2

© 2021 KPMG IFRG Limited, a UK company limited by guarantee. All rights reserved.

Cloud

implementation

costs

Implementation costs in cloud computing arrangements can

be significant – companies need to determine whether these

costs should be expensed as incurred or capitalised. The

IFRS Interpretations Committee’s (the Committee) March 2021

decision clarifies how to perform this analysis for

implementation costs incurred in a cloud service contract –

i.e. when the customer does not control a software intangible

asset.

The decision clarifies that in a cloud service contract the

customer needs to assess whether the implementation service

is distinct from the service of receiving access to the software.

As such, some companies may need to change their current

accounting policy and could also see an impact in their income

statement as many implementation costs for cloud service

contracts will need to be expensed as incurred.

This guide gives our insight and analysis, including a framework

that helps companies apply the Committee’s decision. Using

this framework, assess your current accounting policy and

determine whether any implementation costs incurred should be

expensed or capitalised.

What’s the

issue?

What’s the

impact?

What’s

next?

3

© 2021 KPMG IFRG Limited, a UK company limited by guarantee. All rights reserved.

What is cloud computing?

What is cloud computing?

Software asset or service

contract?

Implementation costs for

a service contract

The framework The framework illustrated

Some questions

answered

What’s next?

In a cloud computing arrangement, a customer pays a fee to a

vendor in exchange for access to software over the internet.

The software is hosted by the vendor on the vendor’s

computing infrastructure

1

.

Customers in cloud computing arrangements often incur up-front

costs to implement the software.

The accounting for these implementation costs depends on

whether the customer has a software asset or a service

contract.

1

This differs from an ‘on-premise’ arrangement where a company licenses or purchases a copy of the

software from a vendor and operates the software on its own computing infrastructure.

Examples of implementation

costs

• Testing

• Data migration and conversion

• Training

• Configuration of the software

• Customisation of the software

4

© 2021 KPMG IFRG Limited, a UK company limited by guarantee. All rights reserved.

