Program Name

Goes Here

Presenter Name Goes Here

Applied Accounting

Programs

Presenter: Prof. Ron Woods

Accounting Department Chair

What is the program?

Short Description/Images

The applied programs and degrees primarily provides students with the training

for a career in accounting in one of accounting’s many related career pathways.

BAS - Bachelor’s of Applied Science

AAS - AAS Associate of Applied Science Degree

CERTIFICATES –Accounting Achievement, Tax Preparer, Non-Profit Management

These degrees, education and training are all intended to prepare students to go

right to work in the appropriately trained field of accounting.

Where is this program

offered?

North Seattle College

9600 College Way N

Seattle, WA 98103

Entry Requirements

• High School Diploma/GED

• Running Start or other similar

high school/college programs

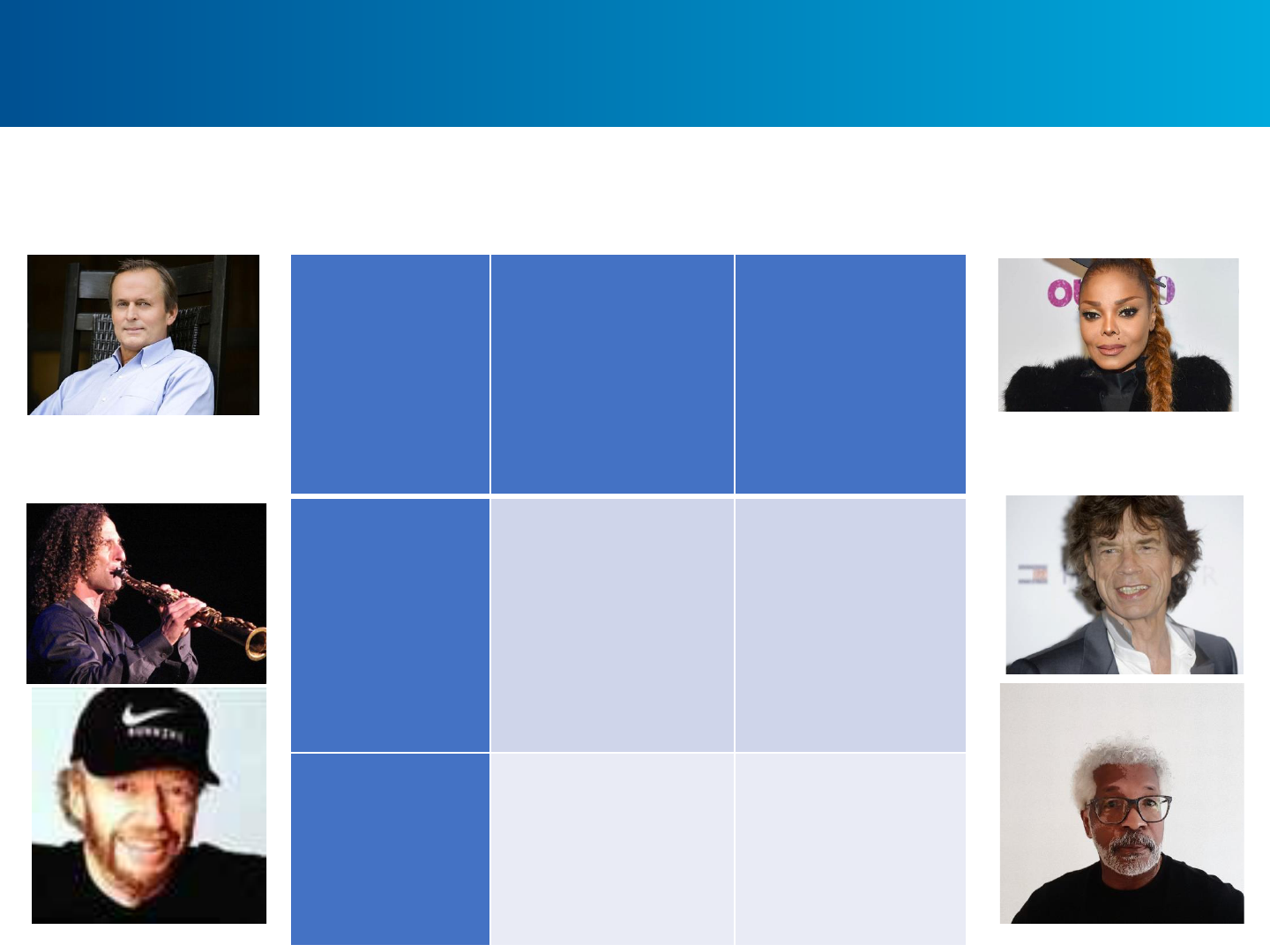

Quiz Time

Which of the following notable people either worked in accounting or majored in accounting?

John Grisham

-

bestselling author of

such classics as The

Firm and The

Pelican

A

Select the single

best answer from

the options below.

