JPMorgan European

Discovery Trust plc

Uncovering Europe’s hidden gems

Annual Report and Financial Statements

for the Year Ended 31st March 2024

European Discovery AR 4pp cover.qxp 20/06/2024 09:47 Page FC1

Key Features

2 JPMorgan European Discovery Trust plc – Annual Report & Financial Statements 2024

Objective

Capital growth from smaller Continental European companies.

Investment Policies

• To invest in a diversified portfolio of high-quality smaller companies in Continental Europe.

• To emphasise capital growth rather than income. Shareholders should expect the dividend to vary from year to year.

• To manage liquidity and borrowings to increase potential returns to shareholders. The Board’s current gearing policy is to be

between 20% net cash and 20% geared.

• To invest no more than 15% of gross assets in other UK listed investment companies (including investment trusts).

Risk

The Company invests in the shares of smaller companies, which tend to be more volatile than those of larger companies. The

Company also employs gearing to generate greater returns. The Company’s shares should therefore be regarded as carrying

greater than average risk.

Further details on investment policies and risk management are given in the Strategic Report on page 33.

Benchmark

MSCI Europe (ex UK) Small Cap Net Total Return Index in sterling terms.

Capital Structure

At 31st March 2024, the Company’s issued share capital comprised 157,474,931 Ordinary shares of 5p each, of which 9,782,472

were held in Treasury.

Management Company

The Company employs JPMorgan Funds Limited (‘JPMF’ or the ‘Manager’ or the ‘Investment Manager’) as its Alternative

Investment Fund Manager. JPMF delegates the management of the Company’s portfolio to JPMorgan Asset Management (UK)

Limited (‘JPMAM’).

Association of Investment Companies (‘AIC’)

The Company is a member of the AIC.

Website

More information about the Company can be found online at www.jpmeuropeandiscovery.co.uk.

FINANCIAL CALENDAR

Financial year end 31st March

Final results announced June

Half year end 30th September

Half year results announced December

Annual General Meeting July

European Discovery AR 4pp cover.qxp 20/06/2024 09:47 Page 2

Contents

J.P. Morgan Asset Management 3

Strategic Report

Financial Highlights 5

Chairman’s Statement 7

Investment Manager’s Report 11

Manager’s Investment Process 19

Portfolio Information 23

Ten Year Record 28

Environmental, Social and Governance (‘ESG’) Report 30

Business Review 33

Principal and Emerging Risks 36

Long Term Viability 39

Duty to Promote the Success of the Company — section 172 statement 40

Governance

Board of Directors 45

Directors’ Report 46

Corporate Governance Statement 49

Audit Committee Report 55

Directors’ Remuneration Report 57

Statement of Directors’ Responsibilities 60

Independent Auditor’s Report 62

Financial Statements

Statement of Comprehensive Income 69

Statement of Changes in Equity 70

Statement of Financial Position 71

Statement of Cash Flows 72

Notes to the Financial Statements 73

Regulatory Disclosures

Alternative Investment Fund Managers Directive (‘AIFMD’) Disclosure (Unaudited) 92

Securities Financing Transactions Regulation (‘SFTR’) Disclosure (Unaudited) 93

Shareholder Information

Notice of Annual General Meeting 97

Alternative Performance Measures (‘APMs’) and Glossary of Terms 101

Investing in JPMorgan European Discovery Trust plc 103

Share Fraud Warning 104

Information About the Manager 105

Information About the Company 107

European Discovery AR 01 Contents p03.qxp 20/06/2024 09:47 Page 3

Image:

Strategic Report

European Discovery AR 02 Strategic Report p04-43.qxp 20/06/2024 09:47 Page 4

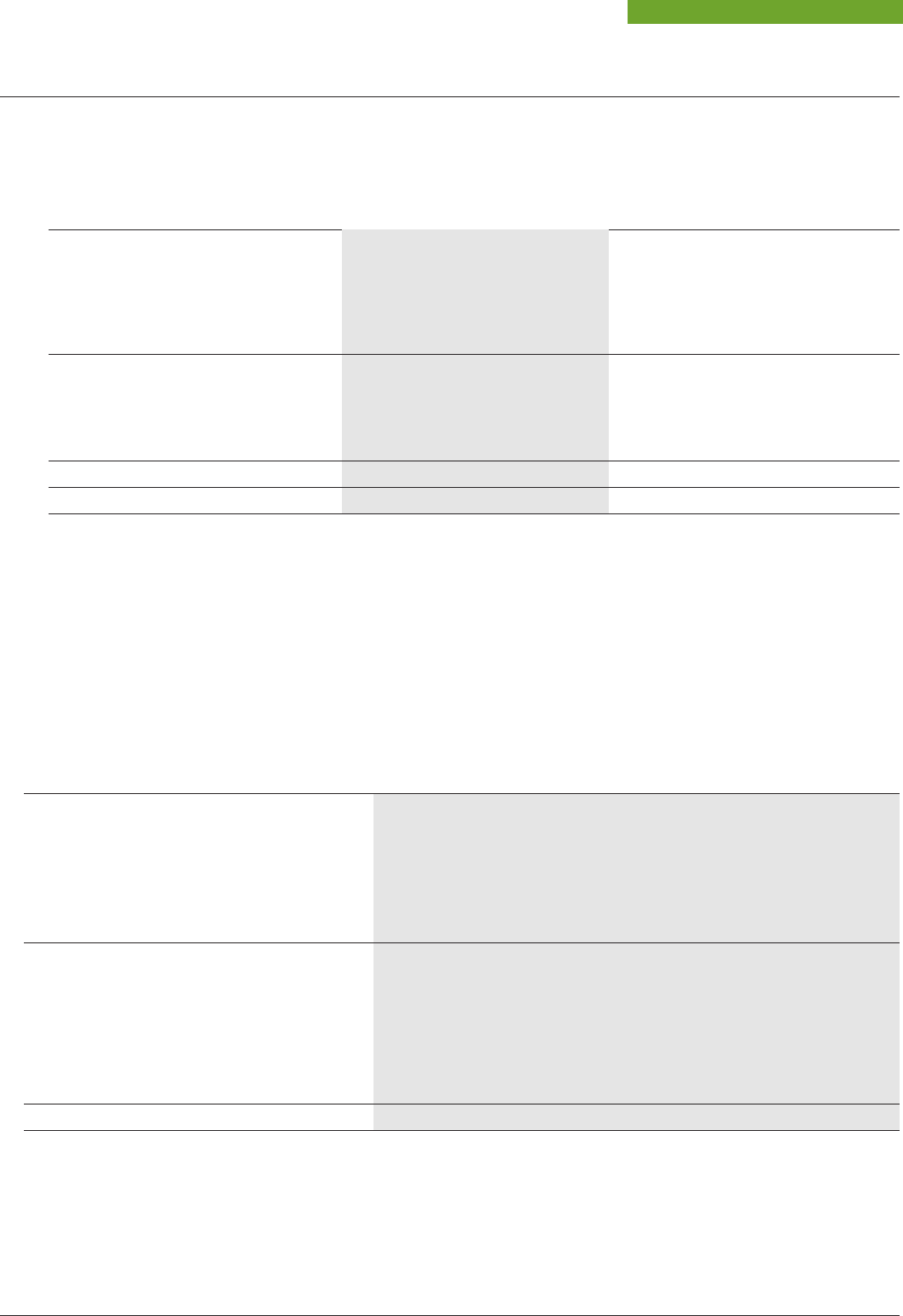

Financial Highlights

J.P. Morgan Asset Management 5

Strategic Report

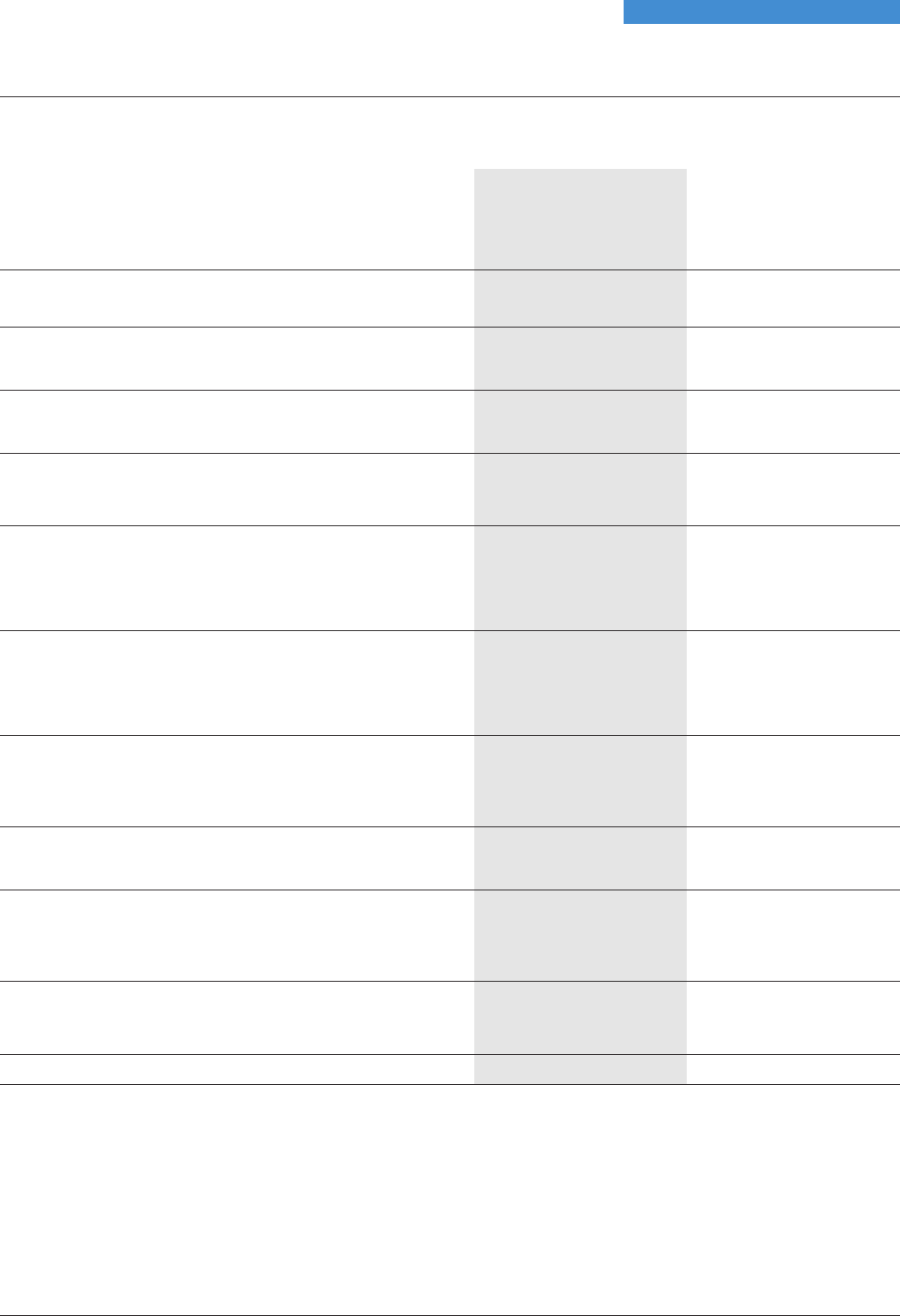

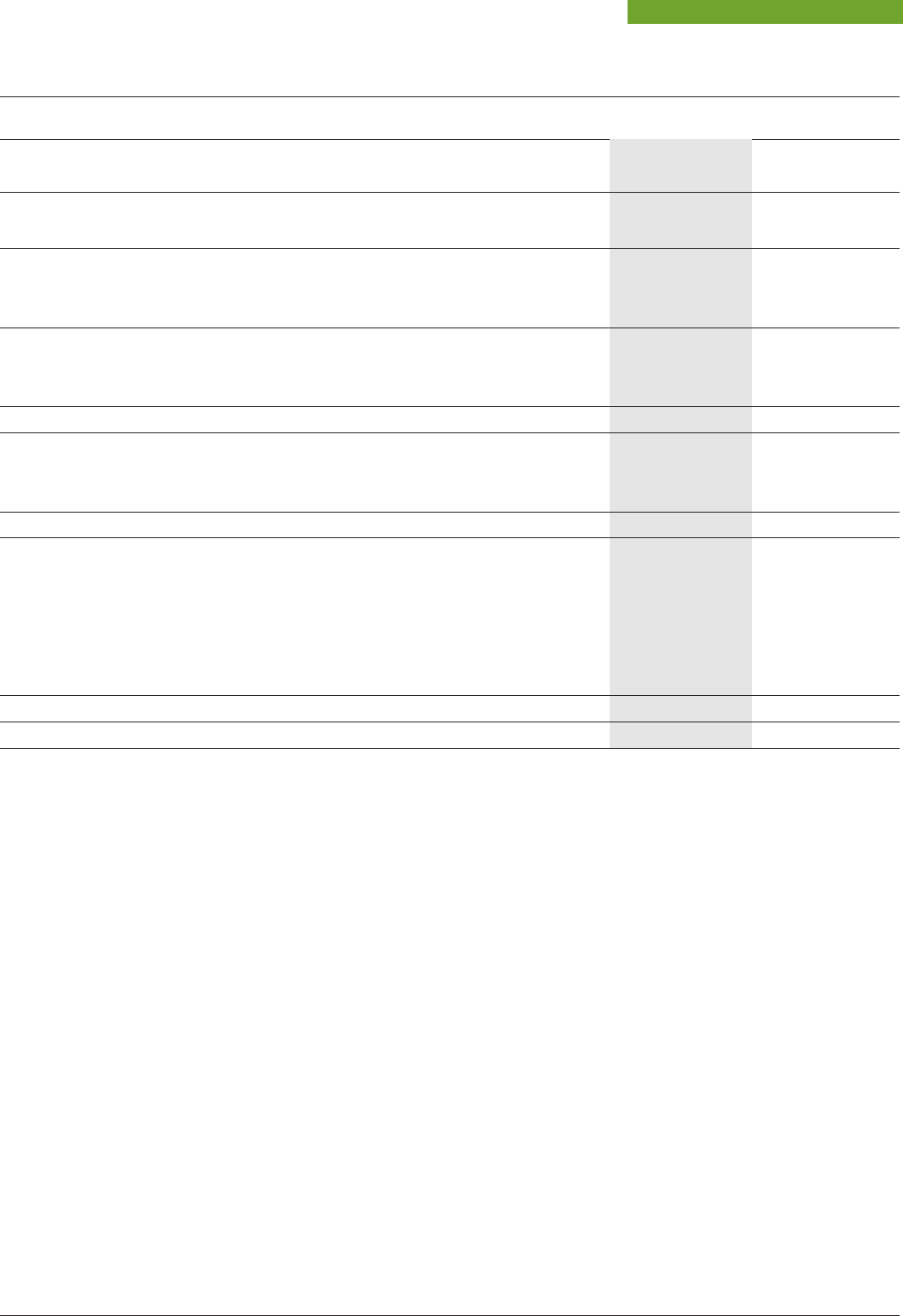

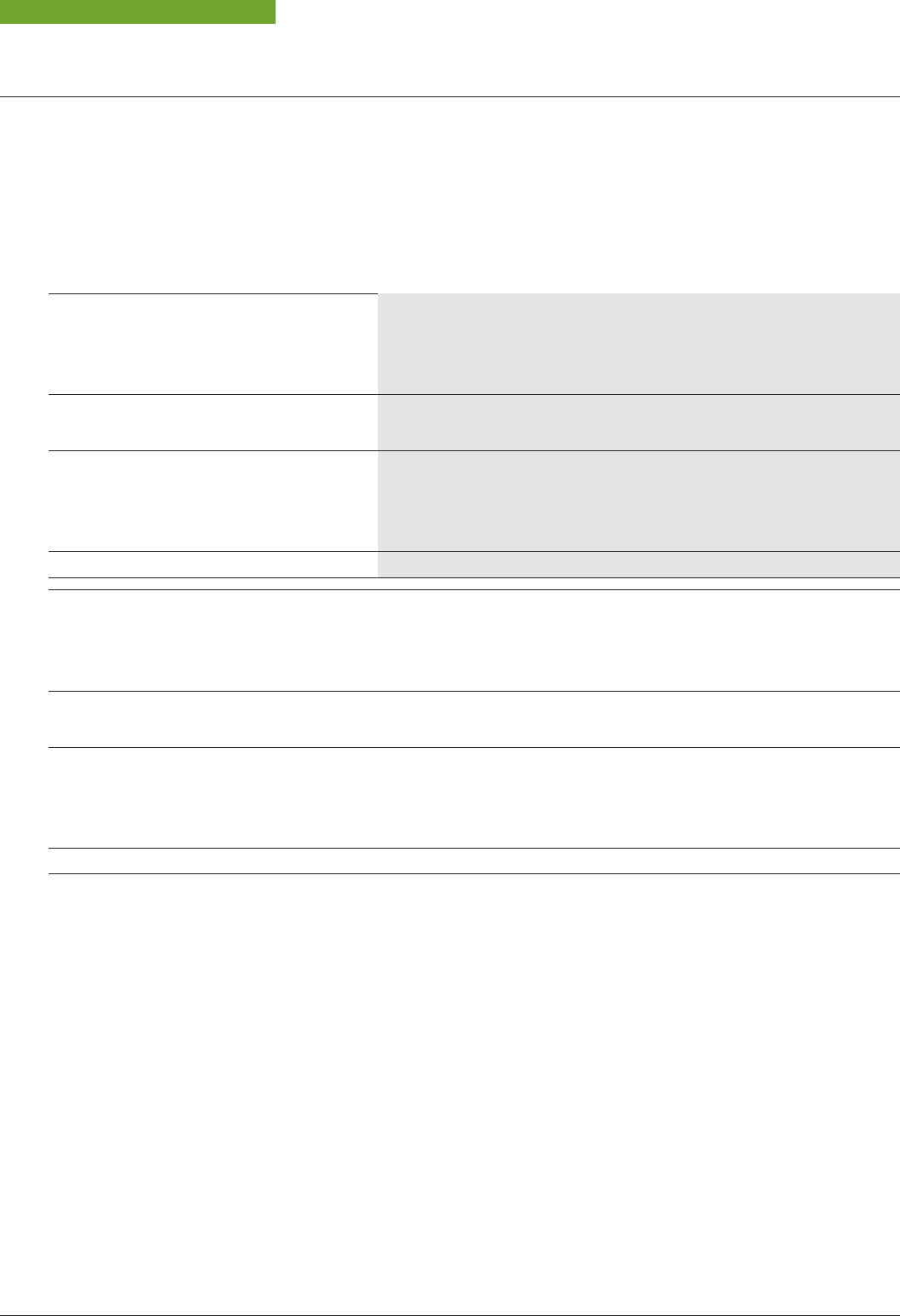

Total returns (including dividends reinvested)

3 years 5 years 10 years

2024 2023 Cumulative Cumulative Cumulative

Return to shareholders

1,A

Return on net assets

2,A

Benchmark return

3

Shareholder return

compared to benchmark

A

return

Net asset return

compared to

benchmark return

3,A

Dividend in respect of the year

+13.0%

–4.3% +6.8% +46.7% +127.8%

+6.8%

–3.8% +3.0% +41.0% +121.0%

+5.9%

–3.2% +6.4% +46.7% +115.2%

10.5p

9.0p

+7.1%

–1.1% +0.4%

+0.0% +12.6%

+0.9%

–0.6% –3.4%

–5.7% +5.8%

1

Source: Morningstar.

2

Source: Morningstar/J.P. Morgan using cum income net asset values per share.

3

Source: Morningstar. The Company’s benchmark is the MSCI Europe (ex UK) Small Cap Net Total Return Index in sterling terms.

A

Alternative Performance Measure (‘APM’).

A glossary of terms and APMs is provided on pages 101 and 102.