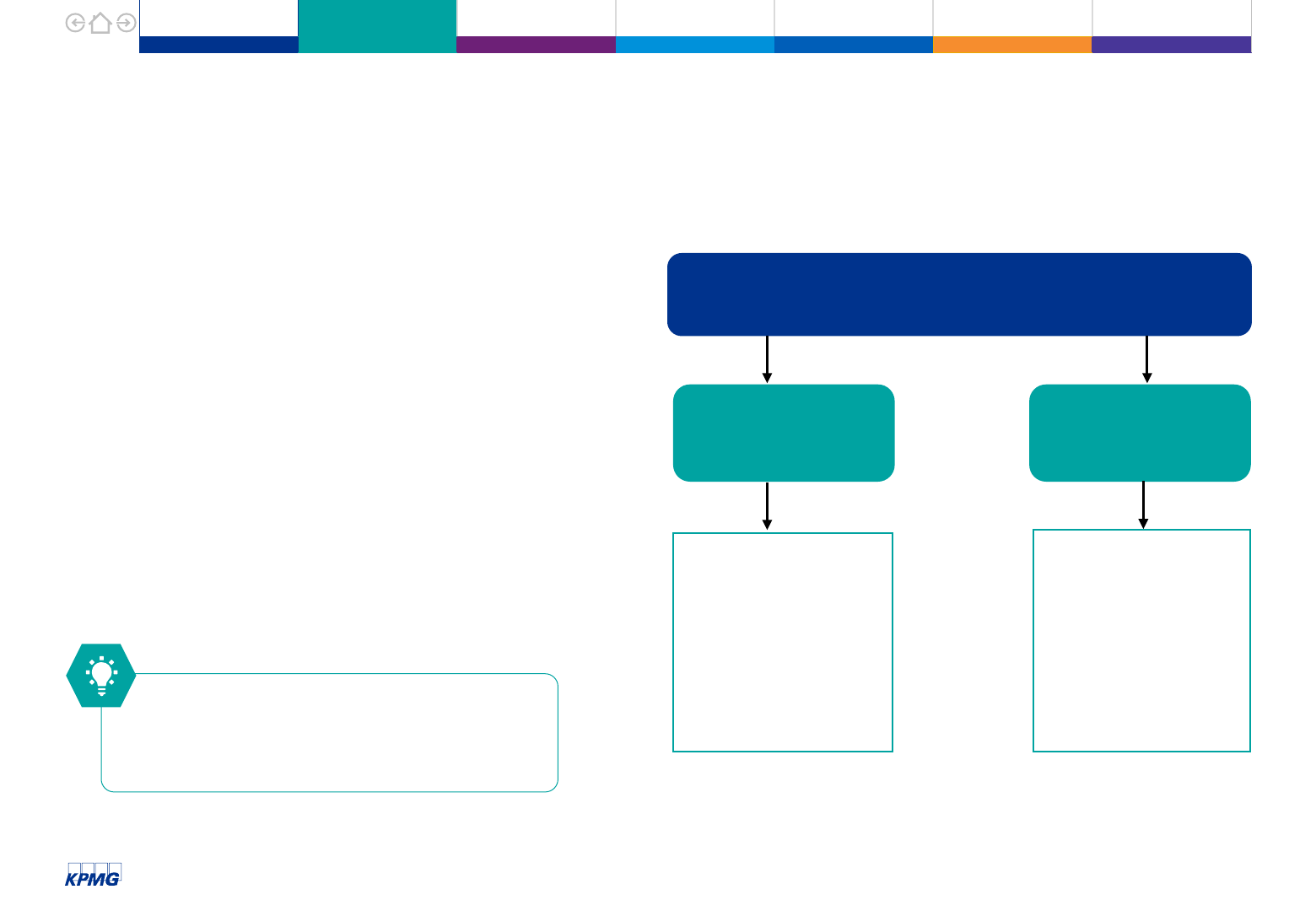

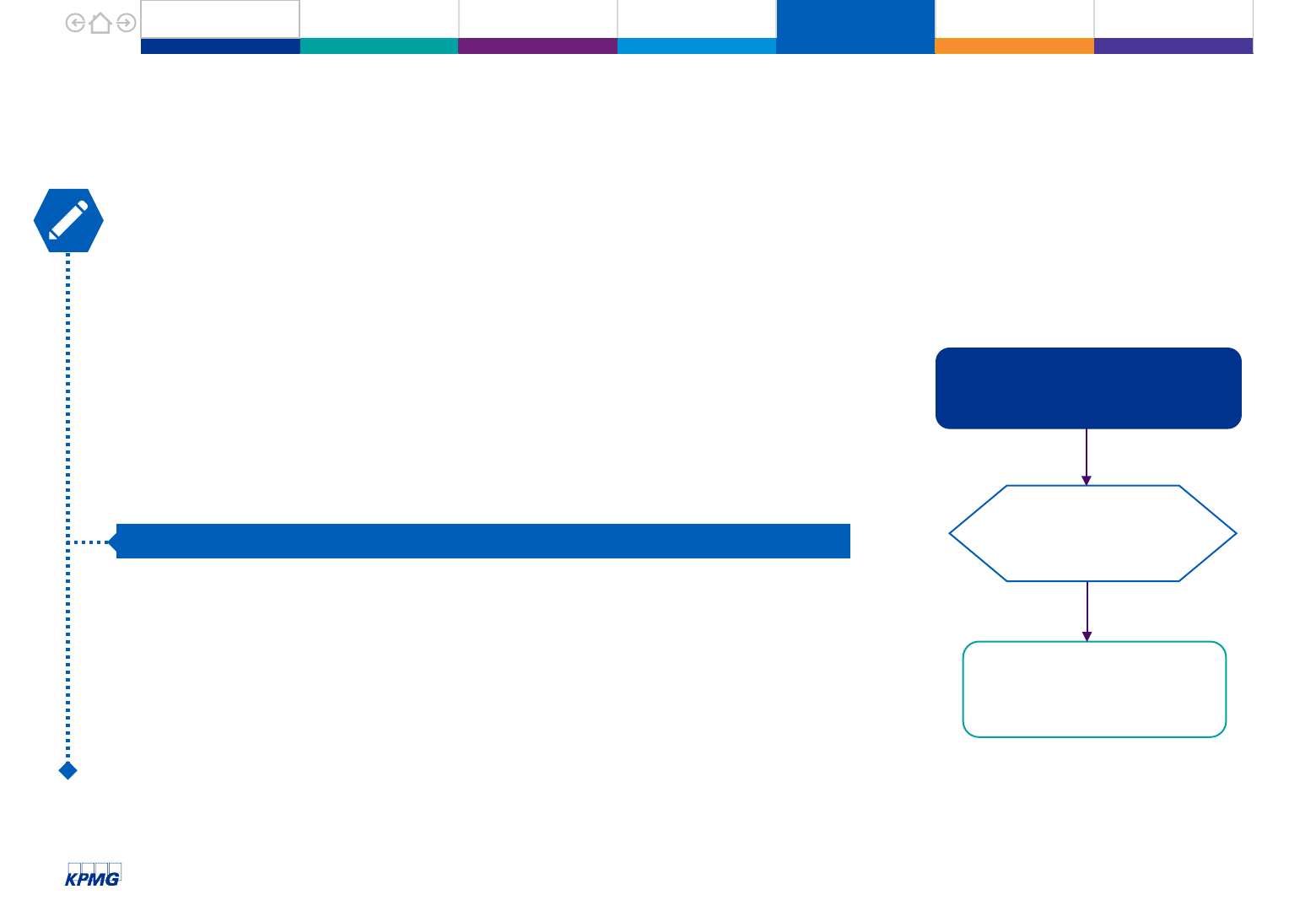

Cloud computing – Software asset or service contract?

