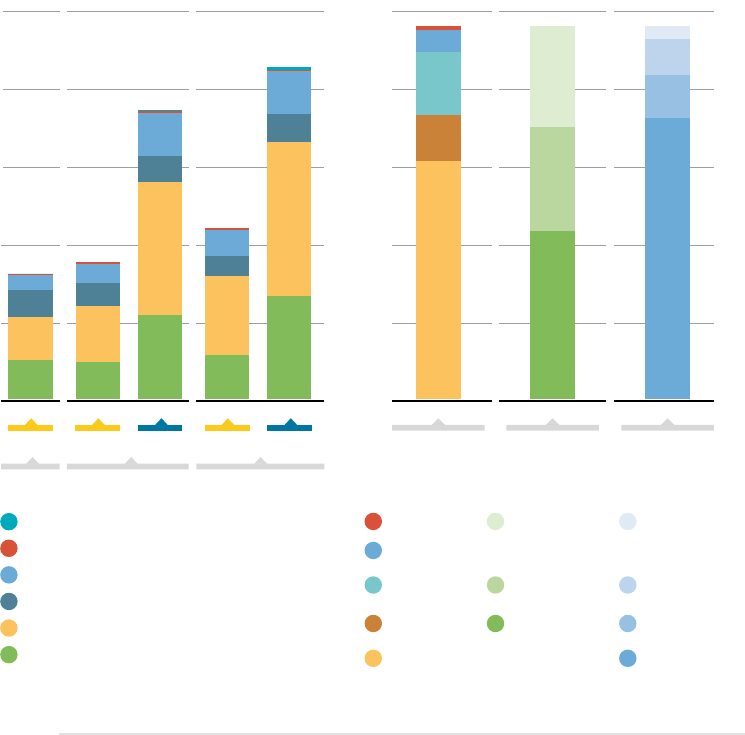

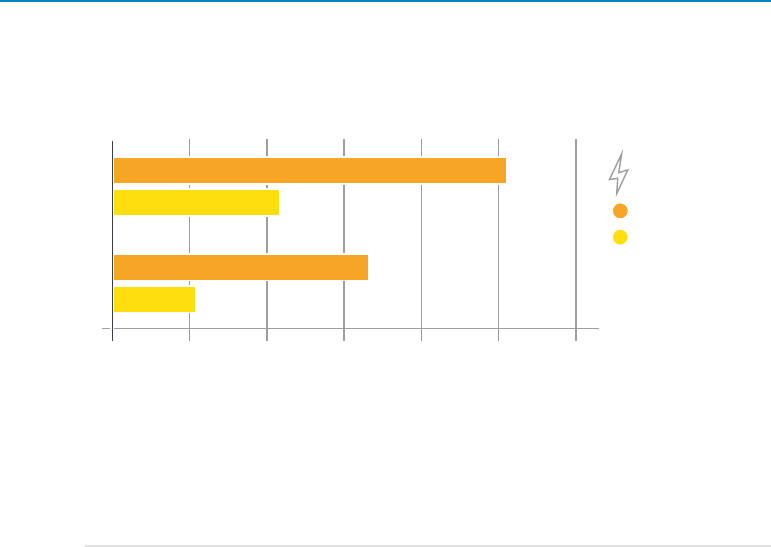

FIGURE S.10 Jobs in renewable energy, by

technology, in the 1.5°C Scenario

and PES (million)

FIGURE S.11 Structure of jobs in the 1.5°C

Scenario by 2050 for a subset of

renewable technologies by

technology, segment of value chain

and occupational requirements

Based on IRENA analysis.

Tidal/Wave

Geothermal

Wind

Hydro

Solar

Bioenergy

Experts

Engineers and

higher degrees

Marketing and

administrative

personnel

Workers and

technicians

Manufacturing

Operations

and

maintenance

Construction

and

installation

Solar water

heater

Onshore

wind

Oshore

wind

Geothermal

Solar PV

Jobs by

technology

Segment of

the value

chain

Occupational

pattern

2021 2030

PESPES 1.5-S

2050

PES 1.5-S

50

40

30

20

10

0

25

20

15

10

5

0

Jobs (million) Jobs (million)