European Discovery AR 02 Strategic Report p04-43.qxp 20/06/2024 09:47 Page 5

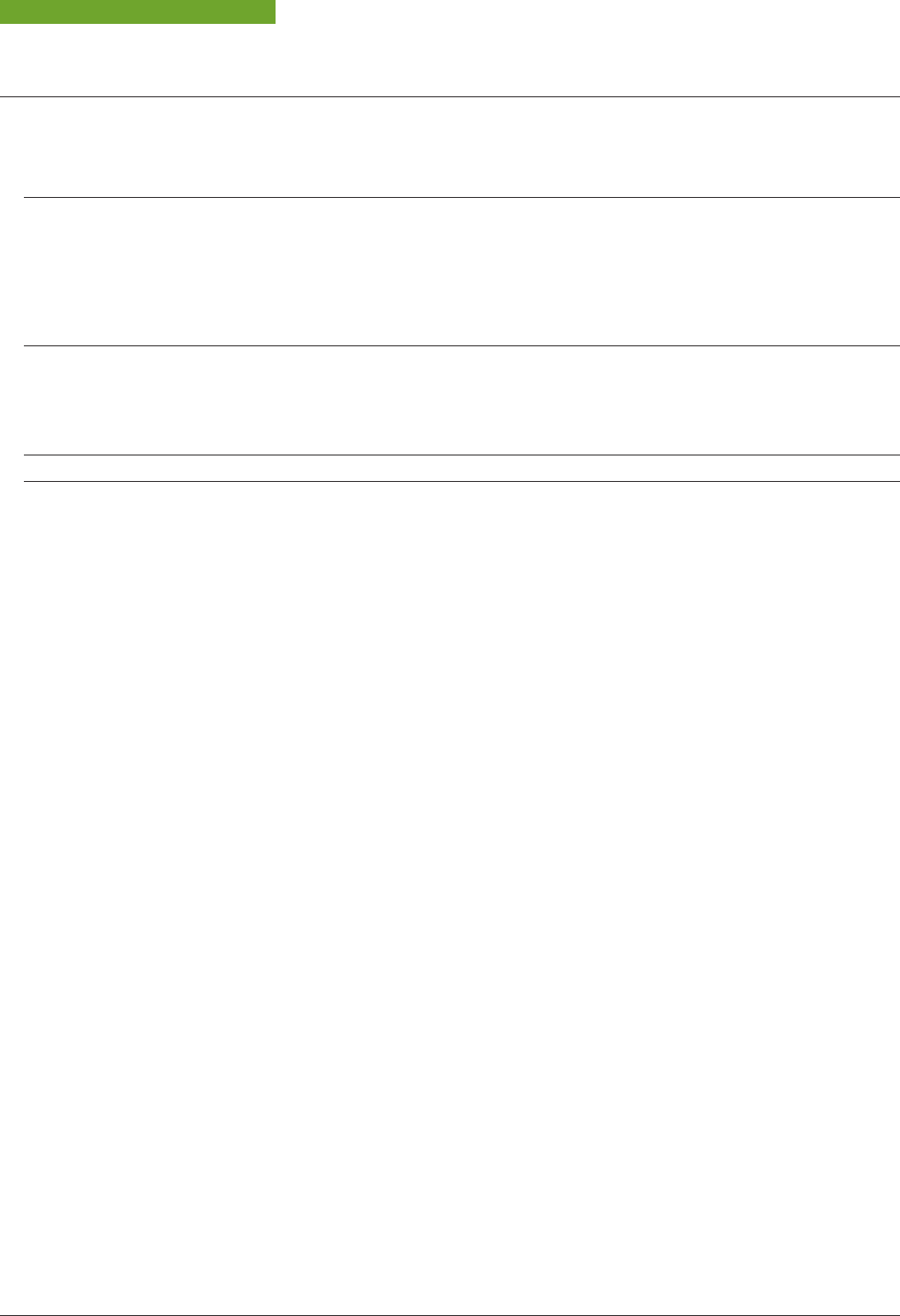

Financial Highlights

6 JPMorgan European Discovery Trust plc – Annual Report & Financial Statements 2024

Strategic Report

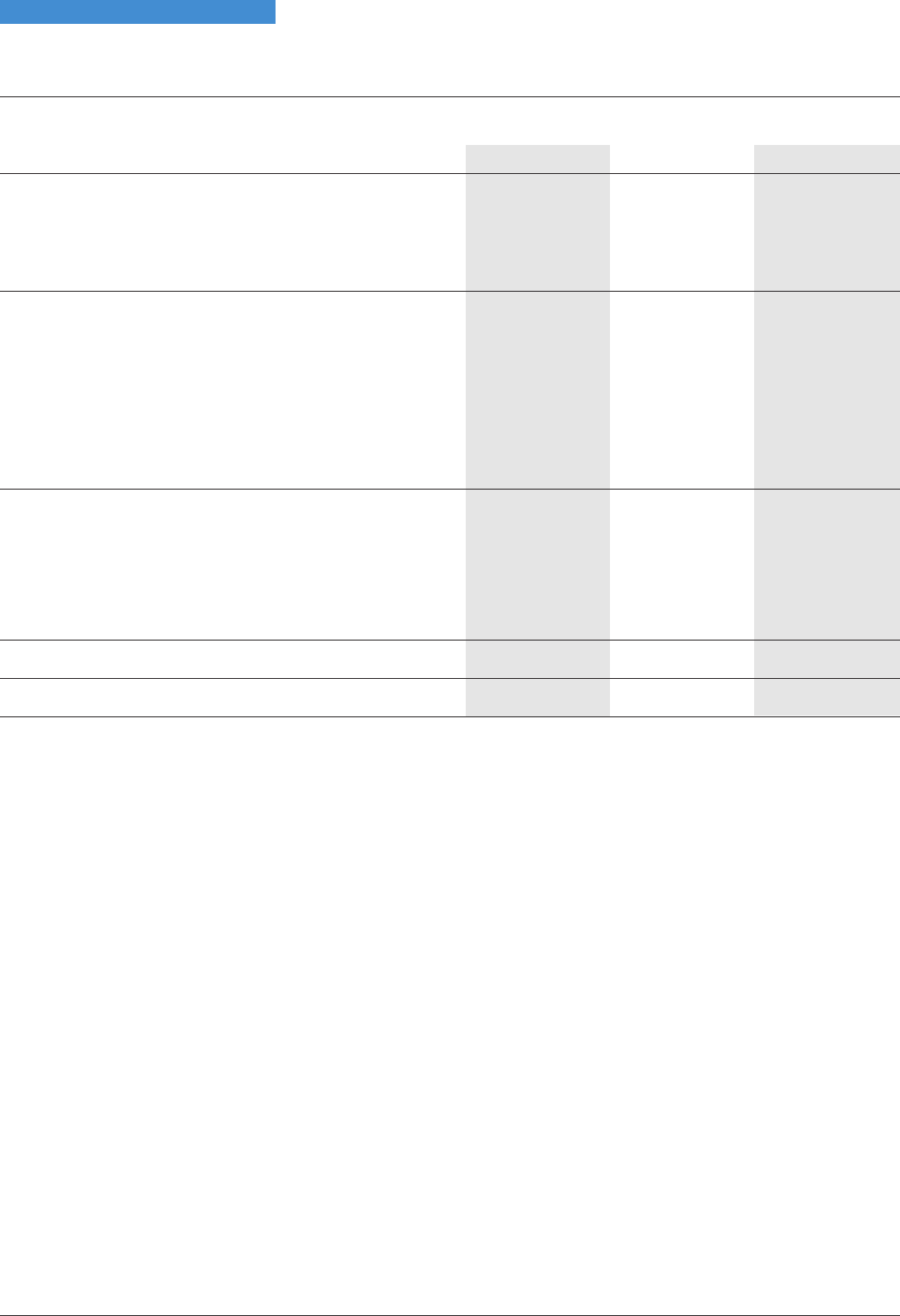

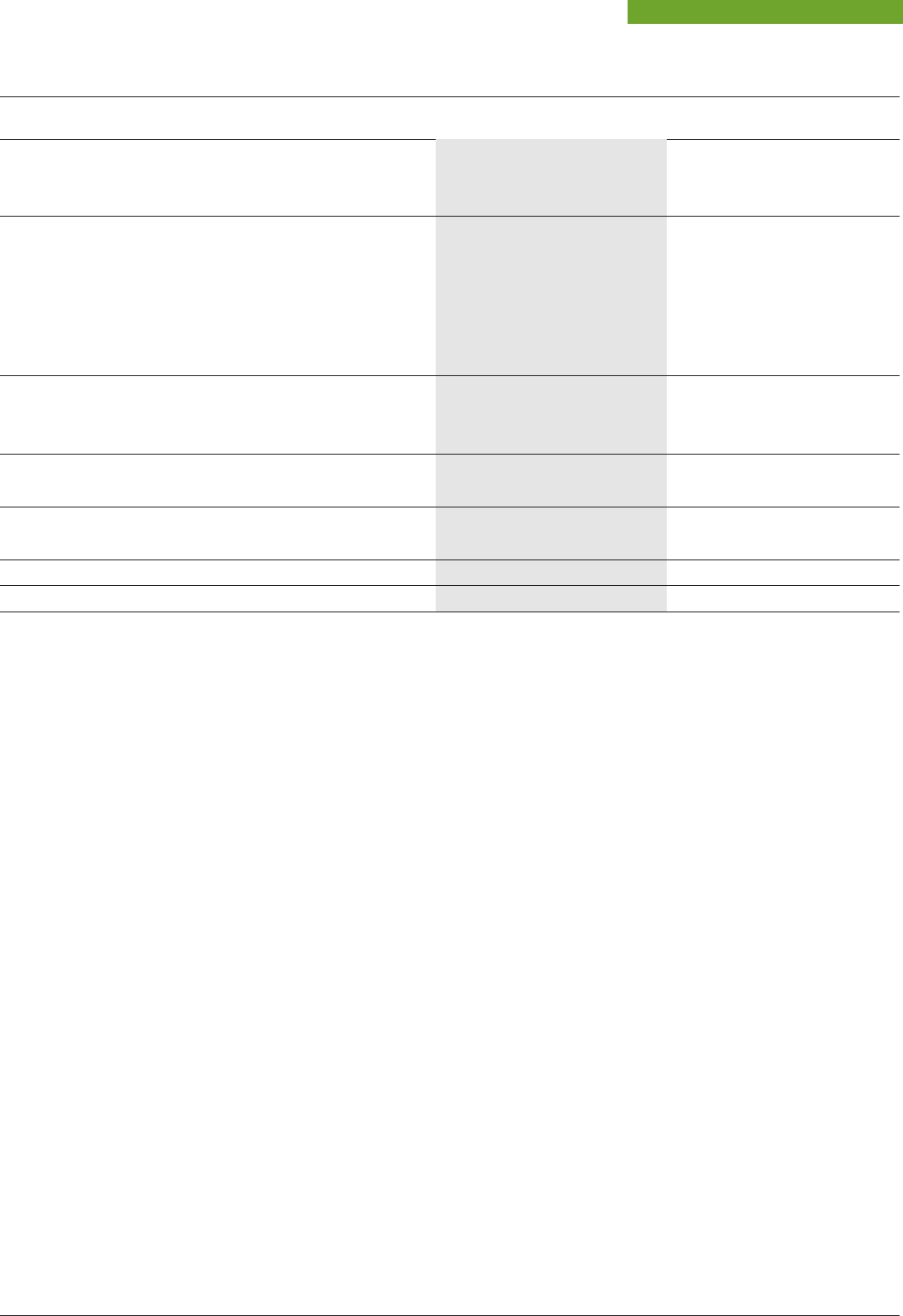

Summary of results

2024 2023 % change

Total returns for the year ended 31st March

Share price total return

1,A

+13.0% –4.3%

Net asset value return

2,A

+6.8% –3.8%

Benchmark return

3

+5.9% –3.2%

Net asset value, share price, discount and market data at

31st March

Shareholders’ funds (£’000) 769,046 785,062 –2.0

Net asset value per share

A

520.7p 498.5p +4.5

4

Share price 465.5p 423.0p +10.0

5

Share price discount to net asset value per share

A

10.6% 15.1%

Shares in issue 147,692,459 157,474,931

Revenue for the year ended 31st March

Gross revenue return (£’000) 23,982 22,502 +6.6

Net revenue attributable to shareholders (£’000) 18,670 17,512 +6.6

Revenue return per share 12.04p 11.11p +8.4

Dividend per share 10.5p 9.0p +16.7

Gearing at 31st March

A

7.9% 6.9%

Ongoing charges

A

0.92% 0.94%

1

Source: Morningstar.

2

Source: Morningstar/JPMorgan, using cum income net asset value per share.

3

The Company’s benchmark is the MSCI Europe (ex UK) Small Cap Net Total Return Index in sterling terms.

4

% change, excluding dividends paid. Including dividends the return is +6.8%.

5

% change, excluding dividends paid. Including dividends the return is +13.0%.

A

Alternative Performance Measure (‘APM’).

A glossary of terms and APMs is provided on pages 101 and 102.

European Discovery AR 02 Strategic Report p04-43.qxp 20/06/2024 09:47 Page 6

Chairman’s Statement

J.P. Morgan Asset Management 7

Strategic Report

Dear Shareholder,

I am pleased to present the Company’s results for the year ended 31st March 2024.

Investment Performance

Over the year to 31st March 2024 (FY24) the total return on net assets was 6.8%, outperforming the

Company’s benchmark index, the MSCI Europe (ex UK) Small Cap Index, which returned 5.9% over the

same period. The total return to shareholders was 13.0%, as a result of a significant narrowing of the

discount at which the Company’s shares trade relative to NAV, from 15.1% to 10.6% over the year.

The explanation for this performance is in the Portfolio Managers’ report on pages 11 to 18. This also

provides a detailed commentary on portfolio positioning and the investment outlook.

Whilst the past year’s performance is pleasing, the Company adopts a long-term investment strategy,

so it is important to also consider performance over a longer timeframe. On this basis, the Company

has underperformed the market over three and five years, returning 3.0% and 41.0% respectively over

these periods, compared to benchmark returns of 6.4% and 46.7%, although its longer-term

performance remains strong in both absolute and relative terms. Over the ten years to the end of

March 2024, its total return on net assets was 121.0%, ahead of the benchmark total return of 115.2%.

Enhancements and Change

The Board has been very mindful of this mixed long-term performance. As I reported in the interim

results, over the five years to 30th September 2023 the net asset value total return was 2.0%, compared

to the benchmark total return of 20.1%. This followed a period of underperformance in the six months to

30th September 2023 of –11.4% with the Company’s benchmark returning –5.7%. The Portfolio

Managers noted in their report that the Company’s investment process tended to struggle during

periods of high volatility. During the year, they therefore implemented some important enhancements

to their process and risk management, seeking to minimise downside risk during periods of volatility

and capture upside risk when volatility reduces.

I am pleased to be able to report that these changes have had a positive impact on performance, with

the net asset value total return up 6.8% for the year to 31st March 2024, outperforming the benchmark

total return of 5.9%. A significant amount of performance came in the last six months of the financial

year, with the net asset value total return up 20.5% against the benchmark return of 12.4%.

As announced earlier this year, in light of the Company’s longer-term performance, the Board of

Directors and J.P. Morgan Asset Management (‘JPMAM’) undertook an internal review of the portfolio

management team and its investment process. This led to Jon Ingram, Jack Featherby and

JulesBloch being appointed as named Portfolio Managers of the Company with effect from 1st March

2024, replacing Francesco Conte and Edward Greaves. The Board is delighted to welcome Jon, Jack

and Jules and looks forward to working with the new investment team to deliver strong, long-term

returns for all shareholders. Since 1st March, the new Portfolio Managers have continued to refine the

investment process; the changes they have made are set out in their Report starting on page 11.

Francesco Conte is retiring and the Board and I would like to take this opportunity to recognise his

immense contribution to the Company for over the 25 years since he has been at the helm. Since 1998

the fundhas provided a share price total return of some 1,666% through several market cycles and

shocks. We would like to thank him for his commitment and efforts during this period, as well as to

EdwardGreaves who has been a named Portfolio Manager since 2016.

Gearing

Gearing can be a differentiator for an investment trust, and the Board believes that it can be beneficial

to performance. The Board sets the overall strategic gearing policy and guidelines, and reviews these

at each Board meeting. During the year, the revolving credit facility with Scotia Bank (EUR125m)

expired. This facility was renewed for a further two-year term. During the year gearing varied between

10.0% geared and 0.5% cash. At the end of the financial year, gearing stood at 7.9%.

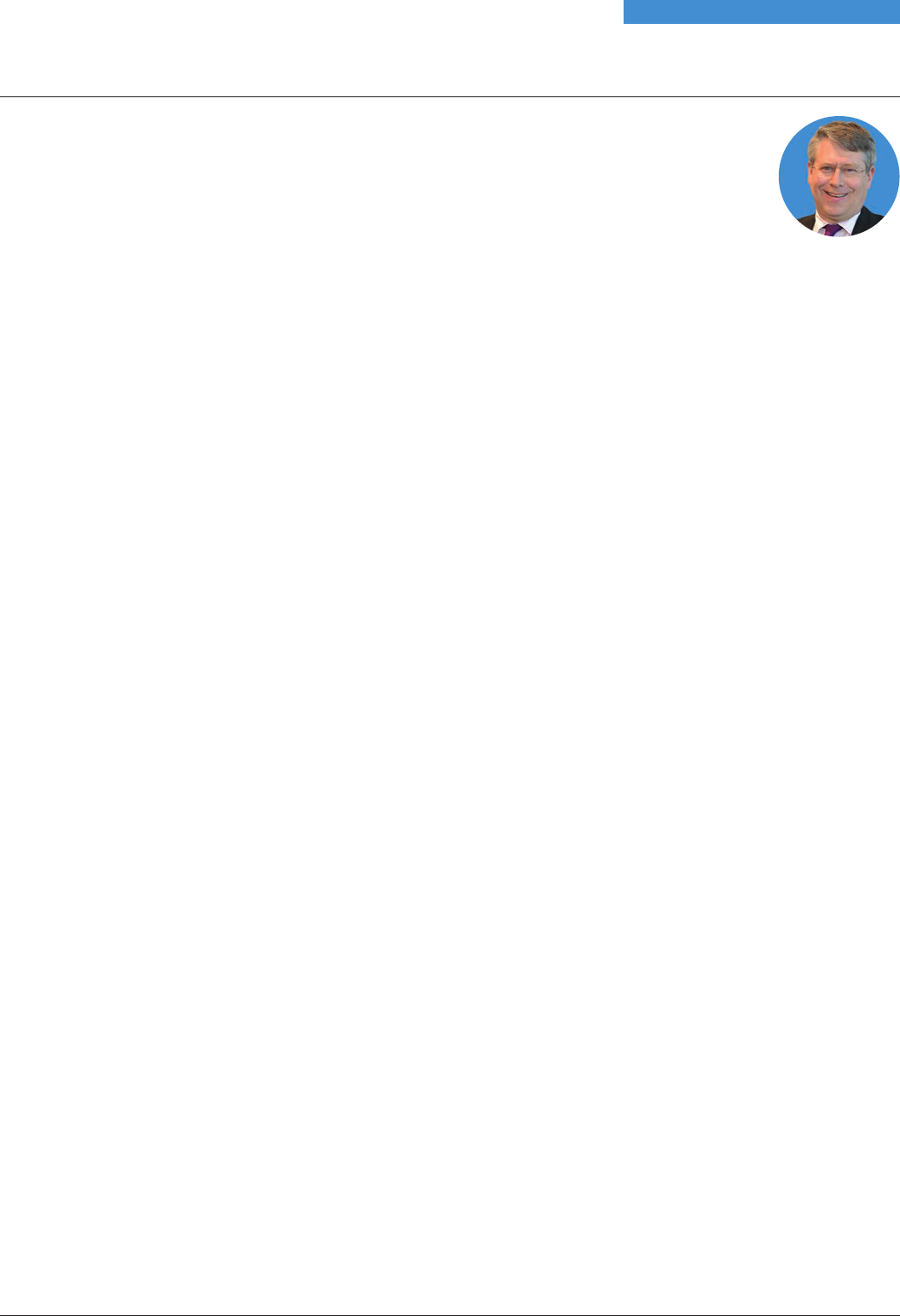

Marc van Gelder

Chairman

European Discovery AR 02 Strategic Report p04-43.qxp 20/06/2024 09:47 Page 7

Chairman’s Statement

8 JPMorgan European Discovery Trust plc – Annual Report & Financial Statements 2024

Strategic Report

Revenue and Dividends

The Board’s dividend policy is to pay out the majority of revenue available each year to its

shareholders. This is set against the Company’s objective of maximising capital growth, and the

Portfolio Managers are therefore not constrained to deliver income in any one financial year.

An interim dividend of 2.5 pence per share was paid on 5th February 2024, higher than the previous

year’s interim dividend of 1.2 pence, reflecting the increased income received by the Company during

the first six months of the financial year, compared to the previous year. After taking into account the

income received and the level of the Company’s revenue reserves, and subject to shareholder

approval at the forthcoming Annual General Meeting, a final dividend of 8.0 pence per share will be

paid on 2nd August 2024 to shareholders on the register as at the close of business on 28th June 2024

(ex-dividend date 27th June 2024). This will take the total dividend for the year to 10.5 pence, compared

to a total dividend of 9.0 pence for the previous year.

Discounts and Share Repurchases

The Company’s share price discount relative to net asset value narrowed during the Company’s

financial year, from 15.1% as at the end of March 2023 to 10.6% as at 31st March 2024. The average

discount over the period was 13.0%. As at 14th June 2024, the discount was 10.76%. The Board

continues to monitor the level of the discount carefully and seeks to use its ability to repurchase

shares to minimise the short-term volatility and the absolute level of the discount when appropriate.

During the year, the Company repurchased 9,782,472 shares at an average discount of 11.8%.

Manager Evaluation

During the year, the Management Engagement Committee undertook a formal review of the Manager,

facilitated by an independent board evaluation firm. The review covered the investment management,

company secretarial, administrative and marketing services provided to the Company. The review took

account of the Manager’s investment performance record, management processes, investment style,

resources and risk control mechanisms. Apart from the changes in the Portfolio Management team as

described above, the Board agreed with the Committee’s recommendation that the continued

appointment of the Manager was in the best interests of shareholders.

The Board

Nicholas Smith will be retiring from the Board at the end of the forthcoming Annual General Meeting

(‘AGM’), having served as aDirector since 2015. The Board would like to thank Nicholas for his

significant contribution to the Company during his tenure as Audit Chair and Senior Independent

Director and wish him well for the future.

Sarah Watters took over the role of the Senior Independent Director of the Company during the year

and Arun Sarwal will succeed Nicholas as Audit Chair following the AGM.

In anticipation of Nicholas’s impending retirement, the Board initiated a search earlier this year to

identify a new Director. As announced on 13th June 2024, James Will has been appointed as an

independent non-executive director with effect from the conclusion of the 2024 AGM. James has

extensive investment company experience and my fellow Board members and I look forward to

working with him.