To determine whether it has a software

intangible asset or a service contract, a

company assesses whether it controls the

software.

This drives the accounting for the related

implementation costs.

In our experience, cloud computing

arrangements usually do not give rise to a

software intangible asset under IAS 38.

Does the customer control the software?

Software

intangible asset

Service

contract

Apply IAS 38

Intangible Assets

Capitalise the directly

attributable

implementation costs

of preparing the

software for its

intended use.

Apply the framework

on page 5 which is

based on IFRIC’s

March 2021 agenda

decision

1

to account

for implementation

costs.

1

Configuration or Customisation Costs in a Cloud Computing Arrangement (IAS

38 Intangible Assets)

What is cloud computing?

Software asset or service

contract?

Implementation costs for

a service contract

Applying the framework The framework illustrated

Some questions

answered

What’s next?

Yes

No

5

© 2021 KPMG IFRG Limited, a UK company limited by guarantee. All rights reserved.

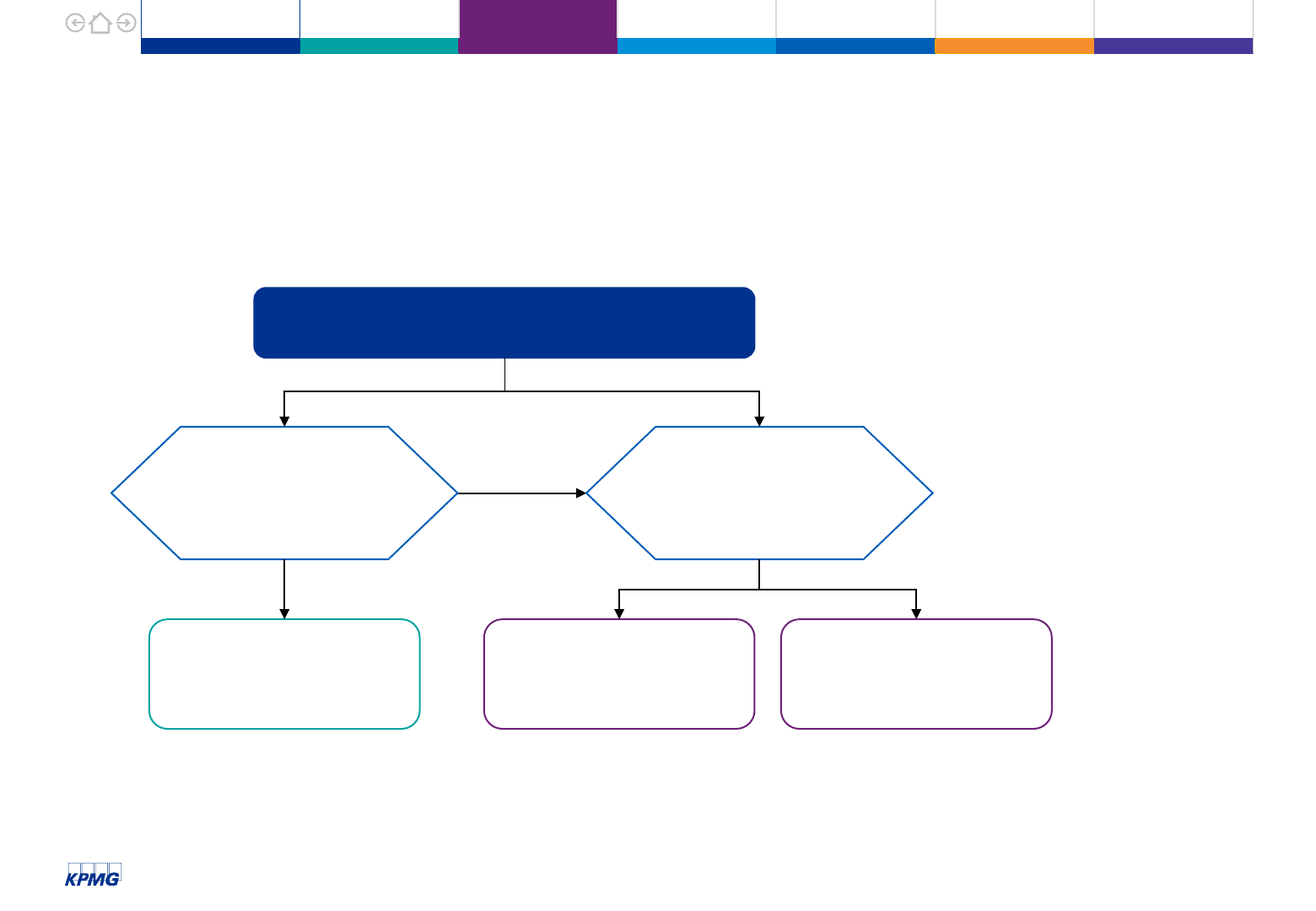

Implementation costs for a service contract

The Committee’s March 2021 agenda decision addressed the accounting for configuration and customisation costs

in a cloud service contract. The following framework is based on the principles in that decision and helps companies

determine how to account for implementation costs in a cloud service contract.

