Public Employees’

Retirement System(PERS)

Member Guidebook

Pensions & Benefits

SP-0333-0624

PERS Member Guidebook June 2024 Page 2

Public Employees’ Retirement System

TABLE OF CONTENTS

PERS General Information ...................3

Foreword ..............................4

The Retirement System ....................4

Contacting the New Jersey Division of

...............4

Plan Information ..........................5

Eligibility ..................................6

Membership .............................7

Part-time Crossing Guards. . . . . . . . . . . . . . . . . . 8

...............8

Enrollments ...............................9

Overview ..............................10

Multiple and Dual Membership. . . . . . . . . . . . . . 11

Transfers ..............................12

Service Credit. . . . . . . . . . . . . . . . . . . . . . . . . . . 13

Vesting ................................13

Purchasing Service Credit ..................14

Overview ..............................15

Types of Service Eligible for Purchase. . . . . . . . 15

Important Purchase Notes .................16

Cost and Procedures for

Purchasing Service Credit .................16

Applying to Purchase Service Credit .........17

Loans ...................................19

Overview ..............................20

Applying for a Loan ......................21

Internal Revenue Service (IRS)

Requirements ...........................21

Supplementing your Pension ................23

Overview ..............................24

Retirements ..............................25

Overview ..............................26

Types of Retirement ......................26

Optional Settlements at Retirement ..........30

The Retirement Process ..................31

.....35

Employment After Retirement ..............36

Active and Retired Death Benets ............37

Overview ..............................38

...................39

Payment of Group Life Insurance ...........39

Group Life Insurance and

Leave of Absence. . . . . . . . . . . . . . . . . . . . . . . . 39

Taxation of Group Life

Insurance Premiums .....................40

Waiving Noncontributory Group

Life Insurance over $50,000. . . . . . . . . . . . . . . . 40

Conversion of Group Life Insurance .........41

..................41

Withdrawal ...............................43

Overview ..............................44

Withdrawing Contributions .................45

Workers’ Compensation ...................45

Appeals. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 47

Overview ..............................48

PERS General

Information

PERS Member Guidebook June 2024 Page 4

Public Employees’ Retirement System

FOREWORD

The New Jersey Public Employees’ Retirement Sys-

tem (PERS) Member Guidebook provides a summa-

the rules and regulations governing the plan. The

PERS Member Guidebook should provide you with all

the plan or regulations implementing the statutes, the

statutes and regulations will take precedence. Com-

are set forth in the New Jersey Statutes Annotated.

Regulations, new or amended, are published in the

-

trative Law supplementing the New Jersey Admin-

istrative Code. This guidebook, containing current

updates, is available for viewing on our website at:

www.nj.gov/treasury/pensions While at the New Jer-

be sure to check for PERS-related forms, fact sheets,

Addenda guidebooks have been created for the Law

Prosecutors Part, and Workers’ Compensation Judges

Part, which are components of the PERS, but have sig-

for viewing on our website.

The purpose of this guidebook is to provide you with

information about the retirement system to assist you

in making decisions concerning you and your family’s

future. If you have questions concerning your retire-

(NJDPB)” section.

Since this is your guidebook, we would appreciate any

comments or suggestions for improvement that you

might have. Please send them to the address listed be-

low.

New Jersey Division of Pensions & Benets

ATTN: Oce of Communications

P.O. Box 295

Trenton, NJ 08625-0295

THE RETIREMENT SYSTEM

The State of New Jersey established the PERS in 1955

to replace the former State Employees’ Retirement

System. The NJDPB is assigned all administrative

functions of the retirement system except for invest-

ment.

The PERS Board of Trustees has the responsibility

for the proper operation of the retirement system. The

Board consists of:

• Six employee representatives;

• The State Treasurer; and

• Two individuals appointed by the Governor.

The Board meets once per month. A PERS member

who wishes to be a candidate upon a vacancy for the

PERS Board of Trustees must be nominated by peti-

tions bearing the signatures of 500 active members.

Nominating petition forms, along with instructions

of the PERS Board of Trustees, P.O. Box 295, Trenton,

NJ 08625-0295.

CONTACTING THE NEW JERSEY

DIVISION OF PENSIONS & BENEFITS (NJDPB)

Member Benets Online System

registered PERS members access to their pension

online. Resources available through MBOS include:

pension loan; purchase of service credit; withdrawal

application; and retirement applications. If applicable,

account information for the New Jersey State Employ-

ees’ Deferred Compensation Plan (NJSEDCP), Sup-

plemental Annuity Collective Trust (SACT), and State

Retirees may use MBOS to: view retirement account

information; update an address; change direct deposit

-

date federal and/or New Jersey State income tax with-

holding.

Before you can begin using MBOS, you must be reg-

istered with MBOS and the MyNewJersey website.

Registration information can be found on the NJDPB

website.

If you need assistance registering for MBOS, call

the MBOS Help Line at (609) 292-7524 or send

pensions.nj@treas.nj.gov

Telephone Numbers

• For computerized information about your individ-

ual pension account 24 hours a day, seven days

a week, call our Automated Information System at

(609) 292-7524. With Interactive Voice Response

and added services, all you need is your Social

Security number and membership number to hear

• To speak with a representative about your PERS

7524 weekdays (except State holidays). The most

current hours of operation can be found on our

Page 5 June 2024 PERS Member Guidebook

Public Employees’ Retirement System

website. If you require the services of a relay oper-

ator please dial 711 and provide the operator with

the following phone number, (609) 292-6683. You

will then be connected to a Client Services phone

representative for assistance.

• To speak with a plan representative about the

NJSEDCP, also known as Deferred Comp, call

Empower (formerly Prudential) at 1-866-NJSED-

CP (1-866-657-3327) weekdays between 8:00

a.m. and 9:00 p.m. (except State holidays). A plan

representative will answer your questions and pro-

vide enrollment and distribution forms.

• To speak with a plan representative about the

SACT, call (609) 292-7524 weekdays (except State

holidays). The most current hours of operation can

be found on our website. SACT representatives

will answer your questions and provide enrollment

and distribution forms.

Internet, Email, and Mailing Address

General information and most publications of the

NJDPB can be found on the NJDPB website. You can

email the NJDPB at: pensions.nj@treas.nj.gov

Our postal address is:

New Jersey Division of Pensions & Benets

P.O. Box 295

Trenton, NJ 08625-0295

On all correspondence, be sure to include your mem-

bership number or the last four digits of your Social Se-

curity number.

Counseling Services

programs. Online video-based personal counseling

appointments are available for members of the PERS,

TPAF, PFRS, SPRS, and DCRP. In-person counsel-

ing is available by appointment only on a limited basis

for members of the PERS, TPAF, PFRS, SPRS, and

DCRP. Walk-in counseling services will not be avail-

able. Appointments can be made on our website.

PLAN INFORMATION

Name of Plan

The Public Employees’ Retirement System of New Jer-

sey (PERS)

Administration

Provisions of Law

The PERS was established by New Jersey Statute and

can be found in the New Jersey Statutes Annotated,

Title 43, Chapter 15A. Changes in the law can only be

made by an act of the State Legislature. Rules govern-

ing the operation and administration of the system may

be found in Title 17, Chapters 1 and 2 of the New Jersey

Administrative Code.

Funding

-

es: employer contributions, employee contributions,

and investment income from those contributions. All

contributions not required for current operations are in-

vested by the State Division of Investment.

Plan Year

For record-keeping purposes, the plan year is July 1

through June 30.

Service of Legal Process

Legal process must be served on the Attorney General

of New Jersey pursuant to New Jersey Court Rules, R.

4:4-4(7).

Employment Rights Not Implied

Membership in the PERS does not give you the right to

be retained in the employ of a participating employer,

have not accrued under terms of the system.

to changes by the legislature, courts, and other

-

-

in the New Jersey Statutes Annotated. Regu-

lations, new or amended, are published in the

-

ministrative Law supplementing the New Jersey

Administrative Code.

Eligibility

Page 7 June 2024 PERS Member Guidebook

Public Employees’ Retirement System

MEMBERSHIP

Eligibility rules and regulations are described in general

terms in this guidebook and may not cover all situa-

tions. If you have been a public employee for several

years, you should be aware that the present rules and

regulations governing enrollment in the retirement sys-

or membership status, you may wish to contact the

NJDPB for additional information.

PERS Special Employee Groups

The information contained in this guidebook applies

to the majority of the members enrolled in the PERS.