Environmental, Social and Governance (‘ESG’)

The Board shares the Investment Manager’s view of the significance of financially material

environmental, social and governance (‘ESG’) factors when making long term investments. The

Portfolio Managers regularly discuss financially material ESG issues with the management teams of

potential and current investee companies on an ongoing basis. Further information on the Manager’s

ESG process and engagement is set out in the ESG Report on pages 30 to 32.

Shareholder Engagement

The Board believes that shareholder interactions are very helpful in assisting it with the management

of the Company’s affairs. Over the course of the year, we have engaged with a number of our largest

shareholders to listen to their thoughts and views. The Board values the feedback it has received and

European Discovery AR 02 Strategic Report p04-43.qxp 20/06/2024 09:47 Page 8

Chairman’s Statement

J.P. Morgan Asset Management 9

Strategic Report

insights it has gained through the engagement process and we thank the shareholders for their

support.

We remain committed to continued engagement over the coming year; in particular, Board members

welcome and seek such meetings as and when such opportunities arise.

During the year, the Board also undertook an Asset Reunification Programme, conducted by the

Company’s registrar, which ultimately traced and reunited shareholders with unclaimed shares and

dividends in the Company valued at approximately £230,000. More details can be found on page 43.

Tender Offer

Following a consultation with a number of the Company’s largest shareholders, the Board has

decided to undertake atender offer for up to 15% of the issued share capital (excluding shares held in

Treasury) of the Company (the ‘Tender Offer’). The Tender Offer, which is subject to shareholder

approval, will be made at a tender price equal to a 2% discount to the prevailing net asset value per

share as at the calculation date, less the costs of implementing the Tender Offer.

In addition, the Board intends to introduce a performance related tender offer for up to 15% of the

issued share capital (excluding shares held in Treasury) of the Company (the ‘Conditional Tender

Offer’). If the Company’s net asset value total return does not equal or exceed the benchmark total

return (MSCI Europe ex UK Small Cap Index (net)) over the five-year period beginning 1st April 2024 and

ending on 31st March 2029. The Conditional Tender Offer will be held as soon as practicable following

the conclusion of the 2029 Annual General Meeting. The Conditional Tender Offer, which is subject to

shareholder approval, will be made at atender price equal to a 2% discount to the prevailing net asset

value per share as at the calculation date, less the costs of implementing the Conditional Tender Offer.

Further announcements in relation to the Tender Offer and Conditional Tender Offer will be made

following the conclusion of the Company’s upcoming Annual General Meeting.

Annual General Meeting

The Company’s Annual General Meeting will be held on Wednesday, 24th July 2024 at 12.30 p.m. at

60Victoria Embankment, London EC4Y 0JP.

The Portfolio Managers’ will give a presentation to shareholders, reviewing the past year and

commenting on the outlook for the current year. The meeting will be followed by lunch, providing

shareholders with the opportunity to meet the Directors and representatives of the Manager. We look

forward to seeing as many shareholders as possible at the AGM.

For shareholders wishing to follow the AGM proceedings but choosing not to attend in person, we will

be able to welcome you through conferencing software. Details on how to register, together with

access details, will be available shortly on the Company’s website:

www.jpmorganeuropeandiscovery.co.uk

, or by contacting the Company Secretary at

invtrusts.cosec@jpmorgan.com

.

As is normal practice, all voting on the resolutions will be conducted by a poll. Due to technological

reasons, shareholders viewing the meeting via conferencing software will not be able to vote on the

poll and we therefore encourage all shareholders, and particularly those who cannot attend in person,

to exercise their votes in advance of the meeting by completing and submitting their form of proxy.

If you have any detailed or technical questions, it would be helpful if you could raise them in advance

with the Company Secretary at 60 Victoria Embankment, London EC4Y 0JP or via the ‘Ask a Question’

link on the Company’s website. Shareholders who are unable to attend the AGM are encouraged to

use their proxy votes.

If there are any changes to the arrangements for the Annual General Meeting, the Company will

update shareholders through the Company’s website and, if appropriate, through an announcement

on the London Stock Exchange.

European Discovery AR 02 Strategic Report p04-43.qxp 20/06/2024 09:47 Page 9

Chairman’s Statement

10 JPMorgan European Discovery Trust plc – Annual Report & Financial Statements 2024

Strategic Report

Stay Informed

The Company delivers email updates with regular news and views, as well as the latest performance. If

you have not already signed up to receive these communications and you wish to do so, you can opt in

via https://web.gim.jpmorgan.com/emea_investment_trust_subscription/welcome?targetFund=JEDT

or by scanning the QR code on this page.

Outlook

The outlook for European small cap companies seems considerably brighter than when I wrote my

last statement to shareholders for the Half Year Report six months ago. Since then, economic and

financial conditions have improved, and real wage increases should give the recovery further

momentum. It seems very likely that the European Central Bank (‘ECB’) will cut interest rates at least

acouple of times this year which will further improve economic conditions in the region.

These positive developments have already had a favourable impact on investor sentiment. European

small and mid-cap companies tend to outperform as the broader market rallies and based on history

your Company’s carefully selected, high quality, investments should do even better in such markets.

Looking further ahead, as you will read in the Portfolio Managers’ report, the innovative, nimble

businesses that germinate in the small cap and mid cap space are positioned to benefit significantly

from the emerging trends we are seeing, such as the Artificial Intelligence (AI) and research in certain

areas in pharmaceuticals.

These macro and structural developments all bode well for the sector and your Company. Together

with a new investment team and the ongoing support of JPMorgan’s extensive research resources,

the Board is confident that the Company is well positioned to make the most of this supportive

environment to deliver strong results to shareholders over the rest of 2024 and beyond.

Marc van Gelder

Chairman 19th June 2024

European Discovery AR 02 Strategic Report p04-43.qxp 20/06/2024 09:47 Page 10

Investment Manager’s Report

J.P. Morgan Asset Management 11

Strategic Report

This year was a major one for the Company as the decision was made in February to transition the

investment management team to a new team consisting of Jon Ingram, Jack Featherby and

JulesBloch – three experienced portfolio managers with a collective history of 40 years of investing in

European Small Caps.

Through this time, especially following a period of tough absolute and relative performance, we

appreciate the continued support of all our shareholders. We believe that the change in management

team, alongside the continued commitment to the existing investment process, should be positive for

our shareholders. As we, the new managers, step in, we would like to thank both Francesco Conte and

Edward Greaves for their many years of stewardship and we wish them well going forward.

As to the Company, we are very excited about the current investment opportunity in European Small

Caps. Itis an asset class with a fantastic long-term track record. As we write in our outlook below, we

firmly believe that the current set up of the asset class, one supported by multiple tailwinds, align the

Company in a good position to deliver strong returns for you, our shareholders.

Review

The financial year ended 31st March 2024 was marked by dramatic shifts in investor sentiment and

market performance. At the start of the period, global markets were still reverberating from the

collapse of Silicon Valley Bank (SVB) and Credit Suisse in March 2023.

As concerns around a banking crisis receded, markets were swayed by inflation figures and the

corresponding reactions of central banks. As the year progressed, investors welcomed confirmation

that inflation rates were falling. Nonetheless, central banks continued to raise rates, motivated by

concerns that inflation would otherwise become entrenched.

There was almost universal consensus amongst forecasters that Europe was heading into recession,

induced by the compounding effects of a regional energy crisis, Russia’s invasion of Ukraine,

double-digit inflation and monetary tightening that pushed interest rates to their highest level in well

over adecade.

This recession failed to materialise, but these macroeconomic fears still had a significant impact on

European Small Cap stocks which are typically more levered to the economic performance of their

national home markets.

Inflation rates around the world cooled as the year progressed, and central bankers started to

recognise the progress made on the inflation front. In late October 2023, Federal Reserve Chairman

Powell adopted a more dovish stance, marking a significant turning point in investor sentiment.

Global equity markets began a recovery that continued through to the end of the review period.

Though European smaller companies did benefit from the improvement in market sentiment in the

second half of 2023, they have now underperformed European large companies by more than 25%

since September 2021. This is the longest and sharpest period of underperformance in the past

20years. These periods have historically been followed by strong outperformance of European

smaller companies.

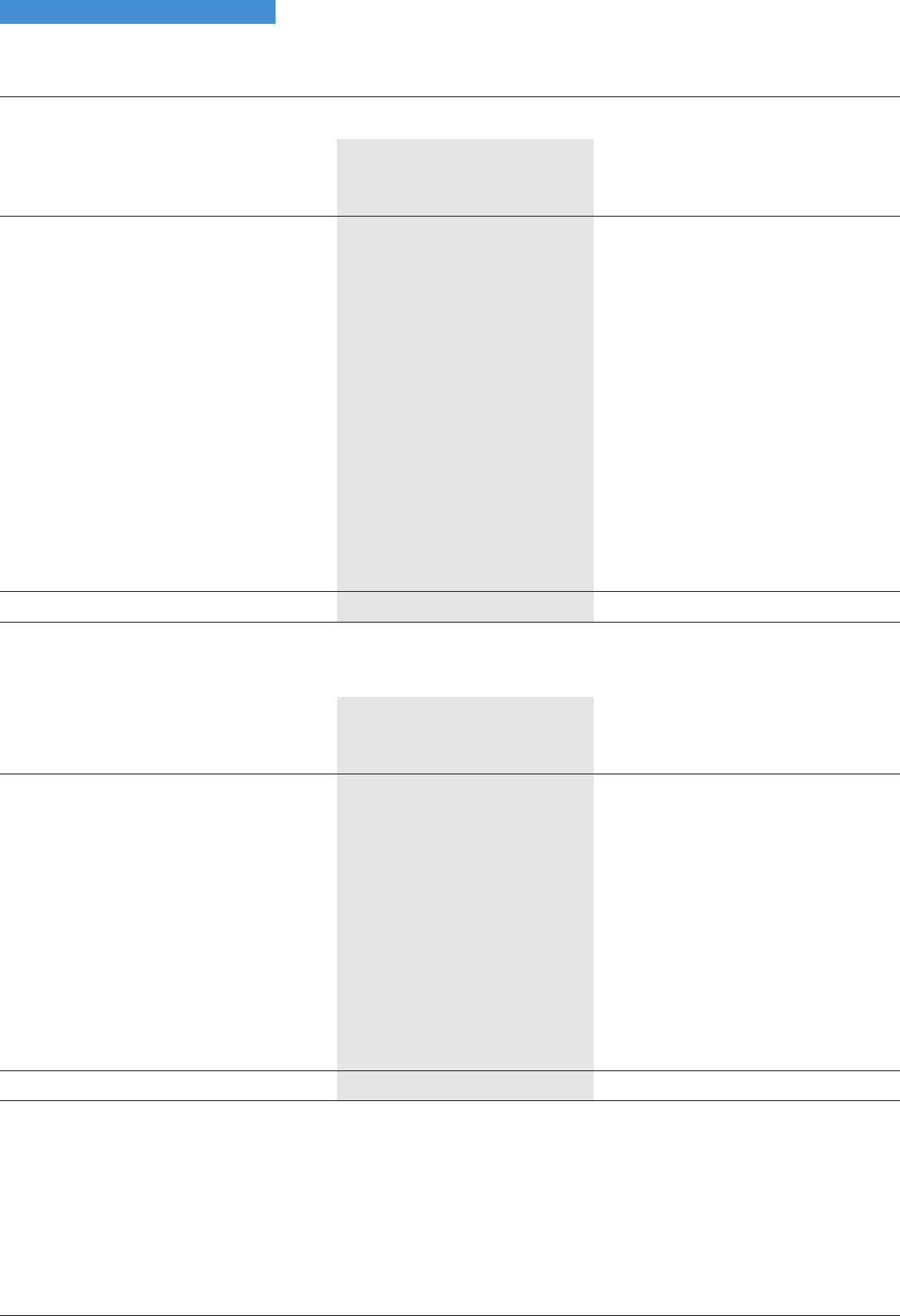

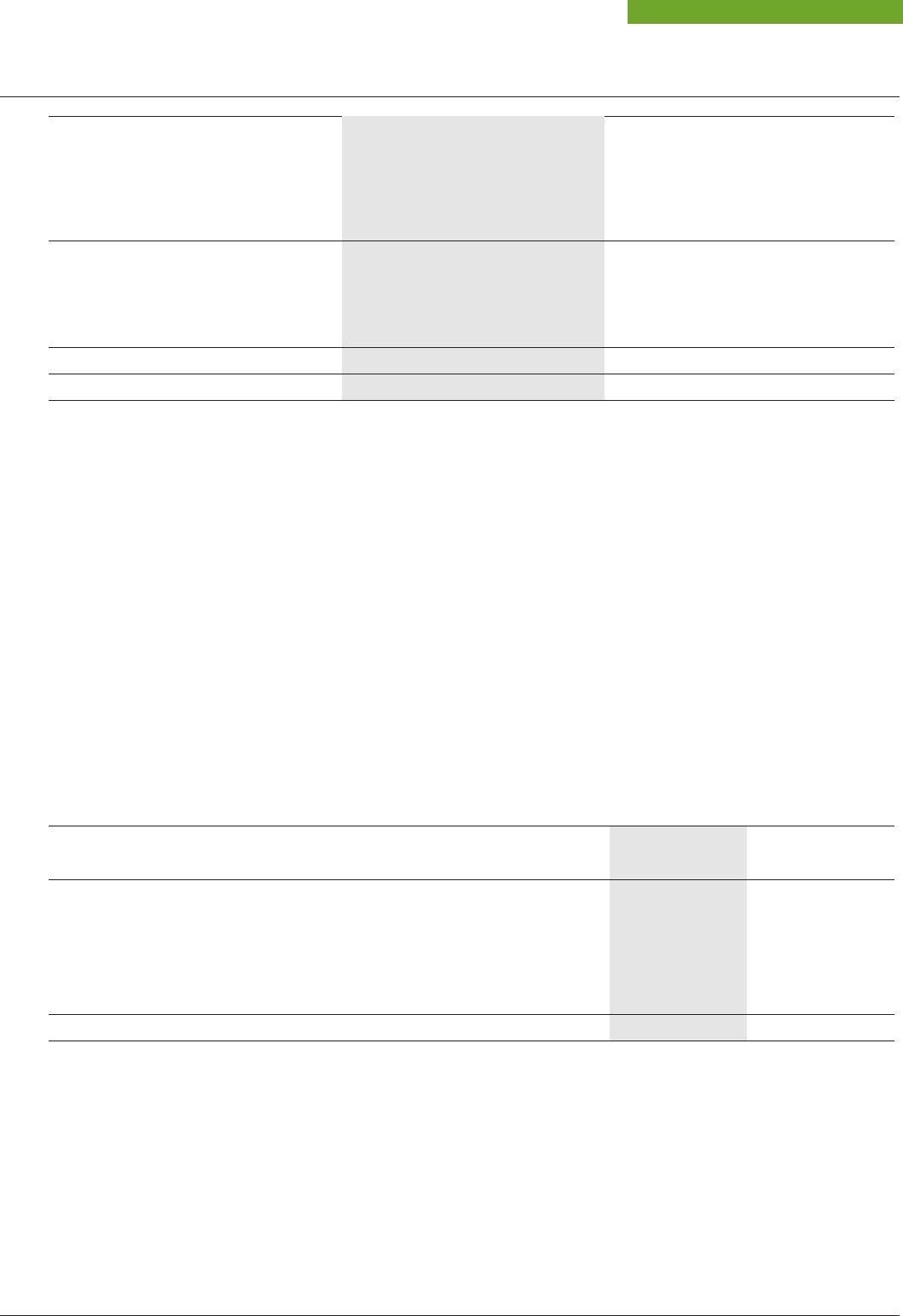

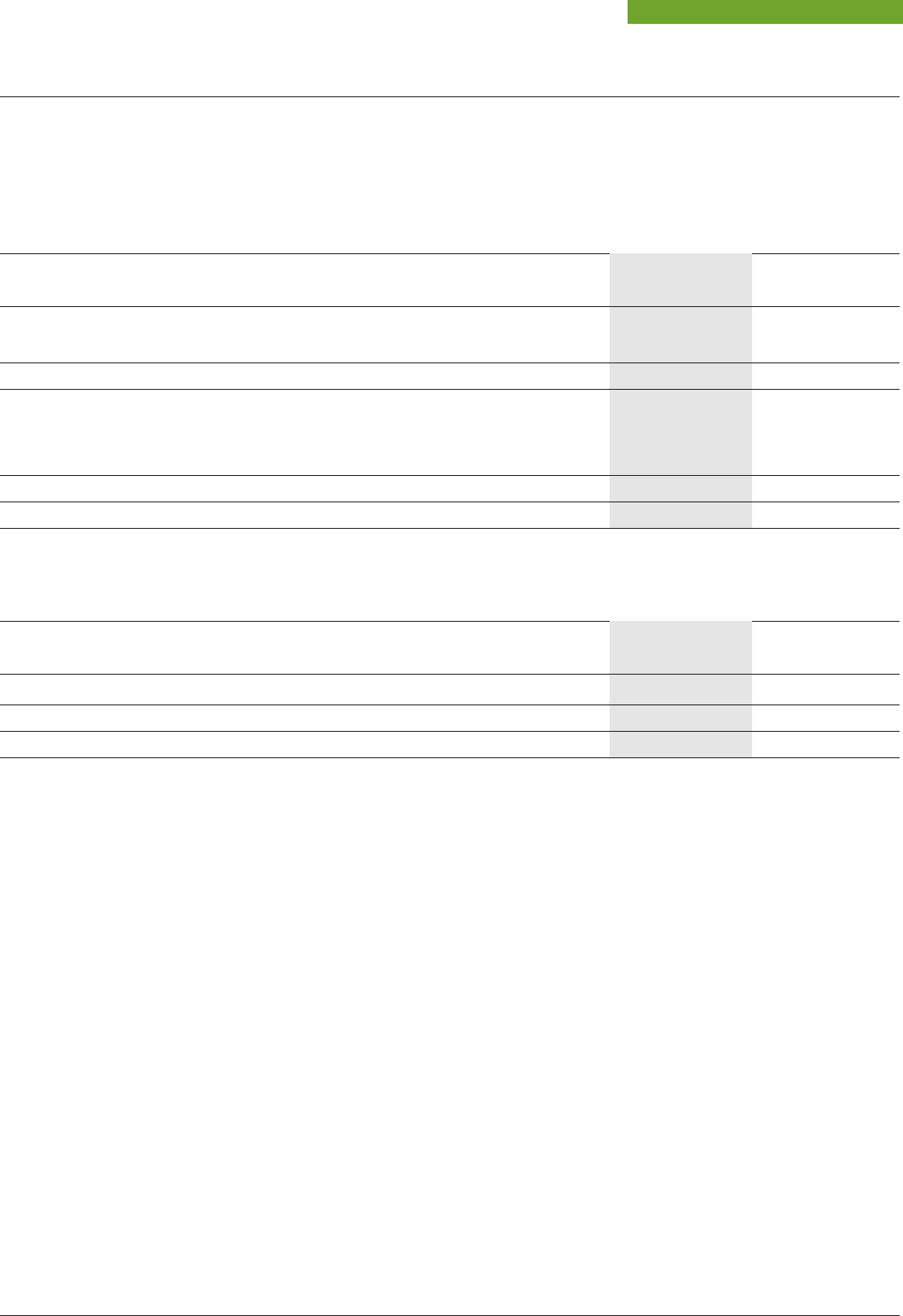

Table 1: Periods of European Small Cap underperformance and the corresponding

performance rebound

Under- 5Y forward

Period Number of months performance outperformance

September 2021 – March 2024 30 –29% Still within period

March 2007 – December 2008 22 –15% 95%

March 2018 – September 2019 19 –10% Still within period

January 2011 – December 2011 12 –10% 53%

March 2014 – October 2014 8 –7% 19%

Source: J.P. Morgan Asset Management, Bloomberg. Large Caps: MSCI Europe, Small Caps: MSCI Europe Small Caps.