Janet Jackson

–

sister of

the King of Pop,

Michael Jackson,

platinum record and

five Grammys holder

singer, and entertainer.

B

Kenneth Bruce

Gorelick, better

known as Kenny G,

-

world

-famous

saxophonist and top

-

selling instrumental

musician in modern

history.

C

.

1.

A & F

2.

A, F & C

3.

E, F & B

4.

A, F & D

5.

All of them

Legendary Rolling Stones

front

-man Mick Jagger

D

Phil Knight

–

Philanthropist,

business magnate,

and co

-founder of

Nike, Inc.

E

Ron Woods

–

Faculty Chair

and distinguished

professor of accounting,

North Seattle College.

F

What do you learn?

Below are among the many tasks that accountants perform for their clients.

• Organizing and maintaining financial records

• Evaluating financial operations and making recommendations to

management about best financial practices

• Examining account books and accounting systems to make sure they

are efficient and conform to accepted standards and accounting

procedures

• Preparing tax returns and related tasks

• Examining financial statements to make sure they are accurate and

meet legal requirements

• suggesting ways to increase revenue, reduce costs, and improve

profits

If we go back to the question of what accounting students learn in our

programs – They essentially learn the skills to do the above.

Education Pathway

The Programs Presented in This Applied Accounting Break-out Session

• Are designed to be completed from two academic quarters, to two academic

years if you are participating as a full-time student taking three courses per

quarter. An academic quarter is approximately 11-wweeks on average.

• The length for any one part-time student might take to complete a given

program varies with each part-time student, depending on the program

selected and their personal schedule.

• While it is preferably for students to complete their program study as quickly

as possible and in accordance with the respective program schedule, there are

no requirements to do so. Student can start, stop, and resume program study

to meet employment and personal needs.

• The nature of accounting courses and learning objectives require certain

courses be completed before others. Consult with your advisor before

deciding to pause your study or skip a quarter.

• Designed to be part of a longer education pathway? They a start with

certificates that are stackable and generally connects to an associate’s degree

and BAS degree pathway.

• Many of the certificates qualify students to get employment right away. Still,

more education is typically needed to start work in some fields.