34

WORLD ENERGY

TRANSITIONS OUTLOOK

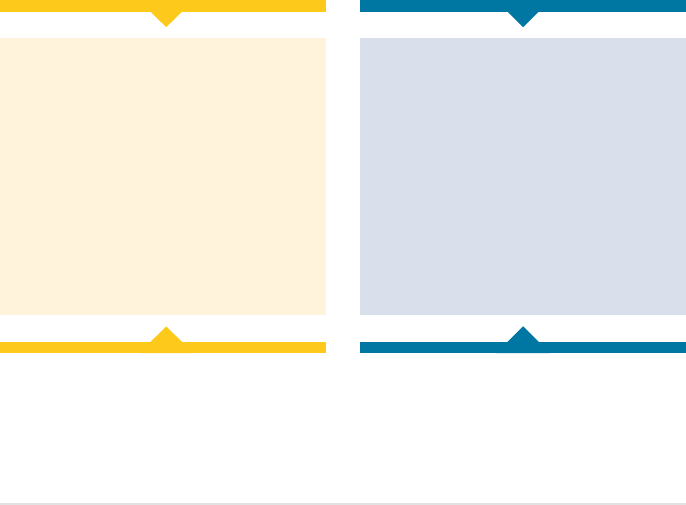

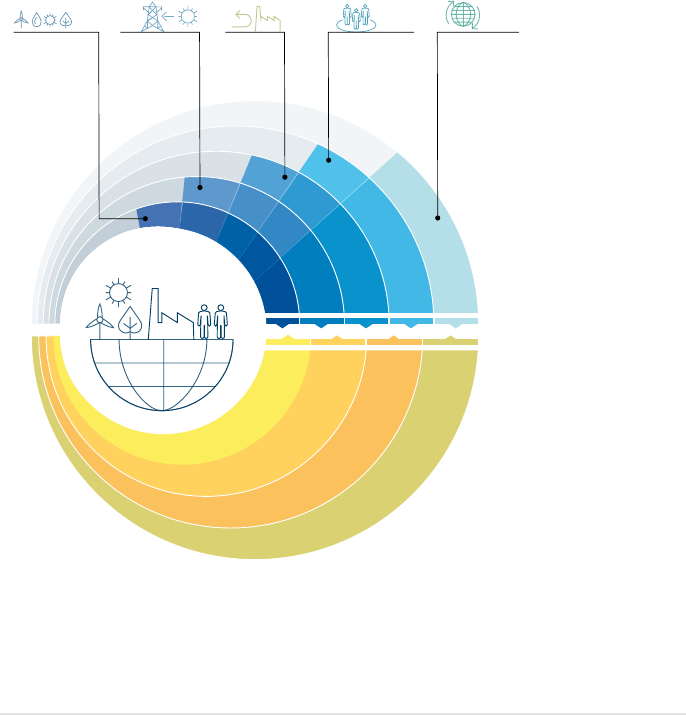

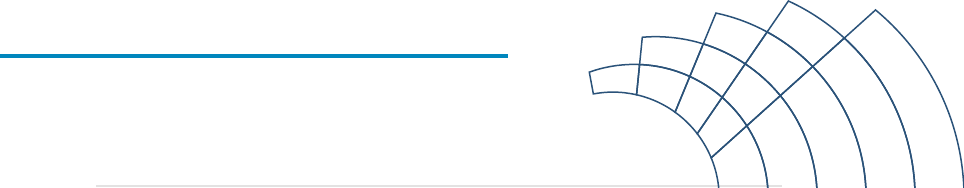

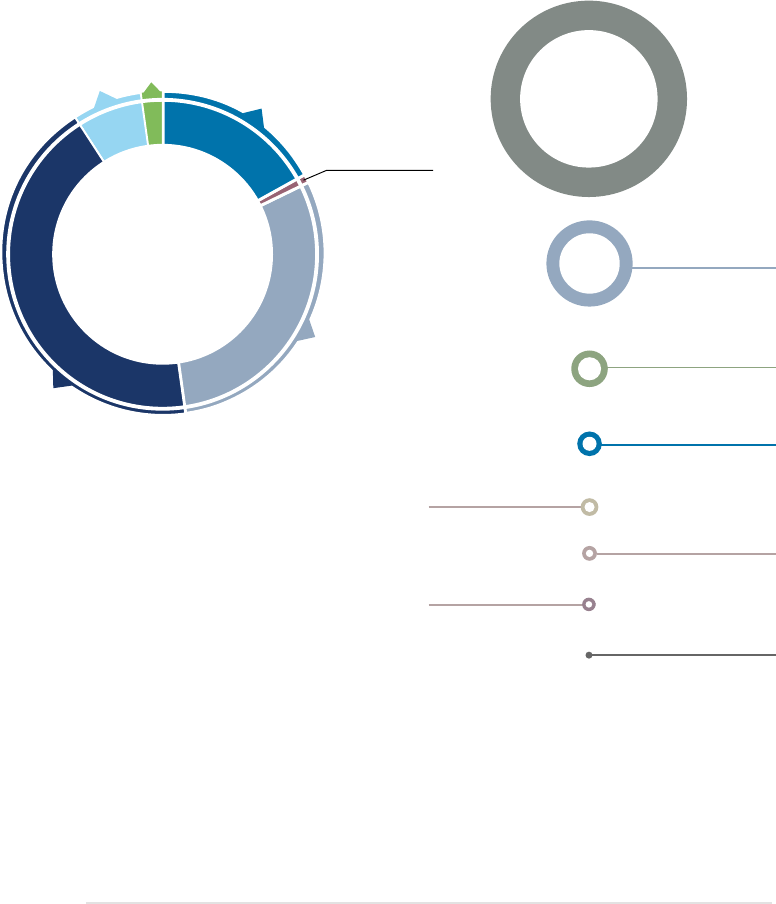

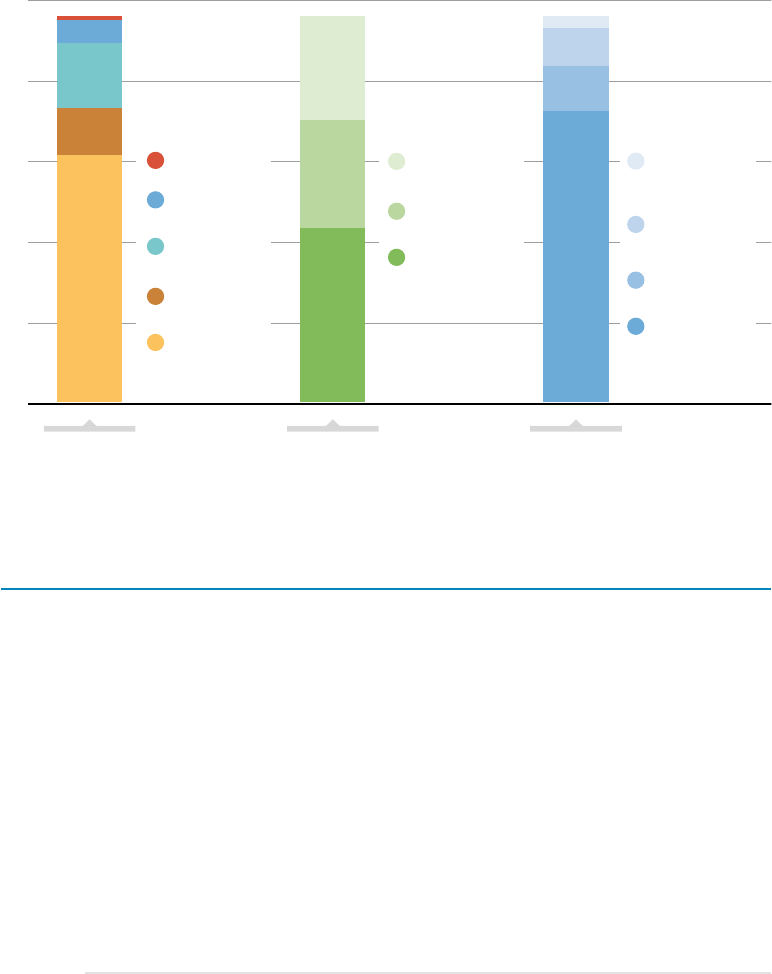

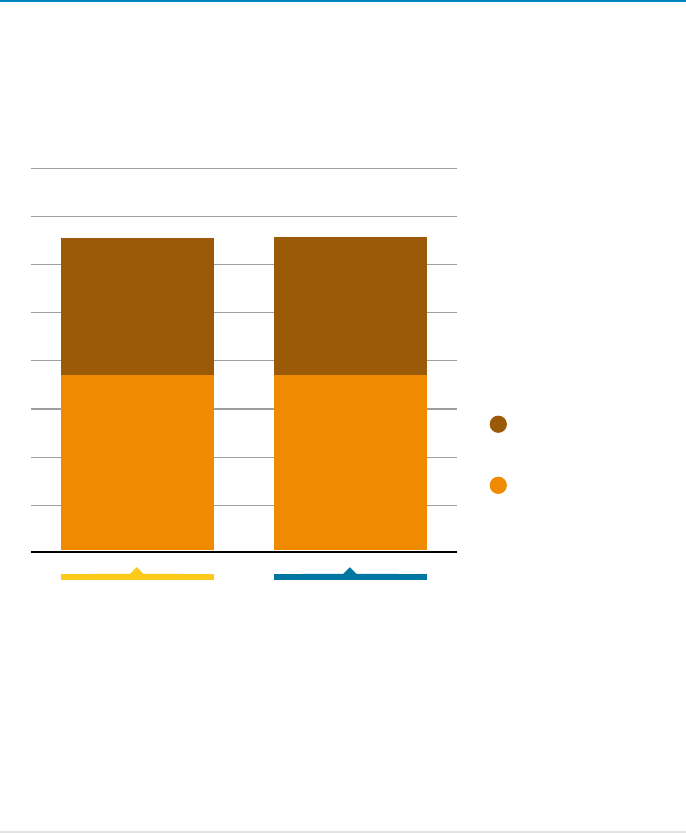

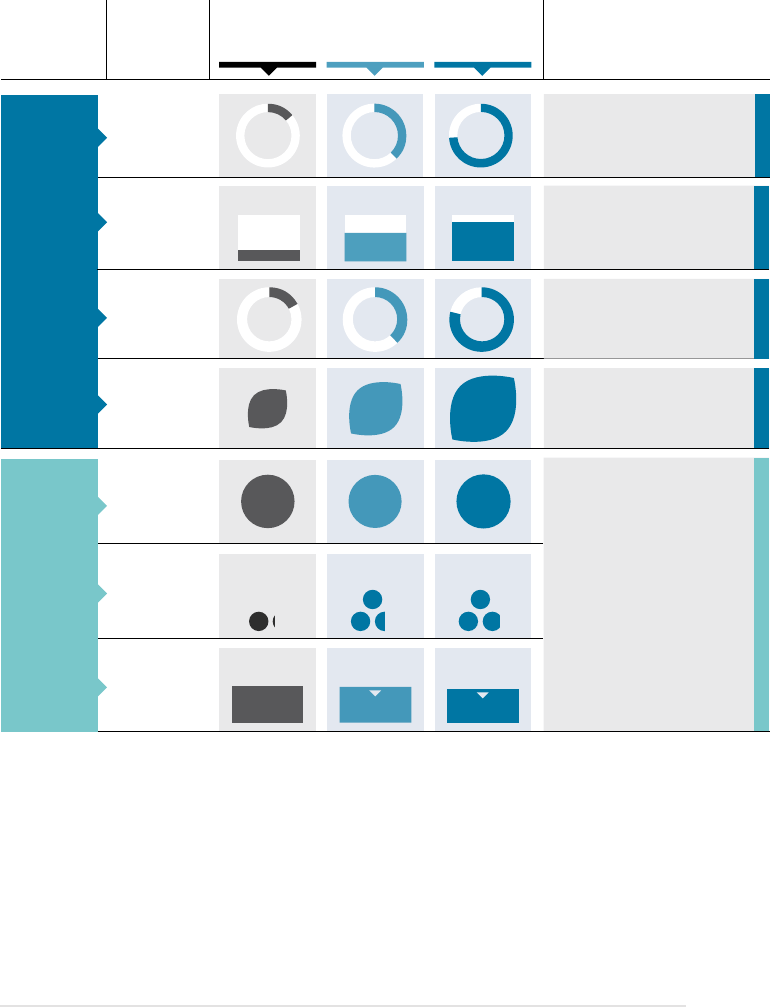

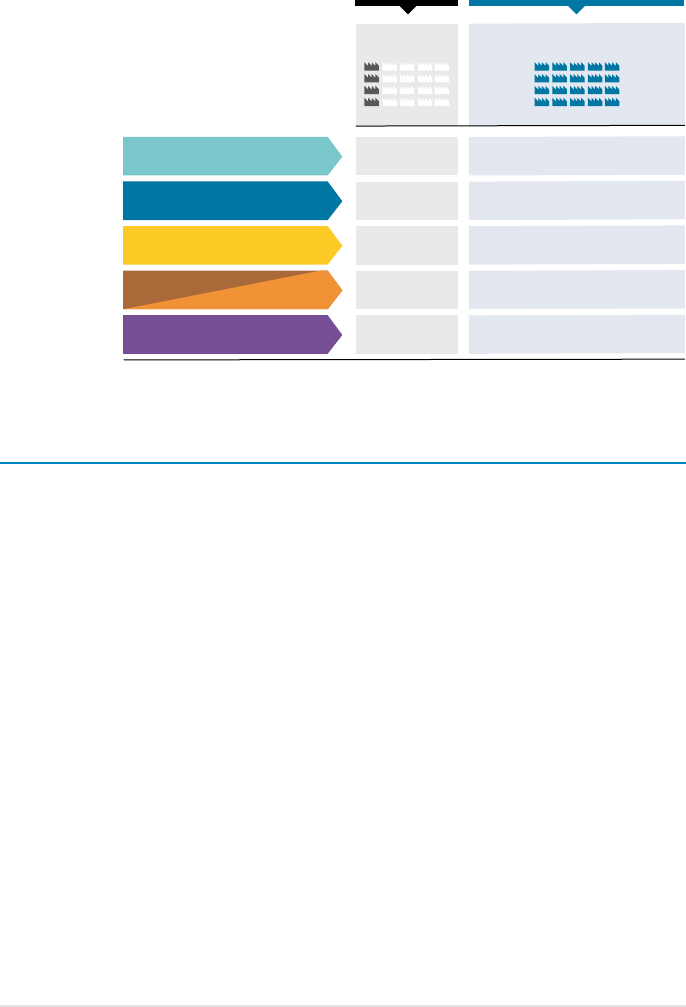

IRENA’s Energy Transition Welfare Index captures economic, social, environmental,

distributional and energy access dimensions. For the first time, the Index reports distributional

and energy access dimensions that are often overlooked in other analyses. Measuring the impact

of the transition across these dimensions provides a quantitative basis for roadmaps designed

to reap the transition’s full socio-economic and environmental benefits.

FIGURE S.12 Structure of IRENA's Energy Transition Welfare Index

Environmental Distributional AccessEconomic Social

E

c

o

n

o

m

i

c

S

o

c

i

a

l

E

n

v

i

r

o

n

-

m

e

n

t

a

l

I

n

d

e

x

I

n

d

e

x

I

n

d

e

x

I

n

d

e

x

I

n

d

e

x

D

i

s

t

r

i

-

b

u

t

i

o

n

a

l

A

c

c

e

s

s

Welfare

Index

CO

2

emissions