However, certain members of the PERS qualify for en-

rollment into special employee groups:

• Prosecutors Part of the PERS (closed to new

members May 22, 2010, and reopened September

24, 2021);

• State Legislative Retirement System (LRS) of the

PERS (closed to new members July 1, 2007); and

• Workers’ Compensation Judges (WCJ) Part of the

PERS (reopened to new members and certain ex-

(DCRP) members as of June 30, 2021.

Members of these special employee groups should re-

employee group for exceptions to the regular PERS

under the section headings in this guidebook.

PERS Membership Tiers

-

ship tiers based on enrollment date. Membership tiers

These membership tiers, pursuant to N.J.S.A. 43:1A-7

• Membership Tier 1 — Members enrolled prior to

July 1, 2007, and who have a minimum pension-

able salary of $1,500.

• Membership Tier 2 — Members enrolled on or

after July 1, 2007, and prior to November 2, 2008,

and who have a minimum pensionable salary of

$1,500.

• Membership Tier 3 — Members enrolled on or

after November 2, 2008, and on or before May 21,

2010, and who meet or exceed the minimum pen-

sionable salary set for the current year, subject to

future adjustment.

• Membership Tier 4 — Members enrolled after

May 21, 2010, and prior to June 28, 2011, and who

hours of 35 hours for State employees or 32 hours

for local government, local education, or State ed-

ucation employees), with no minimum pensionable

salary requirement.

• Membership Tier 5 — Members enrolled on or

after June 28, 2011, and who work the minimum

for State employees or 32 hours for local govern-

ment, local education, or State education employ-

ees), with no minimum pensionable salary require-

ment.

Unless otherwise indicated by membership tier — with

the exceptions noted above for LEO, LRS, Prosecutors

this guidebook are the same for all PERS members.

Eligibility Criteria

Membership in the retirement system is generally re-

quired as a condition of employment for most employ-

ees of the State, or any county, municipality, school

district, or public agency.

You are required to enroll in the PERS if:

• You are employed on a regular basis in a position

covered by Social Security; and

• You are not required to be a member of any other

State or local government retirement system on

the basis of the same position;

or if:

• You are receiving a monthly retirement allowance

from the PERS and you work more than the mini-

mum number of hours per week required for PERS

Tier 5 enrollment.

Note: See the Employment After Retirement Restric-

tions Fact Sheet about federal tax implications if retired

and returning to public employment.

Although most employees are required to enroll in the

retirement system when hired, in some instances you

may not qualify for enrollment in the system until up to

one year from your date of employment. For example,

if you are hired as a temporary or provisional employee

by an employer covered by Civil Service, you would not

be eligible for enrollment until the beginning of the 13th

month of continuous employment or the date of regular

Factors for Ineligibility

You cannot join the PERS if:

• You are a provisional or temporary employee cov-

ered by Civil Service with less than 12 months of

continuous service.

• You do not meet the minimum salary requirements

for Tier 1, 2, or 3 membership or the minimum

hourly requirements for Tier 4 or 5 membership.

• Your position is not covered by Social Security.

PERS Member Guidebook June 2024 Page 8

Public Employees’ Retirement System

-

sionally working in a position that does not lead

to permanent employment, and does not extend

beyond six consecutive months for employing lo-

months for employing locations that report on a

10-month basis).

retirement, who returns to public employment on a

part-time basis.

• You are a PERS disability retiree who has been

approved to return to PERS-covered employment,

but do not earn the minimum annual salary for en-

rollment under your original PERS membership

tier.

• You are retired and receiving a monthly retirement

allowance from another public retirement system in

New Jersey.

• You received a lump-sum retirement distribu-

DCRP, regardless of distribution amount.

• You are employed under a Professional Services

Contract.

section to follow).

and do not have an existing PERS account (see

below).

If you are in doubt about the eligibility of a position,

have your employer contact the NJDPB.

PART-TIME CROSSING GUARDS

Part-time crossing guards hired after May 21, 2010, are

ineligible for enrollment in the PERS, as they do not

work the minimum number of hours per week required

for Tier 4 or 5 membership. Prior to May 21, 2010, en-

rollment of part-time crossing guards depended on sev-

eral factors:

• Enrollment was optional if the part-time crossing

from the federal government (whether military, ci-

• A crossing guard who had previously retired from

any public retirement system in New Jersey, oth-

er than the PERS, was ineligible for enrollment,

though he or she could still be employed in the

crossing guard position.

• If a crossing guard was retired from the PERS, and

earned more than $15,000 total from PERS em-

ployment, then enrollment was mandatory.

If you had the option and chose to join the retirement

system, you cannot withdraw your funds until you end

your employment.

ELECTED OR APPOINTED OFFICIALS

-

enrollment in the DCRP.

veterans were required to enroll in the PERS and en-

These members may continue to receive PERS service

credit while serving continuously in the same elected

-

Program (DCRP)” section.

Note: Service in either House of the State Legislature

-

ditional information in the PERS Guidebook Addendum

for the LRS.

elected prior to July 1, 2007, and opted not to enroll in

the PERS, will immediately become eligible for mem-

bership in the DCRP upon re-election to the same

(DCRP)” section.

section.

Governor on or after July 1, 2007, is ineligible for enroll-

ment in the PERS. This includes: those requiring the

advice and consent of the Senate; those appointed by

the Governor to serve at the pleasure of the Governor

in a substantially similar manner by the governing body

of a local entity (county, municipality, etc.). Newly ap-

(DCRP)” section.

If the State or local appointee was a PERS member pri-

or to July 1, 2007, the individual may continue to receive

PERS service credit while serving in the same, or any

new or subsequent appointment, provided that there

has not been a break in PERS service of more than two

consecutive years prior to the appointment.

In addition, an appointee may be enrolled in the PERS

-

cate and is appointed to one of the following titles that

-

-

works manager.

Enrollments

PERS Member Guidebook June 2024 Page 10

Public Employees’ Retirement System

OVERVIEW

(Prosecutors Part members see addendum)

Enrollment/Certication of Payroll Deductions

Your employer must complete an Enrollment Applica-

tion

Information Connection (EPIC).

Online enrollments are processed immediately by the

that includes your PERS membership number.

When enrollment processing is complete, you and your

employer will receive a Certication of Payroll Deduc-

tions with the date pension deductions will begin, your

rate of contribution, and any back deductions due.

You may wish to keep the Certication of Payroll De-

ductions

that you have a record of your enrollment in the retire-

ment system.

Proof of Age

All members of the PERS must provide documentation

that proves their age. If possible, you should provide

your proof of age to the NJDPB when you enroll; how-

ever, it does not delay the processing of your enroll-

ment application if you do not. Proof of age will be re-

quired to be eligible to retire.

Acceptable evidence of your age includes a photocopy

of:

• Passport or U.S. Passport Card;

• A current digital New Jersey driver’s license or

N.J. Motor Vehicle Commission;

• A current digital Pennsylvania or New York driver’s

license; or

• Naturalization or immigration papers.

Unacceptable documentation includes military records

indicating your age, expired documentation, out-of-

state driver’s licenses except P.A. and N.Y., hospital

-

members.

Designating a Beneciary

When the Enrollment Application is submitted, the new

member should also submit a Designation of Bene-

ciary through MBOS. Your PERS membership number

online enrollment.

Note:

record until the NJDPB receives a properly completed

designation.

MBOS. Otherwise, the NJDPB will only accept a writ-

Life Insurance Over Age 60

A member must prove insurability when age 60 or older

at the time of enrollment — this is validated by Pruden-

tial Financial.

Public Information and Restrictions

Most of the information maintained by the retirement

system, including member salary and/or pension ben-

N.J.S.A. 47:1A-1 et seq., the Open Public Records Act

(OPRA). However, certain personal information, such

as a member’s address, telephone number, Social Se-

-

ciary information while the member is living, and medi-

cal information is restricted from public access.

Further restrictions to personal health information ex-

ist under the privacy provisions of the federal Health

Insurance Portability and Accountability Act (HIPAA).

authorization for the release of medical information to

a third party who is not a doctor, hospital, or business

Information about HIPAA is available on the NJDPB

website.

The NJDPB has implemented additional protection for

members in accordance with the New Jersey Identity

Theft Prevention Act, N.J.S.A. 56:11-28 et seq. Secu-

rity Freeze procedures are available to restrict access

to the accounts of members who are, or have a serious

risk of becoming, victims of identity theft. Additional

information is available in the Identity Theft and Your

Benets Fact Sheet.