Notes:

1

Includes cases in which the cloud vendor subcontracts services

to a third party.

2

A company may have a prepayment asset if it is paid in

advance.

Is the implementation service performed by the

cloud vendor

1

?

Is the service distinct from

the access to the software?

(See page 6)

Does the expenditure give

rise to a separate

intangible asset under IAS

38? (See page 7)

Yes

No

Yes

Recognise the expense

over the period of the

access to the software

2

Recognise an intangible

asset under IAS 38

Recognise the expense

as incurred – i.e. when

the service is received

Yes

No

No

What is cloud computing?

Software asset or service

contract?

Implementation costs for

a service contract

Applying the framework The framework illustrated

Some questions

answered

What’s next?

6

© 2021 KPMG IFRG Limited, a UK company limited by guarantee. All rights reserved.

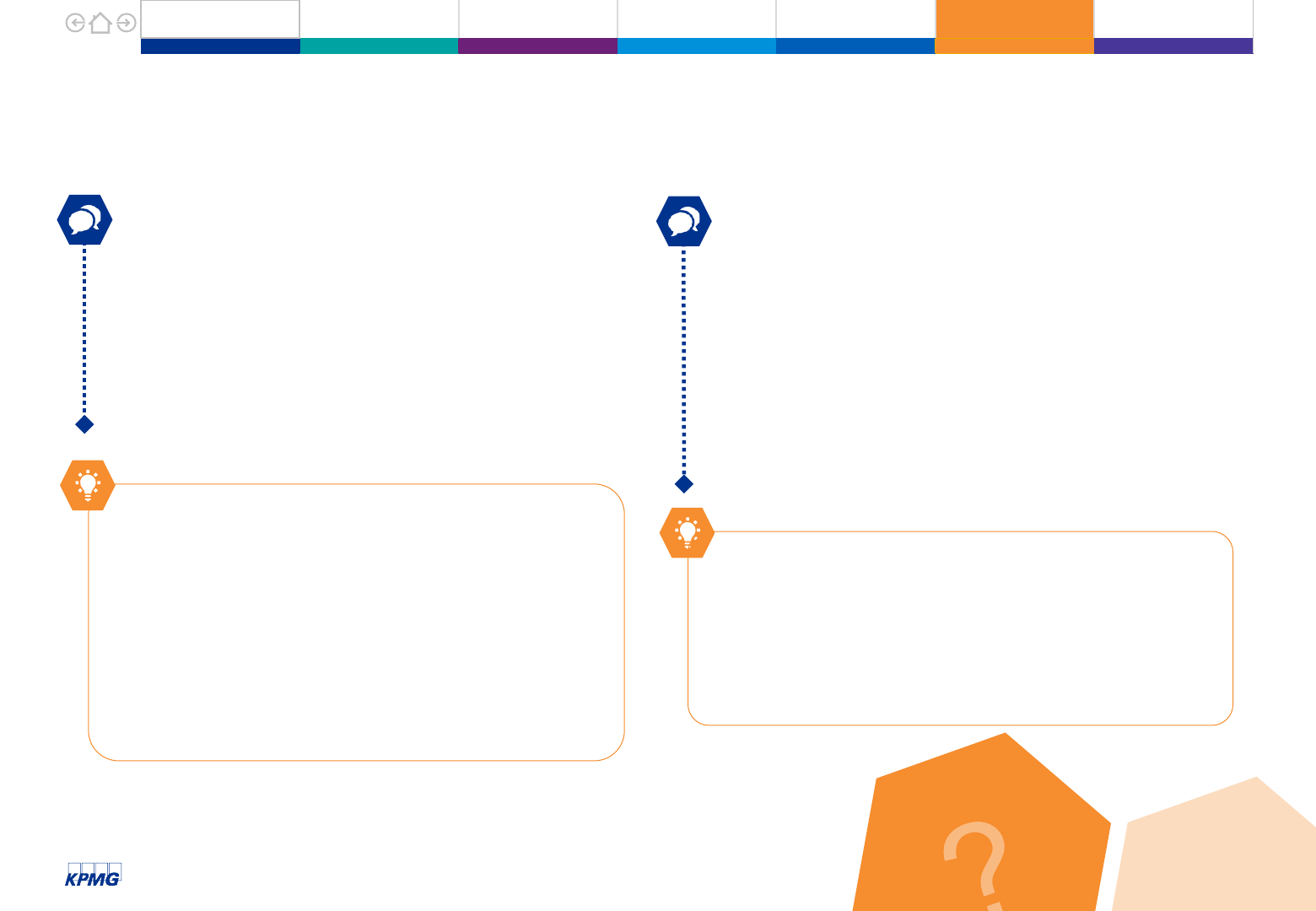

Applying the framework – Is the service distinct?