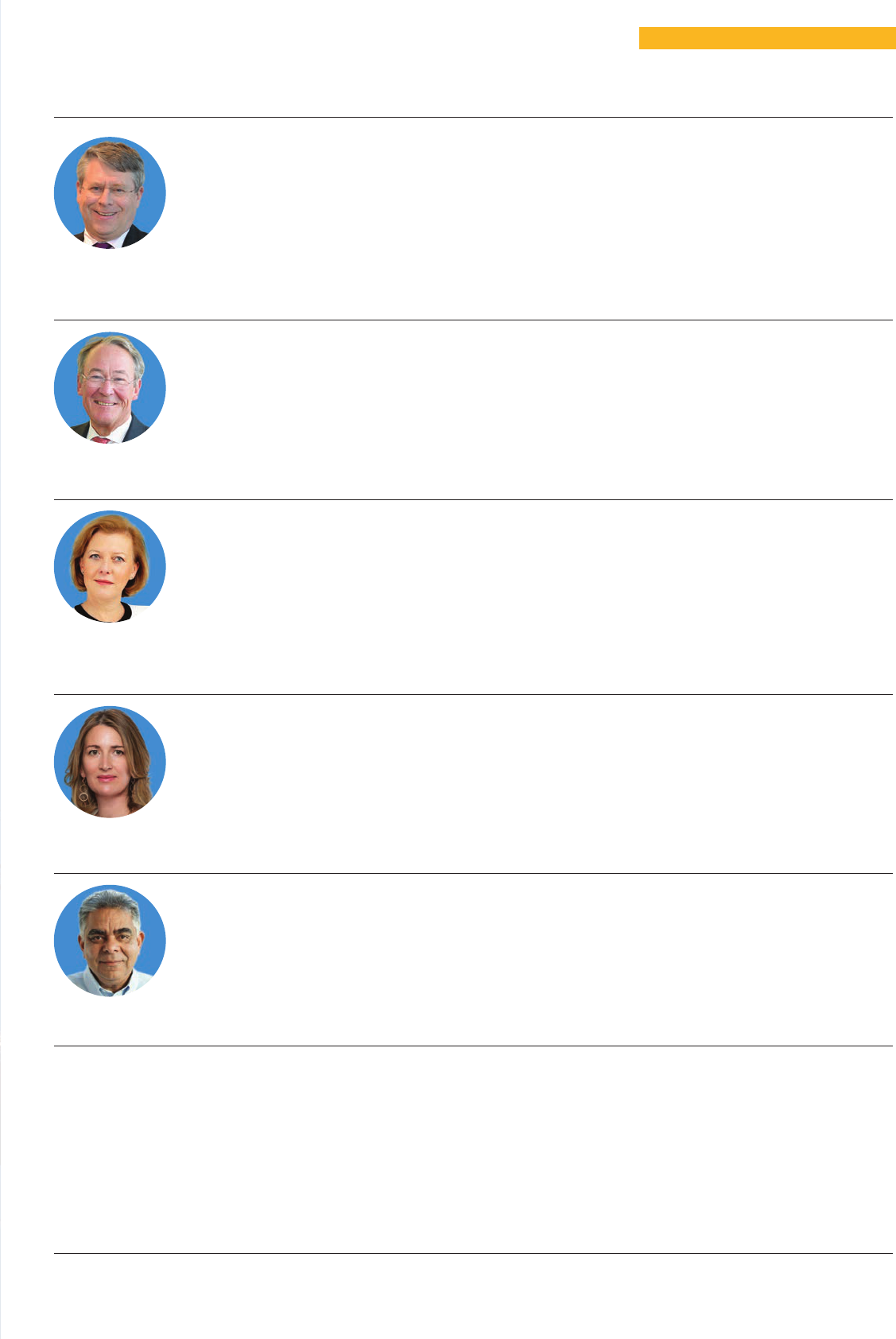

Jon Ingram

Investment Manager

Jack Featherby

Investment Manager

Jules Bloch

Investment Manager

Portfolio Performance

Despite the volatility induced by macroeconomic factors, the Net Asset Value of the Company

increased by 6.8% during the year, outperforming the benchmark by 0.9%.

Performance attribution

Year ended 31st March 2024

% %

Contributions to total returns

Benchmark return +5.9%

Asset allocation –1.6%

Stock selection 1.5%

Gearing/cash effect 1.1%

Currency effect 0.1%

Investment Managers’ added contribution 1.1%

Portfolio return 7.0%

Management fees/other expenses –0.9%

Share Buy-Back 0.7%

Other effects –0.2%

Return on net assets

A

6.8%

Return to shareholders

A

13.0%

Source: JPMAM/Morningstar.

All figures are on a total return basis.

Performance attribution analyses how the Company achieved its recorded performance relative to its benchmark.

A

Alternative Performance Measure (‘APM’).

A glossary of terms and APMs is provided on pages 101 and 102.

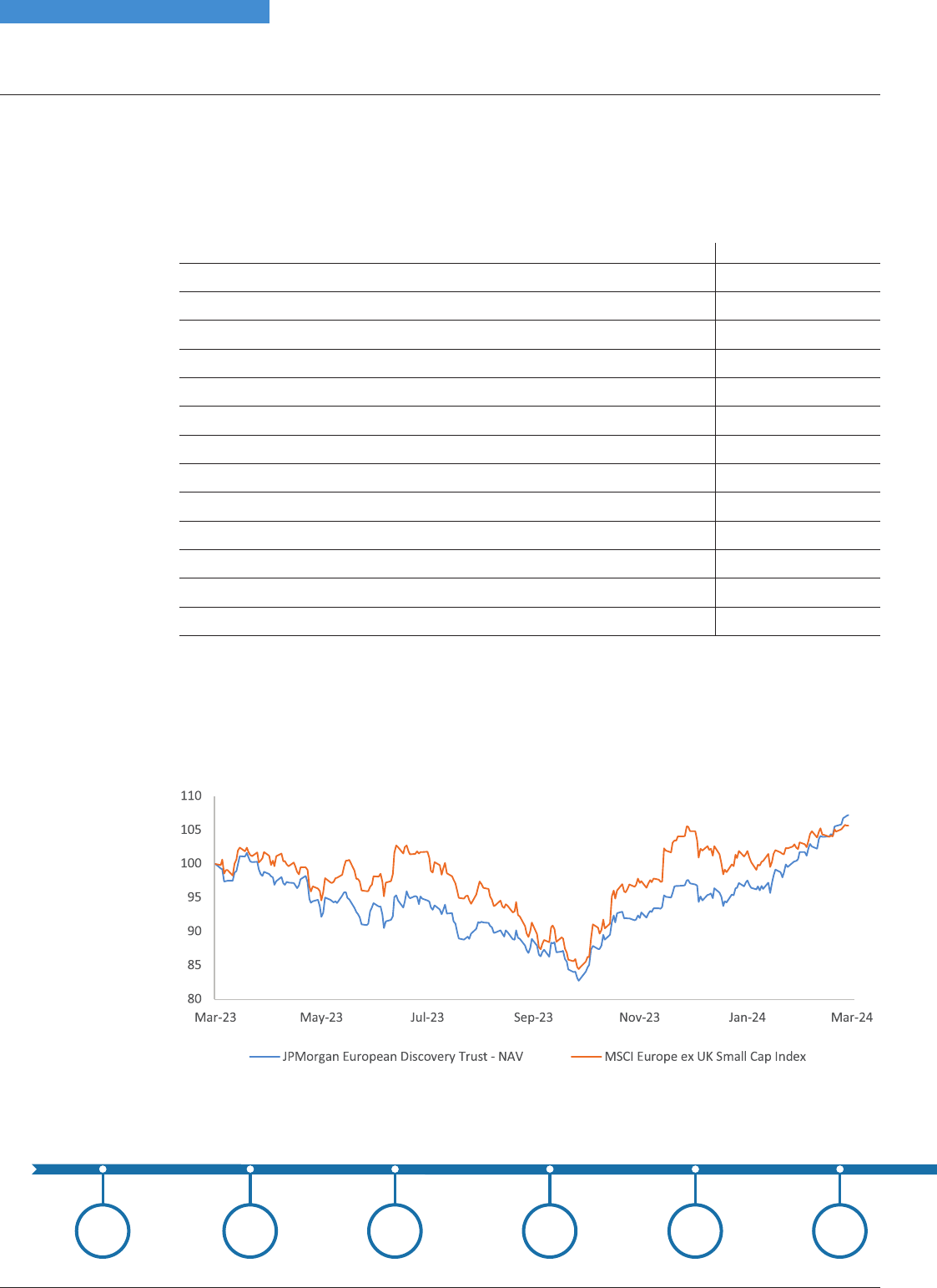

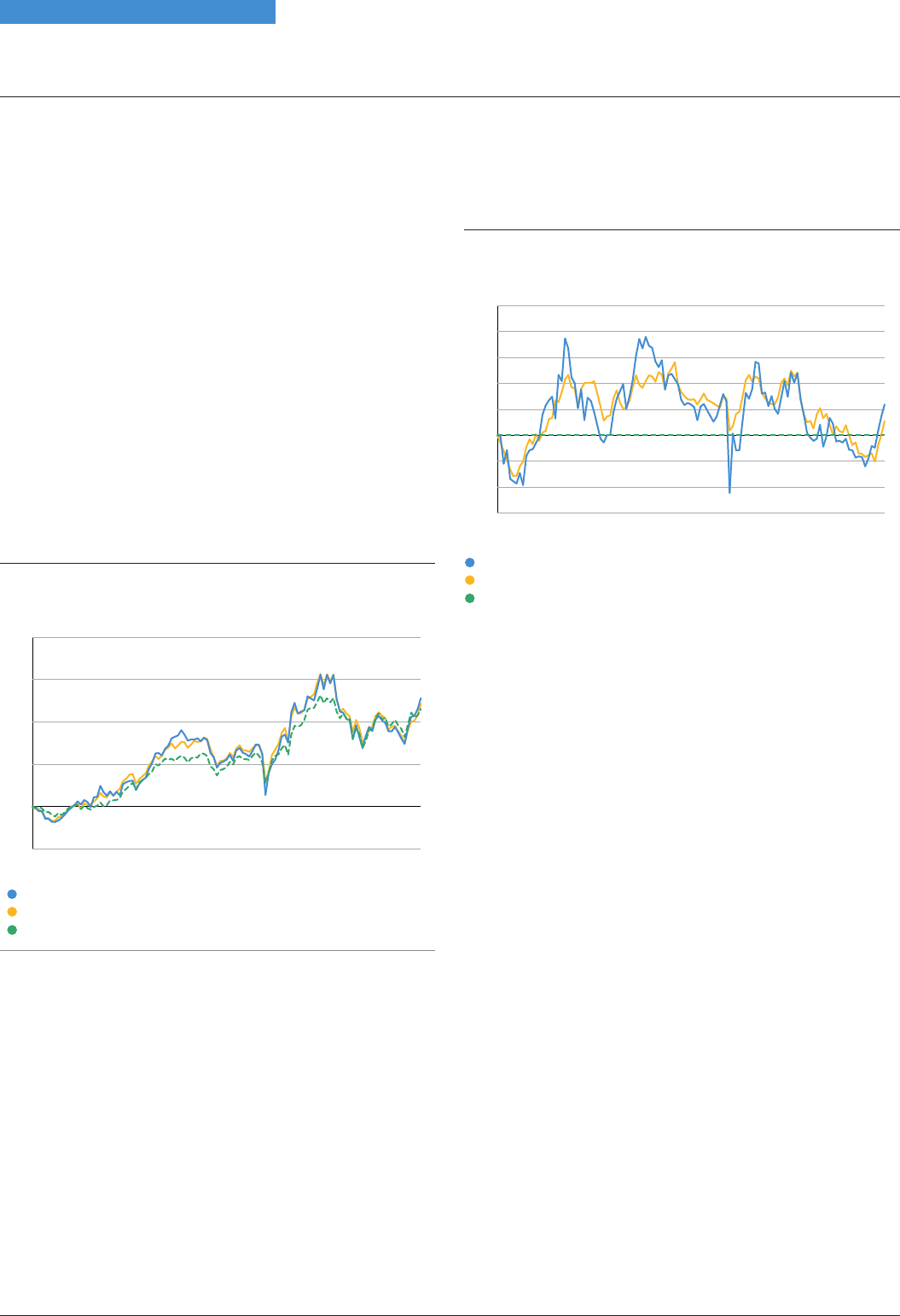

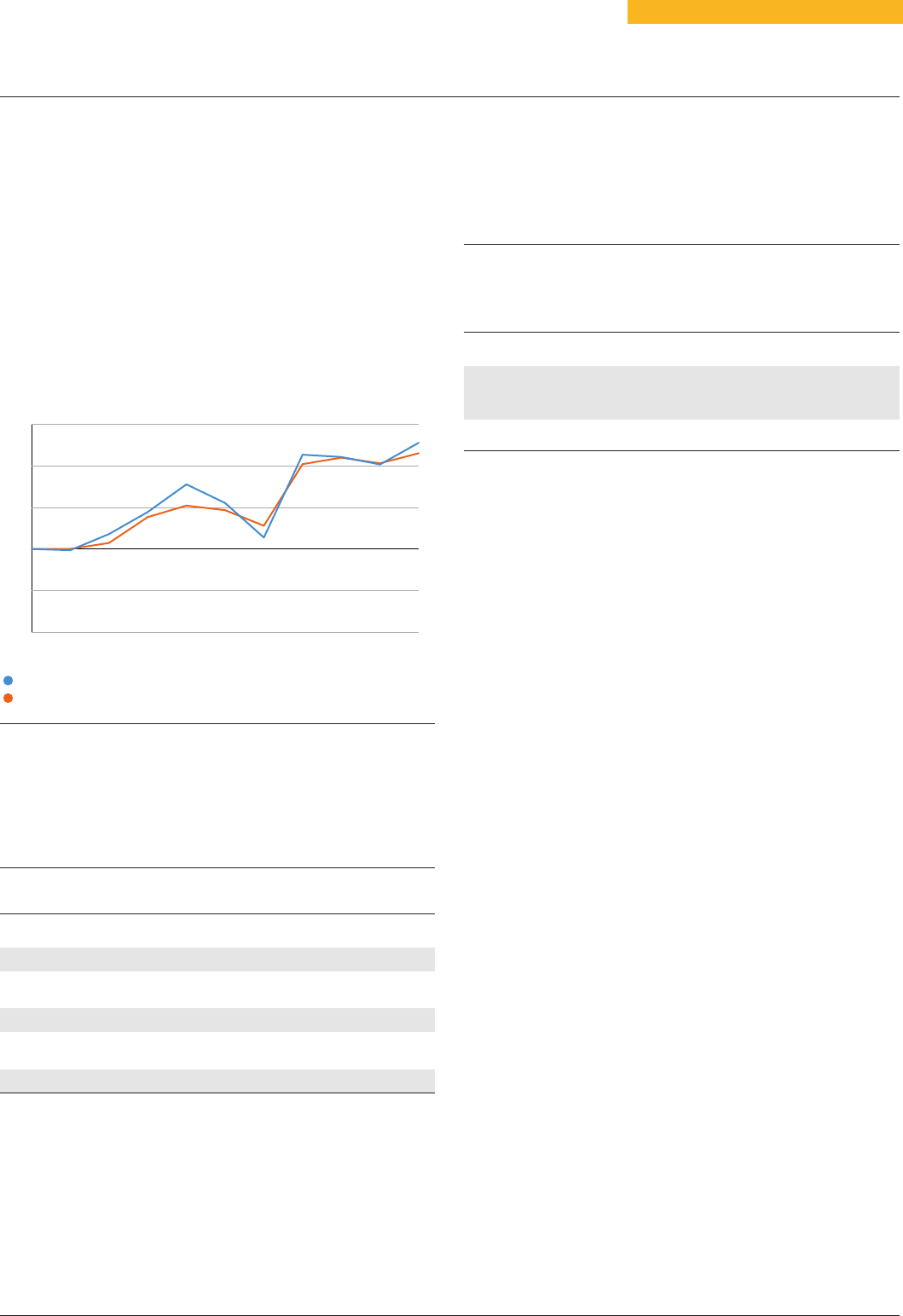

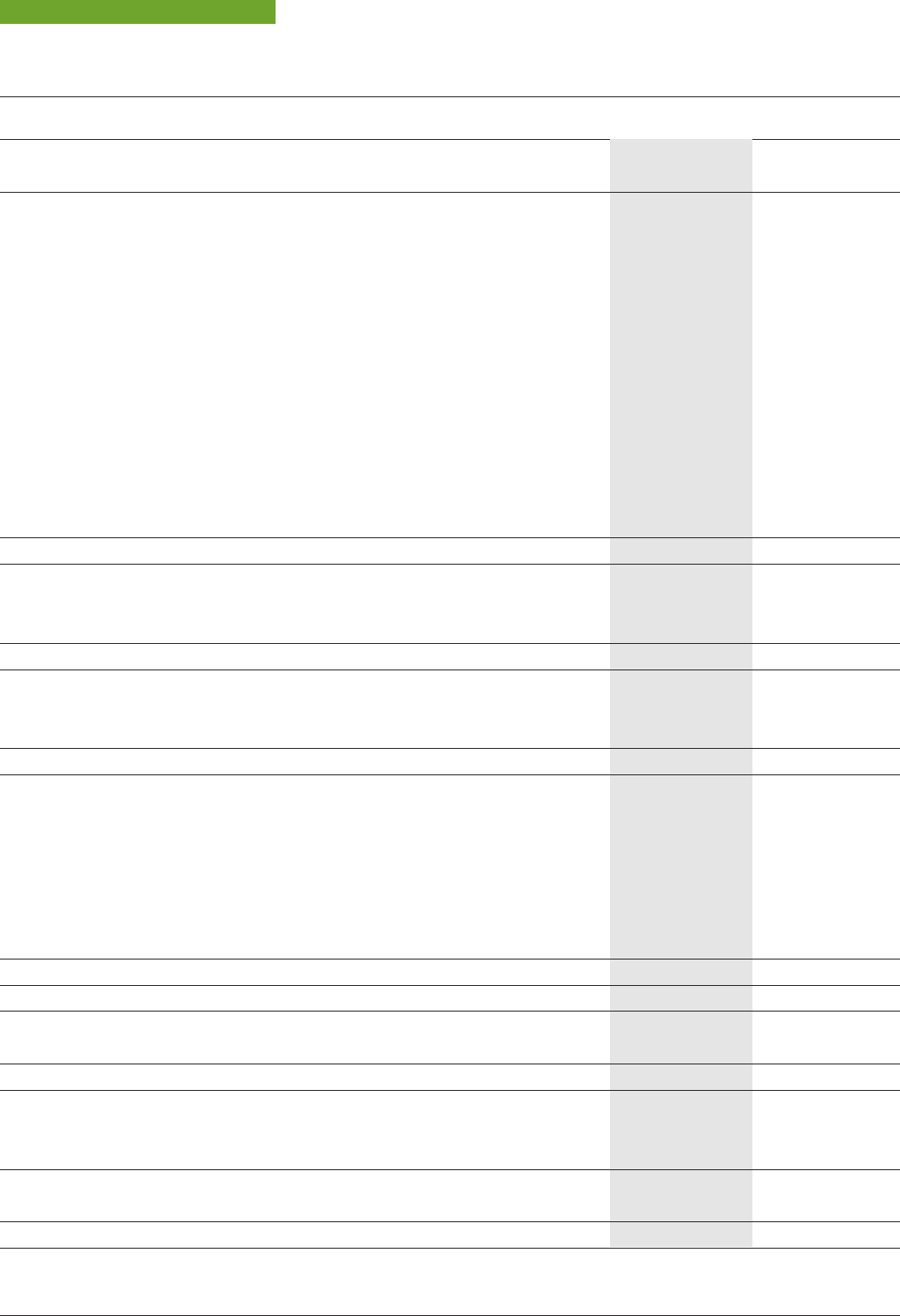

Chart 1: Performance of JPMorgan European Discovery Trust versus MSCI Europe ex UK -Small

Cap Index benchmark

Source: Bloomberg

Investment Manager’s Report

12 JPMorgan European Discovery Trust plc – Annual Report & Financial Statements 2024

Strategic Report

1987

dot com boom

2000

Euro

introduced

2002

Global banking

crisis

2008

Formation of

the Company

1987

Fall of

Berlin Wall

1989

European

single market

created

1993

European Discovery AR 02 Strategic Report p04-43.qxp 20/06/2024 09:47 Page 12

Investment Manager’s Report

J.P. Morgan Asset Management 13

Strategic Report

The relative performance of the Company has been volatile during the year. Performance was

adversely impacted in periods where macroeconomic themes dominated. For instance, the portfolio

underperformed in the last quarter of 2023, when expectations of significant interest rate cuts fuelled

a substantial rally in low-quality and high-risk companies.

However, since the start of 2024, company fundamentals have become the main driver of share price

performance again. In the first three months of 2024, the NAV increased 10.4% compared to 2.1% for

the MSCI Europe ex-UK Small Cap index.

Sector contribution

Table 2: Sector performance – Top 3 and Bottom 3 sectors contributing to performance

Account (%) Benchmark (%) Attribution (%)

Group Avg Wgt Return Avg Wgt Return Selection Allocation Total

Communication

Services 6.28 21.78 4.77 8.67 0.84 0.03 0.87

Materials 5.17 7.32 7.91 –4.08 0.51 0.20 0.71

Financials 14.01 35.30 13.92 26.16 0.88 –0.22 0.67

Utilities 0.82 –4.28 2.78 3.18 –0.25 –0.04 –0.29

Consumer

Discretionary 17.42 0.23 8.22 0.41 –0.03 –0.76 –0.79

Information

Technology 12.70 –13.25 10.48 -6.29 –1.30 –0.01 –1.31

Source: J.P. Morgan Asset Management.

Our overweight to Communication Services contributed positively to performance during the year. Our

large overweight in CTS Eventim, the German online ticketing platform, delivered strong performance;

the cost of live entertainment skyrocketed in 2023 due to increased demand as consumers returned

to the experiences they missed out on during the pandemic. Ticketing platforms benefitted from this

‘revenge spending’ which shows no sign of abating.

The positive attribution from Materials is the result of our underweight to companies that have been

hurt by energy prices, have structurally low returns on invested capital or were delivering earnings

that we thought were not maintainable. Our focus on defensive companies with strong balance sheets

and high cash flow conversion allowed us to outperform the sector. This includes the German

producer of industrial lubricants Fuchs Petrolub, which has a robust medium-term volume growth

potential because of recent capacity investments, while the deflation in base oils is a tailwind to its

margins and cash flows.