Member Contribution Rate

Reform Law, increased the PERS member contribution

rate over seven years to bring the total contribution rate

to 7.5 percent of base salary as of July 1, 2018.

Note: For PERS Prosecutors Part members, the con-

tribution rate is 10 percent of base salary with no addi-

tional increases.

Increases in the member contribution rate also in-

creased the minimum repayment amount for pension

loans or for the cost of a purchase of service credit

change.

Pensionable Salary — Your contribution rate is ap-

plied to your base salary to determine pension deduc-

tions. Base salary does not include overtime, bonuses,

Page 11 June 2024 PERS Member Guidebook

Public Employees’ Retirement System

or large increases in compensation paid primarily in

anticipation of retirement. Your pension contributions

are deducted from your salary each pay period and re-

ported to the PERS by your employer.

• The PERS contribution rate for Tier 1 members is

applied to the full pensionable salary (up to the fed-

eral pensionable maximum described later in this

section).

• The PERS contribution rate for Tier 2, Tier 3, Tier

4, and Tier 5 members is applied to the pension-

able salary up to a compensation limit based on

the annual maximum wage for Social Security de-

ductions. Tier 2, Tier 3, Tier 4, and Tier 5 members

who earn in excess of the annual compensation

limit will be enrolled in the DCRP in addition to the

PERS. A contribution of 5.5 percent of the salary

in excess of the limit (plus three percent from the

employer) will be forwarded to a DCRP account

-

gram (DCRP)” section).

Federal Pensionable Maximum — Since the PERS

Internal Revenue Code (IRC), Section 401(a)(17), the

current federal ceiling on pensionable compensation

applies to the base salaries of PERS members.

Tax Deferral — Since January 1987, all mandatory

pension contributions to the PERS have been feder-

ally tax deferred. Under the 414(h) provisions of the

IRC, this reduces your gross wages subject to federal

income tax. Purchases of service credit are voluntary

and are not tax deferred unless funded by a rollover

Purchase Payment” section.

MULTIPLE & DUAL MEMBERSHIP

Multiple Membership

You are considered a multiple member if you are em-

ployed and reported to the retirement system by more

than one PERS-participating employer at the same

time.

Note: If terminating PERS employment and accepting

-

fers” section.

Tier 1, Tier 2, and Tier 3 Members — Under the provi-

sions of N.J.S.A. 43:15A-7, multiple membership is only

available to Tier 1, Tier 2, and Tier 3 members; only

for PERS-eligible positions when enrolled on or before

May 21, 2010; and provided that there has not been a

break in service in any concurrently held PERS-eligible

position.

Note: A break in service is any pension-reporting peri-

od without pay — a monthly or a biweekly pay period as

appropriate to the employer’s reporting method — with

abolishment of position, military leave, Workers’ Com-

pensation, litigation, or suspension.

If there is a break in service with any concurrently held

PERS-eligible position after May 21, 2010, that employ-

er will no longer be permitted to submit pension con-

tributions for a multiple member. Furthermore, service

credit or salary from any future employment with that

employer will not qualify for the compensation base for

pension contributions and calculation of retirement for

the PERS multiple member.

Once you have established multiple membership, you

have retired or terminated employment from every po-

sition covered by the PERS.

Tier 4 and Tier 5 Members — N.J.S.A. 43:15A-25.2

eliminated multiple membership and requires that a

PERS member enrolled after May 21, 2010, be eligible

for Tier 4 or Tier 5 membership based upon only one

position.

The retirement system will designate the position pro-

viding the highest compensation for the member from

among any concurrently held eligible positions. This

designated position will be used as the basis for eligi-

bility for membership, service credit, the compensation

base for pension contributions, and for other pension

calculations.

If a Tier 4 or Tier 5 member leaves a designated posi-

position with higher compensation — the member will

receive a new designation by the retirement system, if it

is deemed appropriate.

For Tiers 1, 2, and 3 — any new, concurrently held

PERS-eligible position begun after May 21, 2010, will

not qualify for service credit or the compensation base

for pension contributions and calculation of retirement

for any PERS member.

Dual Membership

You are considered a dual member if you are a mem-

ber of more than one New Jersey State-administered

retirement system at the same time. For example, if you

are a State employee enrolled in the PERS and an ed-

ucator enrolled in the Teachers’ Pension and Annuity

Fund (TPAF), you are a dual member.

When establishing dual membership, an Enrollment

Application

retirement systems.

Unlike a multiple member, a dual member’s contribu-

tions and service credit are kept separate, and bene-

retirement system in the event of retirement, death, or

withdrawal.

PERS Member Guidebook June 2024 Page 12

Public Employees’ Retirement System

A dual member may also retire from one retirement

system and remain an active, contributing member of

the second retirement system, except ABP and DCRP

members.

TRANSFERS

(Prosecutors Part members see addendum)

Intrafund Transfer

An Intrafund Transfer is the transfer of your account

from one PERS employer to another PERS employer.

If you terminate your current PERS position and accept

-

gible to transfer your PERS account and maintain your

original PERS membership tier status provided:

• You have not withdrawn your membership (see the

• It has not been more than two consecutive years

since your last pension contribution; and

• You meet the eligibility requirements of your PERS

membership tier with the new PERS employer.

If you meet the criteria listed above, your new employer

Report of Transfer form with the NJDPB.

If there has been a break in service of more than two

consecutive years since your last pension contribution,

you cannot continue contributions under your prior

PERS membership. The new employer should submit

a new Enrollment Application through EPIC with the

NJDPB. You will be enrolled in a new PERS account

-

turn to PERS employment.

If you are vested in your prior, inactive PERS account

transfer of your old membership account to your new

membership account. This type of transfer is called a

Tier-to-Tier Transfer and is completed by submitting a

Tier-to-Tier Transfer Form. It is important to note that

by completing a Tier-to-Tier Transfer Form you waive

original, inactive membership tier.

If you are not vested in your prior, inactive PERS ac-

count, you may withdraw your contributions. See the

If you have withdrawn your prior PERS account, wheth-

er you have a break in service of more than two con-

secutive years or not, the new employer must submit

an Enrollment Application through EPIC and you will be

enrolled in a new PERS account under the membership

-

ship. The service credit under the prior, inactive mem-

bership may then be eligible for purchase as Former

-

tion.

Note:

PERS employer and adding employment with a second

(or subsequent) PERS employer, see the limitations in

Interfund Transfer

An Interfund Transfer is the transfer of your account

from a PERS employer to employment covered by a

system, or vice versa.

If you terminate your current PERS position and accept

-

ministered retirement system, you may transfer your

contributions and service credit to the new retirement

system provided:

• You have not withdrawn your membership (see the

• It has not been more than two consecutive years

since your last pension contribution;

• You are not a dual member with more than three

years of concurrent service in the TPAF* or with

any concurrent service in any other retirement sys-

• You meet the eligibility requirements of the new re-

tirement system; and

• You apply for the Interfund Transfer within 30 days

of the date you meet the eligibility requirements of

the new retirement system.

Note: A PERS member who meets the criteria listed

above and transfers to a position covered by the TPAF

is eligible to maintain his/her original PERS member-

ship tier status under the TPAF account.

-

ministered retirement system, except the ABP or DCRP,

who meets the criteria listed above and transfers to a

position covered by the PERS will be enrolled in the

PERS membership tier that corresponds to the original

date of enrollment in the prior retirement system.

If eligible, in order to transfer your membership ac-

count, an Enrollment Application for the new retirement

system and an Application for Interfund Transfer should

be submitted to the NJDPB. Applications must be re-

ceived within 30 days of the date you meet the eligibility

requirements of the new retirement system.

If there is a break in service of more than two consecu-

tive years since your last pension contribution — or you

have withdrawn your account — you cannot transfer

your prior PERS contributions and service credit to the

new retirement system. You will be enrolled in a new

account with the new retirement system. Your new em-

Enrollment Application for the

new retirement system with the NJDPB.

*A PERS member with three years or less of concurrent service in the TPAF may, under certain conditions, transfer all service credit from one fund to the other, less any concurrent service

credit.

Page 13 June 2024 PERS Member Guidebook

Public Employees’ Retirement System

Note: Members enrolling into the PERS or TPAF after

a break in service of two or more years will be enrolled

PERS or TPAF employment begins.

SERVICE CREDIT

(Prosecutors Part members see addendum)

-

mulated service credit, it is important that you receive

the correct amount of credit for the amount of time you

work.