Is the service distinct from the access to the software – e.g. could it be performed by a company

other than the cloud vendor?

If the cloud vendor performs the implementation service, then the customer assesses whether that service forms part of

the service of receiving access to the software or is distinct. It does this by applying the principles in IFRS 15 Revenue

from Contracts with Customers.

This assessment is not necessary for services performed internally or by a third party other than the cloud vendor

because those services are distinct from the service of receiving access to the software provided by the cloud vendor.

Distinct

If the cloud vendor performs the implementation

service, but another company – e.g. a consulting

company – would be capable of performing the service

without also providing the access to the software, then

the implementation service is generally distinct from the

service of receiving access to the software. This is

because in this case, the cloud vendor’s

implementation service is not integral to the customer’s

ability to derive its intended benefit from the software.

In our experience, most implementation services (e.g.

configuration, data migration and conversion,

interfacing, testing) usually could be performed by a

third party that is not the cloud vendor.

Not distinct

If the implementation service could only be

performed by the cloud vendor, then this indicates

that it is not distinct from the access to the software.

For example, when the cloud vendor agrees to

customise the software by modifying the existing

software code or writing new code, this

customisation service is generally not distinct.

In this case, the related implementation costs are

recognised as an expense as the customer

receives access to the customised software – i.e.

over the contract term.

What is cloud computing?

Software asset or service

contract?

Implementation costs for

a service contract

Applying the framework The framework illustrated

Some questions

answered

What’s next?

7

© 2021 KPMG IFRG Limited, a UK company limited by guarantee. All rights reserved.

Applying the framework – Is there a separate intangible?

Does the expenditure give rise to a separate intangible asset under IAS 38?

Typically, no. In our experience, there are limited circumstanc

es

1

in which a company

recognis

es a separate intangible asset.

This is bec

ause the directly attributable costs of preparing software for its intended use

are c

apitalised only when a company acquires a software intangible asset (see page 4).

A

cloud service contract contains no such asset. Therefore, a company does not

capitalise the directly attributable costs incurred to prepare the software for its

intended use (e.g. configuration and testing).

What is cloud computing?

Software asset or service

contract?

Implementation costs for

a service contract

Applying the framework The framework illustrated

Some questions

answered

What’s next?

1

The costs to create a new interface between a company’s existing software and the

cloud software could create a separate intangible asset under IAS 38 – e.g. writing

new software code that the company controls.

8

© 2021 KPMG IFRG Limited, a UK company limited by guarantee. All rights reserved.