Despite the volatility induced by the collapse of SVB and Credit Suisse at the start of the period, the

Financial sector was one of the largest contributors to returns at the sectoral level. After it became

clear that these bank failures were isolated events, this undervalued sector stabilised and reaped the

benefits from high interest rates and low bankruptcy rates. Our investment in BPER Banca, the Italian

banking group, performed particularly strongly for these reasons.

The largest sectoral detractor from performance was the portfolio’s stock selection in Information

Technology. Our exposure to automotive semiconductor companies such as Melexis and Elmos

suffered from the sharp slowdown in the electric vehicle market and fears of a broad-based

2024

EU referendum

vote

June

2016

Synchronised

global economic

recovery

2017

Euro

crisis

2012

Escalating trade

tensions between

US and China

2018/

2019

COVID-19

outbreak

Early

2020

Vaccine programme

roll-out

2021

Russia-Ukraine

War

2022

European Discovery AR 02 Strategic Report p04-43.qxp 20/06/2024 09:47 Page 13

destocking from automotive OEMs. Our overweight to IT consulting companies such as Alten, Reply

and Tietoevry also contributed negatively as clients postponed some IT and innovation projects due to

macroeconomic uncertainty.

The portfolio’s overweight to Consumer Discretionary also contributed negatively. Elevated rates of

inflation and increasing interest rates eroded consumer confidence in 2023. Our overweight to auto

suppliers such as Forvia and Plastic Omnium contributed negatively as they were hit by significant

cost inflation, leaving their levered balance sheets under pressure. Other companies related to

construction such as JM (a Swedish housing developer) or Ariston (an Italian manufacturer of heating

solutions) also suffered from the impact of tightening monetary policies.

Stock contribution

Table 3: Investment performance – Top 3 and Bottom 3 investments contributing to performance

Account (%) Benchmark (%)

Security Name Avg Wgt Return Avg Wgt Return Wgt Diff Total Effect

Top 3 Contributors

SPIE 3.45 30.07 0.49 29.28 2.96 0.71

Arcadis 2.18 48.14 0.39 48.56 1.78 0.57

CTS Eventim 2.49 41.69 0.47 41.46 2.02 0.56

Bottom 3 Contributors

Bravida 2.26 –21.71 0.20 –22.25 2.06 –0.85

Melexis 1.90 –28.42 0.21 –29.25 1.69 –0.78

Forvia 0.81 –44.14 0.37 –31.44 0.44 –0.76

Source: J.P. Morgan Asset Management.

During the year our biggest contributors to performance at the stock level were: SPIE, the French

technical services company, as demand for installation of electrical systems was boosted by the

ongoing energy transition towards electrification; Arcadis, the Dutch engineering and architecture

services company, which has benefitted from strong infrastructure investments in the US and in

Europe; and CTS Eventim, as demand for live events continued to grow significantly post-COVID.

The biggest detractors to performance were Bravida, the Swedish multi-technical services company,

as the sharp slowdown in Swedish residential construction led to significant pricing pressure for

installers; Melexis, the Belgian manufacturer of automotive chips, as automotive manufacturers who

over-ordered chips due to post-COVID supply chain constraints now have to reduce their inventories

in a slowing demand environment; and Forvia, the French automotive supplier, as the company did

not manage to increase prices enough, while increasing interest rates put pressure on a stretched

balance sheet.

Portfolio Changes

During the review period, we aimed to position the Company to take best advantage of the

opportunities available.

We acquired several Healthcare companies with strong innovation pipelines, thereby increasing our

allocation to the Healthcare sector. These included Zealand Pharma, a Danish biotech company with

interesting weight-loss assets. We believe the development of anti-obesity drugs has become a key

structural driver of the Healthcare sector, and Zealand Pharma offers exposure via its long-acting

Investment Manager’s Report

14 JPMorgan European Discovery Trust plc – Annual Report & Financial Statements 2024

Strategic Report

European Discovery AR 02 Strategic Report p04-43.qxp 20/06/2024 09:47 Page 14

Investment Manager’s Report

J.P. Morgan Asset Management 15

Strategic Report

amylin petrelintide. This drug could have a better tolerability profile than existing weight-loss drugs,

and thus offer a superior patient experience. We also purchased Bonesupport, a Swedish

biotechnology company with a unique and innovative bone graft technology platform which is

perceived as vastly superior to current standards of care, with lower deep infection rates and a higher

rate of bone union. Bonesupport’s offering is now approved for various applications, which will allow

the company to grow very rapidly.

We also identified several attractive investment opportunities in the Energy sector. After years of

underinvestment in energy infrastructure, recent changes in the geopolitical landscape are reshaping

energy supply chains. This has been positive for European companies in the sector, which still trade at

attractive valuations. One such company is Vallourec, a French producer of premium pipes for oil &

gas drilling and distribution. In the past 18 months, a new management team has cut debt, closed

loss-making operations across Europe, and re-focused commercial efforts on high-margin

applications. As a result, Vallourec is now a profitable and cash-flow generative business, trading at

an appealing valuation. We also purchased GTT, a French engineering company specialising in the

design of cryogenic membrane containment systems for liquid natural gas (LNG) shipping and

storage. LNG’s share of the world’s energy consumption is increasing as the world strives to cut its

dependence on energy sources with higher carbon emissions. The war in Ukraine has accelerated

investments in liquefaction and LNG transportation, which materially improved GTT’s growth

prospects.

Real Estate is the other area to which we increased exposure. With inflation under control, and interest

rates set to decline, we expect real estate companies with strong balance sheets to start trading

closer to the net asset value (NAV) of their underlying assets. We purchased TAG Immobilien,

aGerman residential company. TAG’s stock trades at a significant discount to NAV despite a low-risk

leverage ratio, high occupancy rates, increasing rents and an attractive growth pipeline in the Polish

market. We also bought Merlin Properties, which owns diversified real estate assets in Spain. Merlin

has a strong balance sheet and will use its financial firepower to invest in data centres, which are

expected to see sustained demand from the rapidly rising appetite for data processing and storage.

We expect this growth to be value accretive for Merlin, but the stock still trades at a significant

discount to the portfolio’s NAV.

To fund these purchases, we reduced overweights to IT and Industrials. Within the Technology sector,

we adopted a more cautious stance on automotive semiconductors. In the post-pandemic recovery,

automotive component companies struggled to source chips due to supply chain disruptions. This

benefited chip manufacturers, as availability became more important than price. However, automotive

component makers now have adequate levels of chip inventories and demand for electric vehicles is

slowing. The earnings growth prospects for automotive chip manufacturers are therefore less

attractive and we have reduced exposure accordingly. We sold Elmos Semiconductors and Melexis

due to their deteriorating operating momentum.

Within Industrials, we reduced our exposure to companies with high exposure to construction; activity

in the sector has suffered due to the rapid rise in interest rates. Building permits in Germany are down

almost 50% from the peak levels of 2021. During the year, we sold industrial companies such as Georg

Fischer (which produces piping systems), Ariston (a supplier of heating systems), Aalberts (which

makes flow control devices) and AFRY (an architectural services company). Other names in the

Industrial sector such as Prysmian, Trelleborg and d’Ieteren were sold because they left our

investment universe following strong performance.

European Discovery AR 02 Strategic Report p04-43.qxp 20/06/2024 09:47 Page 15

Investment Manager’s Report

16 JPMorgan European Discovery Trust plc – Annual Report & Financial Statements 2024

Strategic Report

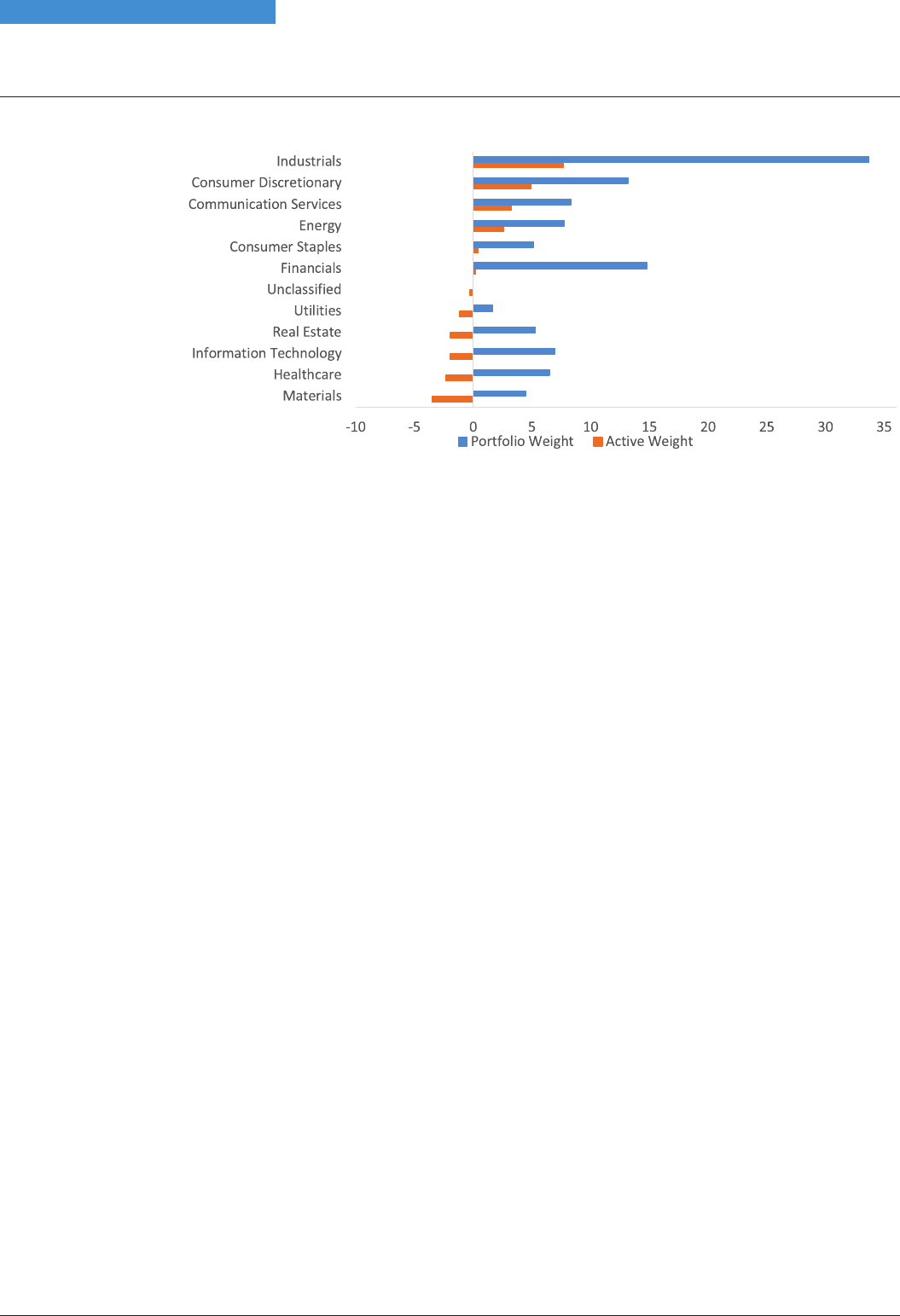

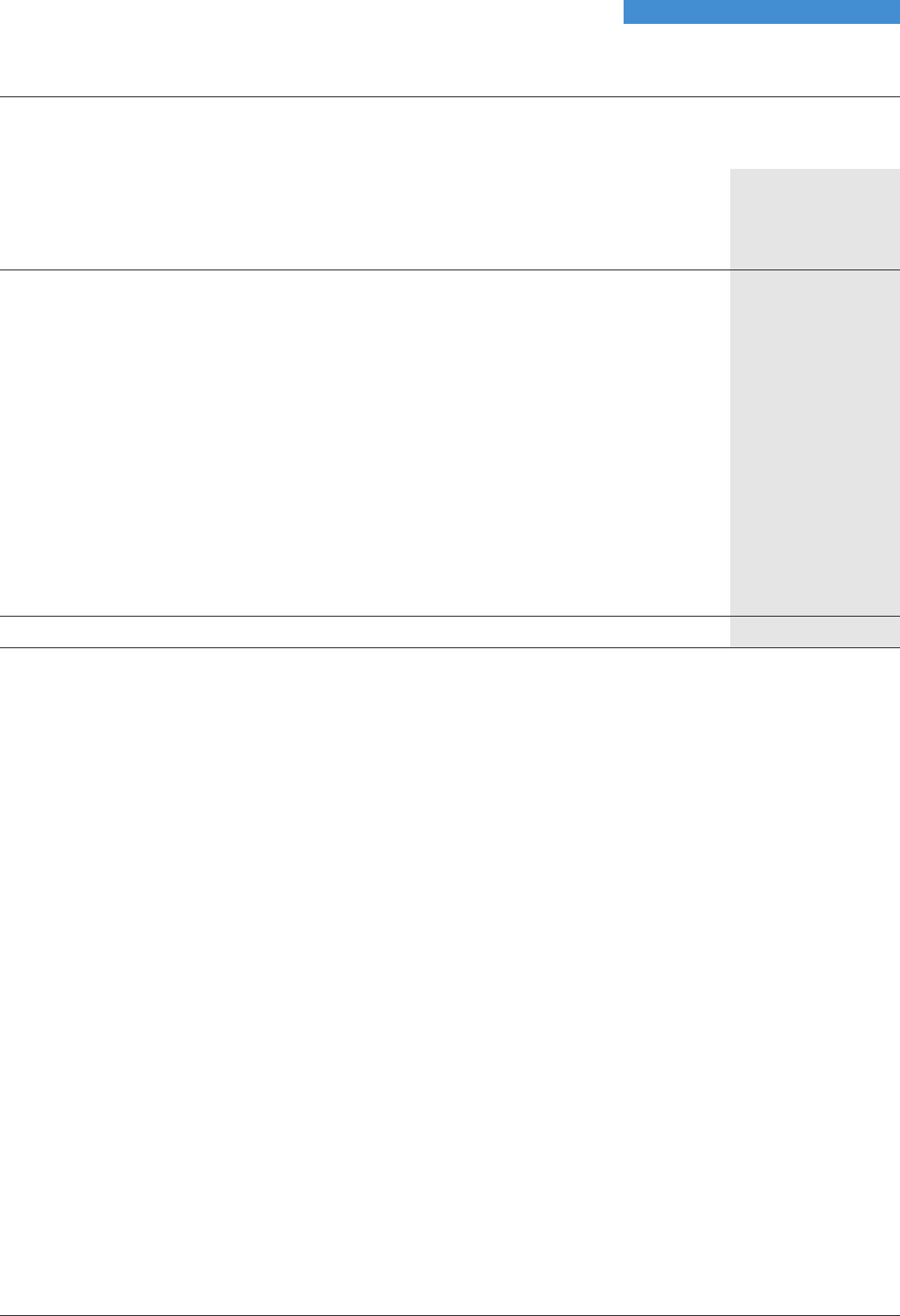

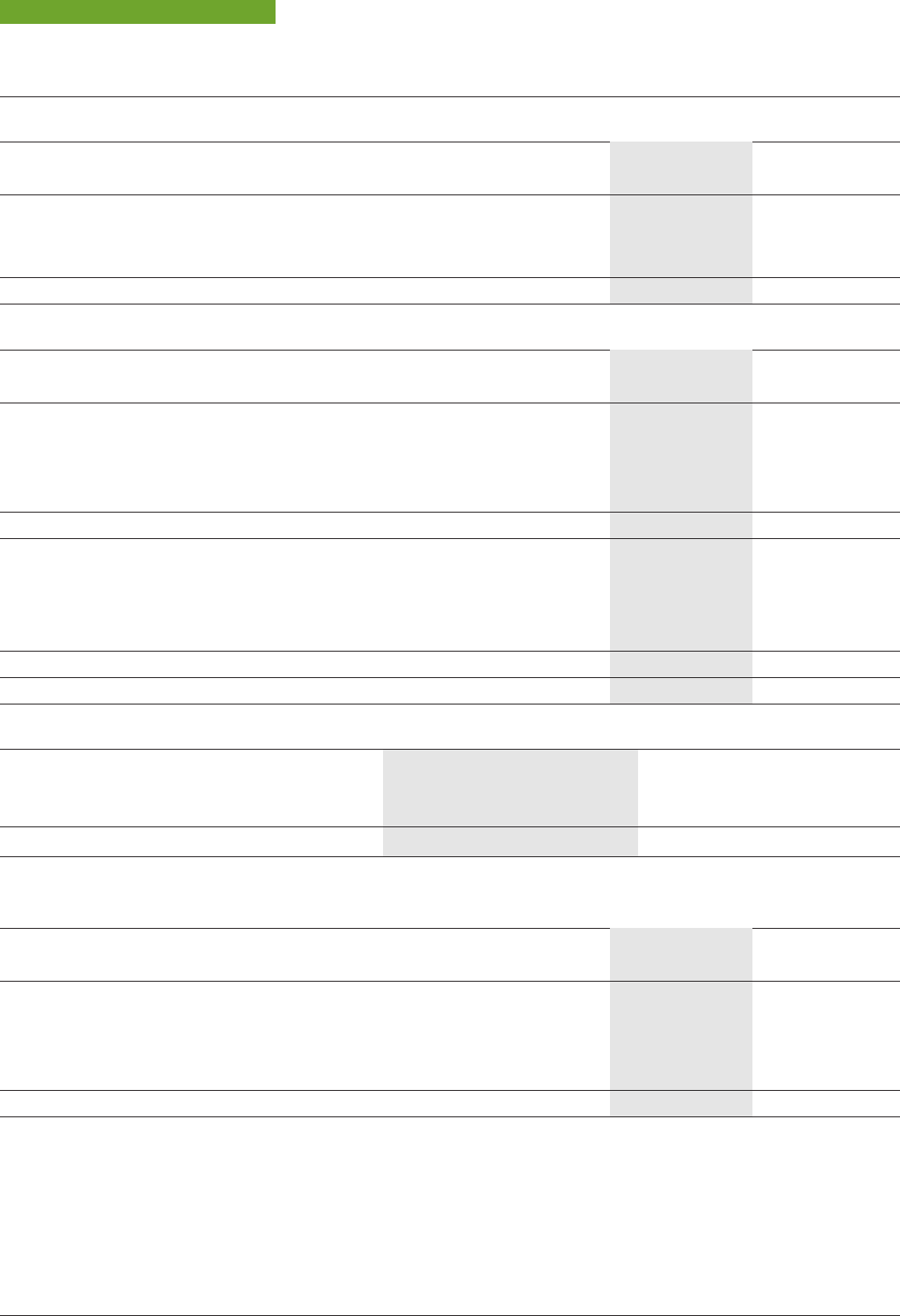

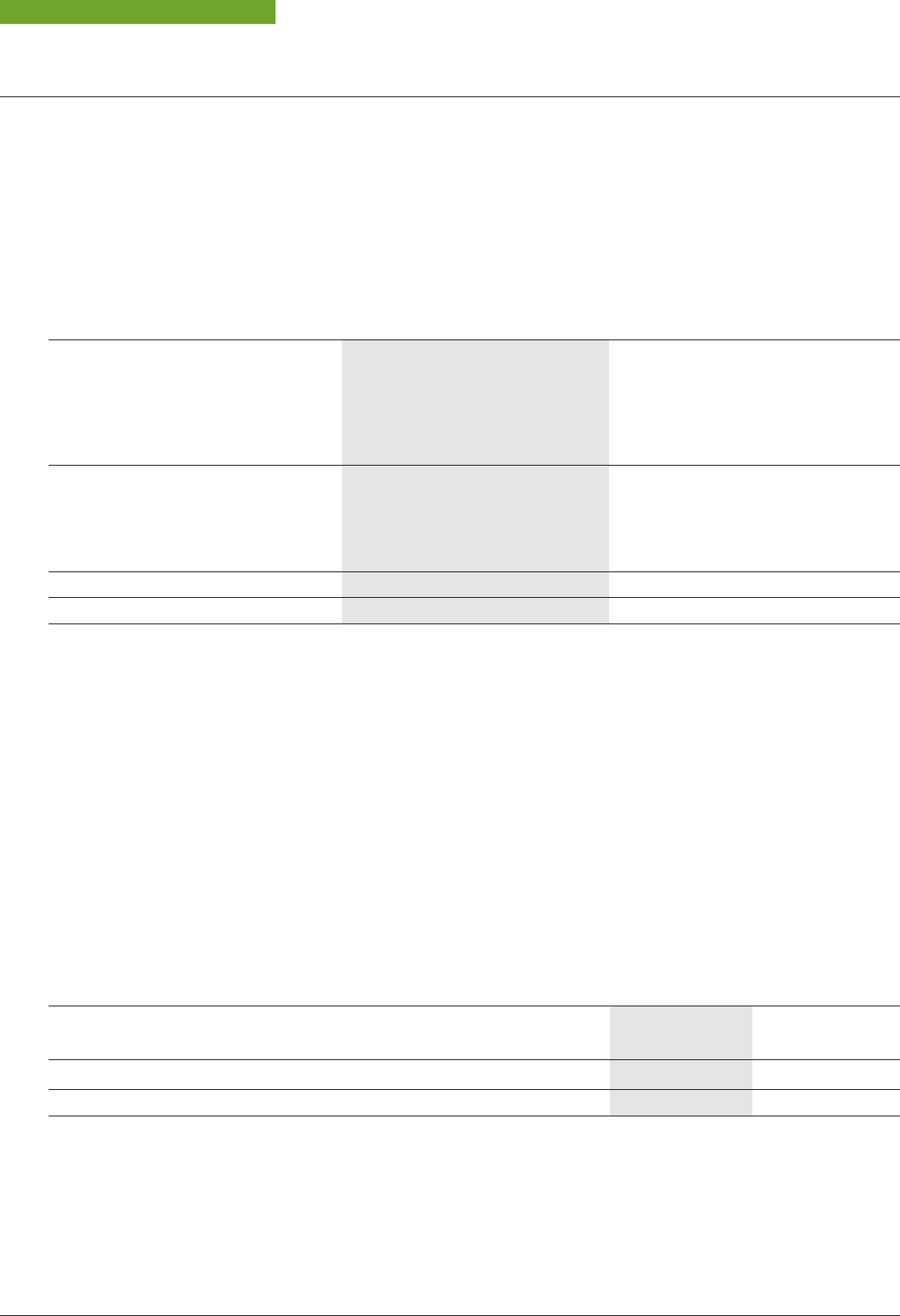

Chart 2: Current Portfolio Positioning

Source: J.P. Morgan Asset Management.