• Employees whose employers report service and

contributions on a monthly basis will receive one

month of service credit for each month a full contri-

bution is made.

• Employees whose employers report service and

contributions biweekly will receive one pay period

of service credit for each pay period a full pension

contribution is made.

• Employees paid on a 10-month contract from

September through June will receive credit for the

July and August that preceded September if a full

month’s pension deduction is taken for September.

Credit For Military Service

After Enrollment

The federal Uniformed Services Employment and Re-

employment Rights Act of 1994 (USERRA) provides

that a member who leaves employment to serve on ac-

tive duty is entitled to certain pension rights upon return

to employment with the same employer. If the mem-

ber makes the pension contributions that would have

been normally required upon return and within the time

will count for vesting, retirement eligibility, the calcula-

When an employee returns from uniformed military

service to PERS-covered employment, the employ-

er should notify the NJDPB no later than 30 days af-

ter the employee’s return by submitting a Request for

USERRA-Eligible Service

NJDPB will provide the employee with a quotation for

the cost for purchasing the service credit.

There is a time-sensitive element to the USERRA pur-

credit provisions available to PERS members. See the

USERRA - Military Service After Enrollment Fact Sheet

for more information.

VESTING

(LEO, LRS, and Prosecutors Part members

see addendum)

You are vested in the PERS after you have attained

10 years of service credit. Being vested in the PERS

means that you are guaranteed the right to receive a

age. For Tier 1 and Tier 2 members, normal retirement

age is 60. For Tier 3 and Tier 4 members it is age 62.

For Tier 5 members it is age 65.

• If you are vested and terminate your employment,

-

you may voluntarily withdraw from the retirement

-

tem” section).

• If you are vested, terminate your employment

without retiring or withdrawing, and return to

PERS-covered employment within two consecu-

tive years of the last pension contribution, you may

continue to make contributions to — and accrue

service in — the existing pension account.

Example: A PERS Tier 1 member with 15 years

of service terminates employment at age 45 and

accepts another PERS-eligible position six months

later. In this case, the member can resume making

contributions to the existing PERS account and will

retain his Tier 1 membership status.

• If you are vested, terminate your employment

without retiring or withdrawing, and return to

PERS-covered employment two or more years

after the last pension contribution, you cannot re-

sume contributions to the vested account. Instead

you would be enrolled in a new PERS account.

Example: A PERS Tier 1 member with 15 years of

service terminates employment at age 45 and ac-

cepts another PERS-eligible position three years

later. In this case, it has been over two consecu-

tive years since the last PERS contribution, and

the member will be required to enroll under a new

PERS account as a Tier 5 member (see “Excep-

tions” section if laid o or terminated through no

fault of your own).

• If you are not vested and you terminate employ-

ment before retiring, your options vary depending

on the nature of your termination and/or your age

-

ing Employment” section).

Purchasing

Service Credit

Page 15 June 2024 PERS Member Guidebook

Public Employees’ Retirement System

OVERVIEW

Since your retirement allowance is based in part on the

amount of service credit posted to your account at the

time of retirement, it may help you to purchase addition-

al service credit if you are eligible to do so.

Only active members of the retirement systems are

permitted to purchase service credit. An active member

is one who has not retired or withdrawn, and who has

made a contribution to the retirement system within two

consecutive years of the purchase request.

In no case can you receive more than one year of ser-

-

ber cannot purchase concurrent service from any other

TYPES OF SERVICE ELIGIBLE FOR PURCHASE

(Prosecutors Part members see addendum)

If a type of service is not listed below, it is not eligible

for purchase.

Temporary Service

Members may be eligible to purchase service credit for

temporary or provisional employment provided the em-

ployment was continuous, immediately preceded a per-

manent or regular appointment in a position covered by

the PERS, and meets eligibility requirements for the tier

in which the member is enrolled.

• Members are allowed to purchase temporary ser-

vice rendered under a former membership in a

New Jersey State-administered retirement system

(PERS, TPAF, etc.).

• Part-time, hourly, and substitute service may be

eligible for purchase.

• Service through the Job Training Partnership Act

(JTPA), and its successor program established un-

der the Workforce Investment Act of 1998, is not

eligible.

Leave of Absence Without Pay

Members may be eligible to purchase service credit for

time eligible for purchase depends on the type of leave

that was taken.

• Up to two years may be purchased for leaves tak-

en for personal illness.

• Up to three months may be purchased for leaves

taken for personal reasons.

• Maternity leave is considered personal illness.*

• Child care leave is considered personal reasons.

A leave of absence without pay under a former mem-

bership in a New Jersey State-administered retirement

system may be eligible for purchase.

If a member who is employed 10 months per year goes

on an approved unpaid leave for personal reasons for

the months of May, June, and/or September, the mem-

ber will be allowed to purchase credit for the months of

July and August as part of the leave of absence — up

Note: Leave of absence for union representation may

also be available for purchase. This type of leave must

be purchased quarterly and within 30 days of the end

Application to Purchase

Service Credit for Union Representation for additional

information and instructions.

Former Membership Service

Members may be eligible to purchase all service cred-

ited under a previous membership in a New Jersey

State-administered retirement system (PERS, TPAF,

etc.) which has been terminated after two continuous

years of inactivity in accordance with statute; or fol-

lowing the withdrawal of the contributions made under

such membership by the member.

Out-of-State Service

Members may be eligible to purchase up to 10 years

of service credit for public employment rendered with

any state, county, municipality, school district, or public

agency outside the State of New Jersey, provided the

service rendered would have been eligible for mem-

bership in a New Jersey State-administered retirement

system had the service been rendered as a public

employee in this State. This service is only eligible for

purchase if the member is not receiving or eligible to

retirement system.

Note: -

vice credit cannot be used to qualify for employer-paid

However, the purchase may be used to increase a

member’s monthly retirement allowance.

U.S. Government Service

Members may be eligible to purchase up to 10 years

of service credit for civilian service rendered with the

U.S. government if the public employment would have

been eligible for credit in a New Jersey State-adminis-

tered retirement system had the service been rendered

as a public employee in this State. This service is only

eligible for purchase if the member is not receiving or

* A certication from a physician that a member was disabled due to pregnancy and resulting disability for the period in excess of three months is required. Otherwise, three

months is the maximum period of purchase for maternity.

PERS Member Guidebook June 2024 Page 16

Public Employees’ Retirement System

government based in whole or in part on this service.

Note:

service credit cannot be used to qualify for employ-

PERS. However, the purchase may be used to increase

a member’s monthly retirement allowance.

Military Service Before Enrollment

Members may be eligible to purchase service credit for

up to 10 years of active military service rendered prior

to enrollment, provided the member is not receiving or

eligible to receive a military pension or a pension from

any other state or local source for such military service.

Active military service eligible for purchase means full-

time duty in the active military service of the United

States and includes full-time training duty, annual train-

ing duty, and attendance at a school designated as a

service school by law or by the secretary of the military

department concerned. It cannot include periods of

service of less than 30 days. It does not include week-

end drills, annual summer training of a national guard

or reserve unit or time spent as a cadet or midshipman

at one of the military academies.

Active military service that has been combined with re-

serve component service to qualify for a military pen-

sion as a reserve component member may be eligible

for purchase.

If you qualify as a veteran, you may be eligible to pur-

Military Service After Enrollment

Under the requirements of USERRA, members may

receive credit for military service rendered after Oc-

tober 13, 1994. However, under N.J.A.C. 17:1-3.10,

USERRA-eligible service will only be used toward

vesting, retirement eligibility, the calculation of the

eligibility, if the employee pays the required pension

contributions that would have been required if the em-

ployee had not left.

Note: There is a time-sensitive element to this pur-

chase. See the USERRA – Military Service After En-

rollment Fact Sheet.

Uncredited Service

Members may be eligible to purchase any regular em-

ployment with a public employer in New Jersey for

which the member did not receive service credit but

which would have required compulsory membership in

the retirement system at the time it was rendered.

Local Retirement System Service

Members may be eligible to purchase service cred-

it established within a local retirement system in New

Jersey if they were ineligible to transfer that service to

the PERS upon withdrawal from the local retirement

system. This service is only eligible for purchase if the

member is not receiving nor eligible to receive retire-

IMPORTANT PURCHASE NOTES

• If you qualify as a non-veteran, you are eligible

to purchase an aggregate of 10 years of service

credit for work outside New Jersey (Out-of-State,

Military, and U.S. Government Service).