Within

country/region

Social

expenditure

Health impact

(pollution)

Materials

consumption

Across

countries/regions

Suciency

Basic energy

access

Consumption

and investment

Dimensions

Indicators

Employment

35

EXECUTIVE SUMMARY

The 1.5°C Scenario performs better than the PES along all welfare dimensions, yielding an

11% improvement over the PES by 2050.

• The economic dimension is similar for both scenarios reflecting the energy sector’s relatively

small share in the overall global economy and labour force.

• The environmental dimension sees a 30% improvement over PES with significantly lower

emissions under the 1.5°C Scenario, although increased materials consumption poses

sustainability challenges.

• The social dimension improves 23% under the 1.5°C Scenario largely due to improved health

outcomes from lower outdoor and indoor air pollution. Social expenditures contribute a much

smaller role.

• The distributional dimension improves 37% over PES; however, the index remains low in an

absolute sense, indicating potential equity barriers. In fact, both social and distributional

dimensions bring down the overall Energy Transition Welfare Index – and these realities deserve

more policy attention.

• The energy access dimension grows 7% under the 1.5°C Scenario compared to PES as universal

energy access and sufficiently levels are reached.

Socio-economic impacts vary at the regional and country level. Global aggregates mask

important differences in how the energy transition affects regions and countries and how benefits

are distributed. What is clear is that the energy transition roadmaps and their resulting socio-

economic implications are closely linked with the policy framework, with those links becoming

stronger as ambitions align with the 1.5°C Pathway. Governments’ involvement in the transition

should be accompanied by international co-operation to ensure that the benefits and burdens of the

transition are equitably shared.

36

WORLD ENERGY

TRANSITIONS OUTLOOK

TABLE S.2 Overview of structural change and just transition policies

OBJECTIVE RECOMMENDATIONS

Address potential misalignments in

labour markets

Ensuring a just and fair transition will require measures

to overcome temporal, geographic and skills-related

imbalances.

Develop local value chains Enhancing and leveraging domestic capabilities requires

carefully crafted incentives and rules, business incubation

initiatives, supplier-development programmes, support

for small and medium enterprises and promotion of key

industrial clusters.

Provide education and build

capacity

Early exposure to renewable-energy-related topics and

careers is vital for sparking young people’s interests in

pursuing a career in the sector, and also to increase social

acceptance by a knowledgeable citizenry.

Support a circular economy Policies and measures are needed to ensure the

sustainability of energy transition-related solutions and

their smooth integration in existing ecosystems in terms

of sustainability, circular economy principles and reduced

environmental impacts.

Support community and citizen

engagement

Community energy can play an important role in

accelerating renewables deployment while generating

local socio-economic benefits and increasing public

support for local energy transitions.

A comprehensive policy framework for the energy

transition

Policy measures and investments in energy transitions can drive a wider structural shift

towards resilient economies and societies. The energy sector must be viewed as an integral