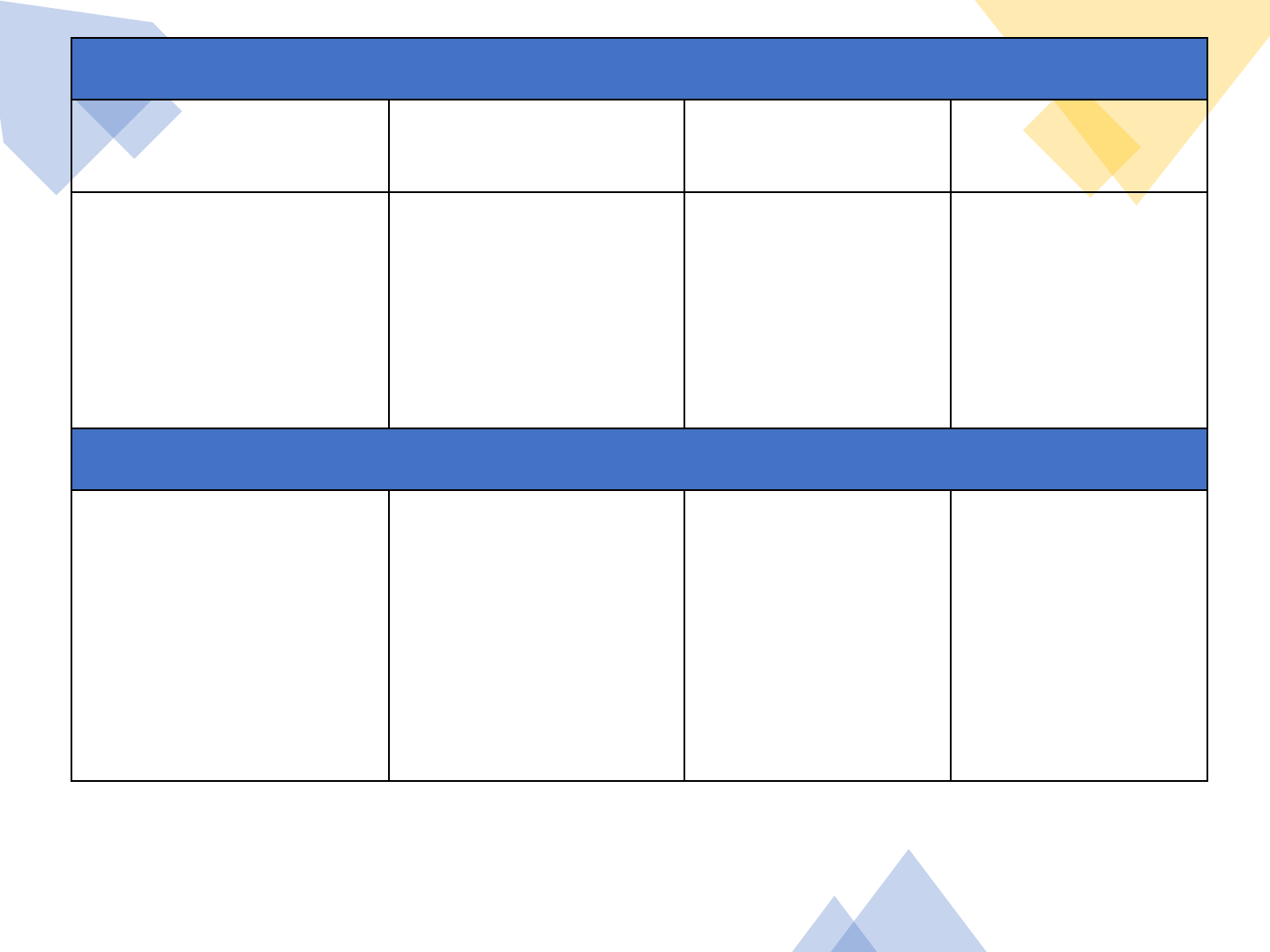

There are Basically Four Types of Accounting

Corporate

Accounting

Public

Accounting Government

Accounting

Forensic

Accounting

Corporate accounting involves the

use, handling, and filing of a

company’s financial data often for

the purpose of external reporting

and tax compliance.

Public accountants work with

external clients, most often

companies, corporations, or

individuals. Their

responsibility to clients is to

help ensure their financial

statements, records, and

filings are accurate.

Government accountants

work within the context of

local, state, or federal

government entities. They

often work within

frameworks that differ from

those employed by public

accountants.

Forensic accounting

refers to a branch of

accounting that collects,

recovers, and

reconstructs financial

data when it is difficult

or impossible to obtain.

Generally, Requires The Following:

4

-year degree in accounting or

higher.

*CPA preferred but not

required.

Some experience preferred.

*

experience required before CPA

license can be issued.

4

-year degree in accounting

or higher.

CPA required.

Experience required.

4

-year degree in

accounting or higher.

CPA preferred but not

required.

Some experience

preferred.

4

-year degree in

accounting or higher.

CPA preferred but not

required.

Some experience

preferred

Careers in

Accounting

Government and Non

-

Profit

Accounting Jobs:

Fund Accountancy

IRS Jobs

Private Accounting Jobs:

Accounting Clerk

Accounts

Payable/Receivable

Clerk

Bookkeeping

Budget Analyst

Comptroller/Financial

Controller

Payroll Accountant

Public Accounting Jobs:

Cost Estimator

Enrolled Agent

Forensic Accountant

Real Estate Appraiser

Tax Accountant

Tax Attorney

Tax Preparer

Financial Services:

Business Valuation

Specialist

Certified Financial Planner

Financial Analyst

Tax Consultant

What you can you earn with skills and/or a degree in

Accounting?

• There are several internship or work-based learning programs offered.

• Program graduates typically work across the full spectrum; private business,

government, and not-for-profit industries.

• Average wages for local area entry level to experienced varies. However, you

can expect to earn from $39,000 to $48,000 after completing a certificate

and/or 2-year accounting degree. If you complete a Bachelor's degree, you

can expect to start on average, at a salary of around $61,513.

NOTE

:

Salary ranges can vary widely depending on many important factors,

including

education, certifications, additional skills, the number of years you

have spent in your profession.

For more detailed information and planning, visit the following site:

https://seakingwdc.emsicc.com/?radius=5%20miles®ion=Seattle%2C%20WA

Salary Ranges for Entry Level Accountants in

Seattle, WA is:

From

$61,513 to $96,263, with a median salary of $94,771. The middle 67% of

Entry Level Accountants makes $75,275, with the top 67% making $76,460.

Salary Ranges for

Bookkeepers is:

Between

$42,573 and $54,416. The average in Seattle as of March was

$48,509.

Salary Ranges for

Tax Preparers in Seattle, WA:

Entry level of

$65,945 and a senior level of $115,404.

Salary Ranges for Financial Services Jobs

in Seattle,

WA is:

Between

$39,000 at entry and $58,000 at the median.

Note:

Jobs in this area vary greatly and includes fields such as banking,

financial planning, property management, etc. Workers in this industry

often earn

considerably more than the median.

Q & A

If you have any questions about a typical studying accounting at NSC

such as:

• What is a typical accounting course workload and schedule?

• Do students often balance work with school?

• What type of faculty are teaching in this program?

My contact information is listed below.

If you have questions about college admissions, advising, etc., I

encourage you to stick around for help from 4:30-5pm.

Contact:

Program Coordinator

Ron Woods

ronald.woods@seattlecolleges.edu

Workforce Instruction Division

Next Session

Return to Main Session

(select “Leave Breakout Room” to return)