• Out-of-State Service, or U.S. Government Ser-

vice, or service with a bi-state or multi-state agen-

cy requested for purchase after November 1,

2008, cannot be used to qualify for any State-paid

• If you qualify as a military veteran, you may be el-

military service rendered during periods of war for

an aggregate of 15 years of service outside New

Jersey (Out-of-State, Military, and U.S. Govern-

ment Service).

• To qualify for an Ordinary Disability Retirement,

members need 10 years of New Jersey service;

therefore, the purchase of U.S. Government, Out-

of-State, or Military Service cannot be used to

qualify for this type of retirement.

• Purchases of service credit are voluntary and are

not tax deferred unless funded by a rollover from

Purchase Payment” section).

COST AND PROCEDURES FOR

PURCHASING SERVICE CREDIT

You can receive an estimate of the cost of purchasing

service credit by calling the Automated Information

System at (609) 292-7524 or by using the online Pur-

chase Calculator on MBOS.

The cost of a purchase is based on four factors:

• A purchase factor based on your nearest age at

the time the NJDPB receives your purchase appli-

• The higher of either your current annual salary or

your membership account;

• The years and months of service being purchased;

and

• The type of service purchased.

The cost of the purchase will rise with an increase in

your age and/or salary.

The cost of purchasing service is borne by both you

and the participating employers with the important ex-

ceptions of Military Service before Enrollment, U.S.

Government Service, and Local Retirement System

employer will not be liable for any costs of the pur-

Page 17 June 2024 PERS Member Guidebook

Public Employees’ Retirement System

chase. If you purchase U.S. Government Service, Mil-

itary Service before Enrollment, or Local Retirement

System Service, you, as the member, are responsible

for the full cost; therefore, the cost quoted to you for

purchasing these types of service will be twice the cost

for other types of purchase.

Partial Purchases

You may purchase all or part of any eligible service. If

you make a partial purchase, you may purchase any

remaining eligible service at a later date. The cost of

any later purchase will be based upon your age and the

your subsequent request to purchase.

Estimating the Cost of a Purchase

To estimate the cost of a shared purchase, multiply the

year salary times the purchase factor corresponding

The result is the cost of one year of service. Multiply

this cost by the appropriate number of years being pur-

chased. This procedure can be used for calculating

the cost of Temporary Service, Former Membership,

Leaves of Absence, Uncredited Service, and Out-of-

State Service.

To calculate the purchase cost of Military Service be-

fore Enrollment, U.S. Government Service, Leave of

Absence for Union Representation, or Local Retire-

ment System Service, the same procedure is used, ex-

cept the resulting cost is doubled.

Note: The cost of a purchase of Military Service after

Enrollment under USERRA is based on the required

pension contributions for the period of military service.

Example: A member, age 45, earning $60,000 a year,

wishes to purchase 18 months Temporary Service:

Purchase Factor (from chart) = 0.048761

Purchase Factor x Annual Salary x Time Being Pur-

chased = Purchase Cost

0.048761 x $60,000 x 1.5 years = $4,388.49

If the same member were to purchase 18 months of

Military Service, the purchase cost would be $8,776.98

— twice the amount of the Temporary Service.

An online Purchase Cost Calculator and additional pur-

chase of service credit resources are available on the

NJDPB website.