Despite the disposal of these companies, Industrials remain the portfolio’s most significant

overweight. Any recovery in manufacturing activity would provide a tailwind for many of the industrial

companies we own, but our holdings have company-specific drivers that should help them perform

regardless of the economic environment. Do&Co for example is an Austrian airline catering company

taking market share from struggling peers thanks to its unique ‘premium fresh cuisine’ branding. An

economic slowdown is unlikely to slow the pace at which the company opens new locations and signs

new airlines. Another holding, Bilfinger, is a German industrial services company whose new

management is implementing better risk controls and pricing mechanisms, which should

significantly increase their operating margin. Although an improvement in economic conditions

would help, the stock’s performance will depend mainly on these internal reforms.

The same is true for our overweight to Consumer Discretionary. Consumer confidence, growth in real

disposable income and the unemployment rate are all significant drivers of consumer spending. With

inflation and energy prices falling, consumer sentiment in Europe has rebounded from the lows of

September 2022. This should help the businesses we own in the sector, but their strong brands and

exposure to structurally growing categories are more significant drivers of stock performance. For

example, De’Longhi, an Italian manufacturer of home appliances, has built a solid reputation for

‘premium quality at the press of a button’ coffee machines, allowing it to benefit from the significant

growth in global coffee consumption. Sanlorenzo’s tailor-made and exclusive superyachts are

recognised for their exceptional Italian design, which makes them appealing to a growing population

of ultra-high-net-worth individuals.

Materials continues to be the portfolio’s largest sectoral underweight. Many companies in the sector

are commoditised, capital intensive, cyclical businesses, with a poor track record of shareholder value

creation. Strong post-pandemic demand and the sharp increase in energy prices after the invasion of

Ukraine significantly boosted the price of materials. However, the subsequent rapid fall in gas and

electricity prices will at some point turn into a headwind for earnings in the sector. During the year we

sold our position in Verallia, the French glassmaker. The shortage of glass in 2022 and early 2023 gave

glassmakers exceptional pricing power. We doubt these earnings will be maintainable.

Despite some sectoral over and underweights, our sector allocation is balanced relative to

benchmark, as every sector is offering attractive investment propositions. Investors’ focus on

macroeconomic variables and their implications for monetary policy has led to a raft of valuation

dislocations. Not only are small cap valuations extremely attractive compared to history, but we think

the opportunity set for alpha creation through stock-picking is also wider than usual.

European Discovery AR 02 Strategic Report p04-43.qxp 20/06/2024 09:47 Page 16

Investment Manager’s Report

J.P. Morgan Asset Management 17

Strategic Report

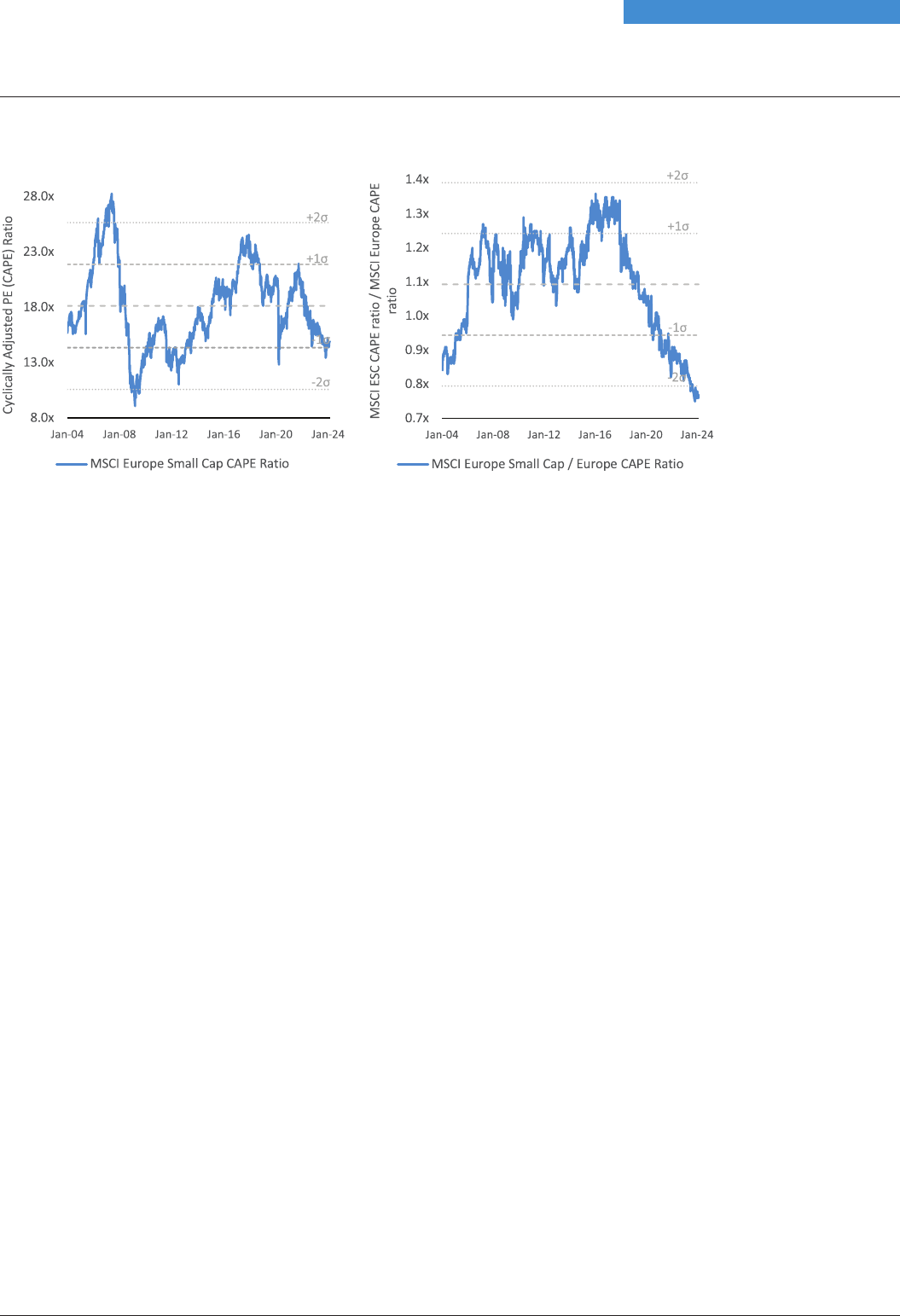

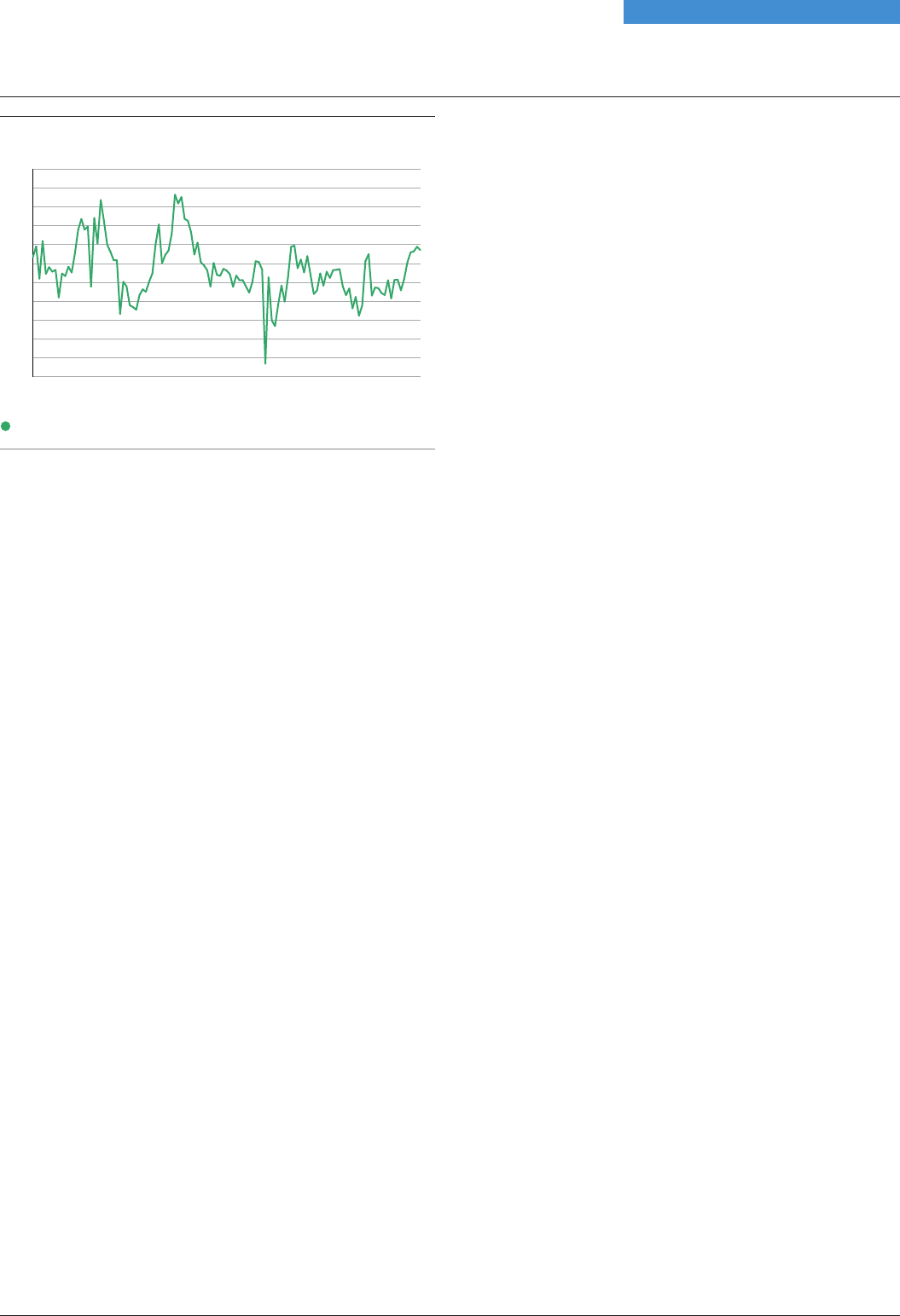

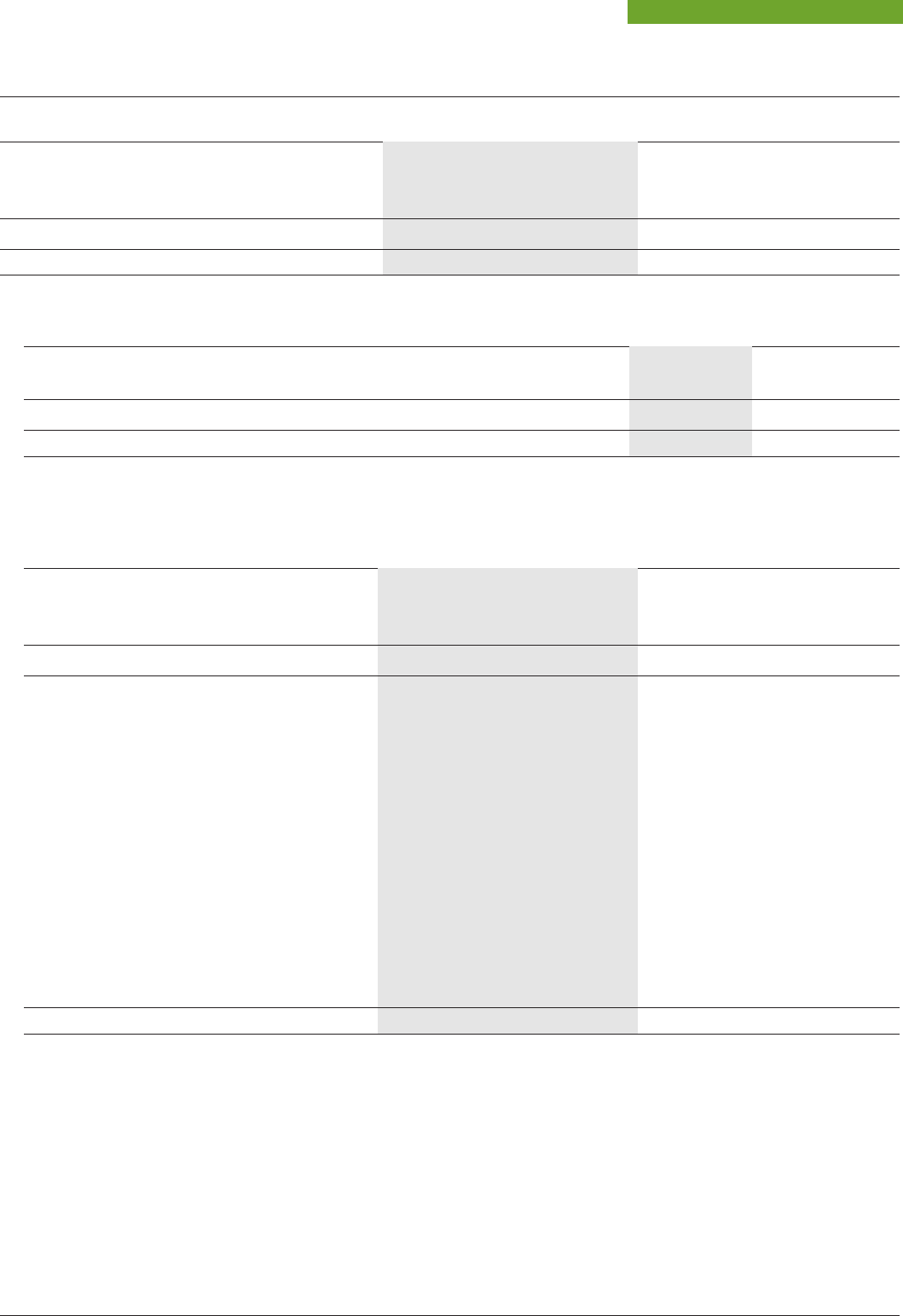

Chart 3: Small cap cyclically adjusted PE ratios, on an absolute basis (LHS) and versus large

caps (RHS)

Source: J.P. Morgan Asset Management.

Our ability to use gearing to increase market exposure has the potential to further enhance returns in

a rising market. Gearing stood at 7.9% at the end March 2024 and has since remained stable.

Outlook

Because of the attractive valuations European smaller companies currently trade at, we think the

expected return for the asset class is higher than usual. In addition, the macroeconomic headwinds

the asset class faced over recent years are now fading. The market expects the ECB to cut interest

rates during 2024 and this should boost investor sentiment, thereby benefitting small cap companies.

Furthermore, the latest data points suggest that global and European economies are more resilient

than anticipated. Indicators such as Purchasing Managers’ Index (‘PMI’) appeared to have bottomed.

And for the first time in years, major European economies are seeing growth in real wages, which

should continue to improve consumer confidence.

The asset class should receive further support from the resurgence of mergers and acquisitions

(M&A) activity. There has been a lull in deal flow within the European Small Caps space in recent years,

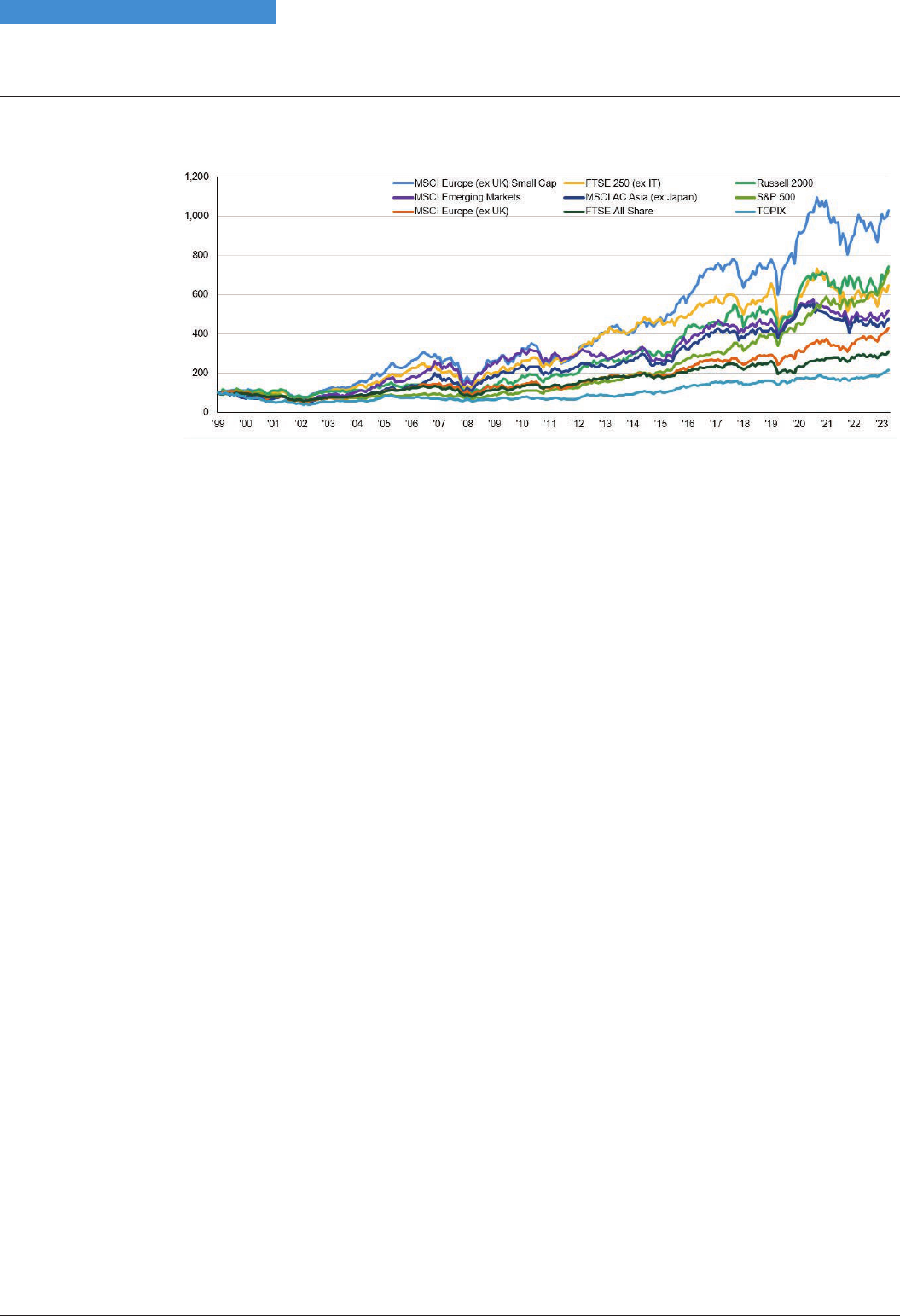

but attractive valuations and the prospect of lower rates could drive a marked pick-up in M&A activity.

Small cap companies are also likely to be supported over the longer-term by emerging themes such

as Artificial Intelligence (AI) and drug-assisted weight loss. To date, both these themes have mostly

played out in the mega cap space. However, the main point for small cap investors is that most of

tomorrow’s winners might be today’s small caps. For example, Amazon and ASML were small caps

back in 2000, while Tesla and Meta were not even founded.

It is our strong conviction that many of the companies which will be most successful in capitalising on

the AI revolution, pharmaceutical breakthroughs and other emergent structural trends over the

coming years are yet to be identified, or even conceived, and are thus most likely to emerge from the

small cap space.

We expect this confluence of attractive valuations, favourable macroeconomic trends, and long-term

thematic developments to act as key drivers for small caps, which have outperformed every asset

class globally over the past 25 years.

All this leaves us feeling positive about the prospects for the portfolio. In fact, in our view, the outlook

has rarely been brighter, and we expect our shareholders to benefit accordingly.

European Discovery AR 02 Strategic Report p04-43.qxp 20/06/2024 09:47 Page 17

Chart 4: A compelling long term asset class

Cumulative returns

Source: J.P. Morgan Asset Management.

Jon Ingram

Jack Featherby

Jules Bloch

Investment Managers 19th June 2024

Investment Manager’s Report

18 JPMorgan European Discovery Trust plc – Annual Report & Financial Statements 2024

Strategic Report

European Discovery AR 02 Strategic Report p04-43.qxp 20/06/2024 09:47 Page 18

Manager’s Investment Process

J.P. Morgan Asset Management 19

Strategic Report

During the past year, the investment management of the Company continued to evolve to take full advantage of JPMorgan Asset

Management’s ever-growing resources. Although the Company’s fundamental investment process remains the same, there

have been several enhancements and changes which the Portfolio Managers believe will enhance their efforts to identify

attractive, but mispriced, investment opportunities across the European Small Cap space, and to deliver strong returns. These

changes continue the evolution of the Company’s Investment Process since its inception.