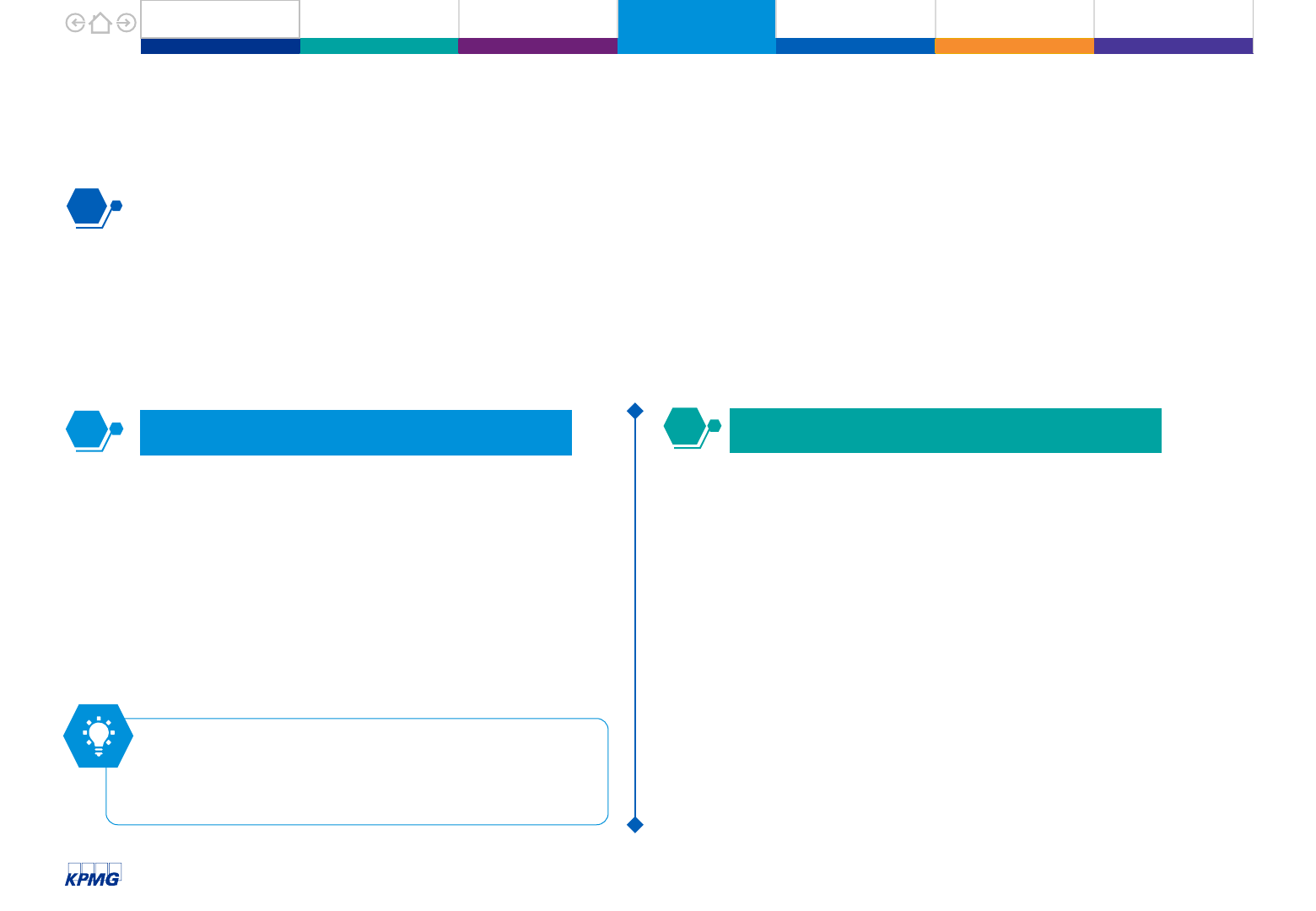

The framework illustrated

Configuration service

Company N enters into a cloud computing arrangement with Supplier T as follows:

– N has access to T’s software for a period of five years for a fee of 500 per year.

– T also agrees to configure the software for N for a fee of 200.

Based on the fact pattern, N determines that it has a service contract with T – i.e. it does not

control the software.

N determines how to account for the configuration costs using the framework.

Is the service distinct from the access to the software?

Yes – N considers that a third party other than T could configure the software without

also providing access to it. Therefore, N observes that T’s configuration service is

not integral to N’s ability to derive its intended benefit from the software.

Does the expenditure give rise to a separate intangible asset?

No – This is because N does not control the configured software that it will access in

the future.

Therefore, N recognises an expense of 200 when it receives the configuration

service. It also recognises an annual expense of 500 over the five-year period of

the cloud arrangement.

What is cloud computing?

Software asset or service

contract?

Implementation costs for

a service contract

Applying the framework The framework illustrated

Some questions

answered

What’s next?

Is the implementation service

performed by the cloud vendor

1

?

Yes

Is the service distinct

from the access to the

software?

Yes

Does the expenditure

give rise to a separate

intangible asset?

No

Recognise the expense

as incurred – i.e. when the

service is received

1

Includes cases in which the cloud vendor

subcontracts services to a third party.

9

© 2021 KPMG IFRG Limited, a UK company limited by guarantee. All rights reserved.