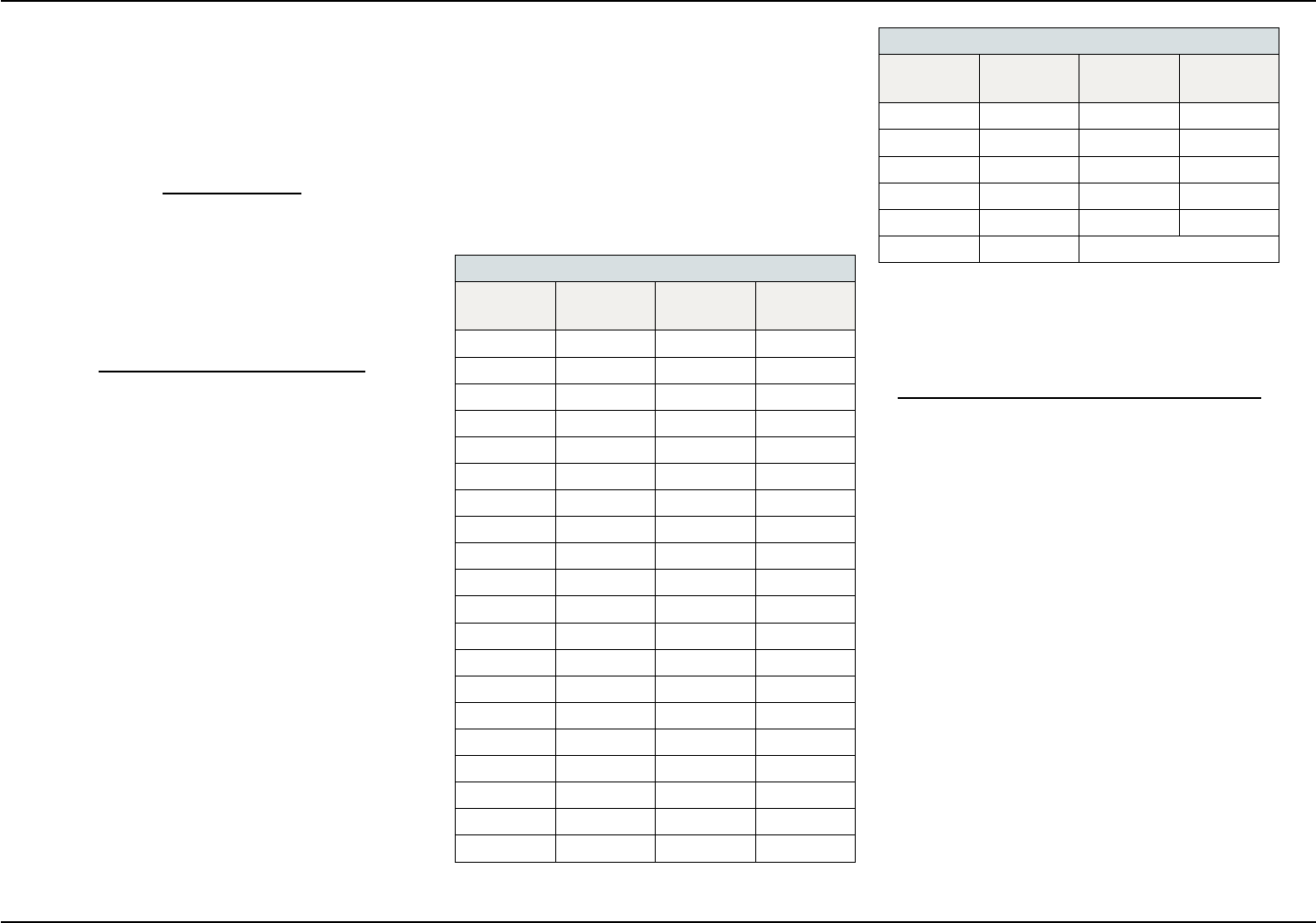

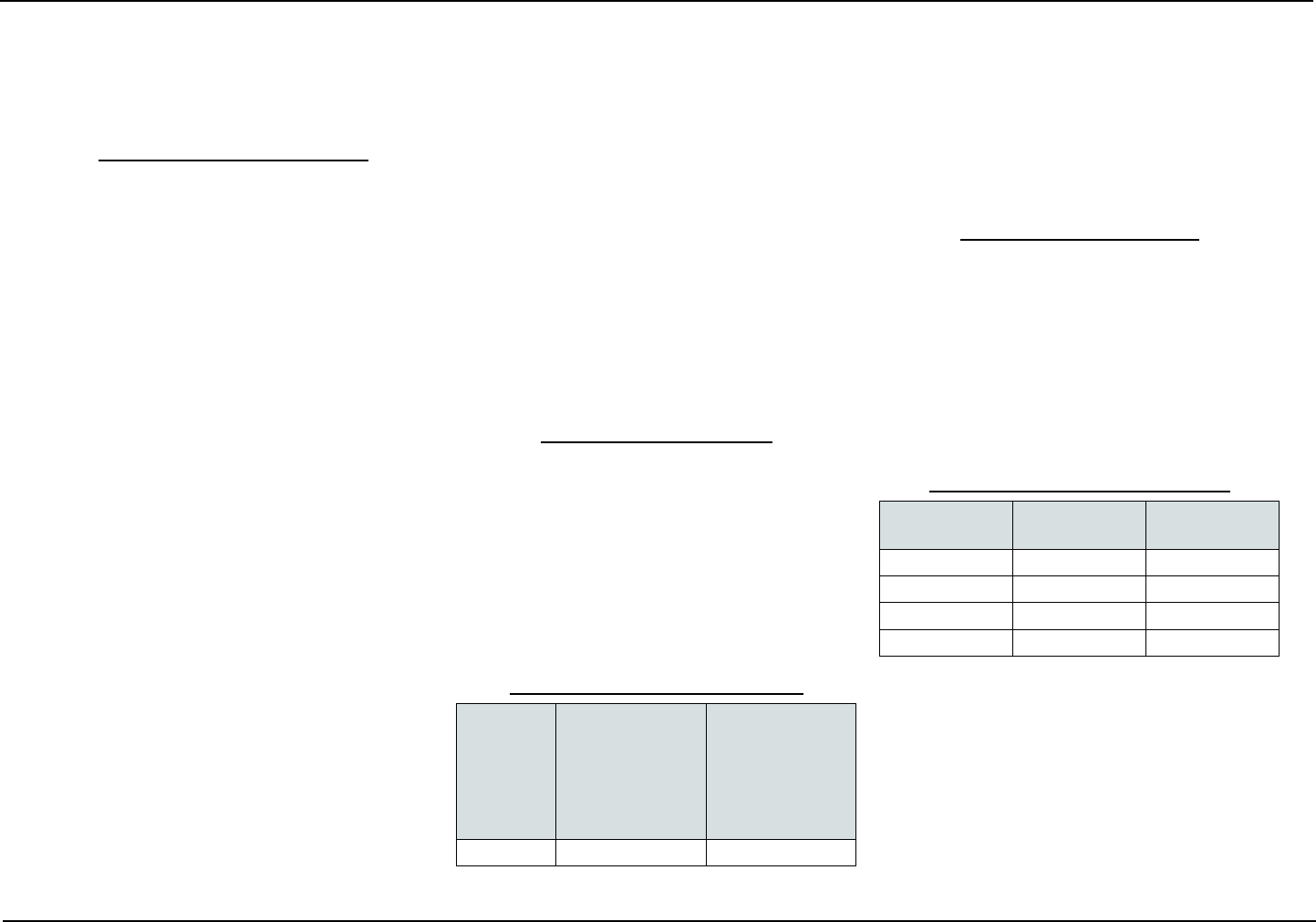

Purchase Rate Chart

Age

Purchase

Factor Age

Purchase

Factor

20 .031379 46 .049932

21 .031759 47 .051155

22 .032158 48 .052433

23 .032578 49 .053768

24 .033018 50 .055163

25 .033480 51 .056620

26 .033964 52 .058144

27 .034471 53 .059737

28 .035002 54 .061403

29 .035558 55 .063145

30 .036139 56 .064967

31 .036748 57 .066873

32 .037384 58 .068868

33 .038048 59 .070956

34 .038743 60 .073142

35 .039469 61 .072021

36 .040227 62 .070853

37 .041019 63 .069637

38 .041847 64 .068380

39 .0 42711 65 .067083

Purchase Rate Chart

Age

Purchase

Factor Age

Purchase

Factor

40 .043613 66 .065746

41 .044555 67 .064376

42 .045539 68 .062973

43 .046567 69 .061545

44 .047640 70 & older .060100

45 .048761

APPLYING TO PURCHASE SERVICE CREDIT

All purchase requests must be submitted using the Pur-

chase Application available through MBOS.

Exceptions to the MBOS Purchase Application

While PERS members are usually required to process

purchase requests through MBOS, members are not

able to use the MBOS Purchase Application for the fol-

lowing types of purchase:

• Members applying for the purchase of Military

Service after Enrollment under the provisions of

USERRA. To purchase this service the employer

must submit the Request for USERRA-Eligible

Service form within the time frames required under

the law (see the USERRA – Military Service After

Enrollment Fact Sheet).

• Members applying for the purchase of Leave of Ab-

sence for Union Representation. This type of leave

must be purchased quarterly and within 30 days of

Application

to Purchase Service Credit for Union Representa-

tion for additional information and instructions.

Please note that these are the only circumstances

where paper purchase requests are permitted. Other

paper applications to purchase service credit received

PERS Member Guidebook June 2024 Page 18

Public Employees’ Retirement System

by mail will not be processed, and the member will be

mailed instructions on submitting the request through

MBOS.

Upon receipt of your MBOS Purchase Application —

and any required supporting documentation — a quota-

tion of cost will be calculated provided that all purchase

eligibility criteria are met. Processing times vary and a

request cannot be completed until the NJDPB receives

a former employer for the purchase of Out-of-State or

U.S. Government Service.

a Purchase Cost Quotation Letter indicating the cost of

any service approved for purchase. You must respond

When you agree to purchase a certain amount of ser-

vice credit, the NJDPB assumes that you will complete

the purchase and credits your account with the entire

amount of service, even if you are paying the cost

through payroll deductions. Any estimates of retirement

allowance you receive are based on the full amount of

credit you agreed to purchase.

You may pay the cost of purchasing service credit:

• In one lump-sum payment;

• By having extra payroll deductions withheld from

your pay. The minimum deduction is equal to one-

half of your normal rate of contribution to the retire-

ment system over a maximum period of 10 years

and includes interest at the assumed return rate of

the retirement system;

• By paying a single down payment and having the

remainder paid through payroll deductions; or

• With a direct rollover or trustee-to-trustee transfer

If you retire before completing a purchase, you may

choose to receive prorated credit for the amount of

service you have paid for, or you can pay the balance

at the time of retirement to receive full credit. See the

A member who authorizes a purchase of service cred-

it through payroll deductions may cancel those de-

ductions at any time. No refunds will be made of any

lump-sum payments, partial payments, or installment

payments. The member will receive prorated service

credit for the service purchased to the date installment

payments cease. Any subsequent requests to pur-

chase the remaining service credit will be based on the

request is received.

If you have an outstanding arrears obligation for the

purchase of additional service credit, interest may be

assessed if there is a lapse of two years or more in

payments toward the purchase.

If you have not made installment payments for the pur-

chase of additional service credit for two years, your

purchase will be canceled. You will receive pro rata

credit for the service purchased to the date that the in-

stallment payments ceased.

If you return from an approved leave of absence after

two years, you may request that the original purchase

be resumed. The purchase will be recalculated to in-

clude additional regular interest accrued between two

years after the date of the last installment payment and

the date the purchase is resumed.

Rollover for Purchase Payment

Members may pay for all or part of a purchase by trans-

ferring or rolling over tax-deferred funds from an eligible

from which a transfer or rollover can be made are:

• 403(b) - Tax-Sheltered Annuity Plan;

• 457(b) - State and Local Government Deferred

Compensation Plan; or

• IRA - With tax-deferred funds:

– Traditional IRA;

– SIMPLE IRA (must have been open for two or

more years);

– Conduit IRA; or

– Rollover IRA.

Note: The NJDPB cannot accept rollovers from a Roth

IRA or a Coverdell Education Savings Account (former-

ly known as an Education IRA).

Additional information on requesting a transfer or roll-

over of tax-deferred funds for the purchase of service

credit is included in the Purchase Cost Quotation Letter

you receive upon the NJDPB’s determination of your

eligibility to purchase service.

Loans

PERS Member Guidebook June 2024 Page 20

Public Employees’ Retirement System

OVERVIEW

(Prosecutors Part members see addendum)

If you are an active contributing member of the PERS,

you may be eligible to borrow from your pension ac-

count.

Loans are governed by the following conditions:

• Service Credit — You must have at least three

years of pension service credit posted to your re-

tirement system account. Pension contributions

are posted to your account on a quarterly basis. It

normally takes 45 days after the end of a quarter

for your contributions to be posted to your account.

For example, if you enrolled in the retirement sys-

tem on February 1, 2015, you would not have three

years posted to your account until May of 2018,

when we update the quarter in which you will attain

three years.

• Number of Loans Per Year — You may borrow

twice in any calendar year. This is determined by

the date of the disbursement, not the date of the

request. For example, if you make a request for a

loan on December 28th, but the disbursement date

the new year.

• Loan Amount — The minimum amount you may

borrow is $50, and loan amounts then increase in

increments of $10.