The following section details the Company’s Investment Process, including recent enhancements made by JPMorgan Asset

Management, such as the introduction of a decision analytics framework. This innovation is intended to improve the quality of

investment decisions and is discussed further below.

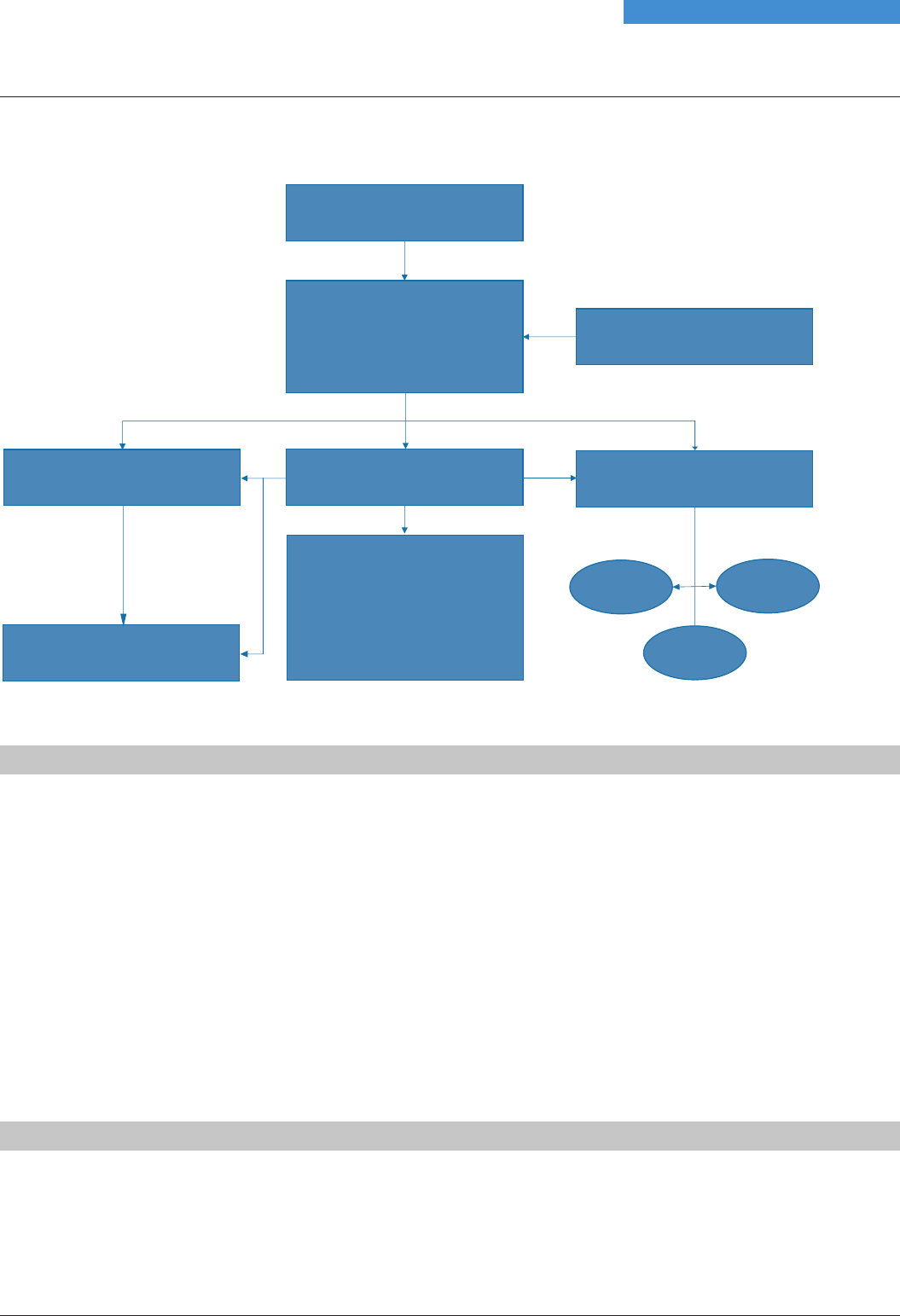

The Core Investment Objective

Through its Investment Managers, the Company aims to achieve capital growth by investing in a portfolio of smaller continental

European companies. The investment universe is defined at the time of purchase by the countries and market capitalisation

range of the constituents of the benchmark, the MSCI Europe (ex UK) Small Cap Index.

The Portfolio Managers employ a bottom-up selection process which seeks to identify Europe’s smaller ‘hidden gems’ before

they are discovered by the wider investing community (and hence the ‘Discovery’ in the Company’s name). Typically, these

companies are attractively priced, market-leading growth companies with strong quality attributes that the Portfolio Managers

expect to drive outperformance over the medium-term.

The search for hidden gems is a collaborative, team-based effort that starts with a quantitative approach to idea generation and

is complemented by fundamental research and the Portfolio Managers’ expertise. Overall risk and financially material

environmental, social and governance (ESG) considerations are integrated into each stage of the investment decision-making

process, including research, company engagement – before and after stocks enter the portfolio – and portfolio construction.

This approach results in the construction of a portfolio of high conviction stocks.

Idea Generation

The primary source of investment ideas is the Investment Manager’s proprietary quantitative investment screening process

(‘Data Driven Insights’ above) that ranks stocks within the Company’s investment universe according to their valuation, quality,

and momentum characteristics. Valuation is assessed using metrics such as valuation multiples, a total expected return

framework and discounted cash flow analysis. Quality is judged on characteristics such as return on capital, whether earnings

can be maintained, and capital discipline, while Momentum is considered in terms of potentially positive catalysts such as

whether acompany is exceeding the market’s earnings estimates.

European Discovery AR 02 Strategic Report p04-43.qxp 20/06/2024 09:47 Page 19

Fundamental Research

After identifying companies with characteristics that meet the Portfolio Managers’ quantitative requirements, the investment

process progresses to in-house fundamental research. At this stage, the Portfolio Managers draw on JPMorgan’s extensive

analytical and technological resources. The continental European small cap team is part of the wider International Equity Group

at JPMorgan, so the Portfolio Managers have access to the expertise of close to 100 investment professionals in this group, as

well as JPMorgan’s broader global resources. Crucially, the Portfolio Managers also evaluate each investment opportunity using

their own skills, knowledge, and experience.

International Equity Group: Drawing on resources around the world

Manager’s Investment Process

20 JPMorgan European Discovery Trust plc – Annual Report & Financial Statements 2024

Strategic Report

European Discovery AR 02 Strategic Report p04-43.qxp 20/06/2024 09:47 Page 20

Manager’s Investment Process

J.P. Morgan Asset Management 21

Strategic Report

Portfolio Construction

This in-depth, bottom-up fundamental research allows the Portfolio Managers to construct a concentrated, best ideas portfolio

of Europe’s hidden gems. The Company’s investment guidelines do not prohibit the Portfolio Managers from investing in any

sector or country. Rather, they pursue the best opportunities given the prevailing market environment.

Any investment portfolio is subject to a range of potential risks, which may be stock or style specific, or related to the economic

environment, or to conditions within a given sector or country. The Portfolio Managers utilise JPMorgan’s proprietary risk tools to

ensure that the portfolio’s risk exposures are identified and evaluated.

Sell Discipline

The Portfolio Managers employ a strict sell discipline. A portfolio holding will be sold if:

• The market capitalisation has significantly outgrown the benchmark index;

• There is a deterioration in the underlying fundamental investment thesis;

• The valuation has become unattractive; or

• Better investment opportunities are identified.

Decision analytics framework

Over the past year the Portfolio Managers launched a project to analyse the performance impact of both successful and

unsuccessful investment decisions. Initially, they looked at both internal analysis and third-party software products designed for

this purpose, but they quickly realised there were significant limitations to existing offerings. Principally, both internal and

external providers are only able to analyse trades undertaken and are unable to consider the opportunity costs of actions not

taken (due to the lack of associated data).

Historical analysis can help determine whether, on average, portfolio managers should hold investments for more or less time

than they do; whether larger positions should be taken to maximise returns, or if more equal weighting between investments

would be appropriate. However, the difficulty with this approach is that most decisions made on a daily basis do not result in

investments. Yet, decisions not to invest are just as potentially significant for returns as decisions to invest. For example, if an

investor considered three AI-related technology stocks at the start of the financial year, and chose to purchase only one, that

decision was likely a good one, but the decision not to invest in the other two was probably detrimental to performance. To

complete this form of analysis, it is necessary to consider all three decisions.

To this end, the Portfolio Managers have started to develop a more complete framework through which to analyse each part of

their decision-making behaviour. This framework records all their decisions in more detail, to build a better picture of their

biases, strengths and weaknesses. Specifically, the framework records decisions related to the Portfolio Managers’ interactions

with company management teams and in-house and external analysts pitching ideas. It also captures their responses to

JPMorgan’s proprietary quantitative analysis and to daily company news flow and share price movements. Their decisions on

single stocks as well as the whole portfolio are also factored into the analysis.

The intention of this new, more comprehensive approach is to derive unique insights to improve investment decision-making,

and help the Portfolio Managers answer the key question driving this work: what is the most effective use of their time? Time is

afinite and valuable resource, and they want to ensure theirs is allocated most effectively, in those investment areas most likely

to benefit the Company’s investors.

Portfolio Gearing and Liquidity

The Board has set a liquidity range of between 20% cash and 20% gearing within which the Portfolio Managers may operate. This

gives the investment team further flexibility to adjust portfolio risk according to their assessment of the market outlook, by

leveraging up individual positions in which they have a high conviction, to amplify expected returns.

In addition, gearing and the closed-end nature of the fund allow the Portfolio Managers to take advantage of opportunities as

soon as they arise, by using gearing as a form of liquidity until market conditions provide them with the opportunity to raise cash

from other portfolio positions.

Less Liquid positions

The Company’s closed-ended nature means that it does not have to deal with daily cash flows into and out of the fund. This has

the advantage of allowing the Portfolio Managers to invest in smaller, publicly traded, but less liquid, positions. Such ‘illiquid’ or

less liquid companies, provide the Investment Managers with attractive opportunities to invest in ‘undiscovered gems’ which are

typically overlooked by open-ended funds due to the liquidity limits under which such funds operate.

European Discovery AR 02 Strategic Report p04-43.qxp 20/06/2024 09:47 Page 21

Currency Hedging

The Company does not hedge the currency exposure of its portfolio assets. This policy is based on the view that the performance

impact of foreign exchange rate fluctuations evens out over the longer term.

Environment, Social and Governance (ESG) considerations

The Portfolio Managers consider financially material ESG factors as part of the investment process, specifically where they see

related risks as a potential threat to the long-term earnings capacity of portfolio companies. Further details of the Investment

Manager’s approach to ESG integration and stewardship is set out in the ESG Report on pages 30 to 32.

Stock Examples

The following are two examples of current investments resulting from the investment process outlined above.

Elis

Stock Overview

Elis provides services for the rental and cleaning of work textiles such as hotel and restaurant linen, workwear, and personal

protection equipment. It serves healthcare, hospitality, industrial, and trade sectors worldwide. Following the acquisition of

Berendsen in 2017, Elis has grown to be the European leader in textile services, with top positions in most key sectors. It is also

present in Latin America, where it benefits from a first-mover advantage.

Investment Thesis

We think Elis is attractively valued given the earnings growth potential, the defensive nature of the business and the

consistency of its capital allocation.

Outsourcing the cleaning of work materials (such as hotel bed linen) offers significant efficiency potential for Elis’s clients who

see it as a secondary function to their main business. Because of this, Elis’s market should continue to grow above GDP rates

as clients grab the opportunity this represents. Due to its scale in the European market, Elis is the most dependable

outsourcing partner and has the highest quality of service, two attributes which we believe will result in continued market

share gains. Alongside this, as the market is still fragmented, Elis should also be able to acquire smaller competitors at

attractive prices. Weexpect Elis to grow its top-line at a mid-to-high-single digit rate over time.

As Elis continues to grow, operational margins should also improve. The more clients Elis serves in a specific area, the higher

the profitability of the area because of the high fixed costs involved (laundry equipment, staff, trucks). The regions with the

highest sales density such as France have materially higher than average margins, which gives us confidence in Elis’s ability to

improve margins in less mature regions. This should result in very robust earnings growth.

The management is also committed to reducing the amount of debt on the balance sheet. Not only will this result in lower

financial costs, but our experience is that reduced financial leverage result in higher valuation multiples and is therefore value

accretive. As Elis continues to de-leverage, we think the stock could re-rate over time.

De’Longhi

Stock Overview

De’Longhi is an Italian manufacturer of coffee machines and small kitchen appliances. It is the global leader in espresso

machines and is twice the size of its next competitor in this business. The company also owns well-known cooking equipment

brands such as Kenwood, Braun and Nutribullet.

Investment Thesis

Thanks to its ‘affordable quality’ brand perception, De’Longhi should continue to benefit from the high-single-digit annual

growth in global coffee consumption, which is mostly driven by emerging markets. Coffee consumption per capita in Asia is

still 9x less than in Europe. The high growth in Asia is likely to continue over the medium-term.

This does not mean there is no growth in developed markets. Today, only around 10% of coffee machines sold are espresso

machines. As consumers continue to shift from filter coffee to espresso, the demand for De’Longhi machines will continue to

rise.

Over time, consumers upgrade from capsules machines to fully automatic coffee beans machines. This considerably

increases the average selling price for De’Longhi, as well as the margin that the company can generate on each machine. This

premiumisation trend should continue to improve the company’s profitability.

Lastly, the company’s strong balance sheet and high free cash flow conversion will allow the company to selectively invest in

M&A. The company considerably strengthened its cooking appliances business with the acquisition of United Brands in 2020. By

acquiring La Marzocco in late 2023, the company also entered the fast-growing and highly profitable professional coffee market.

Manager’s Investment Process

22 JPMorgan European Discovery Trust plc – Annual Report & Financial Statements 2024

Strategic Report

European Discovery AR 02 Strategic Report p04-43.qxp 20/06/2024 09:47 Page 22

Portfolio information

J.P. Morgan Asset Management 23

Strategic Report

Ten largest equity investments

At 31st March

2024 2023

3

Valuation Valuation

Number Number

Company Country of shares £’000 %

1

of shares £’000 %

1

1

Based on total investments of £829.7m (2023: £839.6m).

2

Not included in the ten largest investments at 31st March 2023.

3

At 31st March 2023, the value of the ten largest investments amounted to £282.2m representing 33.6% of total investments.

SPIE

SPIE is the independent European leader in multi-technical

services in the areas of energy and communication.

France

22,143 2.7

CTS Eventim

2

CTS Eventim produces, sells, brokers and distributes entry

tickets for concerts, theater productions, artistic, sporting and

similar events.

Fugro

2

Fugro collects, processes and interprets geological data. The

company collects data at sea, on land, and from the air of land

areas and the sea bed. The data is used in building offshore oil

platforms, tunnels, roads, pipelines, factories and communication

cables and to explore for oil, gas and minerals.

De’Longhi

2

De’Longhi is a designer, manufacturer and distributor of small

domestic appliances worldwide, with market shares in the espresso

coffee makers, food preparation, comfort and home care

segments.

SCOR

2

SCOR operates as a reinsurance company that offers property

and casualty, life and health, and reinsurance solutions.

Merlin Properties Socimi, REIT

2

Merlin Properties Socimi, is a real estate investment trust that

acquires, actively manages, operates and invests in commercial

real estate.

Spain 1,998,019

17,005 2.0

Total 193,387 23.4

743,826

KION

2

KION provides material handling solutions. The Company offers

forklifts, warehouse equipments and other industrial trucks.

Bilfinger

2

Bilfinger SE provides industrial services, power services, building

and facility services, construction and concessions.

Elis

Elis pr

ovides commercial services. The company offers rental and

cleaning of textile and hygiene articles such as workwear, linen,

air purification products, dryers, personal protection equipment,

automatic dispensers, mats, mops, beverage machines,

consumables, and accessories.

BFF Bank

2

BFF Bank is a specialty finance company operating throughout

Europe, specialised in the management and non-recourse

factoring of trade receivables due from public administrations,

securities services, banking and corporate payments.

1,595,548 37,489 4.5

— — —

Italy 1,712,579

18,112 2.2 868,775 6,985 0.8

France 662,648

18,163 2.2 — — —

Italy 696,397

19,088 2.3 — — —

Netherlands

987,940

19,156 2.3 — — —

France 1,085,967

19,553 2.4 1,539,404 23,847 2.8

Germany 279,501

19,750 2.4 440,312 22,266 2.7

Germany 534,878

19,810 2.4 305,957 10,517 1.3

Germany 493,821

20,607 2.5 — — —

European Discovery AR 02 Strategic Report p04-43.qxp 20/06/2024 09:47 Page 23

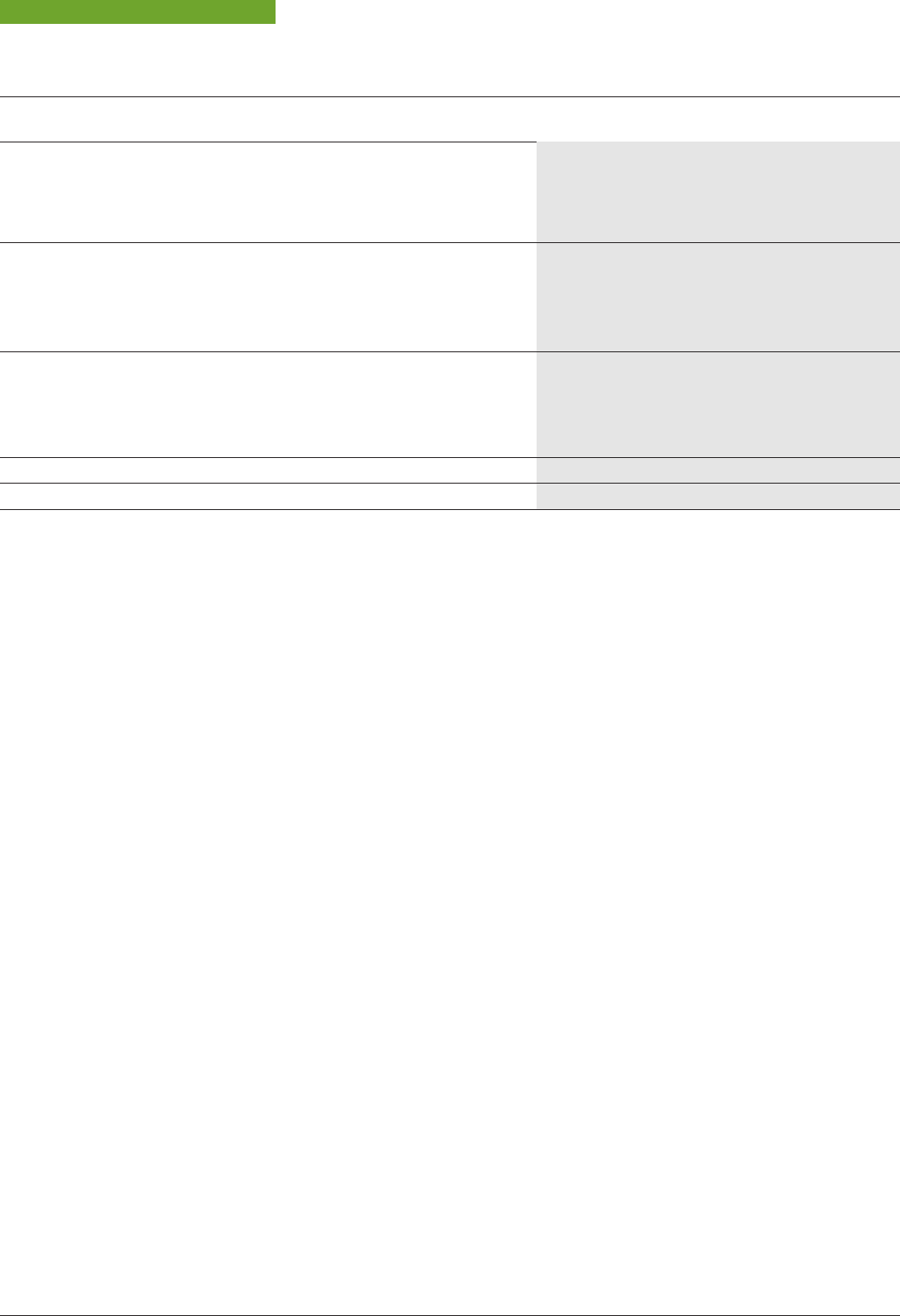

Geographical analysis

31st March 2024 31st March 2023

Portfolio Benchmark Portfolio Benchmark

%

1

% %

1

%

Germany 21.7 13.3 12.4 13.7

France 20.2 11.0 20.0 10.8

Italy 14.8 10.1 19.2 9.7

Sweden 12.1 17.3 15.7 16.6

Netherlands 5.8 5.0 9.9 6.0

Denmark 5.7 6.3 1.9 5.9

Spain 4.1 5.7 1.2 5.3

Austria 3.9 2.8 1.1 2.7

Norway 3.9 6.9 0.9 6.4

Switzerland 2.7 12.9 8.6 13.5

Finland 1.9 3.4 1.7 3.8

Belgium 1.7 3.5 7.4 4.1

Ireland 1.5 0.9 — 0.7

Portugal — 0.9 — 0.8

Total 100.0 100.0 100.0 100.0

1

Based on total investments of £829.7m (2023: £839.6m).