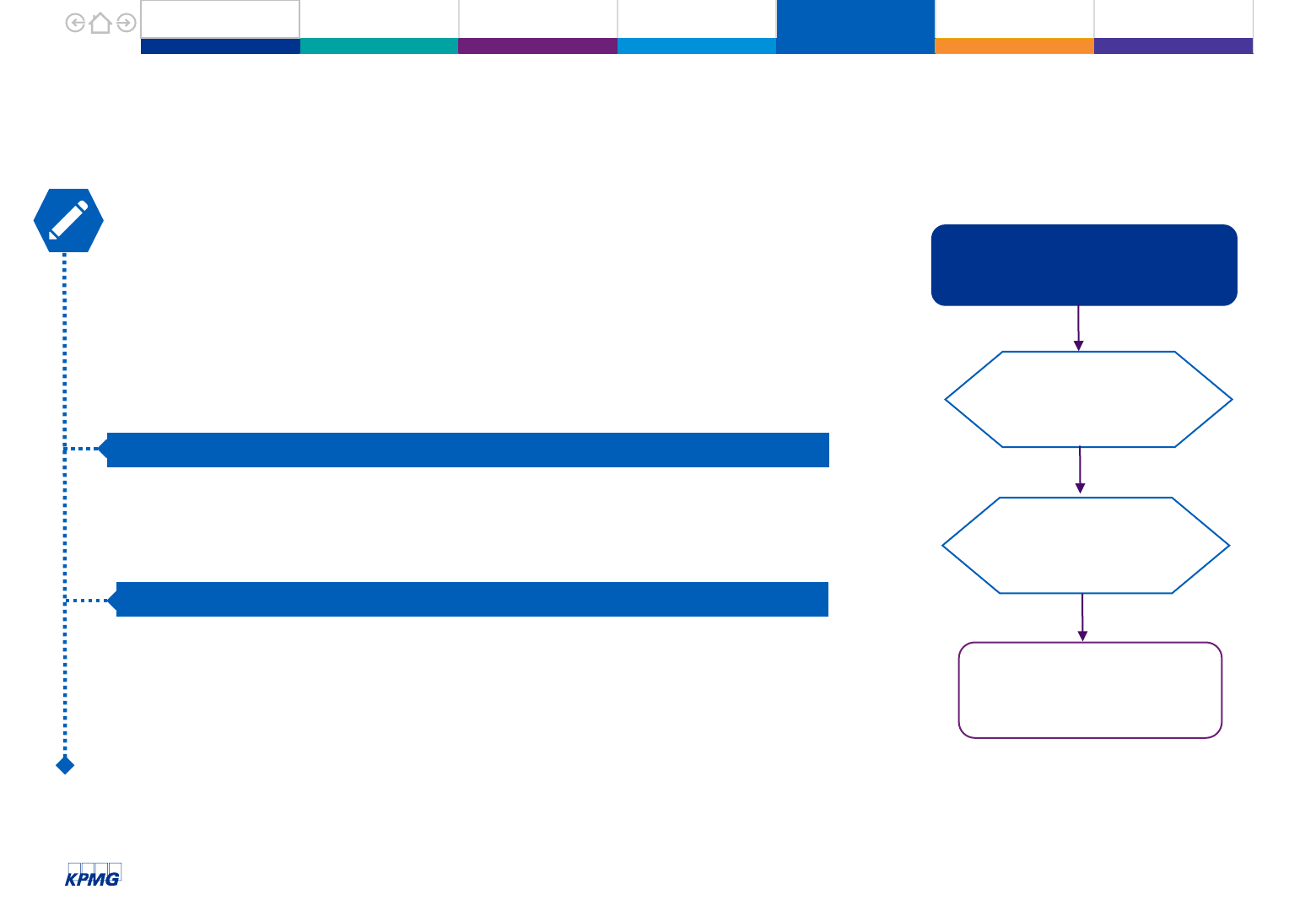

The framework illustrated (cont.)

Customisation service

Company N enters into a cloud computing arrangement with Supplier T as follows:

– N has access to T’s software for a period of five years for a fee of 500 per year.

– T also agrees to customise the software by writing new code that will create an entirely

new functionality that does not yet exist for an additional fee of 300.

– T retains the intellectual property rights to the customised software and can make this

new functionality available to other customers.

Based on the fact pattern, N determines that it has a service contract with T – i.e. it does

not control the software.

N determines how to account for the customisation costs using the framework.

Is the service distinct from the access to the software?

No – N considers that only T is capable of modifying the underlying software code.

Therefore, N observes that it is able to derive its intended benefit from the software only

through T fulfilling both the ongoing access to the software and the customisation

service. N concludes that there is one service in the contract: the access to the

customised software.

N recognises an annual expense of 560 over the five-year period of the cloud

arrangement – i.e. (((500 x 5) + 300) / 5).

What is cloud computing?

Software asset or service

contract?

Implementation costs for

a service contract

Applying the framework The framework illustrated

Some questions

answered

What’s next?

Is the implementation service

performed by the cloud vendor

1

?

Yes

Is the service distinct

from the access to the

software?

No

Recognise the expense

over the period of access

to the software

1

Includes cases in which the cloud vendor

subcontracts services to a third party.

10

© 2021 KPMG IFRG Limited, a UK company limited by guarantee. All rights reserved.

Some questions answered

When is a software intangible asset recognised in a

cloud computing arrangement?

In some limited circumstances, a company may determine

that it controls a software asset if:

• it has the right to restrict the access of others – e.g. the

software vendor and its other customers – to the

economic benefits flowing from the software; or

• it can obtain the benefits from the software without the

software vendor’s hosting services.

Features of a cloud computing arrangement that may

indicate that the company obtains control of a software

intangible asset include:

• the right to take possession of a copy of the software

and run it on the company’s own or a third party’s

computer infrastructure; or

• exclusive rights to use the software or ownership of the

intellectual property for customised software – i.e. the

vendor cannot make the software available to other

customers.

What is cloud computing?

Software asset or service

contract?

Implementation costs for

a service contract

Applying the framework The framework illustrated

Some questions

answered

What’s next?

What implementation costs does a company capitalise

when it controls a software intangible asset?

In the limited cases in which a customer controls a software

intangible asset, the cost of that asset includes the directly

attributable costs of preparing the software for its intended

use. Under paragraph 28 of IAS 38, these costs include

employee benefits and professional fees arising directly from

bringing the software to its working condition, and costs to

test whether the software functions properly.

Consistent with a cloud service contract, implementation

costs that give rise to a separate intangible asset under IAS

38 are also capitalised (see page 7).

Therefore, many implementation costs such as testing,

configuration and customisation of the software are capitalised

because they form part of the cost of the software intangible

asset.

This differs from a cloud service contract in which fewer

implementation costs can be capitalised because the company

does not control a software intangible asset.

11

© 2021 KPMG IFRG Limited, a UK company limited by guarantee. All rights reserved.

Some questions answered (cont.)