The maximum you may borrow is 50 percent of

your contributions that are posted to your account,

up to a maximum loan balance of $50,000, which-

ever is less, when added to the highest balance of

any loan in the last 12 months.

You may learn the amount you may borrow — and

-

nations — by using the online Loan Application on

MBOS.

• Electronic Fund Transmittal (EFT/Direct De-

posit) is Required — All loans are disbursed by

Electronic Fund Transmittal (EFT). You must have

a valid bank routing number and account num-

ber when submitting a Loan Application through

MBOS. Paper loan checks are no longer produced

under any circumstance.

• Interest Rate — Interest is charged on the de-

clining balance of the loan at a commercially rea-

sonable rate set annually by the New Jersey State

Treasurer. The current interest rate is posted on the

NJDPB website.

When you borrow, you will have the same inter-

est rate for the life of your loan unless you borrow

-

est rate has changed. Every time you borrow, the

current year’s interest rate. The new loan must be

The interest rate is determined using the Prime

Rate as of December of the previous year plus 2.5

percent.

• Administrative Fee — An administrative process-

ing fee applies to all pension loans. The adminis-

trative processing fee is set annually and is based

on the actual costs associated with administering

the pension loan program. The current administra-

tive processing fee is posted on the NJDPB web-

site.

• Loan Repayment — Loans must be repaid within

-

payment of a loan is equal to the full pension con-

section). The maximum allowable deduction at the

time of application toward the repayment of your

loan is 25 percent of your base salary. Provided

that the minimum loan repayment amount will re-

-

ment amount of a loan will be similar whether you

borrow $500 or $5,000; however, the repayment

of a larger loan will continue for a longer period of

time than for a smaller loan.

Loan repayments will increase to more than the

minimum deduction if the entire loan balance can-

you have an outstanding loan and take another

loan.

If you have an outstanding loan balance and take

another loan, the Internal Revenue Service (IRS)

requires that the new combined loan balance must

loan. This means that the repayment amount may

be substantially higher to ensure full repayment

issuance of the original loan. Furthermore, the re-

quested loan amount may be reduced, or the loan

request may be rejected, if the payroll deductions

-

riod would exceed the 25 percent of salary restric-

-

vice (IRS) Requirements” section).

repayment schedule after your loan is disbursed,

balance, plus any accrued interest prior to the end

of the regular repayment schedule.

Page 21 June 2024 PERS Member Guidebook

Public Employees’ Retirement System

APPLYING FOR A LOAN

All pension loan requests must be submitted using the

Loan Application available through MBOS and you

must provide a valid bank routing number and account

number. Once you apply, you receive immediate con-

Once the loan application is submitted, a pension loan

cannot be canceled.

Exceptions to the MBOS Loan Application

While most members are required to process loan

requests through MBOS, some members may not be

able to access the Loan Application for one of the fol-

lowing reasons:

• Members applying for a loan within six months of

returning from a leave of absence;

• Members applying for a loan within six months of

transferring to a new employer within the same re-

systems; or

• State employees paid on a supplemental payroll

schedule.

In these cases your employer must complete a Certi-

ed Loan Request to verify your salary and/or certify

that you are actively employed.

• If your employer was late in submitting the Report

of Contributions for the quarterly posting, you may

still be able to borrow; however, your employer

must complete a Certied Loan Request to verify

your salary and active pay status. You may only

borrow based on the prior quarter’s posted pen-

sion contributions.

• If you have established a security freeze on your

pension account due to identity theft, you cannot

access MBOS and must contact the NJDPB’s

Identity Theft Coordinator to request a loan (for

more information see the Identity Theft and Your

Benets Fact Sheet).

Please note that these are the only circumstances

where paper loan requests are permitted.

Early Loan Repayment

balance any time prior to the end of your regular re-

loan balance is permitted — partial payments are not

allowed.

MBOS account by using the Letters and Statements

Loan Payo Letter

amount, the date by which the payment must be re-

ceived, and the date on which scheduled loan repay-

ments from payroll will end.

Loans at Retirement, Death, or

Termination of Employment

If you retire before repaying the outstanding balance of

your loan, your loan payments will be carried into re-

tirement. The monthly loan payment will be calculated

end date. You may also repay your outstanding loan

balance in one lump sum prior to retirement.

If you die before repaying your loan, either before or af-

ter retirement, the outstanding balance will be deduct-

If you terminate employment and withdraw your contri-

butions before repaying your loan, all your contributions

less the loan balance will be returned to you. See the

INTERNAL REVENUE SERVICE (IRS)

REQUIREMENTS

IRC Section 72(p) requires that loan balances cannot

If you take any subsequent loans and your original

loan. The repayment rules on subsequent loans may

result in either a substantial increase in your repayment

amount, or may limit the amount that you can borrow if

the payroll deductions to repay the loan exceeds the 25

percent of base salary restriction on loan repayments.

The IRS regulations also require members to make

timely payments toward outstanding loan balances.

While it is your employer’s responsibility to withhold

loan deductions from your salary, if you are out of work

without pay, your employer has no salary from which

to take deductions. Members who leave payroll with

through personal billing. It is the member’s responsibil-

ity to ensure that the loan balance, plus interest, is paid

in full in accordance with IRS regulations.

Failure to repay the loan as scheduled, either through

lump-sum payment, personal billing, or return to pay-

roll, will result in the unpaid loan balance being de-

clared in default. If a loan is in default, the loan balance

is declared a deemed distribution and will be reported

to the IRS as taxable income. For the tax year in which

the default occurs, the NJDPB will send you a Form

1099-R

include the portion of the loan representing before-tax

contributions as income on your federal return. In ad-

dition, if you are under age 59 1/2, you will be required

PERS Member Guidebook June 2024 Page 22

Public Employees’ Retirement System

to pay an additional 10 percent tax for taking an early

pension distribution.

If you default on your loan, it will be your responsibil-

ity to make an estimated tax payment to the IRS to

cover your tax liability on the deemed distribution; no

withholding will be deducted from your account by the

NJDPB.

Note: Paying taxes on a defaulted loan balance does

not negate the balance; you are still responsible for

paying the loan balance and any interest that accrues

year schedule. Any repayments will be returned to your

account as after-tax contributions.

You may not take another loan until the deemed distri-

bution is paid in full. A deemed distribution cannot be

canceled by resuming your loan payments or repaying

the loan in full prior to the end of the tax year in which

the default occurs. If you resume your loan repayments

after the default, the payments received will be posted

to your account as previously taxed contributions that

will increase the nontaxable portion of your pension at

retirement.

Unlike a normal pension distribution, a loan treated as

a distribution cannot be rolled over to an IRA or other

Supplementing

Your Pension

PERS Member Guidebook June 2024 Page 24

Public Employees’ Retirement System

OVERVIEW

In addition to your regular pension contributions, there

are other opportunities to supplement your retirement

income and possibly set aside money on a tax-deferred

basis.

New Jersey State Employees

Deferred Compensation Plan (NJSEDCP)

If you are an employee of the State, you may be eligible

for the NJSEDCP (IRC Section 457), also known as

Deferred Comp. Contributions to the plan are not sub-

ject to federal income tax until you take a distribution

from the plan, either at retirement or termination before

you save on federal income tax now and to supplement

your retirement income through investments.

For plan and investment information, visit the NJSED-

CP website at: h ttps://newjersey.retirepru.com/ or

call 1-866-NJSEDCP (1-866-657-3327). Other infor-

mation about the plan is available by writing to: New

State Employees Deferred Compensation Plan, P.O.

Box 295, Trenton, NJ 08625-0295.

Local Deferred Compensation Plans

PERS members employed by a municipality, county, or

board of education may also be eligible to contribute to

an IRC Section 457 deferred compensation plan. Con-

tact your employer to see if this type of plan is available

to you.

Supplemental Annuity Collective Trust (SACT)

The SACT is a voluntary investment program that pro-

vides retirement income separate from, and in addition

to, your basic pension plan. Your contributions are in-

vested conservatively in the stock market. The program

consists of two separate plans:

• The SACT Regular Plan is available to all actively

contributing members of a New Jersey State-ad-

ministered retirement system. Contributions to this

plan are made after deductions for federal income

tax.

• The SACT Tax-Sheltered Plan (IRC Section

403(b)) is available to actively contributing mem-

bers of public educational institutions. Contribu-

tions to this plan are made before deductions for

federal income tax.

SACT brochures and enrollment packets are available

on the NJDPB website.