Sector analysis

31st March 2024 31st March 2023

Portfolio Benchmark Portfolio Benchmark

%

1

% %

1

%

Industrials 32.7 29.0 48.5 30.1

Consumer Discretionary 19.7 11.8 17.2 11.8

Financials 13.3 14.6 11.7 14.0

Information Technology 8.1 9.2 15.2 9.9

Healthcare 6.0 8.5 0.1 7.4

Energy 5.2 4.0 — 3.3

Real Estate 4.8 7.8 1.7 7.1

Consumer Staples 4.1 5.3 1.9 5.4

Materials 3.1 5.5 3.4 6.1

Utilities 1.5 2.6 — 2.8

Communication Services 1.5 1.7 0.3 2.1

Total 100.0 100.0 100.0 100.0

1

Based on total investments of £829.7m (2023: £839.6m).

Portfolio information

24 JPMorgan European Discovery Trust plc – Annual Report & Financial Statements 2024

Strategic Report

European Discovery AR 02 Strategic Report p04-43.qxp 20/06/2024 09:47 Page 24

Portfolio Information

J.P. Morgan Asset Management 25

Strategic Report

Investment activity

During the year ended 31st March 2024

Value at Value at

31st March 2023 Change 31st March 2024

% of

Purchases Sales in value % of

£’000 Portfolio £’000 £’000 £’000 £’000 Portfolio

Germany 104,313 12.4 146,734 (87,846) 15,833 179,034 21.7

France 167,901 20.0 100,372 (102,529) 1,491 167,235 20.2

Italy 161,074 19.2 97,018 (146,936) 11,997 123,153 14.8

Sweden 131,885 15.7 106,759 (123,940) (15,191) 99,513 12.1

Netherlands 83,328 9.9 28,660 (69,371) 5,512 48,129 5.8

Denmark 15,842 1.9 53,899 (27,869) 4,953 46,825 5.7

Spain 9,806 1.2 27,311 (9,565) 7,105 34,657 4.1

Austria 9,451 1.1 23,923 (3,364) 2,999 33,009 3.9

Norway 7,855 0.9 24,529 (298) 889 32,975 3.9

Switzerland 71,730 8.6 33,998 (84,889) 1,201 22,040 2.7

Finland 14,021 1.7 10,400 (4,074) (3,717) 16,630 1.9

Belgium 62,376 7.4 12,906 (52,061) (9,071) 14,150 1.7

Ireland — — 11,690 (1,109) 1,807 12,388 1.5

Total investments 839,582 100.0 678,199 (713,851) 25,808 829,738 100.0

European Discovery AR 02 Strategic Report p04-43.qxp 20/06/2024 09:47 Page 25

Germany

KION 20,607 2.5

Bilfinger 19,810 2.4

CTS Eventim 19,750 2.4

Scout24 16,532 2.0

FUCHS Preference 16,417 2.0

Hensoldt 13,912 1.7

Freenet 12,427 1.5

TAG Immobilien 11,561 1.4

Stabilus 10,868 1.3

Evotec 9,195 1.1

Bechtle 8,137 1.0

Fielmann 7,705 0.9

AIXTRON 5,586 0.7

Atoss Software 4,569 0.6

SAF-Holland 1,958 0.2

179,034 21.7

France

SPIE 22,143 2.7

Elis 19,553 2.4

SCOR 18,163 2.2

IPSOS 15,668 1.9

SEB 15,024 1.8

Sopra Steria 14,380 1.7

Gaztransport Et Technigaz 12,384 1.5

Covivio 11,760 1.4

Alten 11,386 1.4

Nexans 9,215 1.1

Vallourec 8,887 1.1

Virbac 8,672 1.0

167,235 20.2

Italy

De’Longhi 19,088 2.3

BFF Bank 18,112 2.2

Sanlorenzo 16,637 2.0

Saipem 14,008 1.7

BPER Banca 12,021 1.4

Unipol Gruppo 10,158 1.2

Brembo 9,124 1.1

Lottomatica 7,716 0.9

A2A 6,746 0.8

Iren 5,811 0.7

Intercos 3,732 0.5

123,153 14.8

Sweden

AAK 14,612 1.8

Bravida 13,698 1.7

Munters 11,780 1.4

Loomis 10,545 1.3

Electrolux Professional 10,447 1.3

Hexpol 9,533 1.1

BoneSupport 9,151 1.1

Thule 8,429 1.0

Sweco 6,521 0.8

Husqvarna 4,797 0.6

99,513 12.1

Netherlands

Fugro 19,156 2.3

Koninklijke Vopak 15,107 1.8

Arcadis 13,866 1.7

48,129 5.8

Denmark

ISS 10,453 1.3

Sydbank 10,382 1.3

Zealand Pharma 9,298 1.1

NKT 9,268 1.1

Jyske Bank 7,424 0.9

46,825 5.7

Spain

Merlin Properties Socimi 17,005 2.0

Banco de Sabadell 13,566 1.6

Fluidra 4,086 0.5

34,657 4.1

Austria

DO & CO 16,528 2.0

BAWAG 8,488 1.0

Wienerberger 4,276 0.5

ANDRITZ 3,717 0.4

33,009 3.9

Norway

Bakkafrost 13,450 1.6

Storebrand 11,808 1.4

Aker Solutions 7,717 0.9

32,975 3.9

Switzerland

Accelleron Industries 13,708 1.7

Inficon 8,332 1.0

22,040 2.7

Valuation % of

Company £’000 Portfolio

Valuation % of

Company £’000 Portfolio

List of investments

At 31st March 2024

Portfolio Information

26 JPMorgan European Discovery Trust plc – Annual Report & Financial Statements 2024

Strategic Report

European Discovery AR 02 Strategic Report p04-43.qxp 20/06/2024 09:47 Page 26

Portfolio Information

J.P. Morgan Asset Management 27

Strategic Report

Finland

Tokmanni 8,543 1.0

TietoEVRY 6,057 0.7

Puuilo 2,030 0.2

16,630 1.9

Belgium

Fagron 13,742 1.7

Melexis 408 —

14,150 1.7

Ireland

Cairn Homes 6,542 0.8

Glanbia 5,846 0.7

12,388 1.5

Total Investments 829,738 100.0

Valuation % of

Company £’000 Portfolio

European Discovery AR 02 Strategic Report p04-43.qxp 20/06/2024 09:47 Page 27

1

Source: Morningstar, share price. JPMorgan, share price total return calculation.

2

Source: Morningstar, cum income net asset value per share. JPMorgan, net asset value total return calculation.

3

Source: Morningstar. The Company’s benchmark.

1

Source: Morningstar, share price. JPMorgan, share price total return calculation.

2

Source: Morningstar, cum income net asset value per share. JPMorgan, net asset value total return calculation.

3

Source: Morningstar. The Company’s benchmark.

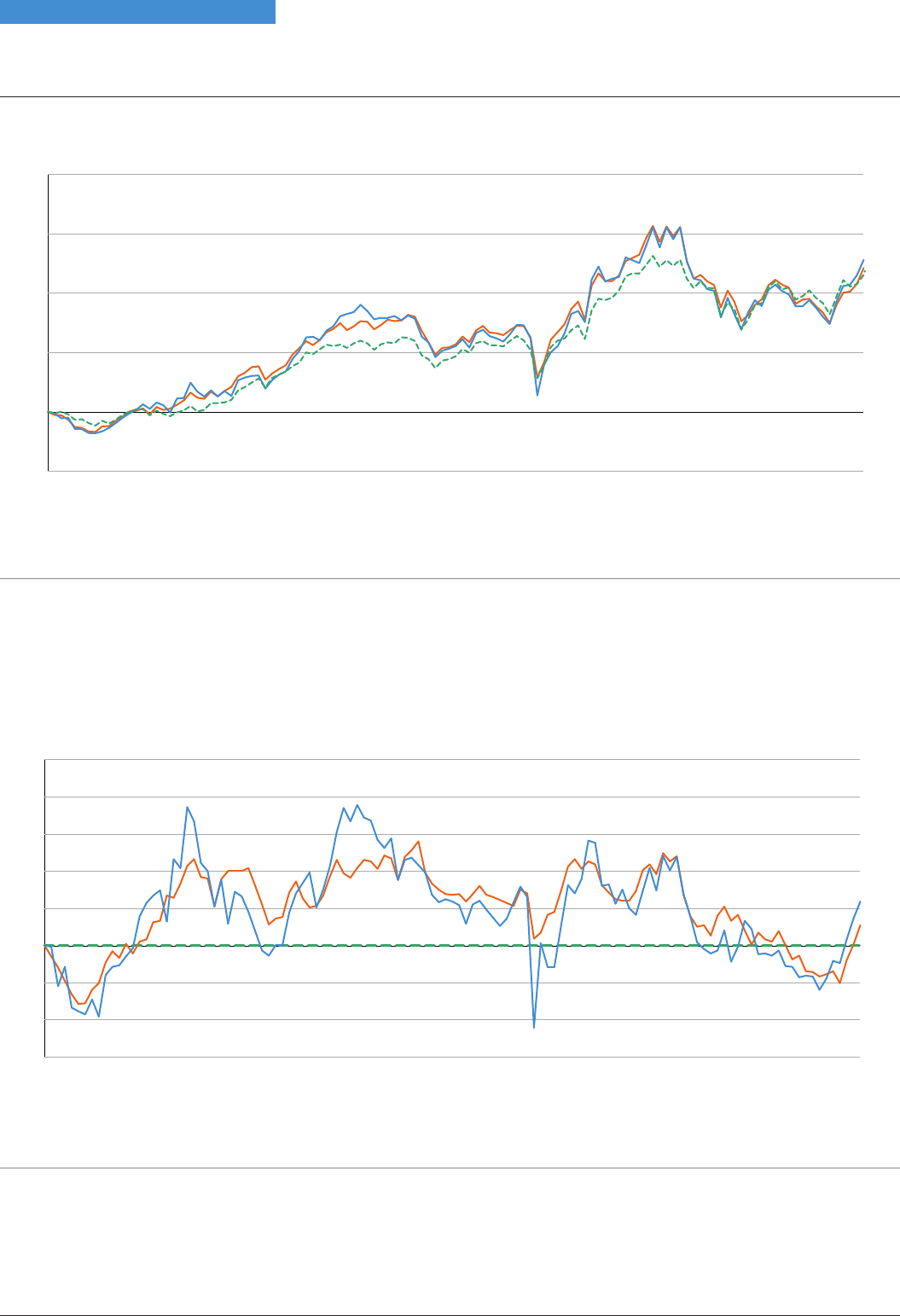

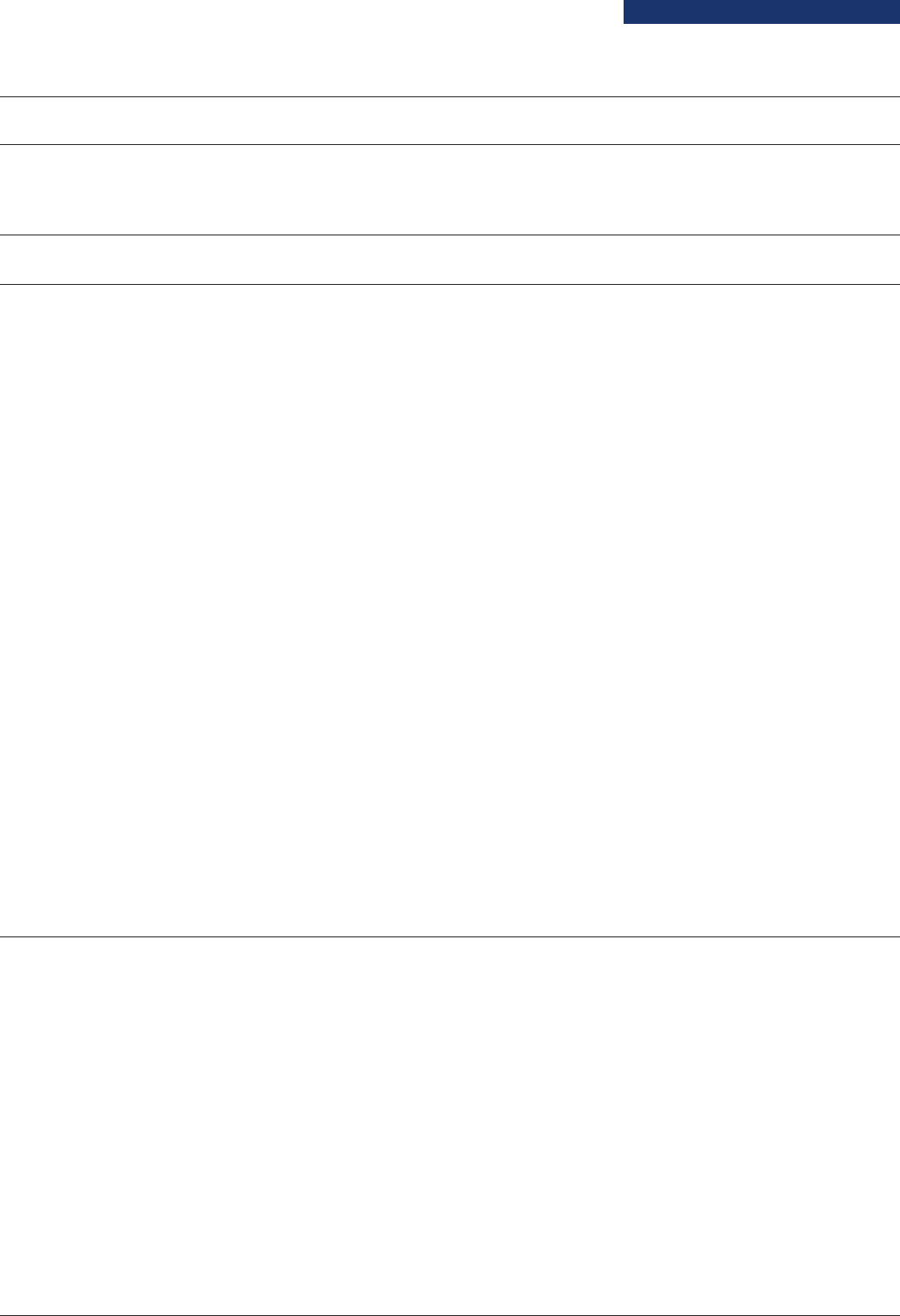

Ten year performance

Figures were rebased to 100 on 31st March 2014

50

100

150

200

250

300

20242023202220212020201920182017201620152014

Share price total return

1

Net asset value total return

2

Benchmark total return

3

Ten year performance relative to benchmark

Figures were rebased to 100 on 31st March 2014

85

90

95

100

105

110

115

120

125

20242023202220212020201920182017201620152014

Share price total return

1

Net asset value total return

2

Benchmark total return

3

Ten Year Record

28 JPMorgan European Discovery Trust plc – Annual Report & Financial Statements 2024

Strategic Report

European Discovery AR 02 Strategic Report p04-43.qxp 20/06/2024 09:47 Page 28

Ten Year Record

J.P. Morgan Asset Management 29

Strategic Report

Ten year financial record

At 31st March 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024

Total assets less current

liabilities (£’m) 474.8 473.1 495.4 620.8 794.2 637.8 517.3 923.0 833.7 785.1 841.7

Net asset value per share (p)

A

270.7 268.3 309.3 388.1 438.9 400.0 324.4 530.7 526.1 498.5 520.7

Share price (p) 240.0 233.5 276.0 334.0 406.0 349.0 251.0 462.0 450.0 423.0 465.5

Share price discount (%)

A

11.3 13.0 10.8 13.9 7.5 12.8 22.6 12.9 14.5 15.1 10.6

Gearing (%)/(Net cash)

A

12.6 7.5 (2.8) 5.3 7.9 (5.2) 3.8 8.8 0.0 6.9 7.9

Ongoing charges (%)

A

1.31 1.32 1.18 1.15 1.03 1.07 1.05 0.91 0.93 0.94 0.92

Year ended 31st March

Gross revenue return (£’000) 8,016 8,586 8,448 10,771 13,251 15,837 15,077 9,625 16,498 22,502 23,982

Net revenue available for

shareholders (£’000) 5,047 5,519 5,732 7,807 9,575 11,680 10,886 7,051 11,154 17,512 18,670

Revenue return per share (p) 2.99 3.45 3.58 4.88 5.98 7.31 6.83 4.42 7.00 11.11 12.04

Total dividend(s) per share (p) 2.9 3.2 3.2 4.7 6.7 6.7 6.7 6.7 6.7 9.0 10.5

Rebased to 100 at 31st March 2013

Total return to shareholders

1,A

100.0 98.6 118.0 144.5 177.8 155.3 113.8 213.4 210.7 201.7 227.8

Total return on net assets

2,A

100.0 100.3 116.9 148.2 169.4 156.7 129.1 214.6 215.2 207.0 221.0

Benchmark total return

3

100.0 100.1 107.3 138.4 152.2 146.7 128.0 202.1 209.9 203.1 215.2

1

Source: Morningstar, share price. JPMorgan, share price total return calculation.

2

Source: Morningstar, cum income net asset value per share. JPMorgan, net asset value total return calculation.

3

Source: Euromoney. The Company’s benchmark is the MSCI Europe (ex UK) Small Cap Net Total Return Index. (2019 and before: Euromoney Smaller

European Companies (ex UK) Total Return Index in sterling terms).

A

Alternative Performance Measure (‘APM’).

A glossary of terms and APMs definitions is provided on pages 101 and 102.

European Discovery AR 02 Strategic Report p04-43.qxp 20/06/2024 09:47 Page 29

Manager’s Approach to ESG and JPMorgan European Discovery Trust plc

Why do we integrate ESG into our investment process?

In actively managed strategies deemed by J.P. Morgan Asset Management (UK) Limited (‘JPMAM’) to be ESG integrated under our

governance process, we systematically assess financially material ESG factors (amongst other factors) in our investment

analysis and investment decisions, where possible and appropriate, with the goals of managing risk and improving long-term

returns. Essentially, we seek to determine whether, in our opinion, a company faces potential headwinds or tailwinds from ESG

considerations which may ultimately have a significant impact on its share price.

ESG Integration within the Company’s portfolio

ESG integration does not change the Company’s investment objective, exclude specific types of companies, or constrain the

Company’s investable universe. However, our assessment of financially material ESG factors may influence the investment

decision. Ultimately, it may impact our Investment Manager’s decision to purchase a company or not, or impact the position size

taken in a Company due to the level of conviction.

Engagement

We recognise and embrace our wider stewardship responsibilities to clients as a major asset owner. We use engagement to

better understand and encourage portfolio companies to develop and adopt practices to manage their risk and create

long-term shareholder value. Active ownership in the context of ESG integration allows us to manage ESG risks and

systematically to incorporate insights gained from engagement into our investment decisions. For further details on our

engagement processes, please see JPMAM’s Annual Investment Stewardship Report Annual Investment Stewardship Report

(https://am.jpmorgan.com/content/dam/jpm-am-aem/global/en/sustainable-investing/investment-stewardship-report.pdf

).

In JPMAM’s International Equity Group, corporate engagement is a collaboration between our investors and the Investment

Stewardship specialists within our Global Sustainable Investing Team. Engagement driven by our Investment Stewardship team

focuses on the six firm-wide priorities below.

Underlying each priority are specific themes, which are typically topical issues within the industry and with our clients. JPMAM’s

Investment Stewardship Team has identified a set of ‘focus’ companies, aligned with these themes, which we proactively target

for engagement. These companies are selected because of an issue of concern, typically in reference to our six priorities, that is

sufficiently material to warrant more focused engagement and where the name is held in sufficient size to make our voice

effective. The list of companies will be validated as part of ongoing dialogue between the Investment Stewardship Team and the

Portfolio Managers and Research Analysts.

Portfolio Managers and Research Analysts in the International Equity Group (IEG) also directly drive engagement with the

companies, addressing a broad range of financially material ESG issues as part of their bottom-up stock analysis.

Examples of our recent activity with regard to engagement with stocks in the Company’s portfolio during the year are provided

below:

Environmental Social Governance

Climate change

Natural capital

and ecosystems

Governance

Strategy

alignment with

the long term

Human capital

management

Stakeholder

engagement

Environmental, Social and Governance (‘ESG’) Report

30 JPMorgan European Discovery Trust plc – Annual Report & Financial Statements 2024

Strategic Report

European Discovery AR 02 Strategic Report p04-43.qxp 20/06/2024 09:47 Page 30

Environmental, Social and Governance (‘ESG’) Report

J.P. Morgan Asset Management 31

Strategic Report

Our IEG investors met with SPIE to discuss the company’s ESG initiatives. Our objectives were to: (i) clarify what operations fall

under the company’s oil, gas & nuclear business division and if they have any direct nuclear exposure; (ii) clarify the drivers of

the company’s scope 1, 2 and 3 emission reduction targets; and (iii) discuss the drivers of the recent third-party downgrade of

SPIE’s ESG rating.

SPIE confirmed that they did not have any direct nuclear exposure. Their oil, gas & nuclear business division accounted for 7%