What is the difference between configuration and

customisation?

‘Configuration’ involves changing the default settings of

the vendor’s software to function in a particular way – e.g.

setting various ‘flags’ or ‘switches’ within the vendor’s

software or defining certain values or parameters to

implement a particular set-up of the software’s existing

functionality.

‘Customisation’ involves modifying the vendor’s existing

software code or writing new code to change or create

additional functionalities.

In our experience, configuration services are

typically distinct from the access to the software

while customisation services are typically not

distinct.

Is the accounting outcome for implementation costs

driven by which party performs the service?

No. It is based on the nature of the service. When a party

other than the cloud vendor performs the implementation

service, no ‘distinct’ test is necessary. This is because the

implementation service is inherently distinct.

Contractual restrictions requiring the customer to use the

software vendor do not impact the analysis of whether an

implementation service is distinct because it is based on

the nature of the service.

What is cloud computing?

Software asset or service

contract?

Implementation costs for

a service contract

Applying the framework The framework illustrated

Some questions

answered

What’s next?

If a cloud arrangement includes multiple distinct

services that are received over different periods, then a

company may need to allocate the total consideration

paid to each service – e.g. based on the relative stand-

alone price of each service.

12

© 2021 KPMG IFRG Limited, a UK company limited by guarantee. All rights reserved.

What’s next?

– Consider the Committee’s March 2021

agenda decision on Configuration or

Customisation Costs in a Cloud

Computing Arrangement (IAS 38

Intangible Assets).

Agenda decision

– Understand how your company might

be affected by the Committee’s

agenda decision.

– Consider whether your current

accounting policies remain appropriate

or whether you need to change your

accounting policy.

– If you are affected, then account for the

resulting changes as a change in

accounting policy – i.e. retrospectively.

Accounting policies

– Consider whether you have the

appropriate controls and processes in

place.

– When entering into new cloud

computing arrangements, think about

the accounting implications in

advance.

– You will need to ensure you have the

systems, processes and controls to

track and analyse different types of

costs and allocate amounts paid to

different services received.

Accounting systems and

processes

What is cloud computing?

Software asset or service

contract?

Implementation costs for

a service contract

Applying the framework The framework illustrated

Some questions

answered

What’s next?

13

© 2021 KPMG IFRG Limited, a UK company limited by guarantee. All rights reserved.

Keeping in touch

Whether you are new to IFRS

®

Standards or a current user, you can find

digestible summaries of recent developments, detailed guidance on complex

requirements, and practical tools such as illustrative disclosures and

checklists.

Peter Carlson

Executive Director

KPMG International Standards Group

Julia LaPointe

Director

KPMG International Standards Group

Tara Smith

Partner

KPMG in South Africa

tara.smith@kpmg.co.za

Follow ‘KPMG IFRS’ on LinkedIn or visit home.kpmg/ifrs.

Copyright and disclaimer

home.kpmg/ifrs

Publication name: Cloud implementation costs

Publication number: 137801

Publication date: July 2021

© 2021 KPMG IFRG Limited, a UK company, limited by guarantee. All rights reserved.

The KPMG name and logo are trademarks used under license by the independent member firms of the KPMG global organization.

KPMG International Standards Group is part of KPMG IFRG Limited.

KPMG refers to the global organization or to one or more of the member firms of KPMG International Limited (“KPMG International”), each of

which is a separate legal entity. KPMG International Limited is a private English company limited by guarantee and does not provide services to

clients. For more detail about our structure please visit

https://home.kpmg/xx/en/home/misc/governance.html

The information contained herein is of a general nature and is not intended to address the circumstances of any

particular individual or entity.

Although we endeavour to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is

received or that it will continue to be accurate in the future. No one should act upon such information without appropriate professional advice after

a thorough examination of the particular situation.

This publication contains copyright © material of the IFRS

®

Foundation. All rights reserved. Reproduced by KPMG IFRG Limited with the

permission of the IFRS Foundation. Reproduction and use rights are strictly limited. For more information about the IFRS Foundation and rights to

use its material please visit www.ifrs.org.

Disclaimer: To the extent permitted by applicable law the Board and the IFRS Foundation expressly disclaims all liability howsoever arising from

this publication or any translation thereof whether in contract, tort or otherwise (including, but not limited to, liability for any negligent act or

omission) to any person in respect of any claims or losses of any nature including direct, indirect, incidental or consequential loss, punitive

damages, penalties or costs.

Information contained in this publication does not constitute advice and should not be substituted for the services of an appropriately qualified

professional.

‘IFRS

®

’, ‘IASB

®

’, ‘IFRIC

®

’, ‘IFRS for SMEs

®

’, ‘IAS

®

’ and ‘SIC

®

’ are registered Trade Marks of the IFRS Foundation and are used by KPMG IFRG

Limited under licence subject to the terms and conditions contained therein. Please contact the IFRS Foundation for details of countries where its

Trade Marks are in use and/or have been registered.