-

mental Annuity Collective Trust, P.O. Box 295, Trenton,

NJ 08625-0295.

Dened Contribution Retirement Program (DCRP)

The DCRP was established under the provisions of

N.J.S.A. 43:15C-1 et seq. The DCRP provides eligible

-

coverage.

Individuals eligible for membership in the DCRP in-

clude:

on or after July 1, 2007.

• Employees enrolled on or after July 1, 2007, in

membership Tier 2, Tier 3, Tier 4, or Tier 5 of the

PERS who earn salary in excess of established

maximum compensation limits.

• Employees otherwise eligible for enrollment in

membership Tier 3 of the PERS who do not earn

the minimum annual salary for Tier 3 enrollment

(subject to adjustment in future years) but who

earn at least the DCRP minimum annual salary of

$5,000.

• Employees otherwise eligible for enrollment in

membership Tier 4, or Tier 5 of the PERS who

do not work the minimum number of hours per

week required for enrollment (35 hours per week

for State employees or 32 hours per week for lo-

cal government or local education employees) but

who earn at least the DCRP minimum annual sala-

ry of $5,000.

The DCRP is administered for the NJDPB by Empower.

Empower provides DCRP information, including invest-

ment and distribution options, on the DCRP website:

h ttps://newjersey.retirepru.com/ Employers and

members can contact Empower via their toll-free tele-

phone number: 1-866-653-2771. In certain circum-

stances, an eligible employee can voluntarily waive

participation in the DCRP by submitting a DCRP Waiv-

er of Retirement Program Participation form to the NJ-

DPB.

Additional information about DCRP enrollment, contri-

the Dened Contribution Retirement Program (DCRP)

for PERS, TPAF, PFRS, and SPRS Members Fact

Sheet, the Dened Contribution Retirement Program

(DCRP) for Elected and Appointed Ocials Fact Sheet,

and the Dened Contribution Retirement Program

(DCRP) if Ineligible for PERS or TPAF Fact Sheet,

which are available on the NJDPB website.

Retirements

PERS Member Guidebook June 2024 Page 26

Public Employees’ Retirement System

OVERVIEW

(LEO, LRS, Prosecutors Part, and

WCJ Part members see addendum)

the retirement. It is the member’s responsibility to apply

for retirement and ensure that all required documents

are received by the NJDPB within 90 days.

The IRS will impose a 50 percent excise tax on ac-

counts of members who terminate employment but do

not retire or withdraw contributions by April 1 following

the calendar year in which they turn age 70 1/2 (if born

before July 1, 1949) or age 72 (if born on or after July 1,

72 while they are still actively employed in PERS-cov-

ered positions.

Retirement Calculation Denitions

Years of Service means the years and months of

pension service credited to your account, including pur-

chased service credit. All members receive a slightly

higher percentage for each additional month of service.

Final Average Salary (FAS) is the salary used to

calculate your retirement. It is based on pensionable

salary and does not include extra pay for overtime or

money given in anticipation of your retirement. Nor

does it include amounts paid for housing, clothing, or

uniform allowances.

For Tier 1, Tier 2, and Tier 3 members, FAS means the

average salary for the 36 months (30 months for em-

ployees with 10-month contracts) immediately preced-

ing your retirement. If your last three years are not your

highest years of salary, your allowance will be calculat-

salary.

For Tier 4 and Tier 5 members, Final Average Sala-

ry means the average salary for the 60 months (50

months for employees with 10-month contracts) imme-

are not your highest years of salary, your allowance will

- June) of salary.

Note: If your last years of salary are not your highest,

you must indicate your highest three years on your

MBOS Retirement Application.

TYPES OF RETIREMENT

There are several types of retirement for which you may

qualify:

Service Retirement

Available to Tier 1 and Tier 2 members upon reaching

age 60 or older; to Tier 3 and Tier 4 members upon

reaching age 62 or older; and to Tier 5 members upon

reaching age 65 or older. No minimum amount of pen-

sion service credit is required.

The formula to calculate the maximum annual pension

for a Tier 1, Tier 2, or Tier 3 member is:

Years of Service x Final = Maximum

55 Average Annual

Salary Allowance

Example: A Tier 1 member with 22 years of service

would receive 22/55 or 40 percent of Final Average

Salary.

The formula to calculate the maximum annual pension

for a Tier 4 or Tier 5 member is:

Years of Service x Final = Maximum

60 Average Annual

Salary Allowance

Example: A Tier 4 member with 22 years of service

would receive 22/60 or 36.7 percent of Final Average

Salary.

Early Retirement

Available to members who have 25 years or more of

pension service credit before reaching age 60 for Tier

1 and Tier 2 members, or before age 62 for Tier 3 and

Tier 4 members; and with 30 years or more of pension

membership service credit before age 65 for Tier 5

-

ate Service Retirement formula; however, your allow-

ance is permanently reduced if you retire prior to attain-

• For Tier 1 members who retire before age 55, your

allowance is reduced 1/4 of one percent for each

month (three percent per year) under age 55.

• For Tier 2 members who retire before age 60,

your allowance is reduced 1/12 of one percent for

each month (one percent per year) under age 60

through age 55, and 1/4 of one percent for each

month (three percent per year) under age 55.

• For Tier 3 or Tier 4 members who retire before age

62, your allowance is reduced 1/12 of one percent

for each month (one percent per year) under age

62 through age 55, and 1/4 of one percent for each

month (three percent per year) under age 55.

• For Tier 5 members who retire before age 65 with

at least 30 years of service, your allowance is re-

duced 1/4 of one percent for each month (three

percent per year) under age 65.

Veteran Retirement

and who meet the minimum age and pension service

credit requirements for a Veteran Retirement as of their

retirement date.

The age requirements and formulas for calculating a

Veteran Retirement are the same for all membership

tiers.

Page 27 June 2024 PERS Member Guidebook

Public Employees’ Retirement System

• age 55 or older with 25 or more years of service

credit; or

• age 60 or older with 20 or more years of service

credit

is entitled to an annual allowance equal to 54.5 percent

of the salary upon which pension contributions were

based during the highest the 12 consecutive months

of base salary.

35 years of service credit is entitled to an annual allow-

ance based on the following formula:

Years of Service x Highest 12 = Maximum

55 Consecutive Annual

Months of Salary Allowance

Veteran members may retire on a Service Retirement if

Establishing Veteran Status — Individuals wishing

to establish veteran status with the retirement system

should submit a photocopy of their discharge papers

(Form DD 214) showing both the induction and dis-

charge dates to:

N.J. Department of Military and Veterans

Aairs

ATTN: DVP-VBB

P.O. Box 340

Trenton, NJ 08625-0340

Since the New Jersey Department of Military and Vet-

preference for Civil Service and property tax appeals,

a note should be attached to say that the discharge pa-

pers are being sent for pension purposes. Include your

address on the note. For more information, see the Vet-

eran Status Fact Sheet.

Deferred Retirement

Available to members who have at least 10 years of

service credit and are not yet 60 years of age if a Tier 1

or Tier 2 member, or 62 years of age if a Tier 3 or Tier

4 member, or 65 years of age if a Tier 5 member, when

they terminate employment. The retirement would be

calculated using the appropriate Service Retirement

formula.

-

Deferred Retirement when you terminate covered em-

ployment or any time prior to attaining your Deferred

Retirement age; otherwise, your only payment option

at retirement is the maximum allowance with no pay-

the application is received by the NJDPB.

If a member is removed from employment for cause,

the member will be ineligible for Deferred Retirement.

If you return to PERS-covered employment before your

-

cel your retirement and become eligible to maintain

your original PERS membership tier status, provided

you have not withdrawn your membership and it has

not been more than two consecutive years since your

last pension contribution. If, however, there has been

a break in service of more than two consecutive years

since your last pension contribution, or if you have with-

drawn your account, you will be enrolled in a new PERS

you return to employment.

At any time before your Deferred Retirement becomes

lump-sum withdrawal of all your pension contributions.

However, once you cancel your Deferred Retirement

and withdraw your contributions, all the rights and privi-

leges of membership in the retirement system end.

Please note the following important information about

and purchase arrears if you are considering a Deferred

Retirement:

• Life Insurance — Your life insurance coverage will

end 31 days after you terminate employment and

becomes payable. If you die before your Deferred

-

der these circumstances. However, during the 31-

day period after you terminate employment, you

may convert your group life insurance coverage to

a private policy with Prudential Financial. For more

-